Working Group 2

advertisement

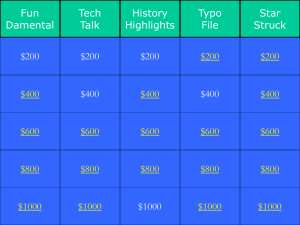

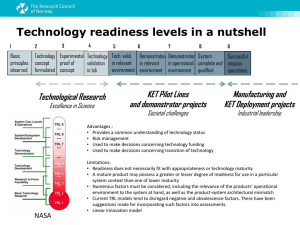

P4ITS Meeting #3 Giacomo Somma Project coordinator Welcome! Participants list Benef. Number 1 1 2 3 4 5 6 6 7 8 9 10 11 13 14 15 15 15 16 17 Short name ERTICO ERTICO NDR ATE ASFINAG VL VIGO VIGO CTAG FTA VTT EARDA ITSB TUDOR STA LIGURIA LIGURIA LIGURIA OHLC TOPOS First name Giacomo Anita Lasse Bianca Bernhard Jozef Antonio Manuel Jose Manuel Kari Satu Melinda Imad Christophe Lisa Jacopo Cristina Silvia Ana Jean-Philippe Family name Somma Toni Stender Kapl Jelinek Cannaerts Vivero Mijares Monroy Castro Martinez Hiltunen Innamaa Mátrai Fhail Feltus Silvemark Riccardi Battaglia Risso Pou Merina Méchin VERONA Arnaldo Vecchietti Excused 12 Meeting objectives and agenda P4ITS objectives Overall project objectives • • • • • Mutual learning and training Set-up of an external consultation process Raise awareness on PPI in C-ITS purchasers Propose key recommendations (guidelines) for PPI in C-ITS Consolidate P4ITS into a sustainable longer-term network Specific WP2 objectives (M1 – M6) • • • • Trigger the networking function Identify main specific points for discussion Agree on the planning for the first period meetings Prepare the framework for accession of new partners Specific WP3 objectives (M7 – M12) • Trigger in-depth discussion on the first identified barriers • Prepare first discussion paper/points • Identify potential external stakeholders-speakers for consultation P4ITS Meeting #2, Verona, 11-12.06.2014 Main outcomes of Meeting #2: • Updated flowchart defining the PPI concept – Presentations: Procedures & approaches in PPI (NDR), Technology Readiness Levels (TOPOS) • Discussion on key network topics (methods & procedures, ITS related risks & opportunities) – Presentations: IPRs (FTA), Procurement of services (FTA), Preferred supplier (Verona), Standardisation (TUDOR), Liability (Liguria), Modules strategies in ITS procurement (ATE) • Finalisation of deliverable D2.1 (submitted to the EC, to be published on P4ITS website) Agreement on objectives of Meeting #3 : • Completing the PPI flowchart with TRLs • Further discussion on key network topics • Develop methods table with smaller working groups • Find examples linked to the different methods • Prepare a discussion paper for the external consultation Agenda of P4ITS Meeting #3 Day 1 – Monday, 20 October 2014 13:30 14:00 – 14:15 Arrival of the participants Opening and welcome Meeting objectives and agenda 14:15 – 14:45 Network management and status overview Final approval of the PPI flow chart with TRLs 14:45 – 18:30 Presentations from the partners (TOPOS and ITSB) (coffee break around 16:30) Discussion on PPI strategies & methods, including pros & cons with practical examples and court cases 19:30 Open discussion on barriers and solutions of different methods Network dinner Day 2 – Tuesday, 21 October 2014 Discussion in Working Groups to develop table on PPI methods: 08:30 – 11:00 Legal aspects (incl. IPRs, liability, etc.) Practical aspects (e.g., product vs. service procurement) C-ITS specific aspects 11:00 – 11:30 Coffee break 11:30 – 12:30 WGs summary and completion of the table on PPI methods 12:30 – 13:30 Lunch Preparation of the external consultation and D3.2 (Discussion paper) 13:30 – 15:30 Update of work plan, next steps and meetings First annual report and review AOB 15:30 - 16:30 Visit to the urban traffic control centre of Bordeaux “Gertrude” Network management status overview Management of the network • The Project coordinator: – Manage the network, provide the secretariat, and organise the network meetings and regular conference calls – Support the preparation of the meeting agenda by interacting with the network participants to define the topics to be addressed and the needed speakers and cases to be presented – Follow up the meetings with minutes and a list of actions and decisions – Be in contact with the EC to implement any recommendation formally addressed to the network • The WP leaders: – ERTICO (WP1, 6, 7), NDR (WP2), CTAG (WP3), ATE (WP4), and VTT (WP5) – Other than for ERTICO, this function is meant as ‘honorary’ and does not imply a role in managing the WP – The WP leaders will support the organisation of the network meetings at their facilities and chair the meetings • The Management team: – As a basis, the project coordinator and the WP leaders form the Management