Pobal Community Services Programme Manual Part Two

advertisement

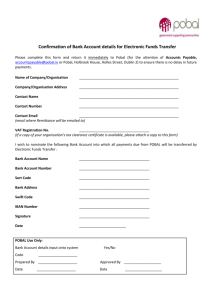

Pobal Community Services Programme Manual Part Two: Procedures and reporting Information and instructions on the procedures required to comply with the terms of a Pobal / CSP contract. Community Services Programme manual, part two TABLE OF CONTENTS 1. Introduction................................................................................................ 4 1.1 Pobal supports..................................................................................... 4 2. Eligibility and application............................................................................ 5 2.1 CSP eligibility criteria........................................................................... 5 2.2 Application process ............................................................................. 5 2.2.1 Larger grants: business plans...................................................... 6 2.2.2 Smaller grants: application......................................................... 6 2.3 Renewal of contracts........................................................................... 6 2.4 Mid-term contract review ................................................................... 7 2.5 Other submissions............................................................................... 7 2.5.1 Apportionment of costs ............................................................. 7 2.6 Documents to retain on file ................................................................. 7 3. Systems and records .................................................................................. 8 3.1 Governance and decision-making......................................................... 8 3.2 Internal financial procedures and books & records................................ 8 3.3 Individual policies and procedures ....................................................... 8 3.3.1 Electronic banking ..................................................................... 9 3.3.2 Income controls......................................................................... 9 3.3.3 CSP timesheets.......................................................................... 9 3.4 Documents to retain on file ................................................................... 9 4. Contract, payments and eligible expenditure ............................................. 10 4.1 4.2 4.3 4.4 Your first contract & payment............................................................ 10 Subsequent payments ....................................................................... 10 Final Payments.................................................................................. 10 Categories of Eligible Expenditure ...................................................... 10 4.4.1 Contribution to Manager Salary Cost ........................................ 11 4.4.2 Contribution to FTE Salary Costs ............................................... 11 4.4.3 Operational Costs (Where Granted) .......................................... 11 4.5 Ineligible costs .................................................................................. 11 4.6 Dates for Eligible Expenditure ............................................................ 12 4.7 Redundancy...................................................................................... 12 4.8 Documents to retain on file ............................................................... 12 5. Monitoring and Reports ........................................................................... 13 5.1 Monitoring submissions .................................................................... 13 5.1.1 Annual monitoring forms ......................................................... 13 5.1.2 Audited accounts & reconciliation of income and expenditure ... 13 5.1.3 Combined worker profile and expenditure return...................... 14 5.2 Submission and supporting documents .............................................. 14 5.3 Documents to retain on file .............................................................. 15 Published by Pobal. Document reference: 2013/03 2 Community Services Programme manual, part two 6. Pobal Audit & Verification Visits ................................................................ 16 6.1 Right of access .................................................................................. 16 6.2 Conducting the audit/verification....................................................... 16 6.3 The Final Audit/Verification Report .................................................... 17 6.4 Following the Audit/Verification ........................................................ 17 7. Recruitment and Employment .................................................................. 18 7.1 Responsibility of the contract-holder.................................................. 18 7.2 Contract of employment.................................................................... 18 7.3 Employment eligibility ....................................................................... 18 7.4 Transparent and fair recruitment practices ......................................... 19 7.5 Retaining Employment Records - Checklist......................................... 20 8. Procedures for Boards of Management ..................................................... 21 8.1 Governing documents ....................................................................... 21 8.2 Directors .......................................................................................... 21 8.3 Company secretary ........................................................................... 21 8.4 Policies & procedures ........................................................................ 22 8.5 Reporting to the board, directors and minutes.................................... 22 8.6 Code of conduct................................................................................ 22 8.7 Disclosure of interests ....................................................................... 22 8.8 Books and Records to Retain.............................................................. 23 9. Statutory and Other Compliance ................................................................ 24 9.1 Data protection................................................................................. 24 9.2 Freedom of information .................................................................... 24 9.3 Accounting for state benefits ............................................................. 24 9.4 Appointment of your external auditor................................................ 24 9.5 Indemnification................................................................................. 25 9.6 Connected parties............................................................................. 25 9.7 Public procurement........................................................................... 25 9.8 VAT registration................................................................................ 25 9.9 Publicity & logos ............................................................................... 25 9.10 Acknowledgements .......................................................................... 25 9.11 Child protection guidelines ................................................................ 25 9.12 Compliance with laws and public requirements .................................. 