Introduction to MIS

advertisement

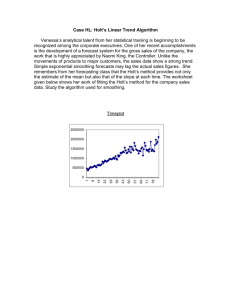

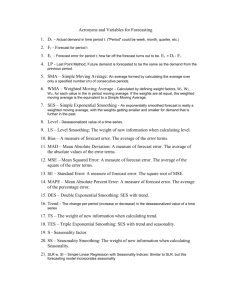

INFSY540.1 Information Resources in Management Lesson #4 Chapters 8 Models and Decision Support Copyright © 1998 by Jerry Post 1 Information Systems & Technology An information system (IS) is an arrangement of people, data, processes, communications, and information technology that interact to support and improve day-to-day operations in a business as well as support the problem-solving and decision making needs of management and users. Information technology is a contemporary term that describes the combination of computer technology (hardware and software) with telecommunications technology (data, image, and voice networks). A practical way of making data useful. 2 What is an information system? 3 What is an information system? Information System Transaction Processing System Decision Support System Data-Driven DSS Model-Driven DSS 4 Information Systems Transaction Processing Systems aka Data Processing Systems Decision Support Systems Executive Information Systems Management Information Systems Expert Systems Office, Workgroup, Personal Information Systems Our text does not have any of these being DSS subsets 5 Data-Driven Decision Support Using Transaction Processing Systems for anything but processing transactions is hard: Not easily accessible Mainframes Cost Mainframe Complexity Mainframes open to many users is risky Data spread to many databases and computers But users now have powerful PCs with user friendly analysis tools & they want to use them 6 Data-Driven Decision Support History: On Line Transaction Processing (OLTP) DataBase Management System (DBMS) Indexed Sequential Access Method (ISAM) Relational DataBase Management System (RDBMS) Structured Query Language (SQL) Executive Information Systems (EIS) Data Warehouse On Line Analytical Processing (OLAP) 7 Front- and Back-Office Information Systems Front-office information systems support business functions that reach out to customers (or constituents). Marketing Sales Customer management Back-office information systems support internal business operations and interact with suppliers (of materials, equipment, supplies, and services). Human resources Financial management Manufacturing Inventory control 8 What is a model? Webster’s New American Dictionary (1995) One who poses for an artist. An example for imitation or emulation A miniature representation A structural design Model ( verb): to shape, fashion, construct “A model is a simplification of something else.” Bob Kilmer 9 Models and Analysis INPUTS MODEL OUTPUTS ASSUMPTIONS 10 Assumptions and Conclusions The aviation instructor had just delivered a lecture on the use of parachutes. “And if it doesn’t open?” someone asked. “If it doesn’t open?” replied the instructor, “Well, ... that is what’s known as jumping to a conclusion.” 11 GIGO INPUTS MODEL OUTPUTS ASSUMPTIONS INPUTS Constants Parameters OUTPUTS Criteria or MOE Additional Statistics Variables 12 Types of Models Mental Symbolic Mathematical Computer Physical 13 Sample Model $ Determining Production Levels in Perfect Competition Marginal cost Average total cost price Q* Quantity 14 Order Model vice-presidents Decide if we should produce warehouse manager marketing manager sales manager sales staff summarize sales orders review sales orders receive sales orders customer check stock to match order production manager decide steps to produce accounting manager review costs add fixed costs compute costs to produce engineers bill customers Simple Model of Evaluating Custom Orders 15 Models of Physical Items: CAD Computer-aided design. Designers traditionally build models before attempting to create a physical product. CAD systems make it easier to create diagrams and share them with multiple designers. Portions of drawings can be stored and used in future products. Sample products can be evaluated and tested using a variety of computer simulations. 