Revised Schedule VI as applicable FY 2012 onwards

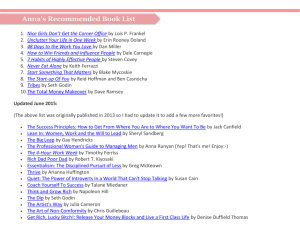

advertisement

Revised Schedule VI, Companies Act, 1956 CA ASHOK SETH, Lucknow B. Sc., FCA, DISA (ICA) as@sethspro.com Introduction MCA Notified Revised Schedule VI (RS) on 28th Feb 2011 amended on 30th March 2011 RS based upon the existing nonconverged Indian Accounting Standards Notified under Rules 2006. RS applicable on accounts starting on or after 1st April 2011 (i.e. for FY 2011-12) 18th Dec 2011 CA Ashok Seth 2 Accounting Standards & Revised Schedule VI General Instructions provides that requirements of RS shall stand modified with requirement of Act including Accounting Standards. The disclosure requirements of RS are in addition to and not in substitution of the disclosure requirements specified in the Accounting Standards. Terms used –as per applicable AS 18th Dec 2011 CA Ashok Seth 3 At a Glance Only Vertical format allowed Introduction of Format for P&L also Existing Part III & Part IV done away The narrative descriptions or disaggregation to be presented in Notes instead of schedule format. Each item of BS and P&L to be cross referenced to related information in notes. 18th Dec 2011 CA Ashok Seth 4 General Previous year’s figures need to be given in the revised format along with the current financials. Limits of Rounding offTurnover Rounding Off Less Than 100 Crore To the nearest hundreds, thousands, lakhs or millions, or decimals thereof. More Than 100 Crore To the nearest lakhs, millions or crores, or decimals thereof. 18th Dec 2011 CA Ashok Seth 5 OVERVIEW Part 1- Format of Balance Sheet and General Instructions Part 2- Format of Profit & Loss account and General Instructions “Broad heads shall be decided taking into account the concept of materiality and presentation of true and fair view of financial statements,”. 18th Dec 2011 CA Ashok Seth 6 Liability Side of Balance Sheet I EQUITY AND LAIBILITIES (Old Sources of funds) 1. Shareholders’ funds a) Share Capital b) Reserves and surpluses c) Share warrants 2. Share application money pending allotment 18th Dec 2011 CA Ashok Seth 7 3. Non-Current Liabilities a) Long-term Borrowings b) Deferred Tax Liabilities (Net) c) Other Long term liabilities- e.g. Security Deposits d) Long-term provisions e.g. Provision for Gratuity etc. 18th Dec 2011 CA Ashok Seth 8 4. Current liabilities a) Short Term Borrowings b) Trade Payables c) Other Current Liabilities d) Short-Term Provisions ALL IETMS TO BE CROSS REFRENCED WITH NOTE NUMBERS 18th Dec 2011 CA Ashok Seth 9 II ASSETS (Old Application of Funds) 1. Non Current Assets a) Fixed assets (i) Tangible assets (ii) Intangible assets (iii) Capital work-in-progress (iv) Intangible assets under development b) Non-current investments c) Deferred tax assets (net) d) Long-term loans and advances e) Other non-current assets 18th Dec 2011 CA Ashok Seth 10 2. Current Assets a) Current investments b) Inventories c) Trade receivables d) Cash and cash equivalents e) Short-term loans and advances f) Other current assets 18th Dec 2011 CA Ashok Seth 11 GENERAL INSTRUCTIONS BALANCE SHEET 18th Dec 2011 CA Ashok Seth 12 Current Assets- satisfying ANY of the following Criteria a) Expected to be realized in, or intended for sale or consumption in, normal operating cycle; b) held primarily for the purpose of being traded; c) expected to be realized within twelve months after the reporting date; or d) is cash or cash equivalent unless it is restricted from being exchanged or used to settle a liability for at least twelve months 18th Dec 2011 CA Ashok Seth 13 Normal Operating Cycle RM Transit Period Holding Period of RM Production Cycle Holding Period of FG Collection period of Drs. Normal Operating Cycle ½m 3m ½m 1m 2m 7m Where the normal operating cycle cannot be identified, it is assumed to have a duration of 12 months. 18th Dec 2011 CA Ashok Seth 14 Current Liability- satisfying ANY of the following Criteria a) Expected to be settled in the company’s normal operating cycle; b) Held primarily for the purpose of being traded; c) Due to be settled within twelve months after the reporting date; or d) The Company does not have an unconditional right to defer settlement of the liability for at least twelve months after the reporting date. 18th Dec 2011 CA Ashok Seth 15 “Trade Receivable” and “Trade Payable” A receivable shall be classified as a ‘trade receivable’ if it is in respect of the amount due on account of goods sold or services rendered in the normal course of business. A payable shall be classified as a ‘trade payable’ if it is in respect of the amount due on account of goods purchased or services received in the normal course of business. 