CVS Company Valuation

advertisement

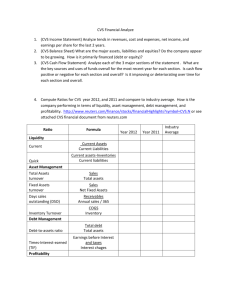

FIN 4310-001 Company Valuation Market Profile 120.00 72.37-105.46 52 Week Price Range 100.00 4,600,250 Average Daily Volume 0.96 80.00 1.40(1.30%) 60.00 1.14B 40.00 Beta Dividend Yield (Estimated) Shares Outstanding Market Capitalization 117.09B Institutional Holdings 87% 20.00 Book Value per Share 33.3 Debt to Total Capital 34.13 CVS Stock Price Current Price: $103.65 0.00 2.04M Insider Holdings 12% Return on Equity Historical EPS Highlights Q1 Q2 Q3 Q4 Year 2012 $0.60 $0.76 $0.80 $0.90 $3.04 2013 $0.77 $0.92 $1.03 $1.06 $3.77 2014 $0.96 $1.06 $0.82 $1.16 $3.98 Stock Info Ticker TICKER: CVS 04/08/2015 CVS Current Price 103.65 Recommendation HOLD Price Target 98.43 Growth in Medicare Lives: With 10,000 baby boomers turning 65 every day, the Medicare-eligible population is increasing. CVS is well positioned to serve this market through their retail pharmacies, PBM, and SilverScript which is currently in second place for Medicare Part D prescription drug plan. CVS has reported more than 24,000 pharmacists across their enterprise. Reduce Costs Not Care: With U.S. health care and prescription drug spending on the rise, CVS offers comprehensive solutions that help clients manage this trend wthout sacrificing patient care. With one large health plan client, CVS’ entire enterprise is involved and collaborating with its patient-centered medical home (PCMH) model. CVS provides face-to face adherence counseling while also providing information directly into the patient’s electronic health record at the PCMH. New Ways to Save: CVS Health is pioneering new strategies to lower costs for health plans and their members, which includes CVS/minuteclinic utilization and innovative formulary strategies. CVS is also participating in narrow restricted pharmacy networks. CVS reduced co-pay at CVS/minuteclinic by 8% for patients who use their walk-in medical clinics. Also, formulary management strategy is expected to drive total incremental client savings of 3.5 billion from 2012-2015. Removing Tobacco Products: CVS is the first national pharmacy chain to remove tobacco products from shelves. It is reported that once you quit smoking, it only takes 20 minutes for the body to begin healing. CVS has proven that they are not solely focused on driving sales and revenues, but in the overall health of its clients. (Source 1) CVS Company Valuation 2015 Business Description CVS Health Corporation, jointly with its affiliates, delivers incorporated pharmacy health care in the United States. Through 7,700 retail pharmacies, more than 900 walk-in medical clinics, a prominent pharmacy benefits administrator with more than 65 million plan members, and escalating specialty pharmacy services, CVS facilitates individuals, businesses and communities to administer well-being while being effective and also making it affordable. CVS has an incomparable suite of competences and the capability and proficiency needed to push innovations that will shape the future of health. For the time being, CVS is the only incorporated pharmacy health care with the capability to influence customers and suppliers with advanced, channel-agnostic solutions. CVS programs are intended to encourage well-being, and to help direct unsuitable application and non-obedience to medication, each of which has the possibility to result in unfavorable medical events that undesirably impact affiliate health and client pharmacy and medical spend. In response, CVS proposes different utilization management, medication management, quality assurance, adherence and counseling programs to complement the client’s plan design and clinical strategies. (Source 2) Primary and Secondary Markets/Products CVS’ predominant clients are employers, insurance providing companies, mergers, government employee groups health plans, Managed Medicaid plans and plans offered on public and private exchanges other sponsors of health benefit plans and individuals located throughout the United States. It offers pharmaceuticals to appropriate members in benefit plans sustained by its clients and utilize its information systems, among other things, to aid in performing safety checks, drug interaction screening and identify opportunities for generic substitution. (Source 2) Business Risks/Outstanding Litigation In the year of 2011, according to the U.S. Justice Department, CVS pharmacies located in Sanford, Florida, ordered