25 Published by Pobal. Document reference: 2013/03 3 Community Services Programme manual, part two 1. INTRODUCTION Part II of the Community Services Programme manual provides information on the procedures required to comply with your CSP contract especially: Application and business planning processes Monitoring and reporting on your grant Recruitment and employment practices and procedures Decision making and board meetings Statutory regulation and other conditions placed on all recipients of public funding The procedures in this document reflect the standard of accounting practice required of publicly funded organisations, combined with practical experience and lessons learnt by Pobal in the management of a number of programmes. They should be used by the Boards of Directors, managers and financial administrators of CSP supported companies and co-ops to assist the effective management and administration of your CSP funding, and to inform your general operations as a company/co-operative in receipt of public funds. Please read this document in conjunction with Part I of the CSP manual Rules and Conditions of the Community Services Programme and the Pobal Managing Better toolkits Volume 1 Good Governance and Volume 2 Financial Management for Community and Voluntary Groups. The links to the documents are: http://www.pobal.ie/Publications/Documents/CSP%20Rules%20and%20Conditions.pdf . https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf. http://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%202%20Financial%20Ma nagement.pdf. The Managing Better series assists organisations in achieving control over their finances and in establishing good financial practices , and can help ensure that you have the structures and basic procedures to meet your legal responsibilities and to be a successful board. Part III of this Manual provides more information on resources and support. The Community Services Programme is managed for the Department of Social Protection (DSP) by Pobal, a not-for-profit company that manages programmes on behalf of the Irish Government and the EU. 1.1 POBAL SUPPORTS Each contract-holder is assigned a regional development coordinator in Pobal to be your primary point of contact in relation to your application or business plan, project delivery, monitoring and conditions of contract. You may also liaise with a finance officer in the Grants Administration unit in the event of queries relating to your grant payment. Pobal tries to assist contract-holders with queries and accessing additional supports that may be required. Support documents are provided mainly through the Pobal website. We organise training and information meetings for contract-holders from time to time. It is a requirement that contract-holders attend these events, when requested to do so. Published by Pobal. Document reference: 2013/03 4 Community Services Programme manual, part two 2. ELIGIBILITY AND 2.1 CSP ELIGIBILITY CRITERIA APPLICATION The criteria of the Community Services Programme are described in detail in the CSP Rules and Conditions, Part I of this manual. In brief, the programme is designed to address locally identified gaps in the provision of services to communities and to exploit the potential of community assets an d resources. And in so doing, the programme supports the delivery of services to improve community well -being. The Programme can play an important role in addressing disadvantage and provides long term employment opportunities for certain Service Providers of people who have been previously unemployed. The Programme focuses on communities where public and private sector services are lacking, either through geographical or social isolation or because demand levels are not sufficient. A core requirement of the Programme is that Service Providers generate non-public revenue from their operations by charging fees for services delivered or fundraising. Companies in contract with the Programme must be not-for-profit, social enterprise or community business in nature. These criteria are tested through the CSP application process , subsequent contract reviews and monitoring reports. 2.2 APPLICATION PROCESS It is not possible for applicants to apply directly to Pobal for support under the Community Services Programme. Progression to the application/business planning stage is at the invitation of the Department of Social Protection. The Pobal website will advise when and if the programme is open to receive expressions of interest and give instructions on how to make this initial enquiry. The CSP Rules and Conditions describe the types of services eligible for CSP support a nd, in summary, these comprise: i. Community halls, facilities and amenities: physical premises and other locations which are managed by a local community and are available for use by members of the community. Examples in the programme include traditional community centres, sports, cultural, leisure and heritage buildings, and recreational open spaces . ii. Community services with an emphasis on disadvantaged communities, for example meals on wheels for the elderly, transport for people with disabilities, home insulation and repair for elderly and house-bound, community radio stations . iii. Community enterprises that provide supported employment for individuals “distant from the labour market”. These could include people with disabilities, Travellers, recovering drug misusers and ex-prisoners. Typical enterprises includes craft, environmental and recycling businesses, grounds maintenance, retail and catering targeted at disadvantaged or other communities of need. Once the Department has invited an application, they will issue an instruction to Pobal and the applicant will be asked to submit one of the following: Published by Pobal. Document reference: 2013/03 5 Community Services Programme manual, part two 2.2.1 LARGER GRANTS: BUSINESS PLANS Where the application seeks support for employment of a manager and a number of FTEs or for support towards employing more than 3 FTEs (and no manager), applicants are required to submit a three year business plan in line with the Programme’s guidelines and templates. The Department will make funding decisions, informed by the appraisal of the plan and recommendation by Pobal. Funding is then typically awarded for three years. In appraising a CSP business plan, Pobal looks particularly at the following criteria: Nature of the service and evidence of need for the service Capacity of the applicant to deliver the proposed service, including their governance arrangements Sustainability Value for Money Overall quality of the plan And, the applicant’s track record in contract compliance A regional development coordinator will support the applicant through the application/business planning process providing guidelines and templates. These include guidance in drafting a cash flow forecast and a reserves plan, which is a practical plan to explain the purpose for which the company’s retained funds are being held and developed. 2.2.2 SMALLER GRANTS: APPLICATION For smaller grants (usually those for providing community halls, facilities and amenities) to support three or fewer FTEs (no manager contribution), amounting to an annual grant value of €57,099, the applicant must submit an application form. In some instances they may also be asked to submit a work-plan. The appraisal criteria set out above also apply. Funding will be awarded by the Department, typically for three years, based on Pobal’s recommendation. We will make our recommendation on the information supplied and your match with programme eligibility. 2.3 RENEWAL OF CONTRACTS The Department will advise Pobal when i t is possible to offer contract-holders the opportunity to renew their CSP contracts. In this event, we will ask you to submit an up-dated business plan, application or other form of contract review, and we will provide support and guidance materials. Renewed funding is subject to the satisfactory appraisal of your up-dated business plan (or application or other contract review) and to the approval of the Department of Social Protection. Renewal is also contingent on a history of satisfactory reporting and compliance with contract terms. The appraisal criteria set out in section 2.2.1 and the need to demonstrate a continuing fit with the programme’s criteria continue to apply. Published by Pobal. Document reference: 2013/03 6 Community Services Programme manual, part two 2.4 MID-TERM CONTRACT REVIEW In a minority of cases, it is a condition of contract that a Mid Term Review (MTR) is undertaken of your contract. This may involve a meeting between Pobal staff, usually the regional development coordinator, with the manager of your service and one or more board members. There are a number of reasons for requiring such a review, for example, if there are concerns regarding the financial viability of the service or contract-holder, where significant unplanned change is happening to the service or where the contractholder appears to be failing to deliver the service as set out in the business plan or application. A MidTerm Review may result in a change to the CSP contract value. 