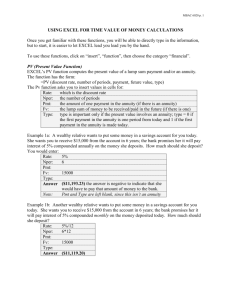

Formulas for Loans, Mortgages and Savings accounts

advertisement

Formulas for Loans, Mortgages and Savings accounts Bernard Liengme January 2012 The interest rates banks charge on credit card Interest Rate balances is criminal! Somewhere around 26% • When you borrow money you pay interest; when you save money you earn interest. • The interest is computed as a percentage rate and in normally quoted as a yearly (per annum) value. It is then called the APR – annual percentage rate. • But you are generally charged (or earn) on a monthly basis • If rate is the per annum percentage then the monthly percentage is rate/12 Number of Periods (nper) • A period is the interval between which you make a payment on the load (or the bank deposits earned interest into your account) • All of our examples will use monthly periods • If nper is the number of years over which you will pay of the load then in our formulas we replace nper by nper * 12. Principal • The starting amount of a load to distinguish it from the interest • Get the spelling right it is NOT principle • This word does not appear in Excel formulas Present Value PV • A $100 bill is worth (surprise!) $100. That is its present value. • You have won a prize that pays you $100 a month for 10 years. What is it worth? Or what is its present value? • Its PV is the amount of money someone would need to invest and get $100 a month for 10 years leaving nothing in the bank at the end of that time • We have to assume the interest rate remains the same as today’s value. Future Value FV • A $100 bill is worth $100 today and will be worth $100 in 10 years time (It may not buy as many pints of beer but it will still have a value of $100). That is it PV and its FV. • I deposit $100 in the bank, wait 10 years and then withdraw it. How much will I get? Or what will be its future value? • The catch phrase is the time value of money. Payment pmt • You borrow $1,000 from the bank for 1 year. • Every month you give the bank $86.99 (normally this will be deducted from you regular bank account automatically) • After 12 months the loan is paid off • When you began the loan: PV = 1000, FV = 0, rate = 8%/12 and nper = 1 * 12. We will see soon how to compute the payment pmt. How are these thing related? • By the money equation shown here nper 1 rate ) 1 nper fv 0 pv *(1 rate) pmt *(1 rate * type) * rate • But we will not have to worry about it Money has a value and a direction • There is a difference between giving and receiving money. • Money received is a credit and we give it a positive value • Money paid into the bank is a debit and we give it a negative sign Excel formulas • All the formulas for personal finance use the terms PV, FV, rate, nper and pmt • For everything but rate, we can rearrange the money equation to get just one term on the left. nper 1 rate ) 1 nper fv 0 pv * (1 rate) pmt * (1 rate * type) * rate nper pmt * (1 rate * type) 1 rate) 1 fv pv * nper (1 rate)nper (1 rate) rate PV • Present value =PV(rate,nper, pmt, [fv],[type]) • Arguments in brackets [] can be omitted when zero • My prize gives me $100 each month for 10 years, what is its PV? If the rate is 8% pa then we compute the present value with: =PV(8%/12,10*12,100) What if I will also get $500 at the end of the 10 years? =PV(8%/12,10*12,100, 500) And the answer is • Open the workbook Finance and on the PV worksheet note the way we do the calculations. Why are the two PV values shown in red? • Because it someone went to the bank to set up a price like this they would have to give money to the bank. Money would flow away from them. FV • Future value =FV(rate, nper, pmt, [pv],[type]) • I deposit $100 each month into a saving account. The interest rate is 8% pa. • PV = 0 since the saving account had nothing in it before the first payment. What formula should I use to find how much I can expect after 3 years? =FV(8%/12,3*12,-100) Why is pv given the value -100 with a negative sign? See worksheet FV Payment • Payment: =PMT(rate, nper, pv, [fv], [type]) • I borrow $1,000 at 8% pa and pay off the loan in 12 monthly installments. How much must I pay? • See worksheet PMT Number of Periods • I plan to save $250 each month until I have $100,000. Assuming the APR is 8%, how many monthly payments must I make? • Number of periods =NPER(rate, pmt, pv, fv, type) • Rate=APR/12; PMT = -250 (note the negative) • PV = 0, FV = 100,000, type = 0 (end of month) • Worksheet NPER Rate • Rate is found with RATE(nper,pmt,pv,fv,type,guess) • When the syntax is shown like this the bold arguments are required and the others are optional – in the other form we used [] for optional arguments • The money equation cannot be solved for rate, so Excel uses a ‘trial-and-error’ method like GoalSeek. Hence the guess argument: it sometimes helps to give Excel a start! Rate (cont) • I plan to save $400 each month for 25 years to give myself a pension. If my target is $500,000 what must the APR be during this time? • The answer is 9.65% which is unlikely at the present time. See worksheet Rate IPMT and PPMT • Where as PMT computes the payment on a loan, IPMT computes the interest part of this payment and PPMT computes how much went to paying down the principal. • See worksheet IPMT