X 2 - Binus Repository

advertisement

Mata kuliah

Tahun

: A0392 - Statistik Ekonomi

: 2010

Pertemuan 13

Data Deret Waktu dan Analisis

Regresi dan Korelasi Linier

Sederhana

1

Outline Materi :

Data Deret Waktu (Times Series)

Analisis Regresi Linier Sederhana

Koefisien Korelasi dan Uji

Ketergantungan antar Peubah Acak

2

PENDAHULUAN

•

Data deret berkala adalah sekumpulan data yang dicatat

dalam suatu periode tertentu.

•

Manfaat analisis data berkala adalah mengetahui kondisi

masa mendatang.

•

Peramalan kondisi mendatang bermanfaat untuk

perencanaan produksi, pemasaran, keuangan dan

bidang lainnya.

KOMPONEN DATA BERKALA

Trend; Variasi Musim; Variasi Siklus; dan Variasi yang

Tidak Tetap (Irregular)

3

3

TREND

Suatu gerakan kecenderungan naik atau turun dalam jangka panjang

yang diperoleh dari rata-rata perubahan dari waktu ke waktu dan

nilainya cukup rata (smooth).

Y

Y

Tahun (X)

Trend Positif

Tahun (X)

Trend Negatif

4

4

Metode Kuadrat Terkecil Untuk Trend Linier

Menentukan garis trend yang mempunyai jumlah terkecil dari

kuadrat selisih data asli dengan data pada garis trendnya.

Y = a + bX

a = Y/N

b = YX/X2

Pelanggan (Jutaan)

Trend Pelanggan PT. Telkom

8

7

6

5

4

3

2

1

0

97

98

99

00

01

Tahun

Data Y'

Data Y

5

5

CONTOH METODE KUADRAT TERKECIL

Tahun

Kode X

(tahun)

-2

Y.X

X2

1997

Pelanggan

=Y

5,0

-10,0

4

1998

5,6

-1

-5,6

1

1999

6,1

0

0

0

2000

6,7

1

6,7

1

2001

7,2

2

14,4

4

Y.X=5,5

X2=10

Y=30,6

Nilai a = 30,6/5=6,12

Nilai b =5,5/10=0,55

Jadi persamaan trend Y’=6,12+0,55x

6

6

ANALISIS TREND KUADRATIS

Trend Kuadratis

Jumlah Pelanggan

(jutaan)

Untuk jangka waktu pendek,

kemungkinan trend tidak

bersifat linear. Metode

kuadratis adalah contoh

metode nonlinear

8.00

6.00

4.00

2.00

0.00

Y=a+bX+c

X2

97

98

Y = a + bX + cX2

99

00

01

Tahun

Koefisien a, b, dan c dicari dengan rumus sebagai berikut:

a = (Y) (X4) – (X2Y) (X2)/ n (X4) - (X2)2

b = XY/X2

c = n(X2Y) – (X2 ) ( Y)/ n (X4) - (X2)2

7

7

CONTOH TREND KUADRATIS

Tahun

Y

X

XY

X2

X2Y

X4

1997

5,0

-2

-10,00

4,00

20,00

16,00

1998

5,6

-1

-5,60

1,00

5,60

1,00

1999

6,1

0

0,00

0,00

0,00

0,00

2000

6,7

1

6,70

1,00

6,70

1,00

2001

7,2

2

14,40

4,00

2880

16,00

5,50

10,00

61,10

34,00

30.60

a = (Y) (X4) – (X2Y) (X2) = {(30,6)(34)-(61,1)(10)}/{(5)(34)-(10)2}=6,13

n (X4) - (X2)2

b = XY/X2

= 5,5/10=0,55

2

2

c = n(X Y) – (X ) ( Y)

= {(5)(61,1)-(10)(30,6)}/{(5)(34)-(10)2}=-0,0071

n (X4) - (X2)2

Jadi persamaan kuadratisnya adalah Y =6,13+0,55x-0,0071x2

8

8

ANALISIS TREND EKSPONENSIAL

Persamaan eksponensial dinyatakan dalam bentuk variabel waktu (X)

dinyatakan sebagai pangkat. Untuk mencari nilai a, dan b dari data Y

dan X, digunakan rumus sebagai berikut:

Y’ = a (1 + b)X

Ln Y’ = Ln a + X Ln (1+b)