2.5 OTHER SUBMISSIONS Pobal may require applicants/contract-holders to submit further information on a case by case basis. For example holders of smaller value CSP contracts may be requested to submit a reserves plan (see 2.3.1). Or organisations that benefit from multiple sources of public funding may be required to submit an apportionment policy. This is explained further, below: 2.5.1 APPORTIONMENT OF COSTS Where an organisation benefits from multiple funding streams you will be required to develop an agreed equitable method / basis of apportioning costs between the various programmes that you implement. Apportionment of costs is the process of sharing expenditure across the various funding streams/programmes being implemented by an organisation. The aim is to ensure that a funding source is not bearing the costs of running other programmes’ activities and services and/or unapproved activities. Apportionment is generally used to cover cost items such as salaries, overheads and on -going running costs. In this event, you will be asked to document this apportionment in an “apportionment policy ” and to submit this to your regional development coordinator in Pobal for approval. A guidance note on developing an apportionment policy is provided on the Pobal website. http://www.pobal.ie/Beneficiaries/CommunityServicesProgramme/Pages/Finance.aspx . 2.6 DOCUMENTS TO RETAIN ON FILE Remember to keep on file any business plan or application that you have submitted to Pobal, together with any supporting documents. We also recommend that you keep your working notes used in preparing forecasts and other financial information. This is all useful for future reference, to prepare for a Pobal visit or audit, when up-dating your plan and for inducting new members of staff and boards. Published by Pobal. Document reference: 2013/03 7 Community Services Programme manual, part two 3. SYSTEMS AND RECORDS All organisations in receipt of public funds must ensure that robust internal systems and procedures, books and records are in place that can evidence the accuracy and reliability of their monitoring information and financial reports submitted to Pobal. The award of a new contract for public funds presents a timely opportunity to review your systems and records to make sure that they are still fit for purpose. The Managing Better Good Governance and Financial Management toolkits, available on our website, set out the good practice standard required. The links to the documents are: https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf. http://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%202%20Financial%20Ma nagement.pdf. The critical areas for contract compliance are set out below. 3.1 GOVERNANCE AND DECISION-MAKING Section 8 of this manual, sets out the procedural standards required of your board in operating your CSP contract. 3.2 I NTERNAL FINANCIAL PROCEDURES AND BOOKS & RECORDS Your company/co-op must devise an internal financial procedures document specifying their practices and procedures, as well as who has responsibility for them. This document should be ratified by the board of directors. The company must ensure that responsibil ity for completing the various tasks outlined in their financial procedures document is clearly assigned to specific individuals and consideration should be given to introducing formalised internal review procedures which will help to ensure that the Board ’s agreed financial policies are adhered to on an on-going basis. A sample template is available to download from our website. The link is: http://www.pobal.ie/Publications/Documents/Document%201p1%20Financial%20Procedure%20Guidelin es.pdf. Your company/co-op must maintain proper books of account to record the day to day transactions of the organisation. The main objective is to have a record of all financial transactions in a way that makes them easily accessible and that provides an accurate picture of the organisation’s financial position. The books and records should record all income received and all payments made; these form the basis of the financial accounts. Your books and records include payments journal, lodgment records, receipts book, petty cash book, bank statements and bank reconciliations, payroll and Revenue records. As a minimum the payments journal must provide headings which correspond with those used in budgets, forecasts and business plans and allow for comparative analysis. 3.3 I NDIVIDUAL POLICIES AND PROCEDURES We have provided below guidance on several topics that are particularly relevant to the Community Services Programme: Published by Pobal. Document reference: 2013/03 8 Community Services Programme manual, part two 3.3.1 ELECTRONIC BANKING Electronic banking is now common practice among mos t Pobal contract-holders. The guidance note provided on our website sets out the procedures to safeguard your funds. The link to the document is: http://www.pobal.ie/Publications/Documents/Document%201p2%20Best%20Practice%20re%20Electroni c%20Banking.pdf. 3.3.2 INCOME CONTROLS Contract-holders in the Community Services Programme generate trading and other income from diverse sources and business activities, including cash receipts and one-off payments for goods and services. Formal guidance is currently being drafted (2013) and you are encouraged to visit the CSP Supports and Resources webpage for up-date. The link is: http://www.pobal.ie/Beneficiaries/CommunityServicesProgramme/Pages/default.aspx. In the meantime, please note the need to ensure that controls are in place to ensure the following: That all income received is lodged intact That income is identified and analysed in the receipts book and that the analysis is against headings that are used in budgets, forecasts and plans to ensure that financial targets are monitored That income is reconciled against invoices issued and procedures are in place for collection of monies owing That procedures are in place for managing a till Similarly that procedures are in place for managing fund-raising collections and other charitable donations 3.3.3 CSP TIMESHEETS Pobal provides a CSP timesheet template that is formatted to take account of the CSP fun ding allocation that is described as an “FTE”, this being 39 hours worked per week. You cannot claim for breaks. All contract-holders are required to keep time records and you are advised to use this model timesheet. It will help you complete your Half Year Return (see section 5.1.3) quickly and accurately. It will also help you avoid claiming for ineligible expenditure that must later be paid back to Pobal. A guide on using the timesheet is provided on our website: http://www.pobal.ie/Publications/Documents/Guidance%20notes%20re%20Time%20sheet%20recording. pdf. 3.4 DOCUMENTS TO RETAIN ON FILE Organisations are required to retain all records after the cessation of funding/activities in line with legal and funder regulations. Funder requirements will be specified in your Pobal contract. It is your responsibility to be aware of the length of time records relating to various stakeholders must be retained. This information should be obtained from your accountant/auditor, funder, revenue commissioners etc. In no circumstances should any of the documentation be destroyed or otherwise disposed of before the relevant retention period has expired or without the prior consent of the relevant party. Published by Pobal. Document reference: 2013/03 9 Community Services Programme manual, part two 4. CONTRACT, PAYMENTS AND ELIGIBLE EXPENDITURE Pobal will issue a CSP contract based on the Department’s funding decision. The funding represents the maximum grant for the period and payment of the gra nt is dependent on funding being made available to Pobal by the Department. The contract is also subject to the contract-holder’s satisfactory performance during the term of the contract. 