18th Dec 2011 CA Ashok Seth 16 New Disclosure Requirements SHARE CAPITAL- for each class of SC Reconciliation of the number of shares at the beginning and at the end. The rights, preferences & restrictions attached to each class of shares Shares of each class held by its holding company or its ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate. 18th Dec 2011 CA Ashok Seth 17 Share Capital- Contd. Shares held by each shareholder holding more than 5 percent shares specifying no. of shares held. Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts 18th Dec 2011 CA Ashok Seth 18 Share Application Money New Exhaustive disclosure requirement: Terms and conditions for issuance of shares Amount of premium & period before which new shares need to be issued Period of pendency of such allotment and reasons for such That there is sufficient authorized capital to cover the share capital amount 18th Dec 2011 CA Ashok Seth 19 Reserve & Surplus The balance of ‘Reserves and Surplus’, after adjusting negative balance of surplus (profit & loss account), if any, shall be shown under the head ‘Reserves and Surplus’ even if the resulting figure is in the negative. 18th Dec 2011 CA Ashok Seth 20 Long Term BorrowingsSignificant New Disclosures Related parties’ transactions in case of long term loans and advances as a sub line item of long term borrowings. Terms of repayment of all loans Period and amount of continuing default as on the BS date in repayment of loans & interest, to be specified separately in each case 18th Dec 2011 CA Ashok Seth 21 Other Long Tern Liabilities and Provisions Other Long term Liabilities shall be classified as: (a) Trade payables (b) Others Long-term provisions - shall be classified as: (a)Provision for employee benefits. (b)Others (specify nature). 18th Dec 2011 CA Ashok Seth 22 Significant additional Disclosure In Short term borrowings From Related parties’ transactions Period and amount of continuing default as on the balance sheet date In Other current liabilities Interest accrued but not due on borrowings- for interest payable within 12 months Application money received for allotment of securities and due for refund In Short term provisions Provision for employee benefits. Current part to appear here. 18th Dec 2011 CA Ashok Seth 23 Tangible Assets Assets under lease shall be separately identified under each class of asset. Separate Disclosure requirement for Office Equipment 18th Dec 2011 CA Ashok Seth 24 Presentation of Tangibles Gross: Opening Balance Additions Acquisitions through Business combination Other Adjustments Sub-total Less: Disposals Gross block at year end 18th Dec 2011 CA Ashok Seth 25 Presentation of TangiblesContd. Less: Depreciation/Amortization Opening depreciation/amortization Depreciation/Amortization of the year Impairment loss/Reversal of Impairment Loss Total depreciation at year end Net Carrying Value 18th Dec 2011 CA Ashok Seth 26 Intangible Assets- To be classified into Goodwill Brands/trademarks Computer software Mastheads and publishing titles Mining rights Copyrights, and patents and other intellectual property rights, services, and operating rights Recipes, formulae, models, designs and prototypes Others (Specify nature ) 18th Dec 2011 CA Ashok Seth 27 Non Current Investments i. Trade Investments ii. Other Investments and further classified as:- i. Investment Property (Refer AS 13) Investment in Equity Instruments Investment in Preference Shares Investment in Government or trust securities. Investments in debentures or bonds. Investments in Mutual Funds Investment in Partnership firms. Other Non-current Investments 18th Dec 2011 CA Ashok Seth 28 Long Term Loan & Advances- to be Classified as 1. Capital advances (Not in CWIP) 2. Security deposits 3. Loans and advances to related parties (giving details thereof) 4. Other loans and advances shall also be sub-classified as: Secured, considered good; Unsecured, considered good; Doubtful. 