excess amounts of painkillers, enough to supply a population eight times its size. At the time, Sanfords population was a measly 53,000, however, the order requested from CVS would be enough for a population of 400,000. According to the Drug Enforcement Administration, it was recorded that in 2010, one CVS store located in Sanford ordered a staggering 1.8 million Oxycodone pills, which averages 137,994 pills a month. When compared to its competitors, CVS’ average was more than 130,000 pills a month. According to the Drug Enforcement Administration, a pharmacist working at a location in Sanford stated that, “approximately every third car that came through the drive-thru lane had prescriptions for oxycodone or hydrocodone”. It was also stated that customers requested drugs using street slang, which then was lead to believe that the drugs were being misused, not solely for pain management purposes. CVS recently experienced financial risk when they decided that they would no longer be selling cigarettes. However, this was no easy decision since the sale of cigarettes normally results in $2,000,000 in sales. Despite coming to the decision that cigarettes would no longer be carried in CVS stores around the United States, the company’s main focus is to promote health and to secure a positive impact on the well-being of their customers. (Source 3) CVS Company Valuation 2015 Business Model CVS is a company most Americans are familiar with, primarily due to the fact that we are reliant on their pharmaceutical products, and that they have a strong nationwide presence. The company can be split up into three different segments: Retail Pharmacy Segment: CVS currently operates approximately 7,700 stores worldwide. This segment is made up of three categories; Pharmacy, Front Store, and Minute Clinic. The Pharmacy fills prescriptions and accounts for a significant amount of the company’s revenue stream. The Front Store category sells general merchandise as well as over the counter medications. Lastly, the Minute Clinic allows customers to receive basic healthcare at their physical locations, administered by registered professionals. CVS strategically places stores in convenient locations, close to where people live or work. For this reason customers are drawn to CVS not only for their pharmaceutical products, but also for groceries and other consumer goods. Pharmacy Services Segment: This segment consists of their PBM business, Mail Order Pharmacy, Medicare Services, and Specialty Pharmacy services. The bulk of annual revenue is attributable to this segment. The PBM services consist of designing drug plans for other large entities, managing benefits, and offering discounts through scale. The Mail Order business accounts for all of their customers who prefer to receive their prescriptions through the mail. The Medicare services part accounts for customers who are subscribed to the Part D program, CVS distributes the benefit of that plan for those eligible customers. Lastly the Specialty Pharmacy administers expensive medications for serious illnesses, such as cancer or multiple sclerosis. Corporate Segment This segment provides support for the other two segments; including departments like; Executive Management, Finance, Legal, Compliance, Human Resources, etc. (Source 1) SWOT Analysis Strengths Low Cost Provider of Drugs Limited Competition Large Network of Locations Loyalty Rewards Program Large Brand Awareness Weaknesses Difficult to integrate acquisitions High COGS and operational expenses Opportunities Change in healthcare laws Aging population Introduce more generic drugs Global Expansion Threats Walmart focusing on pharmaceutical drugs Changing Healthcare Environment Generic drugs lowering margins CVS Company Valuation 2015 Revenue Drivers: The bulk of the company’s revenue comes from their Retail Pharmacy, and PBM business. It is also important to note that their specialty drug products, for serious illnesses, have exceptionally good margins, therefore CVS should focus on increasing their specialty drug business. Expense Drivers: CVS does have a high Cost of Goods Sold, relative to Sales. The majority of their expenses stem from COGS, discounts payable, accounts payable, and discounts and claims payable. Gross Margin % Year CVS Walgreens United Health Group Rite Aid. Corp. Express Scripts 2010 21.10% 28.20% 26.90% 26.60% 6.80% 2011 19.20% 28.40% 27.00% 26.50% 7.00% 2012 18.30% 28.40% 27.50% 