4.1 YOUR FIRST CONTRACT & PAYMENT To ensure Pobal is in a position to approve the payment of your grant, it is essential that your board members read the contract thoroughly, understand its provisions and address all pre-contract conditions, before signing and returning to Poba l. You will be asked to submit the following in order to secure your first payment: Current Tax Clearance Certificate (TCC). The company/co-op name on the TCC must match both that on the Memorandum and Articles of Association (or Rules) and Pobal contract Most recent and signed Audited Accounts Bank Details form (Pobal will provide template) – the first and subsequent payments will be made to this account Signed Contract Certificate of Acceptance Public Procurement Declaration (Pobal will provide template) Insurance Indemnification of Pobal and the Department of Social Protection Contact Sheet including list of current directors (Pobal will provide template) Ensuring these items are addressed in accordance with the timelines laid down will minimise queries and delays in finalising and approving the grant payment. 4.2 SUBSEQUENT PAYMENTS The Pobal system of grant payments is intended to provide forwa rd funding for contract-holders. For annual (“revenue”) grants such as CSP, we usually pay in instalments of up to 25% at the beginning of each quarter. Some small variation may be made to the schedule to facilitate cash flow. These are currently scheduled for January, March, June and September. Payments are made subject to satisfactory monitoring by Pobal. Payments may therefore be withheld while we work with you to resolve the matter at issue. Additionally payment is subject to the availability of funds from the Department of Social Protection. 4.3 FINAL PAYMENTS Where a CSP contract expires and is not expected to be renewed or is otherwise concluded, a retention is made of 10% of the final year’s grant. This is payable on receipt of the comp leted and accurate final returns. Details of the final return process will be circulated to you in this eventuality. 4.4 CATEGORIES OF ELIGIBLE EXPENDITURE There are three categories of CSP expenditure: Contribution to manager salary cost Published by Pobal. Document reference: 2013/03 10 Community Services Programme manual, part two Contribution to FTE salary costs Operational costs (where granted) 4.4.1 CONTRIBUTION TO MANAGER SALARY COST Where a CSP contribution is made towards the costs of employing a manager, the annual CSP grant amounts to €32,000 and this includes a maximum employer’s (ER) PRSI contribution @10.75%. 4.4.2 CONTRIBUTION TO FTE SALARY COSTS The annual contribution towards employing a stated number of full time equivalent workers (“FTEs”) is €19,033, inclusive of the employer’s PRSI contribution. As explained in the Rules and Conditions of the Community Services Programme, each CSP FTE "award" represents 39 hours of funded work a week (excluding all breaks). Wages over and above the grant amount are required to come from the contract-holder's own resources and this practice is generally rd referred to as "topping up" a salary. Similarly, contract-holders who pay workers weekly and incur a 53 payroll week in a year must budget for that payroll week from their own resources. Reporting of staff costs is to be based on the reporting of actual costs of hours worked as per staff timesheets. Notional or budgeted amounts are ineligible reporting methods against the grant. Where an underspend on the grant may be incurred due to an extended absence of a CSP funded worker , for instance on maternity or sick leave, then the contract-holder may assign or recruit a repl acement to cover the period of absence. This replacement worker must be provided with a letter of appointment and contract referring specifically to the replacement’s role in the Community Service. It is not permissible or eligible to utilise the grant underspend towards the salary costs of an employee not working on the Community Service. This redeployment is to ensure continuity of your community service, so assignments or replacements should occur at the time of the absence. 4.4.3 OPERATIONAL COSTS (WHERE GRANTED) The operational grant is available for a few hardship cases which are assessed on an individual basis and awarded at the discretion of the Department. Recipients will be advised of purpose and restriction of operational funding and any conditions of contr act. Operational funding must be spent on “real costs”. “Real costs” refer to costs which are directly traceable to actual third party expenditure, incurred on an arm’s length basis. Real costs do not include any profit element accruing to any connected party and do not include notional or opportunity costs. This also excludes notional internal management charges and other notional amounts, e.g. rent paid to a connected party. Where Pobal finds that ineligible expenditure has been incurred, we are obli ged by government regulations to recoup that funding. 4.5 I NELIGIBLE COSTS There are standard Pobal / governmental exclusions on expendi ture of public funds including: Bank interest charged (including mortgage interest) Costs of litigation and any awards against you Published by Pobal. Document reference: 2013/03 11 Community Services Programme manual, part two Fines and penalties Entertainment, gift vouchers, rewards. This list is not exhaustive and may be added to by the Department or Pobal as necessary. Should you have any concerns regarding the eligibility of planned expenditure please contact your Pobal finance officer for clarification in advance of incurring expenditure? 4.6 DATES FOR ELIGIBLE EXPENDITURE Expenditure of CSP funds is eligible on and within the dates detailed on your contract only. Costs incurred prior to your contract date are not eligible for funding. Costs incurred after your contract end date are not eligible for funding. If you are unsure as to the dates of eligible expenditure please contact your Pobal finance officer for clarification. 4.7 REDUNDANCY Where the Service Provider is unable to meet the costs of statutory redundancy payments to individuals in CSP supported posts, the Programme may, if the circumstances are such that funding is considered necessary, advance the funding necessary to meet these costs. The payment is based on the CSP contribution to manager’s and FTE workers’ wages excluding employers PRSI and does not apply to salary top ups. Such a contribution is usually assessed on a case by case basis. 4.8 DOCUMENTS TO RETAIN ON FILE Copy of signed contract with funder (Pobal) and letter of offer Signed declarations re public procurement Insurance documents including indemnifications of Pobal and the funding Department Copy of all procedures and policies signed and approved by Board Tax Clearance Certificate Bank Mandate Bank accounts details Payments journal (cheques, direct debits, electronic funds transfers, bank charges etc.) Lodgement records Receipts book Petty cash book Bank reconciliation statements & bank account statements Payroll records including tax deductions cards, remittances to Revenue etc. Signed and dated management accounts Copy o board minutes reflecting all financial decisions and sign-off of books and records Published by Pobal. Document reference: 2013/03 12 Community Services Programme manual, part two MONITORING AND REPORTS 5. This chapter discusses the purpose of monitoring. It outlines the monitoring documents and procedures required by your Community Services contract. 