Kellogg's Marketing Strategy and Marketing Plans

advertisement

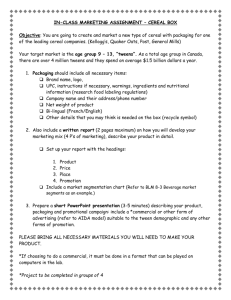

Like Coco the monkey we sing the praises of the chocolatey cereal Kellogg Company Mission Statement “Kellogg is a Global Company Committed to Building Long-Term Growth In Volume and Profit and to Enhancing its Worldwide Leadership Position by Providing Nutritious Food Products of Superior Value” W. K. Kellogg Kellogg’s Marketing Strategy and Marketing Plans Organizational Strategies Leadership in product innovation Strengthening the company’s seven largest cereal markets Accelerating the growth of convenience foods business Developing a more focused organization Continuing to reduce costs Global Strategy Management continues global strategy Offers brand-differentiated pricing Invests in new product research Brand-building marketing activities Cost structure reduction Product Market Strategies Product development – Constant innovation. Introduction of new product to present customers. Market development – Maintain global position Diversification – Introduction of new products to fit new customers needs Kellogg’s SWOT Analysis Strengths Control 42% of global market share for Presweeter cereal, which is more than triple the market share of any of their competitors. They have the strongest brand recognition and advertising recollection of all the cereal manufacturers Weaknesses Have not aggressively developed many new cereal lines in the past four years. Slow erosion of their U.S. market share in the past few years, Follower in Pricing Strategy Opportunities International expansion is the biggest area for growth for Kellogg’s. Kellogg can continue to slowly diversify, while still remaining in their core business area, which will increase their profitability. If they can develop a better pricing strategy and guarantee lower prices, they can reduce costs while increasing their market share. Threats General Mills, Post, and Quaker Oats are using price competition and product proliferation to erode Kellogg’s share of the market. Discount imitation cereals brands have been successful in reducing premium brands in the more commodity like cereals. Market Analysis Market Analysis Market size: sales of nearly $9.7 billion in the Ready-To-Eat Market in 2001 Product segments: the best-selling kids’ cereal brands--GM Lucky Charms, GM Count Chocula, Post Marshmallow Alphabits, Q Marshmallow Safari, Rice Krispy. Market share: competition is heating up in this market as flat sales and low-priced clones have eroded the market shares of Kellogg and General Mills Market Forecasts: the kids’market has been growing at a rate of more than 15% a year, for the 5 to 7 years and shows no sign of slowing through the end of the decade. Growth in the overall kid’s food market was driven, to the largest extent, by gains in cereals. Cereal Industry Volume Sales for Presweet Cereal Volume Sales 4.5 1.4 16.7 4.8 7.4 11.7 In million (As of 2/01) Kellogg USA GM & Ralston Post & Nabisco Quaker Store Brands Malt O Meal Co Market Analysis (continued) Marketing/promotion: Industry structure: Seven breakfast cereal marketers allocated almost $775 million to purchases of space and time mass media in 2001. Three food giants--Kellogg, General Mills, and Philip Morris--responsible for 70% of kid’s foods in 2001. Major Trends in Cereal Industry New products are dominated by line extension and product promotion Increasing popularity of private labeled cereals due to high cost of branded products Higher demand for health food markets & products Health claims is becoming more prevalent; Kellogg’s American Heart Association Competitive Analysis Competitive Force Analysis Intensity of Rivals Four Large companies are dominant in the market Oligopoly Competition is very intense Inflated prices Growth Rate has remained Constant Competitive Force Analysis Threat of a Substitution Private Labels Has made substitution very significant Caused other 3 competitors to lower their prices Low switching cost (1/3 of 1,000 shoppers switched to private label) Price competition (1990’s started a price war between rivals) Made the buyer more powerful Strategic Group Map of Competitors in the Presweeter Cereal Industry High Kellogg General Mills General Food Low Quaker Oats Private Label Brand Cereals PRODUCT LINE/MANUFACTURING MIX Private Label Quaker Oats General Foods General Mills Cap’n Crunch KELLOGG Honey Nut Cheerios Lucky Charm Cocoa Krispies Honey Nut Cheerios Honey Nut Shredded Cap’n Crunch Snack Bars Other Cereals Bagged ValuePriced Cereal Cheerios Fruit Cereal Bars Cranberry Almond Crunch Rice Cakes Oatmeal Cereal Bars Competitive Force Analysis High Barriers to Entry Main barriers to entry in the breakfast cereal market are four major cost factors. Product