EWM Finance & Reporting Requirements

advertisement

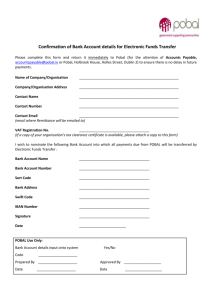

Overview of Finance and Reporting Equality for Women Measure 2010-2013 October 2011 Areas to be covered. 1) Roles & Responsibilities - Books & Records 2) Financial returns & Payment Stages 3) Second Instalment (35%) & Final Instalment 15% 4) Budget Changes – Flexibility levels 5) Public Procurement Requirements 6) Audit and Verification Key areas /weakness 1 Pobal distributes funding on behalf of many government departments using the same basic system. Dept Justice And Equality Pobal – EWM Funds EWM Bank Acc. 2 Position to date - Year 2. 3 • Year 2 Budgets have been agreed and approved. • Contract addendums up to April 2012 received. • First Payment of 50% have been issued July/August. • Second installment of 35% due October/November 2011 will be dependent meeting 50% spend threshold of first payment by the end of September. • Final retrospective payment of 15% due in June/July 2012. Roles & Responsibilities 4 • Contract /Direct relationship exists between the Grantee and Pobal in connection with reporting on the grant. • A nominated finance administrator in place to keep your books and deal with the returns and any queries • The Grantee must ensure that there is oversight of the finances and returns to Pobal at Board Level. • Grantees responsibility to ensure that Half Yearly Returns and Drawdown are complete, accurate and submitted in a timely manner. Setting up or reviewing your books and records. • Set up your EWM books and records (or if previously funded, review current systems) to ensure that routinely undertaking the following accounting functions • Maintain a separate bank account. • Maintain a payments journal clearly identifying expenditure. • Undertake monthly bank reconciliations; should be kept on file. • Group’s responsibility to monitor expenditure against approved Budget. 5 Finance Half Yearly Returns 6 Section 5 of the guidelines. • Returns to be completed and submitted to Pobal within 14 days of the period end. • Half Yearly Return Template will be sent to you for completion prior to 31st December • Drawdown form is used to request funds in between half year returns. i.e. September 30th 2011 • Total project expenditure should be reported. All expenditure is governed by the ESF rules & regulations. What to submit for the Half Year Return. 7 • Completed Return for the period with Declaration Appropriately signed at Board Level. • Total Project expenditure to be reported • Payments Journal for the reporting period. • Receipts and Lodgements Journal for period • EWM Bank statements for the designated a/c for the full reporting period • Extracts only from relevant bank statements where EWM expenditure has been paid out • List of outstanding cheques and lodgements Common Errors on Returns • Reimbursements are not eligible expenditure. Must show the expenditure where it is ultimately paid out from. i.e. transferred out of other bank a/c. • Ensure the columns on Payments Journal clearly match the Budget lines on Budget Template. • Ensure that all salary claims show the name of the relevant staff member. • Include explanations for any deviations from budget. i.e. Any over / under spends. 8 Payment Stages 9 Payments are made in instalments during the lifetime of the grant. Section 5 of Guidelines. First Payment 50% : Payment of 50% of the grant Second Payment 35% : Payment of 35% made in 2011 - paid on receipt and approval of a Drawdown request showing that at least 50% spend of the 1st payment has been reached. Final Payment 15% : Retrospective Payment of 15% in 2012 - paid on the receipt of final financial return and end of year monitoring report showing implementation of project objectives and actions. Second Payment of 35% must be paid by the end of Nov. 2011 • 35% paid on receipt of a drawdown covering spend for the period July to September 2011. • Must meet 50% spend threshold of first instalment example: Grant allocation €45,000 first payment made (i.e. 50%) €22,500 50% expected spend = €11,250 • Group’s responsibility to ensure that a complete & accurate drawdown is submitted in time for the payment to be issued by November. 