5.1 MONITORING SUBMISSIONS Monitoring is the process which involves the regular recording and reporting of information about participants and activities in order to: Indicate how each contract-holder is progressing in delivering the community service described in the business plan or application Ensure allocated funds are used for their intended purpose Provide figures that Pobal can aggregate and analyse to generate information on the overall size, value and impact of the programme This information is required by the Department of Social Protection and may also be used to inform decision-makers in public life and for publicity purposes . Pobal monitors CSP contracts through the following submissions: Annual Business Plan Activities monitoring form or Annual monitoring form depending on the value of the contract Annual Finance Statements (audited accounts) and reconcili ation of income and expenditure Half yearly combined worker profile and expenditure returns 5.1.1 ANNUAL MONITORING FORMS CSP contracts of larger value are monitored through the Business Plan Activities (BPA) monitoring form. The purpose of this form is to help Pobal monitor the activities of the larger community services for the coming year and ensure activities and financial forecasts are consistent with the business plan as approved by the Department of Social Protection. Your regional development coordinator at Pobal provides you with a “BPA” template that, we believe, best matches your community service and c aptures its community benefit and will advise you of the deadline for submission. The format of this monitoring form is currently under review (2013) and contract-holders will be advised of changes as they are introduced. CSP contracts of smaller value (three or fewer FTEs) are monitored through an annual monitoring report form. The purpose of this report is to help Pobal ensure that activities are consistent with the application. This has been requested annually at the end December and is included in the financial returns template and is currently also under review in 2013. 5.1.2 AUDITED ACCOUNTS & RECONCILIATION OF INCOME AND EXPENDITURE Each contract-holder must ensure that audited financial statements are prepared, finalised and approved, so the company’s full annual financial statements (AFS) / audited accounts are submitted to Pobal four months after their respective financial year end. The financial statements submitted to Pobal must include Published by Pobal. Document reference: 2013/03 13 Community Services Programme manual, part two detailed separate analysis of individual Pobal programmes income and expenditure e.g. CSP, LCDP, RTP, etc. Pobal will review your AFS as part of your annual monitoring. 5.1.3 COMBINED WORKER PROFILE AND EXPENDITURE RETURN The Pobal system of grant payments and twice yearly returns is intended to provide forward funding for contract-holders while providing sponsoring Departments with assurance regarding spend of public funding. The instalments cycle is outlined above in section 3.2. In the combined worker profile and expenditure return (half yearly returns or “HYR”) the contract-holder provides details on CSP supported positions and the post-holders, their employment category, gender, and full/part time work. You also provide evidence of eligible expenditure. The Rules and Conditions of the Community Services Programme, as set down by the Department of Social Protection, is specific on the nature of the CSP funding allocation and the combined worker profile and expenditure return has been designed to help contract-holders calculate and claim the correct amount of grant. The return also requests information on other workers and vacancies along with a detailed breakdown of the actual expenditure incurred by the contract-holder for each six month period. Expenditure is analysed across the agreed budget headings i.e. Salary/Wages Manager, Salary/Wages FTE and Operational costs (where an operational grant is approved). The process of submitting the “HYR” is detailed below. The submission of timely, accurate and complete half yearly returns is part of your contractual obligations with Pobal and is required before we can make subsequent payments. Half yearly returns are required st th throughout the life of the grant reflecting actual costs incurred in the periods 1 January – 30 June and st st 1 July – 31 December. Incomplete or incorrect returns submitted to Pobal delay your payment. It is therefore important that you take care when completing the return to make sure that it is correct, approved by the appropriate personnel , and that all supporting documentation is attached and is in agreement with the reported expenditure. PLEASE NOTE THAT IT IS A CONDITION OF CONTRACT TO SUBMIT A HALF YEARLY RETURN EVEN IF YOU HAVE NOT INCURRED EXPENDITURE IN THAT PERIOD. Guidance notes on completing and submitting the combined worker profile and expenditure return are available on our website here. http://www.pobal.ie/Beneficiaries/CommunityServicesProgramme/Pages/Finance.aspx . 5.2 SUBMISSION AND SUPPORTING DOCUMENTS The HYR and supporting documentation as listed below are due for submission 14 days following the period end date. The following completed documents are required: Half yearly return template (includes worker profile) Sample payroll documents and back-up: we will notify contract-holders of a payroll week for which sample payroll documents are requested. You are required to submit copies of the following documentation in relation to the sample week. o Copies of gross to net payroll report for the organisation (please provide current and year to date) o Copies of the bank statement showing net payment to employee for the sample week Published by Pobal. Document reference: 2013/03 14 Community Services Programme manual, part two o o Copies of the final bank statements for the period end date (if different from above) And with your December HYR only, submission of the P35L (Collector General Revenue Return) payroll documentation. If you receive “operational funding” as part of your CSP grant: please supply copies of bank statements detailing operational funding for items claimed of value €500 or over. 5.3 DOCUMENTS TO RETAIN ON FILE A signed hard copy of return: While there is no longer a requirement to submit signed hardcopy of your return, you should retain a signed hard copy for your files Originals of the supporting documents set out in 5.2 above Signed time-sheets Pobal contract-holders must maintain accounting records in support of their expenditure returns which provide an appropriate audit trail. Such records should clearly detail all transactions funded through CSP. Accounting records should be printed off, signed and dated on a regular basis by a person of appropriate authority as evidence of their review and approval.. Published by Pobal. Document reference: 2013/03 15 Community Services Programme manual, part two 6. POBAL AUDIT & VERIFICATION VISITS In administering public funds on behalf of the Irish Exchequer and the EU (where applicable) , Pobal has a responsibility to ensure funds are spent on the purposes intended. It is the responsibility of each funded contract-holder to ensure that funds are spent on eligible activities, and that both the end users of the funds and the funded contract-holder have adequate controls in place to safeguard the funds at all times. Pobal independently appraises the financial and administrative controls of funded contract-holder to ensure they comply with the public accountability requirements of the programmes they operate, using EU rules and regulations as a model of best practice. Pobal carries out this role through the audit team who continuously carry out comprehensive audits and verification visits of each of the programmes administered by Pobal. A verification visit is a routine visit conducted to verify the regularity and reality of a ctivity, assets and expenditure An audit visit involves a more detailed and comprehensive examination of books and records to ensure that money is spent for the purpose intended and that adequate controls and safeguards are in place 6.1 RIGHT OF ACCESS Pobal, the Department of Social Protection and the Comptroller and Auditor General and their agents have a right of access at all reasonable times to enter on any property owned or occupied by the funded company and to inspect and take photocopies of all records relating directly or ind irectly to the Pobal grant monies. 