26.00% 7.90% 2013 18.80% 29.20% 27.10% 28.80% 8.00% 2014 18.20% 28.20% 28.50% 28.70% 8.30% Average 19.12% 28.48% 27.40% 27.32% 7.60% (Source 2) Gross Margin Trend: CVS does not have the most impressive Gross Margin’s when compared to its fellow Pharmaceutical competitors. Another worrying issue for management to consider is the fact that over the past 5 years the gross margin has been trending down, indicating as the company’s revenues increase, margins decrease. Recent Financial Performance Recent Quarter: Overall 2014 was a great year for CVS, but Q4 was an especially strong close to the year. We would like to bring attention to the following key metrics, which give investors promising feedback on the financial position of the company. Adjusted earnings per a share (EPS): up 8.4% from last year Q4 Retail Operating Profit: up 6.5% from last year Q4 Returned more than $1.5 billion to shareholders in Q4 Repurchased more than 14.1 million shares for $1.2 billion in Q4 Consolidated Revenues were up 12.9% in Q4 vs. last year Retail revenues up 2.9% vs last year Q4 Added 35 new clinics in Q4 These metrics reflect strong growth across all of CVS’s operating segments, particularly in retail. Strong performance was driven by strong pharmacy same store growth. (Source 4) CVS Company Valuation 2015 Past Year (2014): Overall 2014 was a very successful year for CVS. Adjusted earnings per a share (EPS): up 13.5% from last year Retail Operating Profit: up 7.9% from last year Free Cash Flow: up 48.1% from 2013 CVS has been able to achieve significant growth in 2014, despite a controversial decision to drop cigarettes from its stores, which had less of a negative impact than expected. Past 5 Years: The past 5 years have seen CVS experience significant growth, steadily increasing its stores by 618, which equates to a 7.9% growth. With the amount of stores increasing, revenues have also enjoyed a healthy growth each year. In 2010 revenues were at $95 billion, but each year they have grown, and last year’s revenues were up to $139 billion. Another area that might excite investors is the company’s dividend over the past couple years, growing from $.35 in 2010, to $1.10 in 2014. It is important to note that in the past 5 years the greater economy has seen significant growth as a whole, especially the stock market. (Source 4) Past 5 Years Income Statement: The past five years have been very beneficial for CVS. They have seen their revenues grow swiftly, but more importantly there profitability steadily grow too. Earnings per a share have grown substantially from $2.51 in 2010, to $3.98 in 2015. Past 5 Years Balance Sheet: As the company has grown steadily over the past few years, most assets categories have imitated that steady increase. However there are some notable increases. In 2013, Total Cash and Short Term investments shot up from $1.3 billion to $4.2 billion, however they experienced a rapid decline in 2014 back down to $2.5 billion. Asset growth has been slow and steady, which is common of such a mature large company. Notably, 2014 was the first year that the company took on long-term investments in this period. On the Liability side of the balance sheet there was similar steady growth in liabilities. Total Current Liabilities saw a major increase, driven by an increased reliance of short-term borrowings. Long-term debt is actually down from 2013. Past 5 Years Cash Flows: Cash from Operations has seen a steady increase over the last few years, experiencing a notable jump in 2014 from $5.7 billion to $8.1 billion. Cash from investing has also seen similar trends, rising from -$1.1 billion to -$4.0 billion. Dividends paid are at a period high, and they are paying back a large amount of debt. The net change in cash flow has been fairly inconsistent, with no recognizable trends. (Source 4) CVS Company Valuation 2015 Peer Group Analysis Our group narrowed down CVS’s long list of competitors to the following. Peer Group CVS Walgreens United Health Group Rite Aid. Corp. Express Scripts Market Cap $ 117,568.20 $95,133.02 $111,916.11 $8,587.42 $61,302.41 Total Revenue $ 139,367.00 $ 77,617.00 $130,474.00 $26,277.91 $100,887.10 Walgreens: A competitor with a very similar business model provides a good benchmark due to their similarity. United Health Group: This is a competitor that possesses a very similar size profile, which is emphasized by close market capitalization and revenue. While not a direct competitor