Understanding the Supply Chain

advertisement

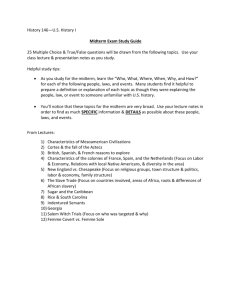

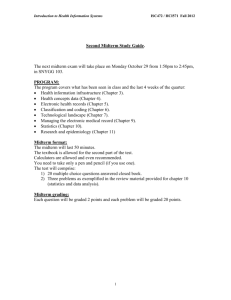

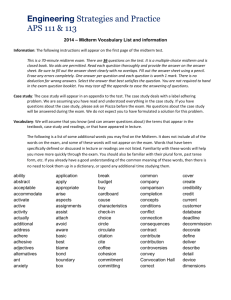

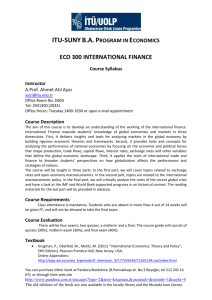

Supply Chain Management Lecture 15 Outline • Today – Simulation game results – Midterm review • Next week – Midterm Tuesday March 9 The Teams Place Team AdWiJuMa Brittany Brown Squad Cobras COSTA Do Nothing Jafar's Crew No use for a name Pangeans for Outsourcing Pole Position Robert and Alex Team Bison Team Predator Team Shinnannigans We Want Dutch Wafers End money The Scores Place Team 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Do Nothing End money 43,114,415.24 42,636,799.36 42,529,886.20 42,401,421.85 41,623,140.34 41,461,152.91 41,011,414.46 40,621,780.33 40,150,372.51 40,149,781.61 39,836,011.64 39,581,049.55 37,850,401.65 37,305,034.75 36,659,589.53 35,394,768.57 Jafar’s Crew 13 14 $37,850,401 Team Bison $37,305,034 20 40 16 40 10 15 40 COSTA 16 Do Nothing $36,659,589 $35,394,768 20 20 16 16 16 9 AdWiJuMa 10 We Want Dutch Wafers $40,150,372 $40,149,781 60 37 40 46 15 16 16 18 11 12 Brittany $39,836,011 $39,581,049 112 30 118 16 36 16 5 Team Shinnannigans $41,623,140 The Designs 6 Robert and Alex $41,461,152 60 60 40 16 7 45 15 15 No use for a name $41,011,414 10 8 16 Team Predator $40,621,780 50 66 46 16 20 40 16 16 16 16 16 2 Pole Position 4 $42,636,799 Brown Squad $42,401,421 100 55 53 56 16 1 Cobras 3 Pangeans for Outsourcing $43,114,415 $42,529,886 72 71 16 95 65 The Results Place Team 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cobras Pole Position Pangeans for Outsourcing Brown Squad Team Shinnannigans Robert and Alex No use for a name Team Predator AdWiJuMa We Want Dutch Wafers Brittany Jafar's Crew Team Bison COSTA Do Nothing End money 43,114,415.24 42,636,799.36 42,529,886.20 42,401,421.85 41,623,140.34 41,461,152.91 41,011,414.46 40,621,780.33 40,150,372.51 40,149,781.61 39,836,011.64 39,581,049.55 37,850,401.65 37,305,034.75 36,659,589.53 35,394,768.57 Midterm • Questions? Stop by… – Friday March 5 – Monday March 8 Midterm • Chapter 1 – Sections 1, 2, 3, 4, 5 • Skipping – Section 1.5: Supply chain macro processes in a firm – Important concepts • • • • • • Supply chain Supply chain surplus 3 decision phases in a supply chain Cycle view 4 process cycles Push/pull view Supply Chain Stages Q1 • A typical supply chain may involve a variety of stages Supplier Manufacturer Distributor Retailer Customer Most supply chains are actually supply networks Midterm • Chapter 2 – Sections 1, 2, 3, (4e: also 4) – Important concepts • • • • • • • • • Competitive strategy Supply chain strategy Strategic fit How is strategic fit achieved Implied demand uncertainty Responsiveness/efficiency Issues affecting strategic fit Scopes of strategic fit Obstacles to achieving strategic fit (3e: Chapter 3 section 9) What is Competitive Strategy? Q2 • Competitive strategy – Defines, relative to competitors, a company’s set of customer needs that it seeks to satisfy through its products and services • Wal-Mart – Everyday low prices (low cost retailer for a wide variety of products) • Coors – The coldest tasting beer in the world, brewed with Rocky Mountain spring water • Dell – Custom-made computer systems at a reasonable cost How do you execute your competitive strategy? Midterm • Chapter 3 – Sections 1, 3, 4, 5, 6, 7, 8, (3e: also 9) • Hint – Sections 3 through 9 focus at:: Role in the competitive strategy, and Overall trade-off • Skipping – Sections 3 though 9: Information-related metrics – Important concepts • 6 drivers of supply chain performance – – – – – – Facilities Inventory Transportation Information Sourcing Pricing From Strategy to Decisions Q3 Corporate Strategy Competitive Strategy Supply Chain Strategy Responsiveness Efficiency Facilities Inventory Transportation Information Sourcing Pricing Logistical drivers Cross functional drivers Midterm • Chapter 4 – Sections 1, 2, 3 – Important concepts • • • • • • Distribution Factors influencing network design Customer service components Relationship between number of facilities and response time Relationship between number of facilities and cost 6 distribution network design options – Relative performance (advantages/disadvantages) Transportation Cost and Number of Facilities Transportation Costs Number of Facilities Q4 Design Options For a Distribution Network Q5 Manufacturers Manufacturers