6.2 CONDUCTING THE AUDIT/VERIFICATION The audit/verification is carried out at the company’s premises. The length of the audit/verification varies, depending on issues such as the length of the period being audited, the number of programmes being audited, the complexity of the company etc. If a previous audit/verification visit was carried out, the auditor will check that the recommendations of the previous audit/verification visit have been implemented. If these rec ommendations were not implemented satisfactorily, the audit report will highlight this. A major part of the auditor’s work is to examine the financial records that the funded contract-holder has used to prepare the expenditure reports to Pobal, and the audit trail (i.e. the ‘paper trail’ or direct link) from the records to the reports. In doing this, the auditor will assess the accuracy of the reports, the eligibility of spending, and the classification of spending in the reports. Similarly, the auditor reviews the adequacy of the accounting systems and related internal controls that the funded contract-holder operates to ensure that the public funding is safeguarded and spent on eligible activities in keeping with the terms and conditions of the providers of funding (e.g. this would typically include the opening and maintenance of bank accounts, delegation of duties to staff members, etc.). Published by Pobal. Document reference: 2013/03 16 Community Services Programme manual, part two When the auditor has finished the fieldwork, he/she will hold an informal post-audit meeting with the CEO/Manager and Financial Controller/Administrator. In certain circumstances Pobal may request a board member to be present. 6.3 THE FINAL AUDIT/VERIFICATION REPORT The audit/verification report is issued to the CEO/Manager of the company and to the Chairperson of the Board of Directors. The final audit/verification report is accompanied by a management letter that sets out the main findings in a summarised form. The Finance sub-committee of Pobal requires that a full unabridged version of the audit/verification report is circulated to the company’s board members in advance of their next board meeting, and considered at that meeting. Each contract-holder is asked to submit a signed declaration page, to the audit /verification section, which indic ates a reasonable final time scale for the implementation of the recommendations across all programmes, within the deadline specified in the report (typically 14 – 30 days). 6.4 FOLLOWING THE AUDIT/VERIFICATION The Audit Section / Pobal Finance Sub-Committee considers in detail the reply sent by the contract-holder in response to the audit/verification report. Depending on the reply, and on the particular circumstances of the audit/verification and the contract-holder, Pobal may then; consider the audit/verification complete and satisfactory, or agree the timescales, or request further clarifications/assurances from the contract-holder on a number of issues. In this case, Pobal will issue a letter to the contract-holder outlining any concerns or areas requiring further attention, or request a meeting with a delegation from the contract-holder’s board, or curtail or suspend funding to the contract-holder until certain recommendations have been agreed and implemented. Published by Pobal. Document reference: 2013/03 17 Community Services Programme manual, part two 7. RECRUITMENT AND EMPLOYMENT The recruitment and employment procedures set out in this section are intended to provide evidence that the contract-holder is observing the specific employment criteria and restrictions, as set out in the Rules and Conditions of the Community Services Programme, and the general HR standards that are required in publicly funded employment. The link to Pobal Managing Better toolkit Volume 3 Human Resources for Community and Voluntary Groups is: http://www.pobal.ie/Publications/Documents/Managing%20Better_Volume%203%20Human%20Resourc es.pdf. 7.1 RESPONSIBILITY OF THE CONTRACT-HOLDER The provision of employment is an important element of the programme. The CSP contract-holder is the employer of all posts supported by CSP and is responsible for determining the following: 7.2 Contract of employment Ensuring the eligibility of individuals to hold CSP supported posts Distribution of an FTE allocati on into full and part-time post. Determination of the hours of full and part-time posts Terms and conditions of employment Duration of contract Salary scale and remuneration policy HR policies Holidays, opening hours and other local arrangements Grievance processes Retaining an employment file for each individual CONTRACT OF EMPLOYMENT It is a requirement to ensure there is a signed contract of employment for each CSP funded employee. Pobal produces a recommended, standard model contract of employment which is available to download from our website under the Employment section. The links are: https://www.pobal.ie/Publications/Documents/Sample%20Indefinite%20Part%20Time%20Contract.pdf . https://www.pobal.ie/Publications/Documents/Sample%20Indefinite%20Contract.pdf. https://www.pobal.ie/Publications/Documents/Sample%20Fixed%20Term%20Part%20Time%20Contract. pdf. http://www.pobal.ie/Publications/Documents/Sample%20Fixed%20Term%20Contract.pdf. It is not necessary to use the Pobal template contract should one already exist. Some programmes and public funders require that a contract of employment be renewed and signed annually. This is not a specific CSP requirement but can be considered good pr actice. Some CSP employers include a clause in the contract indicating that the post is subject to the continuation of funding. 7.3 EMPLOYMENT ELIGIBILITY You are required to obtain evidence of eligibility for each person in a CSP supported post and to retain this on the individual’s employment file. Pobal auditors will check for this during a verification or audit visit. Published by Pobal. Document reference: 2013/03 18 Community Services Programme manual, part two The table below provides information on how to evidence employment eligibility for individuals in CSP supported posts. The most commonly required form of evidence is the CSP Employment Eligibility Form; this is required to be completed at the time of recruitment, stamped and signed by Department of Social Protection to confirm the information supplied. You should retain the form (or other form of evidence) on the individual’s employment file. The Employment Eligibility Form is available from our website under the Employment Section. The link to the document is: http://www.pobal.ie/Beneficiaries/CommunityServicesProgramme/Pages/Employment.aspx . Category Evidence/ supporting documentation Unemployed persons in receipt of jobseekers’ benefit, jobseekers’ assistance or one parent family payment Please ask the local social welfare office to stamp the CSP employment form Persons in receipt of disability allowance (or other disability benefit), invalidity pension or blind persons pension Please have the CSP employment form signed and stamped by the appropriate Social Welfare Office as listed below before employment starts as permission is required from these offices Travellers in receipt of jobseekers’ benefit or jobseekers’ assistance or one parent family benefit Please ask the local social welfare office to stamp the CSP employment form Stabilised and recovering drug misusers Form to be stamped by a drug rehabilitation or other specialist agency (or obtain a letter of referral) Ex-prisoners Form to be stamped by their probation officer or obtain a copy of their certificate of release from the Prison Service People employed from Community Employment (CE) and Job Initiatives (JI) schemes are deemed eligible FAS supervisor to sign CSP employment form. It is also useful if you retain the former contracts of employment and wages slips which specify participation in the CE or JI scheme. (individuals employed under the Social Economy programme would have met CSP employment criteria at the time of the recruitment) (As these individuals were employed prior to CSP and the CSP employment form, the employer should provide evidence of their employment under the Social Economy Programme e.g. payroll records, Revenue P35 returns etc.) 7.4 TRANSPARENT AND FAIR RECRUITMENT PRACTICES Pobal requires that recruitment be fair and transparent. This means that posts must be advertised and filled through a competitive process. It is the responsibility of the contract-holder to decide how best and where to advertise e.g. local press or radio. Other media used by contract-holders include: http://www.localemploymentservices.ie/ http://www.ildn.ie http://www.jobsireland.ie/ http://www.activelink.ie/content/community-exchange Published by Pobal. Document reference: 2013/03 19 Community Services Programme manual, part two You could consider advertising a position with specialist publications/media, e.g. magazines, newsletters or local radio programmes which target any of the CSP categories. Advertising on radio can be particularly suitable for people with a visual impairment. The Employment Equality Acts 1998 and 2004 recommends that a positive action statement is included in job advertisements in order to ensure full equality in practice. The suggested wording is “We particularly welcome applications from….”, for example “We particularly welcome applications from lone parents, Travellers and people with disabilities .” Please retain evidence of your recruitment processes: the advertisement and where it was placed, which candidates were shortlisted for interview, the membership of interview boards and results of the interview process. 7.5 RETAINING EMPLOYMENT RECORDS - CHECKLIST The following checklist summarises the employment documents that you must keep on file for each employee in a CSP supported post. A signed contract of employment for each CSP funded worker which specifies the number of working hours per week Job description for each CSP supported post CSP Employment Eligibility Form or other evidence, as set out above Evidence of the transparency of recruitment processes (e.g. advertisement) Records of recruitment procedure (as set out above) Evidence of hours worked e.g. time sheets or other type of record. These should be signed by manager and employee at regular intervals e.g. weekly Published by Pobal. Document reference: 2013/03 20 Community Services Programme manual, part two 8. PROCEDURES FOR BOARDS OF MANAGEMENT All the procedures and systems required in managing public funds and set out in this manual must be applied, monitored and reviewed by the board of each contract-holder company or co-op. The quality of your corporate governance and decision-making is therefore fundamental to your contract compliance. Some main points are therefore set out below that highlight the compliance requirements made of boards of companies by Irish Company Law and good practice in decision-making. You are also encouraged to read and apply Pobal’s Managing Better Volume 1 Good Governance toolkit that provides guidance on good practice in corporate governance in the non -profit sector and all Pobal contract-holders are encouraged to read and apply the practices recommended. The link to the document is: https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf. 8.1 GOVERNING DOCUMENTS Each contract-holder has been incorporated as a company limited by guarantee or co-operative and operates under the rules and regulations of their Memorandum & Articles of Association, or Rules in the case of co-operatives, as well as the Companies Acts 1963 to 2009. The Memorandum sets out the aims of the company, its powers to carry out these aims, a statement that the liability of members is limited and the names and addresses of the first members. The Articles set out the rules on how the company is run, including items such as the election of directors, rotation of directors, roles of officers, keeping accounts, meetings, quorums, etc. Although these are usually drafted in dry, legalistic language, they are essential documents to the operation of a company and essential reading for managers and directors. It is advisable to keep a copy of the Memo & Articles (or Rules) at hand during board meetings. 8.2 DIRECTORS It is important that each company director is aware of Irish Company Law requirements and ensures that they are up-to-date in complying with them. Failure to comply with company secretarial obligations can result in prosecution and fines for both the company and the directors personally, strike off of the company from the Companies Register, and disqualification of the director from acting as a director in other companies. For detailed guidance on the responsibilities of directors, visit the website of the Director of Corporate Enforcement at www.odce.ie. 8.3 COMPANY SECRETARY The directors of every limited company must appoint a company secretary, who can be one of the directors or a member of staff. The company secretary’s role is to ensure that the company keeps to the company rules as set out in the Articles of Ass ociation, including the requirements of the Companies Office. There are quite a few such requirements, and it is important that the company secretary is very familiar with the relevant obligations and with the company’s own Articles of Association. Furth er guidance on the company secretary’s role is available on www.odce.ie. For more information, click on the link below: https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf. Published by Pobal. Document reference: 2013/03 21 Community Services Programme manual, part two 8.4 POLICIES & PROCEDURES The board of directors of each contract-holder is ultimately responsible for safeguarding the assets of their company. The board of directors should ensure that all significant decisions that affect the company are discussed and approved at board level and documented in the minutes of the meeting. The board of directors must document and approve the policies and procedur es that are adopted and used by them, their managers and staff members, for example the internal financial procedure document outlined in section 3.2 above. This will help ensure that the financial resources allocated to them through Pobal’s programme contracts operated are being used effectively and prudently in accordance with public accountability requirements. In particular the contract-holders’ documented policies and procedures must ensure that value for money is always sought and achieved. 