in the retail pharmacy arena, they are a fierce competitor in the PBM segment. Rite Aid Corporation: While Rite Aid doesn’t match CVS’s size, they share a similar business model. Rite Aid focuses on the Retail Pharmacy segment, as well as the general merchandise products. (Groceries, Consumables, Beauty Products, etc.) Express Scripts: This competitor provides a very good comparable due to the similarity in size, and the similar business model of the PBM. (Source 2) Product Differentiation and Market share CVS Health is subdivided into 3 segments as the largest integrated pharmacy company in the United States. This includes CVS/Pharmacy the second largest retail pharmacy in the country with more than 7,700 stores. CVS/Caremark its leading pharmacy benefit manager and mail service pharmacy serving more than 60 million plan members. CVS/Minute Clinic the retail health clinic system division of CVS Health, the largest in the nation with more than 900 clinics locations. CVS/specialty, the specialty pharmacy division of CVS Health, which provides specialty pharmacy services for patients who require treatment for rare or complex conditions. In 2012, CVS Health filled 718 million prescriptions, which accounted for 20% of the U.S. retail pharmacy market positioning the company as the leader in the country. CVS products and services include: branded prescription drugs, specialty prescription drugs, generic prescription drugs over-the-counter nonprescription medication, cosmetics and toiletries, Food and beverages, other merchandise and photo processing services, personal health goods. (Source 5) CVS Company Valuation 2015 Porter’s Five Forces The Drugstore Industry is a very large industry consisting of large, well-known chains and small pharmacies that provide retail drug prescriptions, over-thecounter medications, health and beauty products, and often many other general merchandise (Groceries, Beauty Products) product categories. The industry annual growth rate is 2.2% with $257 billion in revenue. While local and regional drugstores have their share of the market, the drugstore industry as a whole is defined in large part by its heavy concentration. According to "Drug Channels" in 2013 the pharmacy industry consisted of five major chains which controlled 63 % of the industry revenues. These five major chains included CVS Health, Walgreens Boots Alliance, Rite Aid Corporation, Express Scripts and Walmart. The demand for pharmaceuticals is constantly increasing as they become more affordable to the average American due to health care. The expansion of coverage, from laws such as the Affordable Healthcare Act, will have a lasting positive impact on the demand for drugs prescription and consequently on CVS Health future revenues. Revenues of U.S. drugstores are expected to reach $350 billion by the end of 2015, growing at 5.3% annually. However, cost cutting measures implemented by the government will likely shrink profit margins. Despite potentially small profit margins, competition will remain strong among industry players. The Pharmacies and Drug Stores industry has moderate barriers to entry, although barriers to entry are increasing. Due to industry consolidation, which allows larger players to develop large networks and favorable supply-side contracts with pharmaceutical manufacturers, the industry is expected to have more barriers to entry over the next five years. Further offsetting potential industry entrants, the industry is subject to federal and state laws that make retailing certain products subject to stringent regulations. Nevertheless the sector face increasing competition from general merchandise, food retailers and supermarkets chains such as Walmart which has infiltrated the list of the top five drugstore dispensers and gained market share in the pharmacy business. Many regional and national supermarket chains have significant pharmaceutical departments. Since drugs store companies all elected to buy brand-name drugs via a drug wholesaler rather than directly from a manufacturer they need to contract with wholesalers. So there is some amount of supplier power. Three drugs wholesalers companies control about 85% to 90% of all revenues from drug distribution in the United States: AmerisourceBergen Corp. (NYSE: ABC), Cardinal Health Inc. (NYSE: CAH) and McKesson Corp. (NYSE: MCK). Cardinal services the CVS retail stores and distribution centers, while McKesson supplies the Caremark