team – Maximum of eight partners with a balanced representation (city, region, private road operator, agency, etc…) – The task is to steer the project coordinator in any decision making process – It is foreseen that the management team would participate in a monthly management conference call Management of the network • Network participants: – Consulted on the adoption of the discussion topics and the work plan – Validate candidature of new partners accessing the network • Communication: – Internal communication & information sharing all partners via email, coordinator also via p4its.eu – External communication & dissemination all partners in line with D7.1 - Communication Plan Risk management Description of possible risk Impact Probability of occurrence Low Low Change of staff at one partner Medium Medium Members of the network are not experienced enough in PPI High High Partners send a different member of staff to network meetings each time High Medium Network unable to agree on the key points for discussion High Low Availability of negative experiences High Medium Partner dropping-out Remedial action Invitation of external stakeholders (which will happen anyway) will make up for any partner loss. It is not expected to replace a lost partner with a new contract signatory. Recommend two active participants from each partner to ensure continuity in the event of a person departing. The requirement that named staff should have appropriate knowledge and experience has been made clear while formulating this proposal. In the event of staff changes, a replacement person with an equivalent level of knowledge will be insisted on by the project coordinator. Meetings planned well in advance to ensure that the right people are available. Ensuring the success of WP2, i.e. agreeing to a work plan, is key to creating a common view on where the project should go. Possibly encourage anonymous experience of negative experiences (reported in public documents in a way which explains the problems encountered but does not allow the reader to identify the parties involved). Milestones Mileston e No. Milestone name WP No. Achievement Planned date Actual date Leads to M1 Project confirmed WP1 Grant agreement signed M0 M0 Start of the project. Opening of WP1 and WP2. M2 WP2 end WP2 Agreement on key topics and work plan M6 M7 End of WP2. Start of WP3. M3 WP3 end WP3 Invitation sent to external stakeholders, with the discussion paper enclosed M13 M13M14 End of WP3. Start of WP4. M4 WP4 end WP4 Agreement on the 2nd analysis phase work plan M18 End of WP4. Start of WP5. M5 WP5 end WP5 Draft guidelines internally circulated M24 End of WP5. Start of WP6. M6 Network continuation WP6 Go/no go decision on the continuation of the network M30 Set-up of a sustainable network following the project / end of the network activities M7 Project completed WP1 Final review successfully passed M31 Finalisation of reporting and closing. Deliverables Deliverable No. D1.1 D1.2 D1.3 D1.4 D1.5 D1.6.(0 to 9) D1.7 D2.1 D2.2 D3.1 D3.2 D4.1 D4.2 D5.1 D6.1 D6.2 D6.3 D7.1 D7.2 D7.3 D7.4 D7.5 Deliverable name Network quality plan Year 1 progress report Year 2 progress report Final report Project factsheet Quarterly Progress Report Draft standalone webpage Network topics and work plan Renamed: WP2 description meetings proceedings New partners application process WP3 meetings proceedings Discussion paper WP4 external meetings proceedings and feedback Updated network topics description and work plan WP5 meetings proceedings WP6 meetings proceedings Final guidelines/recommendations Letter of commitment for the network continuation (if agreed by the network members) Communication plan Network website Network leaflet Final event Network compendium WP No. WP1 WP1 WP1 WP1 WP1 WP1 Natur e Report Report Report Report Other Report Dissem. level CO PU PU PU PU CO WP1 WP2 WP2 WP3 WP3 WP4 WP4 WP5 WP6 WP6 WP6 Other Report Report Report Report Report Report Report Report Report Other PU PU PU PU PU PU PU PU PU PU PU M3 M13 M25 M30 M2 M4, 7, 10, 13, 16, 19, 22, 25, 28, 30 M2 M6 M6 M12 M12 M18 M18 M24 M30 M30 M30 WP7 WP7 WP7 WP7 WP7 Report Report Other Other Report CO PU PU PU PU M7 M9 M9 M24 M30 Due delivery date Actual / planned submission date M12 M13 M5 M6, 9, 11 M3 M10 M10 M12 M12-M13 M10 M3 (report M12) M11 Grow the P4ITS network: Associated Partners (see deliverable D2.2) 1. Public stakeholders external to the project consortium having knowledge & interest to work on P4ITS topics without access to EU funding (at own expenses) Main obligation contribute to the project (not just “sit and watch”) What they are 3. P4ITS network to remain at a manageable size in line with work-plan and available resources Current issue 4. 