BS - Capacity4Dev

advertisement

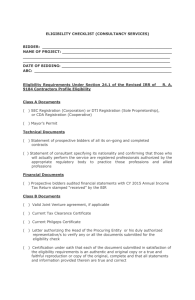

Budget support training Module 1 New Budget Support approach and fundamental values Version October 2013 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 2 Definition of Budget Support (BS) •- EU BS guidelines: Transfer of financial resources of an external financing agency to the National Treasury of a partner country, following the respect by the latter of agreed conditions for payment; It is not a blank cheque Eligibility criteria + disbursement conditions - The resources transferred are: part of the global resources of the partner country used in accordance with its public financial management system 3 BS funds in most cases nontargeted and non-traceable 4 Fiduciary responsibility stops with Budget Support transfer; responsibility for results remains Partner’s Country Central Bank EC external assistance € Conditions for disbursement: (i) General Conditions (ii) Specific Conditions Foreign Exchange Reserves € Treasury Account Tax & non tax revenues Budget implementation through partner country’s Public Financial Management System 5 4 Major Elements of BS Policy dialogue Performance & assessment criteria Capacity building Financial transfers + Other characteristics of BS Partnership and alignment with national policies and procedures; Mutual accountability; Harmonised donor approaches. 6 Specificities of BS Financing Modality Make the national budget and the policy dialogue with the partner country important Help partners to implement their policies through the Budget and to build sustainable, accountable institutions Use of recipient PFM country public finance management systems (planning, management and use of funds, monitoring, reporting, Internal control and auditing done by recipient governments) Respect domestic ownership/responsibility Align aid with national priorities, plan and processes Focus on results 7 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 8 BS: one among three financing modalities Support approaches and funding needs Project : Funding a set of predefined activities Sector : Funding a set of predifined activities and/or a sector complex policy National (macro): funding complex government policies Financing Modality EC procurement and grant award procedures Common Pool Funds Budget Support 9 Potential benefits of BS Financing Modality Strengthen ownership of development process and domestic accountability Better alignment of aid with national priorities, minimised aid-related transaction costs and greater harmonisation of donor practices Stronger focus on results through result-based policy dialogue Improved capacity development Improved aid efficiency (lasting effect) A more stable macro-economic framework and a more coherent framework for public policy & budget Higher funding for public services Risks of limiting factors: too many conditions and safeguards, micro management and intrusive conditions, earmarking/targeting/audit of BS funds... Deserve an efficient risk management. 10 General objectives of EU budget support Eradication of poverty. Promotion of sustainable and inclusive economic growth. Consolidation of democracy. 11 Specific objectives of a BS programme Formulation of specific objectives to be based on two principles: Alignment with policies, priorities and objectives of the partner country; Consistency with EU development policies. Specific objectives should also reflect the development challenges EU sees BS as a “vector of change” addressing the five key development challenges (cf. BS COM) Specific objectives specified by type of contract in annex 2 of the guidelines. 12 Intervention logic of budget support Inputs Direct outputs Induced outputs Funds Policy dialogue Capacity development Improved relations between external support and national budget Strengthened public policies Disbursement conditions Improved relations between external support and policy processes Strengthened public Sector institutions Improved public service delivery Improved public spending Outcomes Impact Positive responses by beneficiaries of improved public services (increased and more effective use; more results at beneficiary level) Sustainable economic growth Poverty reduction Empowerment and social inclusion 13 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 14 More than 10 years of BS programmes experiences Weaknesses in programming Eligibility criteria not applied rigorously enough Initial assessment often superficial Specific context of the partner country not sufficiently taken into account Too much and too general objectives Underdeveloped risk management Higher fiduciary risk especially in the case of weak PFM systems Development risk still to be considered and well understood Growing criticisms from ECA, EP, and MS: BS effectiveness into question Insufficiently effective policy dialogue too much focused on disbursement conditions, indicators and timing issues rather than on government policy priorities and reforms. EC response: Green Paper on BS New approach for BS Difficulties to use performance based indicators/condi tions for assessing