mail facilities and some small retail businesses. (Sources 6,7,8) CVS Company Valuation 2015 Ratio Analysis Our group decided to use a ratio analysis to better compare the peer group of CVS. We focused on 4 major areas of comparison; Profitability, Long Term Investment Activity, Short Term Investment Activity, and Liquidity. Our purpose, after comparing each firm’s relative ratios, is to better understand CVSs’ position in the industry. Profitability Ratios: Year CVS 2010 2011 2012 2013 2014 Average Return on Assets (ROA) Walgreens United Health Group Rite Aid. Corp. Express Scripts 6.20% 8.80% 8.20% 1.70% 12.20% 6.20% 9.50% 8.10% 1.90% 11.10% 6.90% 7.20% 7.80% 2.20% 6.00% 7.20% 6.70% 7.40% 6.10% 4.80% 7.50% 6.80% 7.60% 6.80% 5.40% 6.80% 7.80% 7.82% 3.74% 7.90% Return on Capital (ROC) Year CVS Walgreens United Health Group Rite Aid. Corp. Express Scripts 2010 8.10% 13.50% 14.00% 2.90% 20.30% 2011 8.30% 15.10% 13.80% 3.40% 17.40% 2012 9.40% 10.70% 12.90% 4.20% 8.90% 2013 10.10% 9.60% 12.00% 11.90% 7.10% 2014 10.70% 9.90% 12.60% 13.20% 8.40% Average 9.32% 11.76% 13.06% 7.12% 12.42% Year CVS 2010 2011 2012 2013 2014 Average Year 2010 2011 2012 2013 2014 Average CVS Return on Equity (ROE) Walgreens United Health Group Rite Aid. Corp. Express Scripts 9.30% 14.50% 18.70% NM 33.70% 9.20% 18.60% 19.00% NM 42.00% 10.20% 12.90% 17.90% NM 10.50% 12.20% 13.00% 17.00% NM 8.50% 12.20% 10.20% 16.70% NM 9.70% 10.62% 13.84% 17.86% NM 20.88% Gross Margin % Walgreens United Health Group Rite Aid. Corp. Express Scripts 21.10% 28.20% 26.90% 26.60% 6.80% 19.20% 28.40% 27.00% 26.50% 7.00% 18.30% 28.40% 27.50% 26.00% 7.90% 18.80% 29.20% 27.10% 28.80% 8.00% 18.20% 28.20% 28.50% 28.70% 8.30% 19.12% 28.48% 27.40% 27.32% 7.60% CVS Company Valuation 2015 Profitability Ratios As evidenced above, CVS has had a difficult time increasing its profitability. When focusing on Gross Margin, it becomes clear that they are trending down in this area. Their 5 year average for GM is 19.12%, which ranks them 4 th amongst the selected group of competitors. It is a slightly better picture for the 3 other profitability ratios, all showing signs of modest increases over the last 5 years. However, when it comes to relative positioning, CVS is consistently ranking 4th amongst competitors. To our group, this is a sign of caution, because they have been increasing revenues but at a decreasing rate of profitability. Long Term Investment Activity Long Term Investment Activity Analysis Year 2010 2011 2012 2013 2014 Average 11.79 12.76 14.4 14.7 15.97 13.92 Net Fixed Asset Turnover Walgreens United Health Group Rite Aid. Corp. Express Scripts 6.13 95.44 10.52 153.31 6.36 87.85 11.64 143.12 6.08 55.97 13.25 151.96 5.97 45.76 13.37 108.01 6.26 45.92 13.25 103.05 6.16 66.19 12.41 131.89 CVS 2010 2011 2012 2013 2014 Average Year 1.55 1.69 1.88 1.84 1.91 1.77 Total Asset Turnover Walgreens United Health Group Rite Aid. Corp. Express Scripts 2.62 1.54 3.13 4.00 2.69 1.56 3.23 3.53 2.35 1.49 3.5 2.54 2.09 1.51 3.52 1.86 2.10 1.55 3.64 1.88 2.37 1.53 3.40 2.76 CVS Long Term Investment Activity Ratios Overall CVS does have respectable turnover ratios; however their rank amongst their competitors is not stellar. If you single out Walgreens vs. CVS, CVS is at a slight disadvantage in the Total Asset Turnover, but inches back with a higher Net Fixed Asset Turnover. Based on our selected peer group, CVS does need to improve. CVS Company Valuation 2015 Short Term Investment Activity Short Term Operating Activity Analysis Year 2010 2011 2012 2013 2014 Average Year 2010 2011 2012 2013 2014 Average 7.18 8.34 9.55 9.33 9.92 8.86 Inventory Turnover Walgreens United Health Group Rite Aid. Corp. Express Scripts 6.83 N/A 5.59 120.57 6.7 N/A 5.79 113.42 6.8 N/A 6.14 85.22 7.36 N/A 5.74 54.34 8.48 N/A 5.92 46.43 7.23 5.84 84.00 52.36 44.61 39.95 42.2 41.68 44.16 Cash Conversion Cycle (Days) Walgreens United Health Group Rite Aid. Corp. Express Scripts 33.68 N/A 52.01 -9.68 34.21 N/A 52.38 -12.7 32.26 N/A 48.22 -10.9 29.4 N/A 49.01 -14.77 26.79 N/A 47.87 -15.95 31.27 49.90 -12.80 CVS CVS Short Term Investment Activity Ratios CVS has a Cash Conversion Cycle of 44.16, even though it is not the highest amongst the peer group, it is a negative sign. The fact that it is such a high number, and that it is positive, indicates that CVS may not be using their working capital as efficiently as possible and that it may have a problem turning cash spent on inventory into cash