5. 6. 7. Sign the “non-disclosure agreement” No impact on the budget / resources of P4ITS The interest of the P4ITS network shall prevail both on the interest of the potential Associated Partner and the interest of the individual beneficiary Propose ways of cooperation and active role, including the time 8. 9. Unanimity of partners to accept the application Termination by 2/3 majority of votes 2. Conditions Acceptance / Termination Potential applicants • CHARM project (Coordinator: Ian Chalmers, Highways Agency, UK) Area: PCP for Traffic Management Systems Start End date: 01-09-2012 31-08-2016 Web: www.rws.nl/en/about_us/business_opportunities/charm_pcp • SYNCRO project (Coordinator: Jean-Christophe Maisonobe, Conseil Général de l’Isère, FR) Area: PPI for Road Users Information Systems Start End date: 01-10-2012 31-03-2016 Web: www.syncromobility.eu • V-CON project (Coordinator: Benno Koehorst, Rijkswaterstaat, NL) Area: PCP on Building Information Modelling for virtual road construction and management Start End date: 01-10-2012 30-09-2016 Web: www.rws.nl/en/highways/v_con Source: http://cordis.europa.eu/fp7/ict/pcp/projects_en.html Participants to this Meeting #3 agree unanimously that the P4ITS coordinator invites : - the coordinators of the above listed projects to become Associated Partners of P4ITS - the respective consortia to participate to the external consultation. Final Event: ITS WC, Bordeaux, 5-9.10.2015 P4ITS-CHARM joint session? Yes! http://www.itsworldcongress.com/bordeaux-2015/ P4ITS network leaflet (D7.3) Dissemination • Website: to be updated with public deliverables, publications, news and events • Helsinki ITS European Congress – Special Session on PPI • Other events…? Inputs? suggestions? Please send them to g.somma@mail.ertico.com PPI flowchart with TRLs Proposed… TRL 1 TRL 2 TRL 3 TRL 4 TRL 5 TRL 6 TRL 7 TRL 8 TRL 9 Basic principles observed Technology concept formulated Experimental proof of concept Tech. validation in lab (small scale prototype) Tech. validation in relevant environment (large scale prototype) Technology demostration in relevant environment System/prototype demonstration in operational environment System complete and qualified Actual system proven in operational environment Which TRL? Pre-commercial procurement (PCP) encompasses R&D services up to prototyping or first test production stages (i.e. the development of limited prototypes and/or test products, but not the acquisition of larger volumes of resulting end-solutions on a commercial scale. (pg. 20) TRL range for PCP ? 3-5 or 2-6/7 The innovation process encompasses R&D and later phases such as preproduction, production, distribution, training, market preparation and new organisational or marketing methods. (pg. 5) TRL range for PPI ? 6-7 or 5-9 Source: “Guidance for public authorities on Public Procurement of Innovation”, www.innovation-procurement.org Manufacturing Readiness Level (MRLs) shall be also considered? Agreed TRL 1 TRL 2 TRL 3 TRL 4 TRL 5 TRL 6 TRL 7 TRL 8 TRL 9 Basic principles observed Technology concept formulated Experimental proof of concept Tech. validation in lab (small scale prototype) Tech. validation in relevant environment (large scale prototype) Technology demostration in relevant environment System/prototype demonstration in operational environment System complete and qualified MRL 1 MRL 2 MRL 3 MRL 4 MRL 5 MRL 6 MRL 7 MRL 8 MRL 9 Basic manufact impl.tions identified Manufact. concepts identified Manufact. proof of concept developed Production of technology in a lab environment Production of prototype components in relevant env. Produce of prototype system or subsystem in a relevant env. Production of system, subsystem or components in a representative env. Pilot line demo Low rate prod ready Low rate prod demo Full rate prod ready Actual system proven in oper. env. MRL 10 Full rate prod demo Lean prod practices ready Relationship of MRLs to System Milestones, TRLs, and Technical Reviews ( source: MRL Deskbook V2.21, Oct. 2012, http://www.dodmrl.com/MRL_Deskbook_V2_21.pdf ) TRLs - Technology Readiness Levels MRLs – Manufacturing