Sehingga a = anti ln (LnY)/n

b = anti ln (X. LnY) - 1

(X)2

Jumlah

Pelanggan

(jutaan)

Trend Eskponensial

15,00

10,00

5,00

0,00

97

98

99

00

01

Tahun

Y= a(1+b)X

9

9

CONTOH TREND EKSPONENSIAL

Tahun

Y

X

Ln Y

X2

X Ln Y

1997

5,0

-2

1,6

4,00

-3,2

1998

5,6

-1

1,7

1,00

-1,7

1999

6,1

0

1,8

0,00

0,0

2000

6,7

1

1,9

1,00

1,9

2001

7,2

2

2,0

4,00

3,9

9,0

10,00

0,9

Nilai a dan b didapat dengan:

a = anti ln (LnY)/n = anti ln 9/5=6,049

b = anti ln (X. LnY) - 1 = {anti ln0,9/10}-1=0,094

(X)2

Sehingga persamaan eksponensial Y =6,049(1+0,094)x

10

10

VARIASI MUSIM

Variasi musim terkait dengan perubahan atau fluktuasi dalam musimmusim atau bulan tertentu dalam 1 tahun.

Indeks Saham PT. Astra Agro

Pergerakan Inflasi 2002

Produksi Padi Permusim

Lestari, Maret 2003

150

2

10

0

1,5

Indeks

20

Inflasi (%)

Produksi (000 ton)

2,5

30

1

0,5

Triw ulan

Variasi Musim Produk

Pertanian

50

0

I- II- III- I- II- III- I- II- III- I- II- III98 98 98 99 99 99 00 00 00 01 01 03

100

03

0

1

2

3

4

5

6

7

8

9

10

05

13

14

22

11 12

Bulan

Variasi Inflasi Bulanan

Tanggal

Variasi Harga Saham

Harian

11

11

VARIASI MUSIM DENGAN METODE RATA-RATA

SEDERHANA

Indeks Musim = (Rata-rata per kuartal/rata-rata total) x 100

Bulan

Januari

88

Rumus= Nilai bulan ini x 100

Nilai rata-rata

(88/95) x100

Februari

82

(82/95) x100

86

Maret

106

(106/95) x100

112

April

98

(98/95) x100

103

Mei

112

(112/95) x100

118

Juni

92

(92/95) x100

97

Juli

102

(102/95) x100

107

96

(96/95) x100

101

105

(105/95) x100

111

85

(85/95) x100

89

November

102

(102/95) x100

107

Desember

76

(76/95) x100

80

Rata-rata

95

Agustus

September

Oktober

Pendapatan

Indeks

Musim

93

12

12

METODE RATA-RATA DENGAN TREND

• Metode rata-rata dengan trend dilakukan dengan cara yaitu indeks

musim diperoleh dari perbandingan antara nilai data asli dibagi

dengan nilai trend.

• Oleh sebab itu nilai trend Y’ harus diketahui dengan persamaan

Y’ = a + bX.

13

13

METODE RATA-RATA DENGAN TREND

Y

Y’

