CERTIFIED + logo

advertisement

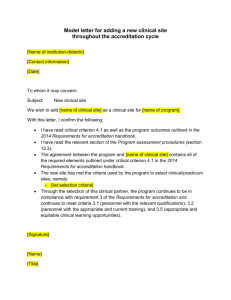

“CERTIFIED” CERTIfication & Accreditation System for FInancial Services Sector EDucation and Training PARTNER MEETING Frankfurt, 14th February 2007 - 1st Session - PARTNERSHIP CERTIFIED Partners: 1. Friedrich-Alexander Universitaet Erlangen –Nuernberg (Germany) 2. EKEPIS (Greece) 3. Hellenic Bank Association – HBA (Greece) 4. EBTN (Luxembourg) 5. SCIENTER (Italy) 6. FABI (Italy) 7. Warsaw Institute of Bankers – WIB (Poland) 8. Financial Institute of Bankers – IFB (Portugal) 9. The Charted Institute of Bankers in Scotland – CIOBS (UK) NATIONAL REFERENCE CENTRES (NRC) EBTN CERTIFIED NRC: 1. 2. 3. 4. 5. DENMARK: The Danish Bankers Association (t. b. c.)* HUNGARY: International Training Centre for Bankers ITALY: ABIFormazione ROMANIA: Romanian Banking Institute SLOVAKIA: National Bank of Slovakia - Institute of Banking Education 6. SLOVENIA: The Bank Association of Slovenia 7. SPAIN: Private Foundation Institute of Financial Studies 8. NETHERLANDS: NIBE-SVV *To be confirmed EXTENDED PARTNERSHIP EBTN CERTIFIED Relay Points N. 7 EBTN PARTNERS CERTIFIED Relay Points N.8 Relay Points (RP) 1. 2. 3. 4. BELGIUM: Febelfin Academy BULGARIA: International Banking Institute FRANCE: Centre Formation Professione Bancaire GERMANY: Frankfurt School of Finance&Management Bankakademie HfB 5. IRELAND: The Institute of Bankers in Ireland 6. LUXEMBURG: The Luxemburg Institute for Training in Banking 7. TURKEY: The Banks Association of Turkey (t. b. c.)* *To be confirmed PARTNERS Relay Points (PRP) 1. 2. 3. 4. 5. 6. 7. 8. CZECH REPUBLIC: The College of Banking (CIOBS) UKRAINE: The National Center for Training of Bank Personnel (CIOBS) BULGARIA: Sofia University (HBA) LUXEMBURG: ATTF (HBA) CYPRUS: IFB (IFB) SPAIN: AEB (IFB) POLAND: GAB (WIB) POLAND: International School of Banking and Finance (WIB) ROLE OF NRC – RP - PRP Activities related to surveys and testing at local level which will consist on Studies at National level on: 1. Banking and Financial System (synthesis) 2. Education and Training in the B.F.S.S. (based on a questionnaire) 3. Accreditation and Certification Systems AGREEMENT WITH EFPA (Frankfurt, 19th January 2007) THE PARTIES AGREE • That the CERTIFIED Project will develop a general framework of competences in the Financial Services Sector in consultation with Project €FA • That both projects will recognise, valorise and whenever possible integrate the work done by the other during the life of the project • That the piloting activities of both projects will remain mutually exclusive • That periodic coordination through the two Contractors, the two Coordinators and a common partner will meet as needed to explore possible synergies in the interest of both Projects • This Memorandum acts as a temporary “bridge” contemplating an expanded Memorandum of Agreement CERTIFIED FSS Context Review and Analysis Two Surveys I SURVEY Identification of Professional Roles & Business Area By now sent to CERTIFIED PARTNERS and EBTN MEMBERS II SURVEY Identification of existing system for competences certification and accreditation of training providers and training programmes/courses By now sent to CERTIFIED PARTNERS STAKEHOLDERS INVOLVED IN THE FIRST SURVEY (Identification of Professional Roles & Business Area) • Banks • External Training Providers (University, Consulting Firms) IDENTIFICATION of Topics and Areas CERTIFICATIONS • Institute of Bankers PRIORITIES TRAINING NEEDS DETECTED BY: RESULTS Surveys on Professional Roles & Business Area BEST RANKED AMONG THE TRAINING NEEDS 5 . Customer Relationship Manager CUSTOMER RELATIONSHIP MANAGEMENT CRM is a business model that has, as its principal goal, the: IDENTIFICATION, ANTICIPATION AND UNDERSTANDING of the needs of potential and current customers, to increase retention, growth and profitability. CRM – MAIN COMPETENCES 1. Data & Information Management 2. Needs Analysis 3. Customer Solutions 4. Relationship Management 5. Customer Satisfaction 6. Selling & Sales Mgt Thanks for your kind attention “CERTIFIED” CERTIfication & Accreditation System for FInancial Services Sector EDucation and Training PARTNER MEETING Frankfurt, 14th February 2007 - 3rd Session - PLANNING What shall we have in month 9? (June 2007 – next coordination meeting) Survey 1: Relevant business areas Selection of the business area(s) to address with CERTIFIED Survey 2: Key features of existing certification and accreditation systems timeline Identification of the key features to be taken into account/integrated into CERTIFIED: Competences certification Accreditation of training / learning providers Accreditation of training / learning paths/courses Accreditation of training / learning resources (?) TODAY Validation by CERTIFIED partners and EBTN members REVI EW & INTE GRA TIO N The CERTIFIED competence-based model for certification and accreditation Ready to start the first piloting in June NEXT FRIDAY END OF JUNE PARTNERS MEETINGS 1) Kick off meeting (Athens, 2-3 November 2006) 2) Coordination meeting (Bucharest, 27-2 June 2007) ? SEMINARS AND WORKSHOPS 1) Validation Workshop (Frankfurt) 2) Local Seminars (Month 6), in each partner Country 3) Integration Workshop (Month 8), Lisbon 4) Consolidation Workshop (Month 19), Luxembourg ROLE OF EBTN ACCREDITATION AND CERTIFICATION COMMITTEE General Meeting COUNCIL OF EXPERT BOARD OF DIRECTORS ACCREDITATION CERTIFICATION COMMITTEE (5 Experts) Tech A.C. 2 Experts EFCB FR EXECUTIVE COMMITTEE WORKING COMMITTEE Tech A. C. 2 Experts …….. Tech A.C. 2 Experts CRM IT EBTN Secretariat PRESIDENT UK Compliance Surveys & Studies Conferences & Workshop …. PREPARATION OF THE WORKSHOP (16th February 2007) AGENDA 1. 2. 3. 4. Presentation of the Project (EBTN) Project methodological approach (SCIENTER) Project state of the art Debate Thanks for your kind attention