Readiness Levels TRL 1: basic principles observed - Basic research. MRL 1: Basic manufacturing implications identified TRL 2: technology concept formulated - Concept and application formulated. MRL 2: Manufacturing concepts identified TRL 3: experimental proof of concept - Applied research. First MRL 3: Manufacturing proof of concept developed laboratory tests completed; proof of concept. TRL 4: technology validated in laboratory - Small scale (“ugly”) MRL 4: Capability to produce the technology in a prototype built in a lab environment. laboratory environment Pre-concept Material solution analysis TRL 5: technology validated in relevant environment - Large scale prototype tested in intended environment. MRL 5: Capability to produce prototype components in a production relevant environment Technology development (component) TRL 6: technology demonstrated in relevant environment tested in intended environment close to expected performance. MRL 6: Capability to produce a prototype system or Technology subsystem in a production relevant development environment (system) TRL 7: system prototype demonstration in operational environment - pre-commercial scale. MRL 7: Capability to produce systems, subsystems or components in a production representative environment TRL 8: system complete and qualified - First of a kind commercial system. Manufacturing issues solved. MRL 9: Low rate production demonstrated. Capability in place to begin full rate production TRL 9: actual system proven in operational environment - Full commercial application, technology available for consumers. MRL 10: Full rate production demonstrated and lean production practices in place Engineering and manufacturing MRL 8: Pilot line capability demonstrated. Ready to development begin low rate production Production and deployment Operations and support Presentations Presentations • PPI in the French regulation, Jean-Philippe Mechin (TOPOS) • Buying results of R&D Projects – The best practices, Imad Fhail (ITSB) Key network topics & Methods table Key network topics Essential for the “Discussion paper” (D3.2) for external consultation due delivery M12 (Nov. 2014) List of topics agreed: • Methods: table on methods and procedures for PPI with PROs & CONs, links to existing cases and possibly to some of the C-ITS modules and tools Method Description Forward commitment procurement Competitive dialogue Open procedure • IPRs • C-ITS related risks and opportunities, such as: – Legacy – Standards – Market size / development issues – Procurement of services vs. products – Human factor and planning – Maintenance and continuity of operations Legal aspects Practical aspects ITS aspects Procedures and Approaches in PPI Procedures: • Preliminary market consultation • Flexible procedures: Approaches: • Early announcement / Forward Commitment Procurement (FCP) or Prior Information Notice (PIN) – Innovation partnership – Needs assessment vs. market solutions – Competitive dialogue – Performance-based or functional requirements, also with variants – Competitive procedure with negotiation • More traditional procedures: – Open procedure – Restricted procedure Directive 2014/24/EU implementation in MS depends on national legislation. – Technical specifications, if known • Information: – Short prospectus or detailed tender documentation (incl. standards) – Info sharing with or without IPR transfer • Joint procurement with other public / private stakeholders www.citymart.com/citiesshare-index • Type of contract (e.g., Framework Agreement or Phase Contract), also based on KPIs & indemnities • Joint committee to steer PPI project and assess risk sharing between procurer and supplier / provider • Award criteria based on Total Cost of Ownership (TCO), Life-cycle costing Procedures and Approaches in PPI Source: “Guidance for public authorities on Public Procurement of Innovation”, www.innovation-procurement.org Working Groups Working groups Basis for discussion to fill in the table on PPI methods: • Legal questions related to public procurement of innovative ITS • Procurement issues for those innovative ITS as identified • Wider integration of PPI in the context of other instruments at regional or national level • Interoperability and certification • Identification and mitigation strategies for risks related to – Technology lock-in – Interoperability – Compatibility with legacy systems – Backward compatibility – Technical