progress and for policy dialogue unsatisfactory measures/indicators complex evolutions to analyse statistical weaknesses 15 A comprehensive response from the EC Differentiation More rigorous and continuous assessment of eligibility criteria More accountability and transparency New governance mechanisms Structured risk management framework 16 EC Communication on BS: key messages BS not an end but a mean of delivering better aid by fostering partner countries ownership of development policies and reforms One among several instruments in EU comprehensive policy as regards aid to partner countries (portfolio approach) Not a blank cheque, not provided to every country Underlying principles and policy dialogue matter: stronger link with « fundamental values » Strengthened eligibility criteria (but continued dynamic approach) Stronger focus on accountability and transparency (new criterion) and more rigorous assessment. Differentiating budget support: three types of contracts, cf. module 2. Continued emphasis on results, performance measurement and predictability. Strengthened and formalised risk management framework Strengthened EU coordination 17 New BS Guidelines (1) Finalised and officially approved in September 2012 To be effective from January 2013 onwards • Part I: Executive Guide • Part II: Programming, Design and Management of Budget Support • Part III: Thematic Topics and Procedural Requirements 20 The new BS Guidelines: content of Part III 1. Glossary 2. Objectives and Intervention Logic of Budget Support 3. Assessing Public Policy (National/sectoral development strategy) Eligibility 4. Assessing Macroeconomic Eligibility 5. Assessing Public Financial Management (PFM) Eligibility 6. Transparency and Oversight of the Budget 7. Risk Management Framework 8. Performance Assessment and Variable Tranche 9. State Building Contract for Fragile States 10.Budget Support in context of SIDS/OCTs 11.Domestic Revenue Mobilisation (DRM) 21 New Guidelines: a revised approach to eligibility and assessment New Guidelines: 4 eligibility criteria + structured risk management framework Previous Guidelines: 3 eligibility criteria, 7 assessments 1. National or sectoral policy/ strategy 1. National or sectoral policy/ strategy 2. Macro-economic stability 2. Macro-economic stability 3. PFM & Accountability systems 3. PFM & Accountability systems 4. The Budget & MTEF: sector allocations 4. Transparency and oversight of the budget 5. Coordination Framework (esp. Donor coordination) 6. Performance measurement 7. Institutional Framework & Capacities Structured risk management framework to inform decision making and policy dialogue 22 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 23 Three types of BS contracts Good governance and development contracts (GGDC), aimed at promoting a national development strategy and national level reforms. Sector reform contracts (SRC), aimed at strengthening implementation of sector policies and reforms and at improving service delivery. State building contracts (SBC), aimed at strengthening fragile states, ensuring vital state functions and basic public services and supporting transition towards democratic governance. 24 Specific objectives of a GGDC Improving financial capability of government to achieve (overall) policy objectives. Fostering domestic accountability. Strengthening national control mechanisms and core government systems. Supporting broader reforms as regards: macroeconomic management, PFM, domestic revenue mobilisation, public sector reform, etc. Addressing constraints to sustained and inclusive growth. Improving public service delivery (a.o in order to achieve MDGs). 25 Specific objectives of a SRC Improving governance and financial capability of government to achieve sector policy objectives. Promoting sector policies and reforms. Improving service delivery and governance at sector level. Addressing basic needs of the population. Emphasis to be put on equitable access and quality of public service delivery. Financial additionality may be key feature of many SRCs. Sectors/ministries could be linked for the purpose of a SRC, in case of coherent policy and budgetary and institutional framework. 26 Running Head 12-Point Plain, Title Case Additionality (in case of SRCs) Distinguish Increase in sector Increase in sector expenditure is not the key expenditure is the key prerequisite for achieving prerequisite for achieving the SRC objectives the SRC objectives 27 Running Head 12-Point Plain, Title Case Increase in sector expenditure is not a main objective of the SRC Objective of SRC is to get better sector results but not necessarily via higher sector spending SRC will add value by improving effectiveness & efficiency: • better budget execution • reallocation of budgets • accelerating reforms • capacity building • etc Increase in sector expenditure is an important objective of the SRC • Identify a baseline to serve as a starting point for defining the future sector expenditure path: o Focus on historical trends o Choose how to express the baseline (per capita terms, % of GDP or government expenditures, growth rate of expenditure in real terms… • Discuss with government the desirable/required increases in sector spending • Assess fiscal sustainability of planned/required increases in sector spending • Where appropriate and/or necessary, formulate disbursement conditions as regards expenditure increases 28 Specific objectives of a SBC SBC to be used to help fragile partner countries: to improve financial capability of Govt to restore peace and macro-ec. stability and to achieve short-term policy objectives; to ensure vital state functions; to support the transition towards development and democratic governance. SBC to be based on forward looking political commitment and on institutional reforms (not on track records). SBC requires a strong political and policy dialogue. 