Perhitungan

Indeks Musim

Januari

88

97,41

(88/97,41) x 100

90,3

Februari

82

97,09

(82/97,09) x 100

84,5

Maret

106

96,77

(106/96,77) x100

109,5

April

98

96,13

(98/96,13) x 100

101,9

Mei

112

95,81

(112/95,81) x 100

116,9

Juni

92

95,49

(92/95,49) x 100

96,3

Juli

102

95,17

(102/95,17) x 100

107,2

Agustus

96

94,85

(96/94,85) x 100

101,2

September

105

94,53

(105/94,53) x 100

111,1

Oktober

85

93,89

(85/93,89) x 100

90,5

November

102

93,57

(102/93,57) x 100

109,0

Desember

76

93,25

(76/93,25) x 100

81,5

Bulan

14

14

VARIASI SIKLUS

Siklus Indeks Saham Gabungan

Siklus

2,5

Ingat

2

1,5

Y=TxSxCxI

TCI = Y/S

CI = TCI/T

Di mana CI adalah Indeks

Siklus

IHSG

Maka

1

0,5

0

-0,5 94 95 96 97 98 99 00 01 02

-1

-1,5

-2

-2,5

Tahun

15

15

CONTOH SIKLUS

Th

1998

1999

2000

2001

Trwl

Y

I

22

T

17,5

S

TCI=Y/S

CI=TCI/T

C

II

14

17,2

95

14,7

86

III

8

16,8

51

15,7

93

92

I

25

16,5

156

16,0

97

97

II

15

16,1

94

16,0

99

100

III

8

15,8

49

16,3

103

102

I

26

15,4

163

16,0

104

104

II

14

15,1

88

15,9

105

105

III

8

14,7

52

15,4

105

106

I

24

14,3

157

15,3

107

108

II

14

14,0

89

15,7

112

III

9

13,6

16

16

GERAK TAK BERATURAN

Siklus

Ingat Y = T x S x C x I

TCI = Y/S

CI = TCI/T

I = CI/C

17

17

GERAK TAK BERATURAN

Th

1998

1999

2000

2001

Trwl

C

I=(CI/C) x 100

I

CI=TCI/T

86

II

93

92

101

III

97

97

100

I

99

100

99

II

103

102

101

III

104

104

100

I

105

105

100

II

105

106

99

III

107

108

99

I

112

II

III

18

18

PENGUJIAN KOEFISIEN

REGRESI DENGAN

ANALISIS VARIANSI

19

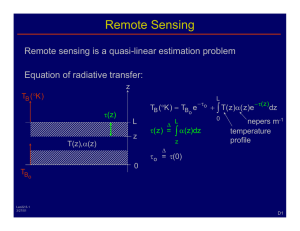

Measures of Variation:

The Sum of Squares

SST

=

Total

=

Sample

Variability

SSR

Explained

Variability

+

+

SSE

Unexplained

Variability

SST = Total Sum of Squares

SSR = Regression Sum of Squares

SSE = Error Sum of Squares

20

Measures of Variation:

The Sum of Squares

SSE =(Yi - Yi )2

Y

_

SST = (Yi - Y)2

_

SSR = (Yi - Y)2

Xi

_

Y

X

21

Venn Diagrams and

Explanatory Power of

Regression

Variations in

store Sizes not

used in

explaining

variation in

Sales

Sizes

Sales

Variations in Sales

explained by the

error term or

unexplained by

Sizes SSE

Variations in Sales

explained by Sizes

or variations in Sizes

used in explaining

variation in Sales

SSR

22

The ANOVA Table in Excel

ANOVA

df

Regressio

k

n

Residuals

Total

SS

MS

F

SS

R

MSR

=SSR/k

P-value of

MSR/MSE

the F Test

n-k- SS

1

E

n-1

Significanc

e

F

MSE

=SSE/(n-k1)

SS

T

23

Measures of Variation

The Sum of Squares: Example

Excel Output for Produce Stores

Degrees of freedom

ANOVA

df

SS

MS

Regression

1

30380456.12

30380456

Residual

5

1871199.595 374239.92

Total

6

32251655.71

F

81.17909

Regression (explained) df

Error (residual) df

Total df

SSE

SSR

Significance F

0.000281201

SST

24

Venn Diagrams and

Explanatory Power of

Regression

r

2

Sales

Sizes

SSR

SSR SSE

25

Standard Error of Estimate

n

•

SYX

SSE

n2

i 1

Y Yˆi

2

n2

• Measures the standard deviation

(variation) of the Y values around the

regression equation

26

Measures of Variation:

Produce Store Example

Excel Output for Produce Stores

R e g r e ssi o n S ta ti sti c s

M u lt ip le R

R S q u a re

0 .9 4 1 9 8 1 2 9

A d ju s t e d R S q u a re

0 .9 3 0 3 7 7 5 4

S t a n d a rd E rro r

6 1 1 .7 5 1 5 1 7

O b s e r va t i o n s

r2 = .94

0 .9 7 0 5 5 7 2

n

7

94% of the variation in annual sales can be

explained by the variability in the size of the

store as measured by square footage.

Syx

27

Linear Regression

Assumptions

• Normality

– Y values are normally distributed for each X

– Probability distribution of error is normal

• Homoscedasticity (Constant Variance)

• Independence of Errors

28

Consequences of Violation

of the Assumptions

• Violation of the Assumptions

– Non-normality (error not normally distributed)

– Heteroscedasticity (variance not constant)

• Usually happens in cross-sectional data

– Autocorrelation (errors are not independent)

• Usually happens in time-series data

• Consequences of Any Violation of the Assumptions

– Predictions and estimations obtained from the

sample regression line will not be accurate

– Hypothesis testing results will not be reliable

• It is Important to Verify the Assumptions

29

Variation of Errors Around

the Regression Line

f(e)

• Y values are normally distributed

around the regression line.