maintenance WG1: • Topics: – Legal aspects (incl. IPRs, liability, etc.) – Practical aspects (e.g., product vs. service procurement) • Composition: A. Toni (moderator), L. Stender, S. Rizzo, C. Feltus, L. Silvemark, M. Mátrai, B. Jelinek, K. Hiltunen WG2: • Topics: – C-ITS specific aspects – Practical aspects (e.g., product vs. service procurement) • Composition: G. Somma (moderator), J.P. Mechin, I. Fhail, J. Riccardi, C. Battaglia, B. Kapl, S. Innamaa, A. Pou, J.M. Martínez, A. Vivero, M. Monroy Working Group 1 - Discussion summary, 1/2 Approach Description Legal aspects Practical aspects Remuneration • Increases the incentives for participating and • Provide incentives / awards to the for participation developing/modifying/adapting solutions suppliers to participate to market and shortlisting • Today: Competitive dialog (and design contest) consultations • Directive 2014/24/EU: + innovation partnership • ‘Design contest’ • The same mechanisms as in PCP – competitive • Always consider the risk of illegal state development but combined with a public aid! procurement contract Reward innovative solutions through the evaluation criteria • Art. 67 • Innovation of PA in PPI • Involve stakeholders in defining the needs (public debate) once needs are known it is easier to achieve the targets / impacts IPR sharing (presupposed in innovation partnership) • IPR in the whole value chain – limited IPR from supplier, then from the subcontractor… • Define in the requirements the ‘openness’ of your platform; example: ACUT project (hospital sector) in Denmark Free test sites? • For the market consultations • Always consider the risk of illegal state aid! • Different stakeholders interest Working Group 1 - Discussion summary, 2/2 Approach Risk reducing procedure (e.g. joint procedure) Description Legal aspects • Get all experts together when writing the specifications • Risk for the future by choosing ‘innovation’ – consequences • Test period before procurement procedure but you do it after Practical aspects Working Group 2 - Discussion summary, 1/5 Approach Early announcement Forward Commitment Procurement Description Practical aspects • Early announcement of intention to procure or the deploy innovative solutions • “Prior information notice” (PIN) in the OJEU (Official Journal of the European Union) • Between announcement and tender: preliminary market consultation (art. 40) – have the industry solutions reached the required readiness (technology, tests, price?) • Combined with long time limits for the receipt of tenders? • Guarantee of minimum procurement volume? - Define the challenge (not easy) define high level objectives from which the functional requirements can be derived - Set up a working group with different expertise involving all relevant public / private stakeholders (avoiding risk of dominant position from potential provider by sharing information adequately), incl. innovation agencies - Need to allocate budget available vs. expected benefit (measured with KPIs) for both the PPI process and then for the actual contract (phased or not) and clearly communicate in the tendering process for each phase ITS aspects - Define mobility policy vision (incl. safety, security, and efficiency and societal challenges) and scenario objectives in a defined time period (in short / mid / longer term) Operational level: - Price evolution of C-ITS technology can change compared to process launch - Service vs. technology acquisition hides more complexity (Comms providers, ITS data sharing) Working Group 2 - Discussion summary, 2/5 Approach Functional requirements Description Practical aspects ITS aspects • Define req.ts Design the technical specifications with the aim of allowing innovation, efficiency improvement, and new ways of thinking – “open specifications” • Suitable for PPI’s following PCP’s or other PublicPrivate-Innovation projects (art. 14/16 f) • Helps to prevent supplier lock-out / disqualifying competitive advantages - Need to define KPIs to decide how to describe functional req.ts; this is not obvious how to measure minimum thresholds vs. optimum quality achievable - Leave it at abstract level (balance between under / over specifying and keeping the competition open) - Market innovation: consider technology transfer from across different sectors (cross-fertilisation) so to open new markets for existing technos Need to refine adequacy of functional req.ts & KPIs while moving on in the PPI process, especially when technical specifications can be defined evaluation tools and metrics to be revised at each step Working Group 2 - Discussion summary, 3/5 Approach Variants Description • Allows the procuring authority to evaluate both the technical specified solutions but also other “already on the market solutions” • In principal a combined tender with, and without, open (functional technical) specifications Practical aspects ITS aspects - Risk of proper definition of req.ts / functional specifications vs. technical specifications not yet defined; - Challenge of how to measure how well the different solutions match the requirements when these are defined at an abstract level - Market innovation: consider technology transfer from across different sectors (cross-fertilisation) so to open new markets for existing technos - Piloting solutions for technology evaluation but also for testing evaluation framework itself (the evaluation tool could be not well suited to assess certain technology aspects) Working Group 2 - Discussion summary, 4/5 Approach Description Total Cost of • E.g. energy efficient or labour Ownership cost-saving solutions (TCO) • An evaluation-technical price Life-cycle costing comprising different aspects of (art. 68) the costs over the life cycle of a product, solution etc. • Focus on data (from the suppliers) and transparent, objectively verifiable and non-discriminatory methods of calculating life-cycle costs Practical aspects ITS aspects - Very difficult to know the cost of running the ITS “ecosystem” (techno acquisition + operating it + …) since the beginning of the PPI process, so a provisional price can be defined at the end of the PPI process when awarding the contract, and then include in the contract a process for annual revision of price based on cost-effectiveness / performance. e.g. if a tender cover a TM service for 5 yrs, the contractor can fix the requirements on annual basis, so that the TM solution is always at the front end of innovation (VTT) - Cost of electricity related to RSU techno should be also looked at in the long term perspective, so maybe the cheapest RSU is more energy demanding, and another solution can be selected because of a lower Life-Cycle cost (TOPOS). - Legacy issues can make the cheapest techno more expensive to integrate in the existing system (e.g. connection to the Traffic Mngt Centre), depending on the volumes of units to be purchased (TOPOS). - Interoperability: need to maintain processing performance of old RSU / OBU when the sw is updated - often it is cheaper to update the sw than replacing the unit; sw vs. hw rebooting of the unit for system updates), hw rebooting in RSU require real road works because RSU are located at the top of the mast Working Group 2 - Discussion summary, 5/5 Approach Description Remuneration • Increases the incentives for participating and for participation developing/modifying/adapting solutions and shortlisting • Today: Competitive dialog (and design contest) • Directive 2014/24/EU: + innovation partnership • The same mechanisms as in PCP – competitive development but combined with a public procurement contract Practical aspects - Clearly define PPI process remuneration as an incentive for suppliers / providers to participate in it, but which does not cover all their participation expenses Option 1) Cost of PPI process is equally shared between procurer and supplier, and risk-benefit to be fairly shared as well. Option 2) The supplier is paid not for the work done but for the extra cost involved with the PPI process - Procurer to communicate that suppliers will be able to gather knowledge on the procurer / market needs while keeping the IPRs if not selected ITS aspects External consultation & plans update WP4: External consultation & feedback WP4 objectives (M13 - M18): • Interact with external stakeholders on the network's discussion paper • Collect feedback • Input the consolidated feedback in the network's work plan Task 4.1 - Start of the external consultation • Invitation to the identified external stakeholders • Interviews and/or questionnaires can be used, but a physical meeting is the main activity: – to present to external stakeholders the “Discussion paper” (D3.2) in detail – to gather external stakeholders opinion on discussion topics – to perform a reality check on the first conclusions of the network (not to