Entertainment and Media Accounting Spring

advertisement

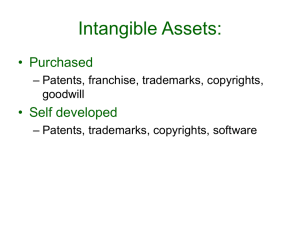

Entertainment and Media Accounting Spring 2014 Final Exam Review PROBLEM 1 You are making a major studio movie. The following are the costs to make this movie and revenue: Year 1 Borrow $10 million at 10% interest rate Spend $10 million on development/packaging for a movie Year 2 Borrow additional $30 million at 10% interest rate Spend $30 million on production cost Year 3 Borrow additional $70 million at 10% interest rate Spend $70 million on production cost The CEO of the parent company gets paid $10 million. Year 4 Movie is released on Memorial Day weekend with a $200 million take (ultimate revenue including Memorial Day weekend is estimated to be $450 million). The Company spends $100 million promoting and advertising the movie in Year 4. Total revenue for Year 4 is $400 million Year 5 Revenue is $100 million bringing revenue release to date of $500 million and the new projected revenue is $750 million or $250 million of revenue after Year 5. For each year 1-5: What is the amount of revenue, expenses, and assets and liabilities? Assume the interest on the debt is not compounding Please show your work. Goodwill and Intangibles 1. ABC Media Corporation acquired Out-of-Sight Productions on January 1, 2010 for $4,000,000, and recorded goodwill of $750,000 as a result of that purchase. At December 31, 2010, the Out-of-Sight Productions had a fair value of $3,400,000. The net identifiable assets of the Out-of-Sight Productions (excluding goodwill) had a fair value of $2,900,000 at that time. What amount of loss on impairment of goodwill should ABC Media record in 2010? $250,000 2. In 2010, Music, Inc. purchased Popstar Music for $3 million. At December 31, 2011, the Popstar Music division reported net assets of $3,300,000 (including $1,700,000 of goodwill). Music reviewed the Popstar division and determined that expected net future cash flows equal $2,500,000 and the fair value is estimated to be only $1,800,000. What entry should Music record concerning the Popstar division on December 31, 2011? 3. ABC Media Company has equipment that, due to changes in use, is reviewed for possible impairment. The asset’s carrying amount is $400,000 ($500,000 cost less $100,000 accumulated depreciation). The expected future net cash flows (undiscounted) from the use of the asset and its eventual disposition are determined to be $380,000 and it has a current market value of $350,000. What is the amount of the impairment, if any, that should be recorded by the Company? 4. On January 2, 2015, ABC Media, Inc. purchased a patent for a new consumer product for $180,000. At the time of purchase, the patent was valid for 15 years; however, the patent’s useful life was estimated to be only 10 years due to the competitive nature of the product. On December 31, 2018, the product was permanently withdrawn from sale under governmental order because of a potential health hazard in the product. What amount should ABC Media charge against income during 2018, assuming amortization is recorded at the end of each year? 5. A patent was acquired by ABC Media Corporation on January 1, 2010, at a cost of $72,000. The useful life of the patent was estimated to be 10 years. At the beginning of 2014, ABC Media spent $9,000 in successfully prosecuting an attempted infringement of the patent. At the beginning of 2015, ABC Media purchased a patent for $25,000 that was expected to prolong the life of its original patent for 5 additional years. On July 1, 2018, a competitor obtained rights to a patent that made the company's patent obsolete. ABC Media records amortization expense directly with a credit to the Patent account. Calculate the following amounts for ABC Media Corporation. (a) Amortization expense for 2010. $72,000 /10 = 7,200 (b) The balance in the Patent account at the beginning of 2014, immediately after the infringement suit. 72,000 - (7,200 * 4) = 43,200 43,200 + 9000 = 52,200 (c) Amortization expense for 2014. 52,200 / 6 = $8,700 (d) The balance in the Patent account at the beginning of 2015, after purchase of the additional patent. (52,200 - 8,700 ) = 43,500 (e) Amortization expense for 2015. 43,500 / 10 = 4,350 (25,000 / 5) + 4,350 = 9,350 **Amortization includes both the old and the new $25,000 patent** (f) The amount of loss recorded at July 1, 2018 [ (43,500 + 25,000) - 9,350 ] = 59,150 59,150 - (9,350 * 2.5) = 35,775 <------- Balance of patents on July 1, 2018 Loss = 35,775 6. Presented below is information related to copyrights owned by XYZ Media Corporation at December 31, 2010. i. Cost $2,700,000 ii. Carrying amount 2,400,000 iii. Expected future net cash flows 2,100,000 iv. Fair value 1,400,000 Assume XYZ Media will continue to use this asset in the future. As of December 31, 2010, the copyrights have a remaining useful life of 5 years. Instructions (a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2010 Impairment Expense 300,000 Accumulated Impairment 300,000 (b) Prepare the journal entry to record amortization expense for 2011. 