18th Dec 2011 CA Ashok Seth 29 Other Non Current Assets i. Long Term Trade Receivables Trade receivable realizable beyond 12 months from end of the reporting period balance should be disclosed under current assets category ii. Others (Specify Nature) 18th Dec 2011 CA Ashok Seth 30 CURRENT ASSETS- Significant Changes Inventories to be classified as: Raw materials; Work-in-progress; Finished goods; Stock-in-trade (in respect of goods acquired for trading); Stores and spares; Loose tools; Others (specify nature). Goods in transit shall be disclosed under the relevant sub-head of inventories 18th Dec 2011 CA Ashok Seth 31 CURRENT ASSETS- Significant Changes “Sundry Debtors” replaced with “Trade Receivables” The revised Schedule VI requires separate disclosure of “trade receivables outstanding for a period exceeding 6 months from the date they became due for payment.” 18th Dec 2011 CA Ashok Seth 32 CURRENT ASSETS- Significant Changes Balance with Non- Scheduled banks not to be shown separately. To be stated separately Earmarked balances with banks (for example, for unpaid dividend) Balances with banks to the extent held as margin money or security against the borrowings, guarantees, other commitments Repatriation restrictions, if any, in respect of cash and bank balances 18th Dec 2011 CA Ashok Seth 33 Major Disclosers- Omitted Various disclosure under Micro , small and medium enterprises development Act 2006 Separate disclosures to dues to subsidiaries 18th Dec 2011 CA Ashok Seth 34 Profit & Loss Statement i. ii. iii. iv. Revenue from operations Other Income Total Revenue (I + II) Expenses Cost of Material consumed Purchases of Stock in trade Changes in Inventories of Finished goods , Work in progress and stock in trade Employee Benefits expenses Finance costs Depreciation and amortization expenses Other expenses Total Expenses 18th Dec 2011 CA Ashok Seth 35 Profit & Loss Statement- Contd. v. Profit before exceptional and extraordinary items and tax (III - IV) vi. Exceptional items vii.Profit before extraordinary items and tax (V - VI) viii.Extraordinary items ix. Profit before tax (VII - VIII) 18th Dec 2011 CA Ashok Seth 36 Profit & Loss Statement- Contd. x. Tax expense: (1) Current tax (2) Deferred tax xi. Profit (loss) for the period from continuing operations (VII - VIII) xii.Profit (loss) from discontinuing operations xiii.Tax expense of discontinuing operations 18th Dec 2011 CA Ashok Seth 37 Profit & Loss Statement- Contd. xiv.Profit/(loss) from discontinuing operations (after tax) (XII - XIII) xv.Profit (Loss) for the period (XI + XIV) xvi.Earnings per Equity Share: (1) Basic (2) Diluted 18th Dec 2011 CA Ashok Seth 38 Major Changes No Appropriation Account- Dividend, Transfer to and from Reserves to be shown under “Reserve and Surplus” heading in BS Proposed dividend should be shown as appropriation item in Reserve & Surplus section and corresponding liability for proposed dividend under short term provision. 18th Dec 2011 CA Ashok Seth 39 Proposed Dividend RESERVES & SURPLUS Balance as on 1-4-2011 Additions/ Balance Deductions/ as on 31-32012 Appropriations General Reserve 554.00 Surplus 100.00 Profit after Tax for the year 654.00 300.00 Less Trf. to General Reserve Less Proposed Dividend (100.00) (50.00) Less DD Tax (7.50) Balance 18th Dec 2011 100.00 242.50 CA Ashok Seth 40 Major Changes- Contd. Excise Duty to be shown in Notes and NOT on the face of P&L The borrowing cost portion of forex fluctuation gain/loss on foreign currency transaction shall now be part of finance cost. Rest shall be shown as forex fluctuation gain/loss as part of general administrative cost 18th Dec 2011 CA Ashok Seth 41 Major Changes- Contd. The limits of disclosure requirement enhanced from higher of 1% of revenue or Rs. 5000 to higher of 1% of revenue or Rs. 1,00,000. The limits now applicable to disclosure of income also. 18th Dec 2011 CA Ashok Seth 42 Major Disclosers Omitted Details of amount and quantity of turnover for each class of goods. Details pertaining to licensed /installed and production quantity. Details of opening and closing stock of goods Quantity related information related to raw material consumption Details of arrear depreciation. Director remuneration under s 198. Computation of Net profit under s 349/350 18th Dec 2011 CA Ashok Seth 43 Key Differences with IFRS IFRS allows expenses to be classified by nature or function. IAS 1 does not recognize extraordinary items IFRS does not require exceptional items on face of P&L Statement In IFRS Prior Period items are corrected by retrospective restatement. 18th Dec 2011 CA Ashok Seth 44 Key Differences with IFRSContd. In IFRS affect of changes in Accounting policies has to be given retrospective effect. IFRS requires presentation of statement of Other Comprehensive Income. 18th Dec 2011 CA Ashok Seth 45 Thank You Please mail your comments to as@sethspro.com Any Questions? 18th Dec 2011 CA Ashok Seth 46