convince anyone) Task 4.2 - Identification of potential enablers and discussion topics update • Based on feedback received, identify PPI enablers remaining realistic in the scale of their potential achievement (e.g. aligning competition laws in all MS is not considered as a realistic enabler) • Identify which points could be effectively addressed through a concerted approach and which will have realistically the highest impact, thus leading to update network discussion topics • Prepare the planning and work plan of the second analysis phase (WP5) Work plan update & next meetings • Revision of work plan confirmed as agreed in Meeting #2, i.e. meeting planned in Dec. 2014 is cancelled • Meeting #4 3-4 February 2015, Brussels, hosted by ERTICO – 3 Feb. 8:30-12:30 review + 3 Feb. 13:30-18:00 meeting + 4 Feb. 9-17 meeting – Rehearsal to be organised via telco – Agreed to invite CHARM, SYNCRO, V-CON coordinators (if they join as Associated Partners) • Meeting #5 20-22 May 2015, Vienna, hosted by AustriaTech / ASFINAG – 1 day workshop + 1,5 days consortium meeting with associated partners only – Agreed to invite external consultation participants to this meeting • Meeting #6 Sep 2015, Genoa, hosted by Regione Liguria (alternative: Helsinki, hosted by VTT) • Meeting #7 Nov 2015 (date, venue and host to be defined) • Meeting #8 Feb 2016 (date, venue and host to be defined) • Meeting #9 May 2016 (date, venue and host to be defined) First annual Progress Report & Review Progress Report: • Simplifications on financial aspects for lump sum Thematic Networks: – No definition of eligible costs – No actual cost reporting – No justification of costs – No provision of certificates – No budget transfers – Only coordinator financially validated • Technical report: – Contractually due to the EC within 60 days after the end of reporting period (29.01.2015) – …but to be submitted at least two weeks prior to the Review (16.01.2015) – Template prepared by coordinator and distributed to partners in November-December 2014 – All partners to provide input two weeks later (9 January 2015 at the very latest) Review: • Duration: half day • Participants: Project coordinator, WP leaders, EC project officer, + two external reviewers appointed • Proposed date and venue: 3 February 2015, 08:30-12:30, Meeting #4 venue (to avoid extra travels) Discussion paper (D3.2) – draft TOC • Executive Summary • Introduction • Document structure • European legal framework (Directive 2014/24/EU on PPI and Directive 2010/40/EU on ITS) • PPI definitions with flowchart & TRLs / MRLs • P4ITS Key Network topics • – PPI approaches table – C-ITS related aspects Experiences and challenges / opportunities – Country implementations / programmes / projects • French case with good practice table • Deloitte study (L. Stender to provide G. Somma with references) – Practical examples – Plans for the future (2020 document) Horizon 2020 calls on PPI / PCP actions Events www.eventbrite.com/e/modernizing-the-public-sector-and-boosting-economic-growth-throughinnovation-procurement-tickets-13238483661 This event is also related to the upcoming 2015 Horizon 2020 calls for proposals which could be of particular attention for procurers in the transport domain: • MG8.3 – call for PPI Cofund proposals on transport Infrastructure • ICT-36 – call for PCP Cofund proposals on any topic in any area of public interest (including transport) requiring ICT based solutions. MG.8.3-2015 – Facilitating market take-up of innovative transport infrastructure solutions • Specific challenge: deployment of highly innovative infrastructure solutions at integrated system level • Type of action: Public Procurement of Innovation (PPI) Cofund • Scope: actions should lead to the improvement and capacity building in the field of public purchasing of innovative solutions in transport infrastructure leading to implementation of best available solutions on cross-border TEN-T network and other business cases representative of typical European situations. Proposals should be driven by clearly identified procurement needs of infrastructure owners (the procurers), including life-cycle and cost-benefit assessments and environmental impacts under the life-cycle perspective, and should effectively control budget across various European regions. The work should contribute to the revision / development of relevant standards and regulatory framework, and to study