8.5 REPORTING TO THE BOARD, DIRECTORS AND MINUTES In order to discharge their statutory and contractual obligations, it should be a normal part of your board’s business to consider, decide on and formally record the following (including but not exhaustive): Consideration of regular management accounts Key financial decisions including changes to staff remuneration, changes to budget, authorisation of new bank accounts, cheque book and electronic signatories, s ignificant purchasing decisions Operating policies e.g. apportionment policy where multiple programmes /funding contracts are in place, reserves policies and financial procedures Actions taken to meet conditions of contract, audit findings (from your own auditor, Pobal’s audi t section or other inspectors) Each contract-holder must keep minutes of all board and sub-committee meetings. The minutes must document all financial decisions. They should be clear, concise, impartial and free from ambiguity. The minutes must clearly list the names of directors present and other advisors or observers in attendance. The minutes should be signed and dated by the Chairperson followin g their review and acceptance. The minutes should be filed in logical order and any documents discussed at the meeting (e.g. management accounts) should be filed along with the minutes. For more information, click on the link below: https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf. 8.6 CODE OF CONDUCT The directors must comply with the Ethics in Public Office Act, which requires a general ethos for all directors including loyalty, integrity, fairness, impartiality and independence, etc. The link to the Ethics in Public Office Act is http://www.irishstatutebook.ie/1995/en/act/pub/0022/index.html . It is considered national and international best practice that all companies have a documented Directors’ code of conduct. For more information, click on the link below: https://www.pobal.ie/Publications/Documents/Managing%20Better%20Volume%201%20Good%20Gover nance.pdf 8.7 DISCLOSURE OF INTERESTS Each contract-holder must have documented procedures that enable them to identify situations where there may be possible conflicts of interest with any director, the company secretary or a key staff Published by Pobal. Document reference: 2013/03 22 Community Services Programme manual, part two member. If a conflict of interest arises the company must ensure the nature of this interest is formally disclosed and the conflict must be addressed and resolved, and is not allowed to persist in a manner that would have adverse effects or perceived adverse effects for the company. Aside from the company law obligations, it is in any event recommended as best practice that where a conflict of interest arises in a matter being discussed, that the individual should formally declare the nature of their interest and absent him/herself from the discussi on on the matter. The minutes must record that this was done. 8.8 BOOKS AND RECORDS TO RETAIN Agendas of meetings Reports and papers circulated with the agenda and tabled at meetings Minutes of the meeting, signed by the chairperson Your standing orders Published by Pobal. Document reference: 2013/03 23 Community Services Programme manual, part two 9. STATUTORY 9.1 AND OTHER COMPLIANCE DATA PROTECTION Companies controlling or processing data on individuals must register their company with the Data Protection Commission as Data Processors or Data Controllers or both, depending on what they do with the information. Data protection compliance is an essential legal requirement for all companies. It is best to put data protection procedures in place before problems occur to avoid legal liability, negative publicity and cost of regulatory enforcement. At the very least the company must have a policy in place. Information may only be retained for as long as the purpose for which it was collected remains. If that purpose ceases, the personal data should be deleted or made a nonymous to remove any identifying characteristics if it is desired to use the information for another purpose such as research etc. An excellent source for information is the Data Protection Commission. Please visit their website: www.dataprotection.ie for further information. 9.2 FREEDOM OF INFORMATION As a public body, Pobal comes under the legislation of the Freedom of Information (FOI) Act 1997 and 2003. The Act imposes various duties on Pobal and gives certain rights to individuals to access the records of the public body concerned and reasons for decisions made by the body. Pobal will hold records about your company and these will be subject to FOI requests. As a matter of courtesy, Pobal will inform you if records pertaining to your company are being released. If, at the time of providing information to Pobal, your company considers certain information to be commercially sensitive, confidential or of a personal nature and should not be subject to FOI, there is a need to identify the relevant information and specify the reasons for its sensitivity. Please visit the Freedom of Information’s website: http://foi.gov.ie. 9.3 ACCOUNTING FOR STATE BENEFITS The employer must claim sick/maternity benefit in respect of employees in CSP supported posts when applicable. If the employer decides to pay an individual their full salary while on sick/maternity leave, benefit must be payable to the company and set off against any CSP grant amount. This must be clearly indicated in the Pobal finance return. Pobal is obliged to recoup any amounts which have not been duly set off. 9.4 APPOINTMENT OF YOUR EXTERNAL AUDITOR Where a statutory auditor is appointed, the contract-holder must ensure that a letter of engagement is in put in place, and includes the following additional provisions/clauses: Reconciliation between the annual financial statements and the cumulative expenditure returns submitted to Pobal for each contract held i.e. an individual reconciliation for each source of Pobal funds. Guidelines for completion and interruption of the reconciliation were circulated to all beneficiaries in May 2012. The need for the auditors to familiarise themselves with the public accountability requirements of the various programmes the contract-holder administers. An all-inclusive audit fee, agreed in writing at the commencement of each audit. Published by Pobal. Document reference: 2013/03 24 Community Services Programme manual, part two 9.5 I NDEMNIFICATION As a contract-holder, you must indemnify Pobal and the Department of Social Protection throughout the life of their Pobal contract. We recommended that you leave a note on file with your current insurance policy to ensure that the indemnification is continued when you renew your policy or change insurers. 9.6 CONNECTED PARTIES Pobal may require sight of financial statements and governing documents of connected companies / companies under common control . This will help us assess viability and capacity of an applicant or contract-holder 9.7 PUBLIC PROCUREMENT You must sign and return a declaration to abide by public procurement regulations. The link to the publ ic procurement declaration form is: http://www.pobal.ie/Publications/Documents/CSP%20Public%20Procurement%20Declaration%20Form.p df. 9.8 VAT REGISTRATION You must advise and supply details of VAT registration where held . 9.9 PUBLICITY & LOGOS It is also a condition of Pobal’s contracts that you use the Pobal logo in printed material and websites . The link to the Pobal logo is: http://www.pobal.ie/Publications/Documents/Pobal%20Logo.JPG. 9.10 ACKNOWLEDGEMENTS CSP contract-holders are required to acknowledge the support of the Community Services Programme and the Department of Social Protection in their literature, including websites and other media. 9.11 CHILD PROTECTION GUIDELINES The state child protection and welfare guidelines “Children First” were updated and revised in mid-2011. If your organization works with children, please ensure that you read and understand the guidelines and that the recommended child protection arrangements are in place in your organization. Further information and details are available from the Department of Children and Youth Affairs: www.dcya.gov.ie. 9.12 COMPLIANCE WITH LAWS AND PUBLIC REQUIREMENTS It is required that companies and co-ops funded through the CSP programme are fully compliant with all laws applicable to their organisation including (but not limited to) the following: Tax legislation –g payment of taxes & compliance with tax laws Organisation of Working Time Act 1997 – working hours and annual leave/break entitlements Irish Pension Regulations – provision of access to PRSA Published by Pobal. Document reference: 2013/03 25 Community Services Programme manual, part two National Minimum Wage Act – payment of staff Companies Acts –filing of returns, holding of AGMs etc. Copyright © 2013 Pobal CSP contract holders and Voluntary Organisations may reproduce parts of the text for their own internal use. The source, author and publisher must be credited. For a hard copy, please contact:Community Supports Unit Pobal Holbrook House Holles Street Dublin 2 01 511 7000 Email: enquiries@pobal.ie Published by Pobal. Document reference: 2013/03 26