29 Choice of contract Specific objectives and expected results will determine type of contract. Content of the policy dialogue, the performance indicators and the disbursement conditions will be determined by objectives and expected results. A GGDC and SRCs have their own specific objectives and may be provided simultaneously in one country. SBCs are generally not combined with other forms of BS. SBS prepares the ground for future GGDC and/or SRC. 30 31 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 32 New governance mechanisms: objectives Five objectives to strengthen the capacity of the Commission to manage budget support: 1° Strengthen continuous policy steering at senior management and Commissioner level. 2° Enhance and ensure coherence of the EU budget support dialogue with partner countries. 3° Ensure policy coherence across countries and regions. 4° Reinforce risk management and risk mitigation mechanisms. 5° Support EU Delegations and HQ in programming, design and implementation of budget support programmes 33 New governance structures: At Headquarters level Budget Support Steering Committee (BSSC) To involve the Director General in the decision making process early enough to provide strategic guidance To consult the Commissioners (Development, Neighbourhood, HR/VP) as appropriate ROLE: Continuous political and policy steer of BS programmes. Assessment of the pre-conditions for GGDC May review BS financing and disbursement proposals wherever there are substantial or high political & policy implications. 34 At Delegations level Regional Budget Support Teams ROLE: To provide advice and support to Delegations and to Geographical Directorates on BS operations in the region To support EU Delegations and Geographic Directors in implementing the risk management strategy To participate with HoD in the BS dialogue with partner countries. To be involved in GGCD & SBC dialogues (unless GD decides otherwise) To be involved in SRC which present substantial or high risks. Role of the EEAS: In charge of the overall political dialogue Leads on the political risks in BS Instructs HoD on the line of the political dialogue 35 BS Cycle of Operations National Indicative Programme: EC Development Policy Partner Government Policy identify sectors of engagement BSSC: assessment of fundamental values Programming Evaluation: focus on joint evaluations Evaluation and Follow-up oQSG1 Identification Fiche: Validation of choice for BS Identification focus on eligibility criteria + next steps Decision process for tranche release: Implementation Formulation Monitoring and dialogue, assessment of payment conditions oQSG2 - Action Fiche: focus on eligibility + context+ conditions. Supporting documents, financing agreement and TAPs Budget Support Steering Committee (BSSC): Continuous political and policy steer of BS programmes. Should be informed of any formulation and disbursement process and may review budget support financing and disbursement proposals wherever there are substantial or high political and policy implications. 36 EU Delegations responsible for: Effective policy dialogue. Monitoring of fundamental values, eligibility criteria, performance criteria and disbursement conditions. Monitoring of reputational risks possibly caused by dysfunctioning of country systems. Providing technical assistance for capacity development. 37 Key messages BS is an effective aid instrument, in particular to support partner country’s policies and reforms, but it must be (more) rigorously implemented. Hence the greater focus on preconditions, assessment of eligibility criteria and risk management BS is one among several instruments of the EU’s comprehensive assistance (portfolio approach). Stronger link with fundamental values Greater differentiation and selectivity Stronger focus on accountability and transparency Continued emphasis on results, performance tranches, Government ownership and predictability More rigorous and formalised risk assessment and management 38 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 39 Running Head 12-Point Plain, Title Case Budget support and decentralisation Let’s first consider the three dimensions of decentralisation POLITICAL Decentralised political powers including formulation & adoption of public policies ADMINISTRATIVE Decentralised resources and responsibilities for delivery of specified public services and functions FISCAL High autonomy for decision & management of significant share of revenues and expenditures by sub-national entities 40 Budget support and decentralisation GGDC: decentralisation can be promoted via policy dialogue, performance and disbursement conditions,. A SRC can support decentralisation of service delivery to subnational governments. A SRC can be provided to support the implementation of a decentralisation policy. A SRC can be provided to a sub-national government having extensive political, administrative and fiscal powers (e.g. in a Federal system). It is not advised to provide a GGDC to a sub-national government. 