received on products sold. CVS has a healthy Inventory Turnover, ranking 2nd behind Express Scripts, this shows that they are able to turnover inventory in an efficient manner. Short Term Investment Activity -see following page. CVS Company Valuation 2015 Liquidity Analysis Year CVS 2010 2011 2012 2013 2014 Average Year 1.6 1.56 1.42 1.64 1.37 1.52 CVS 2010 2011 2012 2013 2014 Average Year 2010 2011 2012 2013 2014 Average 0.57 0.62 0.56 0.84 0.64 0.65 CVS 0.43 0.49 0.47 0.37 0.43 0.44 Walgreens 1.6 1.52 1.23 1.34 1.38 1.41 Current Ratio United Health Group Rite Aid. Corp. Express Scripts 0.67 2.07 0.75 0.74 1.82 1.48 0.67 1.75 0.82 0.63 1.71 0.64 0.67 1.71 0.62 0.68 1.81 0.86 Walgreens 0.58 0.5 0.4 0.53 0.66 0.53 Quick Ratio United Health Group Rite Aid. Corp. Express Scripts 0.62 0.49 0.57 0.69 0.44 1.38 0.62 0.46 0.63 0.58 0.41 0.45 0.62 0.44 0.46 0.63 0.45 0.70 Walgreens 0.5 0.45 0.51 0.48 0.44 0.48 Cash Ratio United Health Group Rite Aid. Corp. Express Scripts 0.26 NM 0.54 0.29 0.16 0.4 0.26 0.1 0.37 0.25 0.32 0.36 0.26 0.28 0.27 0.26 0.22 0.39 Liquidity Ratios CVS has a very strong Current Ratio, especially with respect to the peer group; this highlights the fact that the company shouldn’t have any problems paying off its short term obligations. There is not too much difference between the competitors when it comes to their Quick Ratios; they are all within a small range of each other. It is promising that CVS does rank 2nd in this category. CVS also holds the same ranking when looking at the Cash Ratio. Overall, we consider CVS to be the healthiest when it comes to liquidity; this is based off their strong showing in all three of the above ratios. CVS Company Valuation 2015 Analysis of Future Performance Our group has included a 5 year forecast, 2014-2019, of the project Income Statement, Balance Sheet, and Statement of Cash Flows. The financial statements can be found on the next page, preceded by a list of our assumptions for the forecast. Forecast Assumptions CVS was at full operating capacity for 2014. Assets must grow proportionally with sales. Accounts Payable, Accruals, and Claims and Discounts Payable will also grow proportionally with sales. Assuming that Profit Margin is flexible. Dividend Ratio will be maintained. Holding all items that do not grow with sales constant. All items that are infrequent, or rely on the firm’s decision at that moment in time will also be held constant. Assumption for growth rate: o G1 = 7.83% o G2 = 7.55% o G3 = 7.43% o G4 = 6.93% o G5 = 6.50% If AFN is negative, cash will be place into marketable securities. No new debt will be issued, unless AFN calls for it. CVS will not find it ideal to issue any new stock. Statement of cash flows will be generated using forecasted financial statements exclusively, disregarding any adjustments that CVS may have made in the current year. Forecast will be completed using the percent of sales method. CVS Company Valuation 2015 Analysis of WACC The weighted average cost of capital is a method of calculating whether a company is earning a sufficient return to satisfy those providing its capital, i.e. its creditors and investors. Each element is weighted according to its proportionate share of the total capital. It is the cost of debt, equity and other types of capital weighted according to their relative contribution to total capital. (Source 9) For the fiscal period ending December 31, 2014, CVS Health capital structure was majority weighted with 75% total common equity and 25% total debt. The optimal capital structure would be the one that is able to minimize the weighted average cost of capital; therefore, increasing the intrinsic value of the stock. The expected stock return, which is calculated by adding next year’s dividend yield to the dividend growth rate, is 9.12%. The beta 0.96 is less than 1.00; therefore, implying that the stock is less unstable than the market. With the beta being less than 1.00, the investment has less risk. The CAPM model is used to acquire the cost of equity, which is 9.12%. According to the present capital structure, the weighted average cost of capital is 8.48%. Our method for calculating the WACC of CVS: Calculation of WACC Market Value of Equity Short Term Debt Long Term Debt Total Book Value of Debt Weight of Equity Weight of Debt $ 115,574.00 $ 910.50 $ 12,268.00 $ 13,178.50 0.8976 0.1024 Cost of Equity Risk Free Rate (10 Year Treasury) Beta Market Premium Cost of Equity using