16 Statistical Decision Models Strategy Decision 100 80 60 40 20 0 1st Qtr 2nd Qtr Actual 3rd Qtr 4th Qtr Forecast Output 1 f ( x) 2 1 x 2 exp 2 Model Tactics Data Operations Company 17 File: C08Fig08.xls Why Build Models? Understand the Process Prediction Optimization Simulation To conduct "What If" analysis Dangers 18 Acquisition/Input Data availability Selective perception Frequency Concrete information Illusory correlation Human Biases Processing Inconsistency Conservatism Non-linear extrapolation Heuristics: Rules of thumb Anchoring and adjustment Representativeness Sample size Justifiability Regression bias Best guess strategies Complexity Emotional stress Social pressure Redundancy Output Question format Scale effects Wishful thinking Illusion of control Feedback Learning on irrelevancies Misperception of chance Success/failure attribution Logical fallacies in recall Hindsight bias 19 File: C08Fig09.xls Prediction 25 20 Economic/ regression Forecast Output 15 10 5 Moving Average Trend/Forecast 0 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Time/quarters 20 File: C08Fig10.xls Simulation Goal or output variables 25 Output 20 15 Results from altering internal rules 10 5 0 1 2 3 4 5 6 7 8 9 10 Input Levels 21 File: C08Fig08.xls Optimization Maximum Goal or output variables 25 Output 20 Model: defined by the data points or equation 15 10 5 5 3 0 1 2 3 4 5 Input Levels 6 7 8 1 9 10 Control variables 22 Figure 10.2 23 Simulation Webster’s New American Dictionary (1995) An object that is not genuine The imitation by one system or process of the way in which another system or process works. Simulate (verb): imitate, create the effect or appearance of Handbook of Systems Analysis (1985), E. S. Quade “The process of representing item by item and step by step the essential features of whatever it is we are interested in.” 24 Bob Kilmer’s Simple Definitions: Model: simplified representation of something else.* Simulation: means of using or operating a model.** * Something else = a real or proposed entity or system ** Must have inputs and outputs. 25 Building Models Input Process Equation: Output output = f(input,time) Define System Input - Process - Output Simplifying assumptions System boundary Build Equations Identify parameters (variables you can control) Identify variables you cannot control Define equations for the variables Estimate parameters from data Use Model to transform Inputs into Outputs 26 Modeling Limitations Model complexity Cost of building model Errors in model Data Equations Presentation and interpretation 27 Models are for... “Models are for thinking with.” -- Sir M. G. Kendall “Models are for experimenting with.” “Models are for communicating with.” “Models always have assumptions.” (Even though they might not be stated) “Models are always wrong. They always have error.” (Question: Is the level of error acceptable?) 28 EOQ Model 29 Appendix: Forecasting Uses Marketing Future sales Consumer preferences/trends Sales strategies Finance Interest rates Cash flows Financial market conditions HRM Labor costs Absenteeism Turnover Strategy Rivals’ actions Technological change Market conditions 30 Forecasting Methods Structural Models Derive underlying models Estimate parameters Evaluate model Focus on explanation and cause Time Series Collect data over time Identify trends Identify seasonal effects Forecast based on patterns sales P trend S D’ D Q time Increase in income 31 Structural Equations Demand is a function of Price Income Prices of related products Model QD = b0 + b1 Price + b2 Income + b3 Substitute Time Quantity Price Income Substitute 1 24926 134 20000 155 Data 2 26112 150 21000 155 3 27313 142 22000 135 4 26143 141 21000 150 5 26741 144 21500 150 Estimate QD = 11146- 0.1 26149 Price + 1.2 Income - 21000 1.0 Substitute 137 155 7 27893 140 22500 143 Forecast 33318 = 1114 0.1 (155) + 1.2 (20000) 1.0 (160) 8 26397 142 21200 153 9 24895 147 20000 155 Need to know (estimate) future price, income, and substitute price. 10 28501 148 23000 160 11 29747 150 24000 165 12 29175 134 23500 15332 Time Series Components sales Seasonal Trend time Dec 1. Trend 2. Seasonal 3. Cycle 4. Random Dec Dec Dec A cycle is similar to the seasonal pattern, but covers a time period longer than a year. 33 Exponential Smoothing Exponential Smoothing 1600 1500 1400 1300 1200 1100 1000 900 800 Raw Data Smooth:0.20 1 3 5 7 9 11 13 15 17 19 21 St = Yt + (1 - ) St-1 S is the new data point is the smoothing factor Use Excel: Tools, Data Analysis Exponential Smoothing 34 Exponential Smoothing Choosing the smoothing factor (): It is usually between 0.01 and 0.20 Test multiple values and compare errors: (actual - smooth) * (actual - smooth) Compute the sum. Choose the factor with the least total sum-of-squared error. Larger factors place more importance on recent data, which results in less smoothing. (A2-D2)*(A2-D2) Data 1350.782 1138.733 1104.254 1488.808 