41 Running Head 12-Point Plain, Title Case Budget support and decentralisation: 3 cases BS for the decentralisation of public services If sub-national governments have extensive administrative power but limited political and fiscal authority: SRC can be provided to support the geographic decentralisation of services. BS to support a decentralisation process If support for decentralisation is the objective of the BS: BS provided to a subnational government If sub-national gov. has extensive political, administrative and fiscal powers: The programme • should focus on reforms and institutional aspects of the decentralisation. • a SRC can be provided to sub-national government • Could cover the 3 dimensions (political, administrative, fiscal) • a GGDC is not advised. Take into account both central & sub-national levels in design and implementation (incl. eligibility criteria) Focus on sub-national 42 level 42 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 43 What are the FV and relations with aid policy The Main legal basis and principles Articles 21 of the TUE: 3 FV- guiding principles for EU external action: human rights, democracy and rule of law. Art 208 of the EU Treaty: Development policy/cooperation conducted in the frame of principles/objectives of EU’s external action FV essential elements of all the EU’s partnerships/cooperation agreements with third countries Agenda for change: “objectives of development, democracy, human rights, good governance and security are intertwined”.“EU support to governance should feature more prominently in all partnerships, notably through a focus on partners’ commitments to FV”. 44 Why FV matter for EU Budget Support • A new policy framework strengthening the contractual partnership on EU Budget Support putting a stronger emphasis on the FV. • FV are values in themselves but also conducive to the objectives of Budget Support • Budget Support is provided as vector of change to address several development challenges and objectives including the promotion of democracy. 45 FV and the different BS Contracts • Differentiation among BS contracts to better respond to the specific political, economic and social context of the partner country. • Relative importance to promote FV will vary according to the forms of BS Impact the way FV are assessed. Question: identify the differences between the three types of BS contracts (GGDC, SRC, SBC) with regards to the assessment of FV. 46 Running Head 12-Point Plain, Title Case BS Contracts: why a FV assessment GGDC SRC SBC A mutual and shared commitment to universal FV. An implicit recognition that a partner country’s overall policy stance and democratic governance is on track or moving in the right direction. A vector to improve governance when conditions for a GGDC not fulfilled. State building and transition process towards development and democratic governance. -Positive assessment of country’s adherence and commitment to FV is a precondition. - Assessment during programming phase, submission to BSSC and monitoring during implementation through the Risk Management Framework (RMF). - FV matter but does not constitute a precondition (no separate assessment as for GGDC). -Assessment of adherence to FV is part of the RMF during identification/formulation/ implementation. gggg -BSSC consultation when high risks on political governance. Country’s adherence to FV should be taken into account Particular care to supported sectors such as justice, security (strong links with FV) Country’s commitment to FV (track record?) and/or political response to improve the situation should be taken into account. - FV assessment: not a precondition. A forward looking approach when engaging with the country. - Opportunity intervention vs. risk of inaction. - Separate assessment and RMF to prepare informed decision of BSSC for identification/formulation 47 and future monitoring. 