Are markets moral, cont.

advertisement

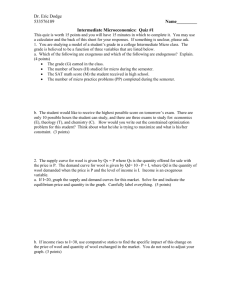

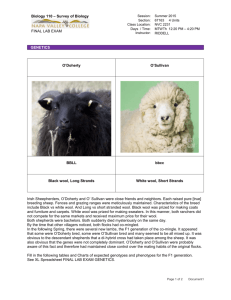

Continuation of Lecture 2 Checking Out • Supermarket Model -- gather all of your purchases into your cart and selecting which line (in front of store) to pay for purchases • Department Store Model -- pay for purchases in the ‘department’ where the goods are located • Snake Line Model -- Enter a single line and when at head of line go to first available clerk 1. 2. What do the stores have in common? Why do certain stores adopt one method and not the other? 7) Resources should be used efficiently to achieve society’s goals • Efficiency -- the inability to improve one person’s well being without hurting someone else (Pareto Optimality) If we are inefficient in our use of resources, we are wasting them. We could increase well-being (produce more) by reallocating them. • Why would you want to deny someone additional welfare if it didn’t hurt anyone else’s welfare? This is a normative (value) statement in contrast to positive statements (statements of fact). What can economists say about other goals for society such as fairness or equity in the distribution of society’s wealth? 8) Markets usually lead to efficiency • This statement is often taken to mean that society (a collective decision perhaps taken by government) should not interfere with individual choice. A positive statement leading to a normative conclusion. • But markets can fail to achieve an efficient result-- for example, congestion on the highways. 9) When markets are not efficient, government intervention can lead to improvement in social welfare • Yet there isn’t a guarantee that governments will improve upon the market outcome. Rather they hold out the possibility to improve upon the efficiency of the outcomes of individual choice. • Important to remember -- it is not that individuals make ‘bad’ choices; rather the market has failed to coordinate their decisions How is equity related to efficiency? • There is a tradeoff between equity and efficiency – As markets become more efficient, they are perceived as less equitable. • Markets generate inequality in earnings – Markets reward winners and punish losers • Losing firms exit from the market • In labor markets, the most able/talented are hired; others accept low wage jobs or are unemployed Equity • What is equity? – Equity is a value judgment that means different things to different people – Equity in the distribution of income often means that income was earned fairly Equity and Equality • Equity is not the same thing as Equality – A equal distribution of income means that all units have exactly the same income. – Some people may define an equitable distribution of income as one in which all incomes are equal, but most Americans would not!!! – To most Americans, incomes in an equitable distribution of income would vary according to individuals contributions to the market. • Most Americans believe the story of the Little Red Hen represents equity! Are markets moral? • If markets generate distributions of income that are unequal, are markets moral? – Markets are neither moral or immoral. – Markets are amoral. • They are simply the interactions among individuals • They move toward equilibrium and • They promise efficient use of resources. Are markets moral, cont. • The issue of morality enters the discussion of markets in two ways: 1. Did the market participants behavior morally? • Was there a level playing field? – Did firms collude? Fix prices? Restrict supply? – Were individuals given equal opportunity to prepare themselves for market activity? Are markets moral, cont. 2. How did society react to the situation of the losers? • Were the losers supported in ways consistent with their dignity as human beings? (alternate definition of equity) – Examine redistributive policies » Tax policies » Social insurance and public welfare Is the market moral, cont. • Additional reading – Chapter 21, “Taxes, Social Insurance and Income Distribution” – Rebecca Blank and William McGurn, Is the Market Moral? A Dialogue on Religion, Economics, and Justice. The Brookings Institution, 2003. – National Conference of Catholic Bishops, Economic Justice for All: Pastoral Letter on Catholic Social Teaching and the US Economy, 1986. Summary: Nine Principles 1) Resources are scarce 2) Every Choice has an Opportunity Cost 3) Choices are made at the margin 4) Individuals seek their self interest 5) There are gains from trade 6) Markets move toward equilibrium 7) Resources should be used efficiently 8) Markets usually lead to efficiency 9) When markets don’t achieve efficiency, government intervention can improve social welfare Trade-Offs and Trading Lecture 3 In Lecture 3 • Models • Trade-Offs (Production Possibility Frontiers and Opportunity Cost) • Implication for Trading and Production (Specialization and Comparative Advantage) To Understand the Complex World, We Construct a Simplified Model • Models are abstractions of reality, capturing what is believed to be the important relationships • Expressed in words, graphs, or mathematical equations • Will imply a path of causation and relationship between variables • Holding Everything Else Constant David Ricardo (1772-1823) • Credited with creation of the ideas of absolute and comparative advantage to understand trade • Examined taxation and government spending • Was successful in his own investing What Can I Produce? Wine • I could produce only Wool (specialization in Wool) • I could produce only Wine (specialization in Wine) • Or combinations of both (efficient combinations) • Why is the production possibility frontier (PPF) bowed outward? Not