Public Finance syllabus

advertisement

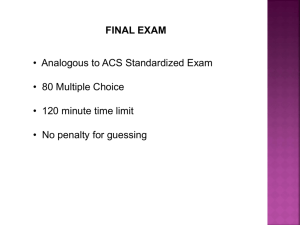

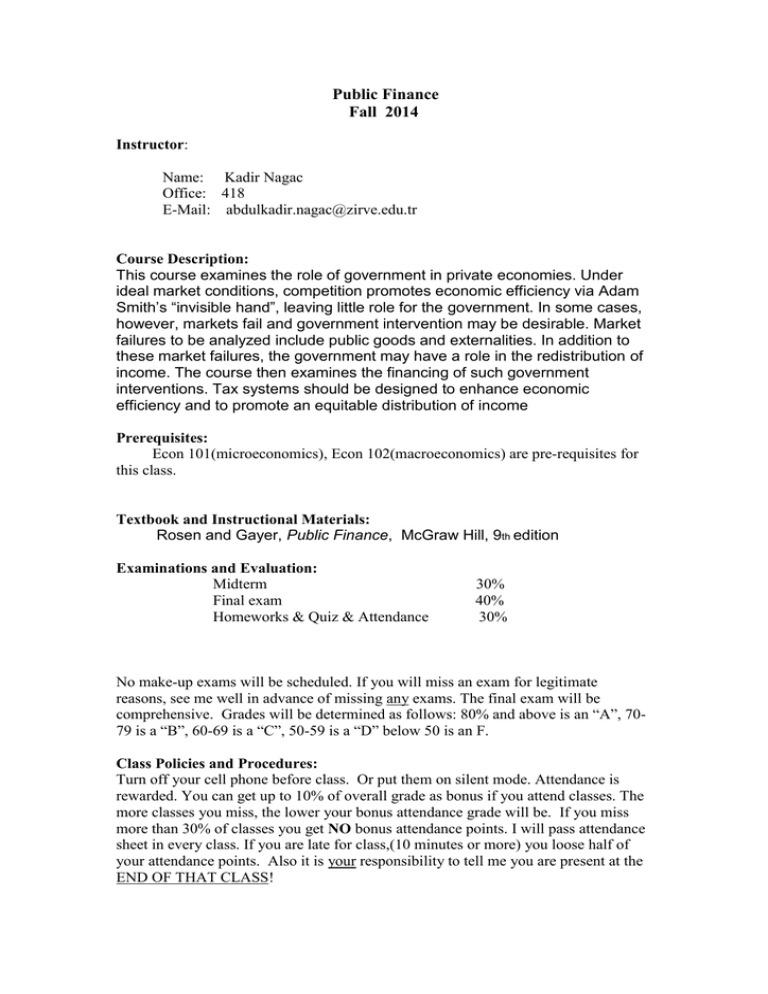

Public Finance Fall 2014 Instructor: Name: Kadir Nagac Office: 418 E-Mail: abdulkadir.nagac@zirve.edu.tr Course Description: This course examines the role of government in private economies. Under ideal market conditions, competition promotes economic efficiency via Adam Smith’s “invisible hand”, leaving little role for the government. In some cases, however, markets fail and government intervention may be desirable. Market failures to be analyzed include public goods and externalities. In addition to these market failures, the government may have a role in the redistribution of income. The course then examines the financing of such government interventions. Tax systems should be designed to enhance economic efficiency and to promote an equitable distribution of income Prerequisites: Econ 101(microeconomics), Econ 102(macroeconomics) are pre-requisites for this class. Textbook and Instructional Materials: Rosen and Gayer, Public Finance, McGraw Hill, 9th edition Examinations and Evaluation: Midterm Final exam Homeworks & Quiz & Attendance 30% 40% 30% No make-up exams will be scheduled. If you will miss an exam for legitimate reasons, see me well in advance of missing any exams. The final exam will be comprehensive. Grades will be determined as follows: 80% and above is an “A”, 7079 is a “B”, 60-69 is a “C”, 50-59 is a “D” below 50 is an F. Class Policies and Procedures: Turn off your cell phone before class. Or put them on silent mode. Attendance is rewarded. You can get up to 10% of overall grade as bonus if you attend classes. The more classes you miss, the lower your bonus attendance grade will be. If you miss more than 30% of classes you get NO bonus attendance points. I will pass attendance sheet in every class. If you are late for class,(10 minutes or more) you loose half of your attendance points. Also it is your responsibility to tell me you are present at the END OF THAT CLASS! Tentative Schedule: Week 1 Introduction (Chap. 1) Week 2 Tools of Positive Analysis(Chap. 2) Week 3 Tools of Normative Analysis(Chap. 3) Week 4 Public Goods (Chap. 4) Week 5 Externalities(Chap. 5) Week 6 Political Economy (Chap. 6) Week 7 Education(Chap. 7) Week 8 Health Care Market (Chap. 9) Week 9 Social Security (Chap. 10) Week 10 Income Redistribution (Chap. 12) Week 11 Expenditure Programs for the Poor (Chap. 13) Week 12 Taxation and Efficiency(Chap. 14,15) Week 13 Turkish Tax System(Chap. 13) Week 14 Review and Final