47 Sequencing of the FV Assessment GGDC: Delegation’s assessment at programming phase, reviewed by the EEAS/consultation with DEVCO. Brief assessment (4/5 pp) + summary section on fulfilment of precondition in the Identification Fiche (IF) and Action Fiche (AF). Submission to the BSSC for political guidance and validation. SRC: Adherence to FV assessed as part of the RMF (political risk category) during the identification and formulation phase (summarised in the IF and AF). If substantial or high political risks: submission to BSSC for political guidance. SBC: Adherence to FV assessed as part of the RMF with summary in IF and AF. Submission to BSSC is required for political guidance and to validate the choice of contract. In the case of SBC and SRC, the BSSC should balance the related political risk/FV concerns with the need to provide/protect basic public 48 services. GGDC: How to assess FV A two step approach: Step 1:does the country meet the core Internationally recognized benchmarks on human rights, rule of law and democracy incl. screening of country's stand on international commitments. Not satisfactory/not eligible- satisfactory/go step 2 Step 2: More in depth analysis of HR, Rule of Law and Democracy guided by a specific set of questions (annex 12) Analytical tools: political analysis of programming phase, EU Human Rights Country Strategies, EU Election Observation Missions’ reports, Delegations’ political reporting, UN open sources... 49 GGDC: How to assess FV Steps 1 & 2 assess the country’s commitment and political willingness Relevant reform programmes/action plans addressing key constraints and weaknesses identified above. Credibility in terms of political commitment, quality of the reform process, and realistic in terms of implementation. The country's track-record and the likelihood that violent conflict could undermine the adherence to fundamental values. Reminder: Delegation Assessment (4 pp max) is used - to recommend whether FV pre-condition is met - to answer relevant set of questions in the RMF - to identify issues to be monitored during implementation and to be discussed in the BS dialogue/political dialogue. - to improve the overall design of programme (formulation). 50 SRC: How to assess FV • Identification/formulation: Sector analysis should take into account the human rights based approach. Cf. EEAS/COM Joint COM: “HR and democracy at the heart of EU external action – Towards a more effective approach” (12.12.2011) + Annex 12 (issues to focus on under HRBA). • Particular care when supported sector closely linked with FV. • Most important/critical issues relevant to the concerned sector to be highlighted in the IF/AF and reviewed as part of RMF. Delegation Assessment = input to strengthen design of the programme, identify specific issues to be monitored during implementation (RMF) and to be discussed in BS/policy dialogue 51 SBC: How to assess FV A forward looking assessment to inform the opportunity of intervention when deciding to engage with the country. Consider different nature of fragile countries (track records?, risk of resumption/emergence of conflict?...). Focus on government’s commitment to FV and particularly the political response to address them. Elements of Steps 1 & 2 (GGDC) can guide the analysis for SBC. Delegation Assessment = input to strengthen design of programme, inform the BSSC decision, identify baselines and specific issues to be monitored during implementation (RMF) and to be discussed in BS/policy dialogue . 52 Monitoring FV during Implementation Political reporting of the Heads of EU Delegations. Political dialogue between the EU and the partner country. Periodic reviews of the EU human rights country strategies. These mechanisms should fed in the BS dialogue Reminder: - EU coordination in the appreciation of the situation of FV (GGDC) - The Risk Management Framework: useful monitoring tool. 53 Possible situations during implementation as regards FV Some concerns are arising but still overall respect of FV. Mitigating measures and or financial or contractual adjustments might be needed. Significant deterioration of fundamental values. Re-orientation of planned BS (GGDC but also possible with SRC) towards other aid modalities might be considered/needed - Consultation BSSC. Extreme cases where overall cooperation needs to be suspended (art 96 of Cotonou Agreement, Art 1 of agreements under DCI and ENPI): possible reallocation of funds (all BS aid modalities) to nongovernmental channels. 54 Graduated response Possible EU responses to deterioration of respect of FV should be proportionate and progressive: 1. Enhancing the dialogue. 2. Delaying/Reallocating/Reducing GGDC disbursements (BSSC decision) with definition of roadmaps. 3. Suspending GGDC/SRC/SBC (BSSC last resort decision). Under specific conditions GGDC funds can be reallocated to SRC. All BS aid modality concerned in case severe/significant FV deteriorations. 55 Outline 1. What is Budget Support? 2. Why using BS: objectives and intervention logic 3. The new approach for Budget Support 4. The three type of contracts Break 5. New governance mechanisms and cycle of operations 6. BS in decentralised context 7. BS and the EU Fundamental values 8. Eligibility criteria 56 Eligibility criteria of EU budget support Relevant and credible national or sector development strategy. Stability oriented macro-economic policy. Relevant and credible PFM reform programme. Publication of the budget (transparency and oversight of the budget). During formulation, the relevance and credibility of the Government’s policies and strategies will be assessed. During implementation, emphasis will be put on progress made. 57 Thank you very much for your attention 58