Feasible Feasible but Inefficient Wool A Word About Slopes Y • Let Y = f(X) denoted by the red line • From the initial point (Xo,Yo) Consider a change in X = X and consequently a change in Y = Y Yo The ratio Y/X is the slope of the blue line drawn through the two points (Arc Method) Y • X Xo X For small (marginal) changes in X, the slope of the line tangent to the function represents the slope of the function (Point Method) Opportunity Cost Slope=Wine/Wool Wine A B W0 W1 Wool •The slope of the PPF tells us how much Wine we would have to give up to get more Wool -- Opportunity Cost of Wool •Assume we are producing small amounts of Wool (W0). The slope of the red tangency tells us the Opportunity Cost of Wool (how much Wine we have to give up). The relatively flat slope indicates small sacrifices of wine are required to obtain additional units of wool. •Now assume we have produced more Wool (W1). The relatively tangency line tells us that larger amounts of wine must be sacrificed to obtain more wool than W1. •The Opportunity Cost of Wool in terms of Wine has risen as we move along the PPF from A to B •The bowing out of the PPF reflects increasing opportunity costs Alternative PPFs Wine Increasing Opportunity Costs Constant Opportunity Costs Decreasing Opportunity Costs Wool Economic Growth Wine Why would the PPF shift outward? -- more resources: land, labor, capital, and human capital -- technological progress Initial PPF Wool Production and Consumption Assume that there are Constant Opportunity Costs in Wool and Wine Production in two Countries Wine Britain is currently producing both wool and wine without trade (current production levels are marked) Consider a potential trading partner’s PPF, Portugal and their current production (neither country has an absolute advantage) Will trade between Britain and Portugal improve the well being in both countries? Wool Specialization and Trading Wine Line Parallel to Portugal’s PPF implies same opportunity cost Assume Britain decides to specialize in Wool and use some of their surplus wool to purchase wine from Portugal - is this possible? If Portugal reduces its wool production by the same amount that Britain has increased Will the gain in their wine production exceed the loss in wine production in Britain? If Portugal trades their increased wine production for Britain’s increased wool production then Portugal continues to be able to consume exactly what it did prior to the specialization and trading but Britain can increase its wine consumption and still consume the same amount of wool -they are better off. Wool Efficiency While Portugal has not gain, Britain has and so there has been a gain in efficiency. On this figure, how can we show wine and wool consumption that would represent both countries being made better off? Wine Draw quadrants through each countries initial consumption points The areas in the ‘northeast’ quadrants represent where both countries would be better off Less aggressive trading terms with Portugal would allow both countries to be made better off. Wool Why do these trading patterns emerge (Portugal trades wine for wool)? Countries specialize in activities they have a comparative advantage -relatively lower opportunity cost of producing. Adjustment Costs What is happening in both Britain and Portugal? In Britain, workers who used to work in the vineyards are working in wool. In Portugal, workers in the woolen industry will migrate to the vineyards. Is there a cost to this adjustment? There is a one time adjustment costs as workers have to find employment in other sectors of the economy but the benefits of trade are on going. How can a democratic society make these adjustments and impose these costs on some in order to reap the gains? Additional Reading In handouts folder on web site, read the New York Times op-ed by Senator Schumer and Paul Craig Roberts and the speech by Ben Bernanke (Chair of the Fed) on globalization The Story over Time • Woolen manufacturing is more likely to benefit from technical progress compared to wine production • Consequently the PPF of the country specializing in wool will shift out faster than the country specializing in wine • Britain became wealthier while Portugal became relatively poorer Trade and Specialization As individuals and countries specialize, they will trade for goods and services they do not produce. Consequently they will become dependent upon others for their consumption. Is this good or bad for countries? Can they trust each other? On the Homefront Market Production (Income) In 1950, women made less in the paid market but were more productive in home production. What would the PPFs for males and females look like? Does this suggest that women would specialize in home production while males went to work? What gave women their comparative advantage? Male Over the last decades of the 1900s, discrimination against women in the labor force lessened (let us assume that our couple would earn the same amount if they devoted their entire time to market work). Would women stop cleaning homes? Female (today) Female (1950) Home Production While women would have an absolute advantage over men, we would expect men to continue to devote themselves exclusively to market work (not to engage in home production). Women may engage in more market work using the extra income to hire someone to clean the home or do two shifts (at the home and at the office). Sharing the home production is not consistent with the theory of comparative advantage and specialization. Assignment for Next Lecture • Do Homework 2 on ‘Homework Assignment’ by Wednesday at 5 pm • Read Chapter 3 • Topics Next Time – Concept of Demand and Supply