development - easy for established manufacturers to duplicate products, new products take more money & time to develop Distribution - high slotting & promotional fees, limited shelf space, need to create retail demand, all increase costs for manufacturers Competitive Force Analysis High Barriers to Entry Marketing - need to compete against current brands that have been established through large advertising and promotional efforts (t.v., coupon) High Capital costs - for different types of equipment and plants Competitive Force Analysis Power of Supplier Supplier does not have much power because of private labels. Similar products have allowed buyers to acquire products from private labels at a Cheaper Price. Now industry is very Sensitive to the buyer. Customer Analysis Cocoa Krispies Buying Criteria Key equity drivers: chocolate taste, Coco the monkey, snap, crackle and pop Package: fun, colorful, capture children’s attention Product: very sweet, colorful and contain nutritious elements Kellogg’s Customer Analysis Who Are the Buyers? Parents, Older Adults How Often Do They Purchase? Kids cereal are purchased roughly 18 times a year 10th fastest-moving product in the supermarket Where Do they Want to Buy? Grocery Stores responsible for 99% of cereal sales Who Are the Influencers? Kids Who consumes the goods? Kids under 18 Who are Kellogg’s Target Market? Kids 8-11 years old Percent of Total Annual Spending on Presweeter Cereal (by Age Group) 75+ Age Groups 65-74 55-64 8.2 8.8 10.3 45-54 22.3 35-44 25-34 29.4 16.3 Percentage Cocoa Krispies Objective Strengthen kid consumer base Secure Kellogg “cocoa” bit subsegment volume share with competitive focus on GM’s Cocoa Puffs and Post’s Cocoa Pebbles Create a product that enhances the “ultimate multisensory food experience” by adding additional attributes that satisfy expended consumer needs Attract different target groups COCOA Krispies Promotion Spent roughly $15 million for ad campaign: TV, print Adds include Coco the Monkey Advertiser: Kellogg Agency (Leo Burnet) Quantity and price discounts Packaging: fun, colorful, capture children attention Cereal Pricing for Retail Stores Farmer Jack Kroger Target Cocoa Pebbles (General Mills) $0.25/ounce $0.25/ounce $0.15/ounce Cocoa Puffs $0.28/ounce $0.27/ounce $0.21/ounce (Post) Cocoa Krispies (Kellogg’s) $0.22/ounce $0.23/ounce $0.17/ounce Private Labels $0.23/ounce $0.13/ounce n/a Kellogg’s Distribution Players Retail/Distribution: Grocery stores are responsible for the overwhelming 99%--of cereal sales – – – Major players: Kroger Farmer Jack Target – – Minor players: Convenience stores Gas stations Kellogg’s Distribution Channels Kellogg’s Kellogg’s Kellogg’s Computer system Wholesaler Kroger, Target, distrib. centers Retailer Retailers Distrib. In stores Cocoa Krispies: PRODUCT LIFE CYCLE Introduction Growth Maturity Time Decline Critique of the Plan Have we heard of it? Promotional issues Can we get it? Distribution Can we afford it? Pricing Are we buying it? Target market record Is it legitimate? Corporate responsibilities Promotional Issues Mass Advertising TV, Cocoa the Monkey, and Snap, Crackle and Pop. Direct Promotions Coupons Trade Promotions In-store displays, Samples Personal Selling Key-account reps, Area reps, Merchandisers Distribution Penetration - Sales Channel - Brand equity helps Logistics Finished goods warehouse / rail / truck / centers or independent warehouses Relationships - Chain stores, Independent wholesalers - Conflict or harmony? The Target Fastest Growing Foods in the American Diet: Carbonated Soft drinks Pre-Sweet Cereal Bagels Toaster Pastries Pizza Corporate Responsibilities Legal Issues - Safety, Information, Choice Environmental - Earth Spirit Award Issues Civic Responsibilities - Ad content standards - Stakeholder orientation - Public program support Ethical Issues - Nutritional education - More than required America’s Top 10 R-T-E Cereals 1. 2. 3. 4. 5. Frosted Flakes Cheerios Frosted Mini-Wheat Corn Flakes Rice Krispies/Cocoa Krispies 6. Honey Nut Cheerios 7. Raisin Bran 8. Fruit Loops 9. Special K 10. Corn Pops Positioning Map Taste Cocoa Krisp Fruit Loops Corn Flakes Cheerios Raisin Bran Nutrition Special K Sorry Coco The boys are back in town! Sources Kellogg - Mike Culverson / Customer Service Farmer Jack’s - Ron Van Este / Cereal buyer Media Week - May‘98 / ‘Something New Under My Nose” Business Week - Wednesday, May 29, 2002 “Kellogg Co.” WWW.industryweek.com - “Food Industry Focus” Field Visits - Kroger, Farmer Jack’s, Target, Rite-Aid. Florida Sun Sentinel - Feb. 7, 1998 / Robin Fields / “Get That One The NPD Group - March, 2001/ “The Twelfth Annual Report on Eating Mommy” Patterns in America” Kellogg - www.Kellogg's.com http://faculty.sba.udayton.edu.schenk.kellcase.htm The End