CAPM 1.92% 0.96 7.50% 9.12% Cost of Debt Interest Expense Book Value of Debt Cost of Debt $ 615.00 $ 13,178.50 4.67% WACC Calculation Weight of Debt Cost of Equity Weight of Equity Cost of Debt Tax Rate WACC 0.8976 9.12% 0.1024 4.67% 0.395 8.48% CVS Company Valuation 2015 Capital Structure The current capital structure for CVS, based on WACC weights, is approximately 90% equity and 10% debt. After looking at the other competitors in their peer group, we feel that the current capital structure is equal to the optimal capital structure. Comparasion of WACC's and Weights Company Weight of Debt Weight of Equity WACC CVS 10.24% 89.76% 8.48% Walgreens 5.47% 94.53% 13.41% United Health Group 13.28% 86.72% 6.45% Rite Aid Corp. 40.72% 59.28% 33.01% Express Scripts 18.37% 81.63% 6.79% CVS Company Valuation 2015 Discounted Cash Flow Analysis Discounted Cash Flow Analysis Total Revenue % of Growth COGS % of Revenue Gross Profit Gross Margin SGA -Depreciation % of Revenue Depreciation and Amortization % of Revenue EBIT % of Revenue Interest Expense % of Revenue Net Interest (Income) % of Revenue EBT % of Revenue Less Taxes (Benefits) Tax Rate Net Income Net Margin Add back: Dep. And Amort. Add back: Interest Expense Operating Cash Flow % of Revenue Current Assets % of Revenue Current Liabilities % of Revenue Net Working Capital % of Revenue Change in Working Capital Capital Expenditures(-SLB) % of Revenue Acquisitions % of Revenue Unlevered Free Cash Flow Discounted Free Cash Flow WACC Years to Discount 2015 $ 150,276.21 7.83% $ 122,923.56 81.80% $ 27,352.65 18.20% $ 16,286.99 10.84% $ 1,577.90 1.05% $ 9,487.76 6.31% $ 661.22 0.44% -15 -0.01% $ 8,841.54 5.88% $ 3,492.41 39.50% $ 5,349.13 3.56% $ 1,577.90 $ 400.04 $ 7,327.07 4.88% $ 27,871.98 18.55% $ 20,417.74 13.59% $ 7,454.23 4.96% $ 513.76 $ 1,743.20 1.16% $ 826.52 0.55% $ 4,243.59 2016 $ 161,625.16 7.55% $ 132,206.82 81.80% $ 29,418.34 18.20% $ 17,500.83 10.83% $ 1,713.23 1.06% $ 10,204.28 6.31% $ 711.15 0.44% -15 -0.01% $ 9,508.13 5.88% $ 3,755.71 39.50% $ 5,752.42 3.56% $ 1,713.23 $ 430.25 $ 7,895.89 4.89% $ 29,837.10 18.46% $ 21,864.55 13.53% $ 7,972.55 4.93% $ 518.32 $ 1,874.85 1.16% $ 888.94 0.55% $ 4,613.78 $3,920.97 8.48% 2 2017 $ 173,634.25 7.43% $ 142,030.07 81.80% $ 31,604.18 18.20% $ 18,783.82 10.82% $ 1,857.89 1.07% $ 10,962.48 6.31% $ 763.99 0.44% -15 -0.01% $ 10,213.49 5.88% $ 4,034.33 39.50% $ 6,179.16 3.56% $ 1,857.89 $ 462.21 $ 8,499.26 4.89% $ 31,916.52 18.38% $ 23,395.51 13.47% $ 8,521.01 4.91% $ 548.46 $ 2,014.16 1.16% $ 937.62 0.54% $ 4,999.01 $3,916.42 8.48% 3 Disco 2018 $ 185,664.52 6.93% $ 151,870.64 81.80% $ 33,793.88 18.20% $ 20,066.69 10.81% $ 2,005.18 1.08% $ 11,722.02 6.31% $ 816.92 0.44% -15 -0.01% $ 10,920.09 5.88% $ 4,313.44 39.50% $ 6,606.66 3.56% $ 2,005.18 $ 494.24 $ 9,106.07 4.90% $ 33,999.62 18.31% $ 24,929.17 13.43% $ 9,070.44 4.89% $ 549.43 $ 2,153.71 1.16% $ 1,002.59 0.54% $ 5,400.34 $3,900.27 8.48% 4 2019 $ 197,726.87 6.50% $ 161,737.45 81.80% $ 35,989.42 18.20% $ 21,350.62 10.80% $ 2,155.22 1.09% $ 12,483.58 6.31% $ 870.00 0.44% -15 -0.01% $ 11,628.58 5.88% $ 4,593.29 39.50% $ 7,035.29 3.56% $ 2,155.22 $ 526.35 $ 9,716.86 4.91% $ 36,088.26 18.25% $ 26,466.92 13.39% $ 9,621.34 4.87% $ 550.90 $ 2,293.63 1.16% $ 1,047.95 0.53% $ 5,824.38 $3,877.85 8.48% 5 CVS Company Valuation 2015 Discounted Cash Flow Analysis Discounted Cash Flow Analysis Assumptions Tax Rate Risk Free Rate Beta Market Risk Premium % of Equity % of Debt Cost of Debt CAPM WACC 39.50% Terminal Growth Rate 1.92% Terminal Value 0.96 PV of Terminal Value 7.50% Sum of PV FCFs 89.76% Firm Value 10.24% Total Debt 4.67% Cash and Cash Equivalents 9.12% Market Capitalization 8.48% Fully Diluted Shares Implied Price Current Price Overvalued 4.8% $ 166,071.12 $110,569.60 $ 15,615.52 $126,185.12 $ 13,178.50 $ 2,481.00 $113,006.62 1,140.00 $ 99.13 $ 101.73 2.56% Based on the above discounted cash flows, our findings show that CVS is fairly priced, maybe slightly overvalued by a very marginal percentage. The current stock price is approximately $101, which we believe fairly represents the PV of future cash flows. Assumption: The terminal growth rate is 4.8%. CVS Company Valuation 2015 Dividend Discount Model Calculations Intrinsic Stock Value Dividend Discount Model Year Assumptions Rf Market Premium Beta Required Return 1.92% 7.50% 0.96 11.4200% Market Portfolio Dividend Growth Rate Retention Rate 0.77 Profit Margin 3.33% Asset Turnover 1.91 Financial Leverage 1.79 Dividend Growth Rate Growth Rate Using the dividend discount model we calculated that the implied price is $98.43, which is in line with the implied price calculated using the DCF method. This essentially shows that the current stock price of CVS, approximately $101, is a fair price for the future performance of the stock. Dividend Growth Rate calculated using the PRAT model. 