• For each X value, the “spread” or

variance around the regression line is

the same.

Y

X2

X1

X

Sample Regression Line

30

Inference about the Slope:

t Test

• t Test for a Population Slope

– Is there a linear dependency of Y on X ?

• Null and Alternative Hypotheses

– H0: 1 = 0

– H1: 1 0

(no linear dependency)

(linear dependency)

• Test Statistic

–

b1 1

t

where Sb1

Sb1

SYX

n

(X

i 1

–

d. f . n 2

i

X)

2

31

Example: Produce Store

Data for 7 Stores:

Store

Square

Feet

Annual

Sales

($000)

1

2

3

4

5

6

7

1,726

1,542

2,816

5,555

1,292

2,208

1,313

3,681

3,395

6,653

9,543

3,318

5,563

3,760

Estimated Regression

Equation:

Yˆi 1636.415 1.487X i

The slope of this

model is 1.487.

Does square footage

affect annual sales?

32

Inferences about the Slope:

t Test Example

Test Statistic:

H0: 1 = 0

From Excel Printout b

1

H1: 1 0

Coefficients Standard Error

.05

Intercept

1636.4147

451.4953

df 7 - 2 = 5

Footage

1.4866

0.1650

Decision:

Critical Value(s):

Reject

Reject

Reject H0.

.025

.025

-2.5706 0 2.5706

t

Sb1

t

t Stat P-value

3.6244 0.01515

9.0099 0.00028

p-value

Conclusion:

There is evidence that

square footage affects

33

annual sales.

Inferences about the Slope:

Confidence Interval Example

Confidence Interval Estimate of the Slope:

b1 tn 2 Sb1

Excel Printout for Produce Stores

Intercept

Footage

Lower 95% Upper 95%

475.810926 2797.01853

1.06249037 1.91077694

At 95% level of confidence, the confidence interval

for the slope is (1.062, 1.911). Does not include 0.

Conclusion: There is a significant linear dependency

of annual sales on the size of the store.

34

Inferences about the Slope:

F Test

• F Test for a Population Slope

– Is there a linear dependency of Y on X ?

• Null and Alternative Hypotheses

– H0: 1 = 0

– H1: 1 0

(no linear dependency)

(linear dependency)

• Test Statistic

SSR

1

– F

SSE

n 2

35

Relationship between a t

Test and an F Test

• Null and Alternative Hypotheses

– H0: 1 = 0

– H1: 1 0

•

t

n2

2

(no linear dependency)

(linear dependency)

F1,n 2

• The p –value of a t Test and the p –value

of an F Test are Exactly the Same

• The Rejection Region of an F Test is

Always in the Upper Tail

36

Inferences about the Slope:

F Test Example

H0: 1 = 0

ANOVA

H1: 1 0

.05

Regression

numerator Residual

df = 1

Total

denominator

df 7 - 2 = 5

Test Statistic:

From Excel Printout

df

1

5

6

Reject

= .05

0

6.61

F1, n 2

SS

MS

F Significance F

30380456.12 30380456.12 81.179

0.000281

1871199.595 374239.919

p-value

32251655.71

Decision: Reject H0.

Conclusion:

There is evidence that

square footage affects

annual sales.

37

Purpose of Correlation

Analysis

• Correlation Analysis is Used to Measure

Strength of Association (Linear

Relationship) Between 2 Numerical

Variables

– Only strength of the relationship is concerned

– No causal effect is implied

38

Purpose of Correlation

Analysis

• Population Correlation Coefficient (Rho)

is Used to Measure the Strength between

the Variables

XY

X Y

39

Purpose of Correlation

Analysis

(continued)

• Sample Correlation Coefficient r is an

Estimate of and is Used to Measure the

Strength of the Linear Relationship in the

Sample Observations

n

r

X

i 1

n

X

i 1

i

i

X Yi Y

X

2

n

Y Y

i 1

2

i

40

Sample Observations from

Various r Values

Y

Y

Y

X

r = -1

X

r = -.6

Y

X

r=0

Y

r = .6

X

r=1

X

41

Features of and r

• Unit Free

• Range between -1 and 1

• The Closer to -1, the Stronger the

Negative Linear Relationship

• The Closer to 1, the Stronger the Positive

Linear Relationship

• The Closer to 0, the Weaker the Linear

Relationship

42

t Test for Correlation

• Hypotheses

– H0: = 0 (no correlation)

– H1: 0 (correlation)

• Test Statistic

t

–

r

where

r

n2

2

n

r r2

X

i 1

n

X

i 1

i

i

X Yi Y

X

2

n

Y Y

i 1

2

i

43

Example: Produce Stores

r

From Excel Printout

Is there any

evidence of linear

relationship between

annual sales of a

store and its square

footage at .05 level

of significance?