2,100,000 / 5 = $420,000 Amortization expense 420,000 Copyright 420,000 (c) The fair value of the copyright at December 31, 2011 is $1,500,000. Prepare the journal entry (if any) necessary to record this increase in fair value. No Entry Necessary- using expected net cash flow, not fair value. Regardless, an increase in fair value would not be shown on the books. Accounting for Compensation 7. ABC Media Co., which has a taxable payroll of $400,000, is subject to FUTA tax of 6.2% and a state contribution rate of 5.4%. However, because of stable employment experience, the company’s state rate has been reduced to 2%. What is the total amount of federal and state unemployment tax for ABC Media Co.? [( .062 - .054) + .02] * 400,000 = 11,200 A company gives each of its 50 employees (assume they were all employed continuously through 2010 and 2011) 12 days of vacation a year if they are employed at the end of the year. The vacation accumulates and may be taken starting January 1 of the next year. The employees work 8 hours per day. In 2010 and 2011, they made $14 per hour. During 2011, they took an average of 9 days of vacation each. The company’s policy is to record the liability existing at the end of each year at the wage rate for that year. What amount of vacation liability would be reflected on the 2010 and 2011 balance sheets, respectively? 50 * 12 * 8 * 14 = $67,200 for 2010 50 * 15 * 8 * 14 = $84,000 for 2011 **15 = 12 + 3 unused days** On December 31, 2010, Filmore Company granted some of its executives options to purchase 50,000 shares of the company's $10 par common stock at an option price of $50 per share. The options become exercisable on January 1, 2011, and represent compensation for executives' services over a three-year period beginning January 1, 2011. The Black-Scholes option pricing model determines total compensation expense to be $300,000. At December 31, 2011, none of the executives had exercised their options. What is the impact on Filmore's net income for the year ended December 31, 2011 as a result of this transaction under the fair value method? 300,000 / 3 = $100,000 Fair value / number of years spread out**** ( the rest is not used) On January 1, 2010, ABC Media Corp. granted an employee an option to purchase 6,000 shares of ABC's $5 par value common stock at $20 per share. The Black-Scholes option pricing model determines total compensation expense to be $140,000. The option became exercisable on December 31, 2011, after the employee completed two years of service. The market prices of Doane's stock were as follows: January 1, 2010 December 31, 2011 $30 50 For 2011, ABC should recognize compensation expense under the fair value method of? $140,000 ÷ 2 = $70,000. ***Again, just use the total expense / the number of years**** Prepare the necessary entries from 1/1/10-2/1/12 for the following events using the fair value method. If no entry is needed, write "No Entry Necessary." 1. On 1/1/10, the stockholders adopted a stock option plan for top executives whereby each might receive rights to purchase up to 12,000 shares of common stock at $40 per share. The par value is $10 per share. No Entry Necessary- under the Fair value method, no entry is made at the time of adoption. A note might be made about the stock option plan, though. 2. On 2/1/10, options were granted to each of five executives to purchase 12,000 shares. The options were non-transferable and the executive had to remain an employee of the company to exercise the option. The options expire on 2/1/12. It is assumed that the options were for services performed equally in 2010 and 2011. The Black-Scholes option pricing model determines total compensation expense to be $1,300,000. No Entry Necessary- no entry should be made at the grant date under the fair value method. At 2/1/12, four executives exercised their options. The fifth executive chose not to exercise his options, which therefore were forfeited 4 * (12,000 * 40 ) = $1,920,000 48000 shares * 10 par value = $480,000 4/5 * 1,300,000 = $1,040,000 JE for exercising the options: Cash 1,920,000 APIC- Stock Options 1,040,000 Common Stock 480,000 APIC- Common Stock 2,480,000 JE for the expired options: APIC- Stock Options 260,000 APIC- Expired stock options 260,000 **This stuff can get pretty confusing, but here is a really great page for further help: http://accounting.utep.edu/sglandon/c19/c19a.pdf******