101.73 11.4200% 1.1 10.23% Dividend Growth Rate Forecast Year 1 2 3 4 5 Value g1 g2 g3 g4 g5 NPV $98.43 8.77% $ Vcs CF 1.1 1.19643042 1.19643042 1.30568639 1.30568639 1.42969077 1.42969077 1.57069664 1.57069664 1.73134923 160.118325 161.849674 1.90843354 Vcs(0) Gordon Growth Model Current Price Rate Do Dividend 0 1 2 3 4 5 6 g 8.77% 9.13% 9.50% 9.86% 10.23% CVS Company Valuation 2015 Relative P/E’s including PEG’s Relative P/E and PEG Ratios Year CVS 2010 2011 2012 2013 2014 Average 13.98 15.93 15.94 19.09 24.2 17.828 Historical P/E Ratios Walgreens United Health Group Rite Aid. Corp. Express Scripts 12.68 8.8 0 4.82 11.98 10.74 0 17.71 14.75 10.27 0 29.41 18.81 13.7 15.33 31.15 30.26 17.74 31.08 31.85 17.696 12.25 9.282 22.988 CVS’s average P/E ratio for the last 5 years is 17.82, which means that investors are paying $17.82 for every dollar that CVS earns. Their P/E ratio is on average higher than most of their competitors, which implies that higher growth rate is anticipated in the future for CVS when compared against its competitors. Current P/E and PEG Ratios CVS Walgreens UNH Rite Aid Corp. Express Scripts Current P/E and PEG Ratios P/E Ratio PEG Ratio Assumptions 25.81 2.3 PE/5 YR EBITDA growth rate 40.36 2.05 20.59 1.57 27.30 1.59 31.82 1.54 CVS’s PEG ratio seems fairly high at 2.3 compared to most of the other competitors who had PEG’s closer to 1.5. The PEG ratio for CVS was calculated by dividing the current P/E ratio with the 2014 5YR average EBITDA growth rate. A value above 1.00 generally indicates that the stock price is overvalued. The PEG ratio shows that CVS’s stock price is higher than its intrinsic value, however based on our analysis we disagree. CVS Company Valuation 2015 Recommendation Based on our analysis of the Discounted Cash Flows, and the Dividend Discount Model our group believes that the current stock price is an accurate reflection of future earnings. We believe CVS will continue to generate excellent revenues as it is well established and has a proven business model. While the Drugstore market is fiercely competitive we feel that CVS has enough brand awareness and product differentiation to remain stable. As CVS continues to grow their Specialty Drug segment we feel that their revenues will be positively affected. While our analysis shows that CVS is currently correctly priced, we feel that CVS will definitely benefit in the future from macroeconomic factors, like the aging population, brand name drugs transferring over to generic, and the changing landscape of US Healthcare. We recommend a HOLD. CVS Company Valuation 2015 Bibliography 1.) "Investors." Investor Relations. N.p., n.d. Web. 07 Apr. 2015. (Annual Report) 2.) Capital IQ. Mcgraw Hill, n.d. Web. 7 Apr. 2015. <https://www.capitaliq.com>. 3.) "CVS Health Corporation." Yahoo! Finance. N.p., n.d. Web. 07 Apr. 2015. <http://finance.yahoo.com/q?s=CVS&fr=uh3_finance_web&uhb=uhb2>. 4.) "Investors." Investor Relations. N.p., n.d. Web. 07 Apr. 2015. (10k Report) 5.) "Specialty Costs: Can They Be Contained?" CVS Health. N.p., n.d. Web. 07 Apr. 2015. <http://www.cvshealth.com/research-insights/cvs-health-researchinstitute/specialty-costs-can-they-be-contained>. 6.) "CVS Health Gross Profit Margin (Quarterly):." CVS Health Gross Profit Margin (Quarterly) (CVS). N.p., n.d. Web. 07 Apr. 2015. <http://ycharts.com/companies/CVS/gross_profit_margin>. 7.) "CVS Caremark | SWOT Analysis | BrandGuide | MBA SkoolStudy.Learn.Share." MBA Skool-Study.Learn.Share. N.p., n.d. Web. 08 Apr. 2015. <http://www.mbaskool.com/brandguide/lifestyle-and-retail/4306cvs-caremark.html>. 8.) "Marketing Mixx." Marketing Mixx RSS. N.p., 13 Jan. 2015. Web. 08 Apr. 2015. <http://marketingmixx.com/marketing-basics/swot-analysis-marketingbasics/176-cvs-caremark-swot-analysis.html>. 9.) Weighted Average Cost Of Capital (WACC) Definition | Investopedia." Investopedia. N.p., 18 Nov. 2003. Web. 08 Apr. 2015. <http://www.investopedia.com/terms/w/wacc.asp>. NOTE: All tables were constructed in Excel by our group, based on numbers pulled from Capital IQ, or GuruFocus.