10 Second Payment of 35% Important Points to note. 11 • Payment must be made to groups prior to the year end to avoid loss of funds. • No guarantee that the 35% instalment will be available in January 2012 to be drawn down. • Tight Timeframe for issue of payments will not allow finance to follow up on incomplete information. • If you have difficulty with meeting the spend threshold of 50% please alert your development officer. Final 15% of the grant will be paid retrospectively. • Paid on receipt of a Final Financial return and the end of Year 2 Monitoring report. • Funds must be in place to cover the retrospective payment until all documentation has been submitted and verified. • Group’s responsibility to ensure the bank account is managed efficiently and does not go into an overdrawn position. • Details in relation to contract conclusion will be provided by Pobal nearer the project end date. 12 Budget Changes Important Points to note. See Section 4 of the guidelines. Flexibility re budget changes. • Budget changes can be made of up to : - €500 on Programme Costs budget lines - €200 on Administration budget lines without seeking approval from Pobal. • Anything above these levels requires prior written approval from Pobal. 13 Budget Changes. Important Points to note cont’d. 14 • There will be one opportunity during each project year to formally request a change to the budget. • The budget change ‘window’ for year 2 will be in December 2011. Templates to be submitted with your expenditure return. • In April 2012 if exceptional changes are required then at that stage submit revised budget templates and detailed explanatory notes with revised apportionment policy. • Changes in excess of the agreed amounts must not be implemented without the prior written approval from Pobal. Reporting schedule will look like this Timeline: Year 2 First payment; 50% of Year 2 Allocation July/August 2011 Second payment; 35% of Year 2 Allocation Based on Drawdown due in by 14th October 2011 December 2011 Financial return to be submitted; To cover period 1st July – 31st December 2011 Due in by 20th January 2012 Request for Changes to Year 2 Budget to be submitted Due in by 20th January 2012 ESF/HCIOP Annual Progress Report for 2011 to be submitted Due in February 2012 (template will be issued in late 2011) Final Year 2 Financial return to be submitted; To cover period Due in by 14th May 2012 1st January 2012 – 30th April 2012 End of Year 2 Monitoring report Due in by 14th May 2012 End of Year 2 - 15% payment made retrospectively Payment made after approval of: Final Expenditure return and End of Year 2 Monitoring Report 15 Public Procurement 16 Section 7.14 of Guidelines • Adhere to Pobal’s /Dept of Finance Public Procurement Requirements. Declaration now signed. Guidelines on the website www.pobal e.g. value for money etc. • Keep all original Quotes on–site. Under €5,000 - One Quote Between €5,000 and €50,000 – Three written quotes These will be checked during Verification Team visits Importance of Audit and Verification. Section 9 of Guidelines. • Rights of Access • Key Areas of a Verification Visit. • Transparent audit trail (paper trail /direct link) from your books and records to supporting documentation and to reported expenditure. 17 Possible Verification / Audit visit 18 Section 9 Guidelines. Pobal is required to ensure that all grant monies paid to beneficiaries has been spent and reported in accordance with the grant approval. The Department of Justice and Equality, the Comptroller and Auditor General, the European Court of Auditors and officials of the European Commission all have right of access at all reasonable times. Key areas of a Verification Visit 19 Verifying the eligibility and the reality of returns submitted to Pobal corresponding backup e.g. invoices, payroll records, public procurement, ESF rules & regulations etc. Reviewing your internal controls, e.g. - Internal financial procedures documents - Electronic banking controls - Board approvals - Disclosure of interests - Authorisation for payments – invoices stamped paid. - Procedures for ordering goods/services, Cheque Requisitions. - Insurance indemnifying Pobal , Department and EU Commission. Common Audit Issues/Weakness 20 • Payments not supported by original invoices. • Discrepancies between salaries claimed and group’s payroll records. • Claiming expenditure twice • Participant details not maintained i.e. copies of certificates awarded & participant lists. • Income/Fees generated not netted off against project expenditure. • Timesheets not appropriately certified or sufficiently detailed. Other Audit Findings • Public Procurement rules not adhered to • Apportionment Policies not implemented or sufficiently documented. • Outstanding cheques not monitored. • Back dating & Frontloading expenditure • Internal Control risks – electronic banking /EFT • Internal Financial Procedures not satisfactorily documented. 21 Equality finance team contact details are on the website. • Any additional questions? 22