strategies oriented to favour the innovation in transport sector. Good practices should be made available for replication. • Expected impact: serve as pilot projects; allow for a better coordinated dialogue between procurers and suppliers; contribute to competence building in the sector; build a coherent basis for progressive step changes to regulation, standardisation and public procurement practices fostering innovation and sustainability in transport infrastructure. • Call funding: total budget 18,5 Million euro (1 to 5 Million euro per project, but request can be higher); 20% funding rate. • Call details: one-stage proposal submission; opening 24-06-2015; deadline 15-10-2015. http://ec.europa.eu/research/participants/portal/desktop/en/opportunities/h2020/topics/2647-mg-8.3-2015.html ICT-36-2015 – Pre-commercial procurement open to all areas of public interest requiring new ICT solutions • Specific challenge: to drive innovation and reduce fragmentation of public sector demand in Europe by together challenging the market to develop innovative ICT based solutions. To share costs of procuring high-tech R&D and to speed up the time-to-market for promising research outcomes. To engage in more forward looking R&D procurement strategies to modernize the provision of public services faster whilst creating opportunities for EU industry and research. • Type of action: Pre-Commercial Procurement (PCP) Cofund • Scope: bring radical improvements to the quality and efficiency of public services through development and validation of breakthrough solutions through Pre-Commercial Procurement in all areas of public sector interest requiring innovative ICT based solutions, complementary to PCP Cofund actions foreseen under other challenges in ICT LEIT. Open both to proposals requiring improvements mainly based on one specific ICT technology field, as well as to proposals requiring end-to-end solutions that need combinations of different ICT technologies. • Expected impact: reduced fragmentation of demand for innovative solutions from procurers in the public sector; increased opportunities for wide market uptake and economies of scale for the supply side through the use of joint specifications, wide publication of results and where relevant contribution to standardisation, regulation or certification to remove barriers for introduction of PCP innovations into the market. • Call funding: total Call budget 561 Million euro (4 Million euro per project, but request can be higher); 70% funding rate. • Call details: one-stage proposal submission; opening 15-10-2014; deadline 14-04-2015. http://ec.europa.eu/research/participants/portal/desktop/en/opportunities/h2020/topics/9092-ict-36-2015.html ERTICO Partnership Project Proposal(s) • Coordinated by ERTICO Office or by ERTICO Partner • Based on the ERTICO Proposal Development Process • ERTICO Selection Committee selects Project Core Group based on: – Active contributions to proposal development – Proven competence/experience and expertise of organisation and person – Balanced and appropriate participation of sectors – Geographical balance – Optimum consortium size according to EC funding budget request • Participation of non-ERTICO Partners in project proposal is decided by the Project Core Group according to the following selection criteria: – Needs expressed by ERTICO Partners already in the consortium (e.g. local partners for test site activities) – Filling gaps in competence / expertise Statement of interest to participate in ERTICO Partnership Project Proposal(s) • • • • Submitted by: Organisation Contact person: Name SURNAME, email, phone Call identifier: MG.8.3-2015 and/or ICT-36-2015 Project contribution: Please describe briefly your contribution in the context of the proposal selected above • Proposed role for your organisation: Please select among Coordinator, Core team member, Consortium partner • Proposed contribution for your organisation: Please select one or more among Requirements, Architecture, Research, Development, Implementation, Test- or pilotsite, Validation, Communication, Other (please specify) • Expertise, competence and experience of your organisation: Please state your organisation’s specific expertise, competence and experience relevant for this particular call topic & proposed project; describe the tasks of your organisation Please return it to g.somma@mail.ertico.com by 31 October 2014. Thank you!