1193.076 1304.652 1089.714 1182.478 1225.365 1417.266 1079.631 1162.129 0.01 #N/A 1350.782 44964.83 1140.854 1339.502 1104.62 147600.4 1484.967 85200.11 1195.995 11806.3 1303.565 45732.48 Sum 1091.852 8213.119 1181.572929,916 1917.838 1224.927 36994.37 1415.343 112702.6 1082.988 6263.334 0.1 #N/A 1350.782 1159.938 1109.823 1450.91 1218.859 1296.072 1110.349 1175.265 1220.355 1397.575 1111.425 44964.83 3100.666 143630.1 66478.32 7360.322 42583.99 Sum 5202.577 848,686 2509.985 38774.04 101088.6 2570.888 0.2 #N/A 1350.782 44964.83 1181.143 5911.847 1119.632 136291.1 1414.973 49238.37 1237.455 4515.339 1291.212 40601.79 Sum 1130.013 2752.577 1171.985 769,265 2849.41 1214.689 41037.54 1376.751 88280.28 1139.055 532.425935 Smoothing with Trends Double Exponential Smoothing 34000 32000 30000 28000 Raw Data 26000 Smooth:0.20 24000 22000 20000 1 3 5 7 9 11 13 15 17 19 Apply exponential smoothing and choose smoothing factor (). Apply exponential smoothing a second time to the smoothed data. 36 Forecasting with Exponential Smoothing Forecast for time T+ [ 2] yT 2 S T 1 ST 1 1 T = 20 =1 = 0.2 S20 = 32,064 last of the raw data forecast one period ahead smoothing factor (value at time 20, after one smoothing) S[2] = 33,141 (value at time 20, after second smoothing) Y21 = (2.25)32,064 - (1.25)33,141 = 30,718 37 Time Quantity Trend Difference 1 24917 24484 432 2 26152 24983 1169 3 27297 25482 1816 4 26157 25980 177 5 26710 26479 231 6 26103 26977 -874 7 27981 27476 505 8 26327 27975 -1647 9 24913 28473 -3560 10 28524 28972 -448 11 29774 29470 303 12 29136 29969 -833 13 29332 30468 -1136 14 30306 30966 -660 15 32133 31465 669 16 33329 31963 1366 17 34522 32462 2060 18 34769 32961 1808 19 33355 33459 -104 20 32684 33958 -1274 21 34456 22 34955 23 35454 24 35952 Estimating Trend Yt = b0 + b1(t) Use regression to estimate b0 and b1. Intercept Time Coefficients Std Error t Stat P-value 23985.81 652.48 36.76 2.2E-18 498.60 54.47 9.15 3.4E-08 Plug t into equation to estimate new value (on trend): Y21 = 23,986 + 498.6 * (21) = 34,456 Result is the prediction on the trend, with no random factors and no cycles. 38 An Overview of Decision Support Systems File: C08Fig11.xls DSS: Decision Support Systems Sales and Revenue 1994 300 Model 250 Legend 200 150 sales 154 163 161 173 143 181 revenue profit 204.5 45.32 217.8 53.24 220.4 57.17 268.3 61.93 195.2 32.38 294.7 83.19 prior 35.72 37.23 32.78 47.68 41.25 67.52 Sales Revenue Profit Prior 100 50 0 Jan Feb Mar Apr May Jun Output Database 40 Characteristics of Decision Support Systems Handle lots of data from various sources Report & presentation flexibility Text and graphics capabilities Support drill down analysis Complex analysis, statistics, and forecasting Optimization, satisficing, heuristics Simulation What-if analysis Goal-seeking analysis 41 Figure 10.14 42 Capabilities of a DSS Support all problem-solving phases Support different decision frequencies Support different problem structures Support various decision-making levels 43 The Model Base Financial models Statistical analysis models Cash flow Internal rate of return Averages, standard deviations Correlations Regression analysis Graphical models Project management models 44 Table 10.3 45 Group Decision Support Systems Characteristics of a GDSS Special design Ease of use Flexibility Decision-making support 47 Characteristics of a GDSS Anonymous input Reduction of negative group behavior Parallel communication Automated record keeping 48 Figure 10.18 49 Executive Support Systems (ESS) Tailored to individual executives Easy to use Drill down capabilities Access to external data Can help when uncertainty is high Future-oriented Linked to value-added processes. 50 Capabilities of an ESS Support for defining an overall vision Support for strategic planning Support for strategic organizing & staffing Support for strategic control Support for for crisis management 51 Easy access to data Graphical interface Non-intrusive Drill-down capabilities EIS: Enterprise Information System EIS Software from Lightship highlights easeof-use GUI for data look-up. 52 Enterprise IS Sales Production Costs Distribution Costs Fixed Costs Executives Production Costs South North Overseas 5000 4500 4000 3500 3000 2500 2000 1500 1000 500 0 Central Management South North Overseas 1993 1994 1995 1996 Production: North Data Data Sales Data Distribution Data Item# 1995 1994 1234 2938 7319 542.1 631.3 753.1 442.3 153.5 623.8 Production 53