R e g r e ssi o n S ta ti sti c s

M u lt ip le R

R S q u a re

0 .9 7 0 5 5 7 2

0 .9 4 1 9 8 1 2 9

A d ju s t e d R S q u a re 0 . 9 3 0 3 7 7 5 4

S t a n d a rd E rro r

6 1 1 .7 5 1 5 1 7

O b s e rva t io n s

H0: = 0 (no

association)

H1: 0 (association)

.05

7

44

Example: Produce Stores

Solution

r

.9706

t

9.0099

2

1 .9420

r

5

n2

Critical Value(s):

Reject

.025

Reject

.025

-2.5706 0 2.5706

Decision:

Reject H0.

Conclusion:

There is evidence of a

linear relationship at 5%

level of significance.

The value of the t statistic is

exactly the same as the t

statistic value for test on the

slope coefficient.

45

Estimation of Mean Values

Confidence Interval Estimate for

Y | X X

:

i

The Mean of Y Given a Particular Xi

Standard error

of the estimate

Size of interval varies according

to distance away from mean, X

Yˆi tn 2 SYX

t value from table

with df=n-2

(Xi X )

1

n

n

2

(Xi X )

2

i 1

46

Prediction of Individual Values

Prediction Interval for Individual Response

Yi at a Particular Xi

Addition of 1 increases width of interval

from that for the mean of Y

Yˆi tn 2 SYX

1 (Xi X )

1 n

n

2

(Xi X )

2

i 1

47

Interval Estimates for Different

Values of X

Y

Confidence

Interval for the

Mean of Y

Prediction Interval

for a Individual Yi

X

X

a given X

48

Example: Produce Stores

Data for 7 Stores:

Store

Square

Feet

Annual

Sales

($000)

1

2

3

4

5

6

7

1,726

1,542

2,816

5,555

1,292

2,208

1,313

3,681

3,395

6,653

9,543

3,318

5,563

3,760

Consider a store

with 2000 square

feet.

Regression Model Obtained:

Yi = 1636.415 +1.487Xi

49

Estimation of Mean Values:

Example

Confidence Interval Estimate for

Y | X X

i

Find the 95% confidence interval for the average annual

sales for stores of 2,000 square feet.

Predicted Sales Yi = 1636.415 +1.487Xi = 4610.45 ($000)

X = 2350.29

SYX = 611.75

Yˆi tn 2 SYX

tn-2 = t5 = 2.5706

( X i X )2

1

n

4610.45 612.66

n

2

(Xi X )

i 1

3997.02 Y |X X i 5222.34

50

Prediction Interval for Y :

Example

Prediction Interval for Individual YX X i

Find the 95% prediction interval for annual sales of one

particular store of 2,000 square feet.

Predicted Sales Yi = 1636.415 +1.487Xi = 4610.45 ($000)

X = 2350.29

SYX = 611.75

Yˆi tn 2 SYX

tn-2 = t5 = 2.5706

1 ( X i X )2

1 n

4610.45 1687.68

n

2

(

X

X

)

i

i 1

2922.00 YX X i 6297.37

51

PENGGUNAAN MS EXCEL UNTUK REGRESI

• Masukkan data Y dan data X pada sheet MS Excel, misalnya

data Y di kolom A dan X pada kolom B dari baris 1 sampai 5.

• Klik icon tools, pilih ‘data analysis’, dan pilih ‘simple linear

regression’.

• Pada kotak data tertulis Y variable cell range: masukkan data

Y dengan mem-blok kolom a atau a1:a5. Pada X variable cell

range: masukkan data X dengan mem-blok kolom b atau

b1:b5.

• Anda klik OK, maka hasilnya akan keluar. Y’= a+b X; a

dinyatakan sebagai intercept dan b sebagai X variable1 pada

kolom coefficients.

52

52

53

53

54

54

55

55

SELAMAT BELAJAR SEMOGA SUKSES SELALU

56

56