Distributor Warehouse Retailer Retailer Distributor Warehouse Manufacturers Retailer Consumers Manufacturers Consumers Retailer Retailer Consumers Distributor Warehouse Mergers Consumers Manufacturers Distributor Warehouse Distributor Warehouse Consumers Manufacturers Distributor Warehouse Distributor Warehouse Consumers Distributor Warehouse Midterm • Chapter 5 – Sections 1, 2 • Skipping – Section 5.2: Locating to split the market – Important concepts • • • • 4 classifications of network design decisions 8 factors influencing network design decisions 6 facility strategic roles Positive externalities Factors Influencing Network Design Decisions • Strategic factors Q6 Strategic role Global Customers Regional Customers Lead Outpost Offshore Server <low-cost> <exports only> <local market> <avoid tariffs> Many Asian plants Suziki’s Indian venture Maruti <advanced technology> <access to Lockheed Martin’s JSF in Dallas knowledge> Dell in Ireland Source Contributor <low-cost> <global market> <customization> <development skills> Nike plants in Korea Maruti Factors Influencing Network Design Decisions Q7 • Macroeconomic factors – Quotas, tariffs, and tax incentives • Economic trade agreements: Nafta, EU, APTA, AFTZ – Exchange rate and demand risk – Different states or countries often offer economic incentives to companies that decide to set up shop there, including tax incentives and low-interest economic development loans How can trade agreements influence the number of facilities in a supply chain? Factors Influencing Network Design Decisions • Political factors – Political stability • Infrastructure factors – Availability of transportation terminals, labor • Most of Amazon’s distribution centers are located near airports • Competitive factors – Positive externalities (many stores in a mall makes it more convenient for customers – one location for everything the customers need) Q7 Midterm • Chapter 6 – Sections 1, (3e: 2), 3, 4, (4e: 5), (3e: 6) • Important concepts – – – – – – Discounted cash flow Net present value Decision tree Calculating NPV Calculating NPV using decision trees Risk management and network design Midterm • Chapter 7 – Sections 1, 2, 3, 4, 5, 6 – Important concepts • • • • Factors influencing demand forecast 4 characteristics of forecasts 4 forecast types Static and adaptive – Static method, moving average, exponential smoothing, Holt's method • Calculating forecasts • Forecast errors • Calculating forecast errors Types of Forecasts • Qualitative – Primarily subjective, rely on judgment and opinion • Time series – Use historical demand only • Causal – Use the relationship between demand and some other factor to develop forecast • Simulation – Imitate consumer choices that give rise to demand Q8 Midterm • Chapter 8 – Sections 1, 2, 3 – Important concepts • Aggregate planning • Operational parameters • Aggregate planning strategies Aggregate Planning Strategies • Basic strategies – Level strategy (using inventory as lever) • Synchronize production rate with long term average demand • Swim wear – Chase (the demand) strategy (using capacity as lever) • Synchronize production rate with demand • Fast food restaurants – Time flexibility strategy (using utilization as lever) • High levels excess (machine and/or workforce) capacity • Machine shops, army – Tailored strategy • Combination of the chase, level, and time flexibility strategies Q9 Midterm • Chapter 9 – Sections 1, 2, 3 • Hint – Section 3 focus at Impact of promotion on demand (market growth, stealing share, and forward buying), and impact on promotion timing • Important concepts – – – – – Responding to predictable variability Managing supply Managing demand 3 reasons for increase in demand due to promotion Impact on promotion timing Managing Demand Q10 • Pricing and other forms of promotion – Timing of promotion is important • Demand increases from promotion can result from a combination of three factors: – Market growth (increased sales, increased market size) • Increase in consumption from both new and existing customers • Example: Toyota Camry attracting buyers who were considering lower-end models – Stealing share (increased sales, same market size) • Product substitution (overall demand stays the same) • Example: Toyota Camry attracting buyers who were considering Honda Accord – Forward buying (same sales, same market size) • Customers move up purchases (does not increase sales) Midterm Formula Sheet