Capital Budgeting

advertisement

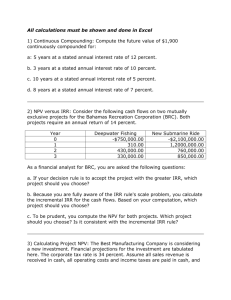

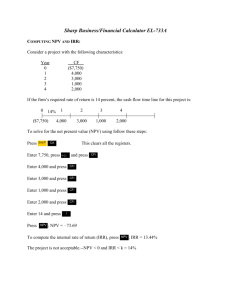

Capital Budgeting For 9.220, Term 1, 2002/03 02_Lecture9.ppt Outline Introduction Problems with IRR Special Considerations for DCF Techniques Mutually Exclusive Projects Capital Rationing Non-Discounted Cash Flow Methods Payback Average Accounting Return (AAR) Summary and Conclusions Introduction Discounted Cash Flow (DCF) Techniques are widely accepted as being among the better methods used for capital budgeting analysis. The three techniques discussed so far include NPV, IRR, and PI There are situations when one method is better to use than another or when adjustments should be made to use a method correctly. IRR Problem Cases: Borrowing vs. Lending Consider the following two projects. Evaluate with IRR given a hurdle rate of 20% Year Project A Cash Flows Project B Cash Flows 0 -$10,000 +$10,000 1 +$15,000 -$15,000 The non-existent or multiple IRR problem Example: Do the evaluation using IRR and a hurdle rate of 15% Year Cash flows of Project A Cash flows of Project B 0 -$312,000 +$350,000 1 +$800,000 -$800,000 2 -$500,000 +$500,000 NPV Profile – where are the IRRs? $80,000 $60,000 NPV $40,000 Project A Project B $20,000 $0 0% 20% 40% 60% -$20,000 -$40,000 -$60,000 Discount Rate 80% 100% No or Multiple IRR Problem – What to do? IRR cannot be used in this circumstance, the only solution is to revert to another method of analysis. NPV can handle these problems. How to recognize when this IRR problem can occur When changes in the signs of cash flows happen more than once the problem may occur (depending on the relative sizes of the individual cash flows). Examples: +-+ ; -+- ; -+++-; +---+ Special situations for DCF analysis When projects are independent and the firm has few constraints on capital, then we check to ensure that projects at least meet a minimum criteria – if they do, they are accepted. NPV≥0; IRR≥hurdle rate; PI≥1 If the firm has capital rationing, then its funds are limited and not all independent projects may be accepted. In this case, we seek to choose those projects that best use the firm’s available funds. PI is especially useful here. Sometimes a firm will have plenty of funds to invest, but it must choose between projects that are mutually exclusive. This means that the acceptance of one project precludes the acceptance of any others. In this case, we seek to choose the one highest ranked of the acceptable projects. Using IRR and PI correctly when projects are mutually exclusive and are of differing scales Consider the following two mutually exclusive projects. Assume the opportunity cost of capital is 12% Year Cash flows of Project A Cash flows of Project B 0 -$100,000 -$50 1 +$150,000 +$100 Incremental Cash Flows: Solving the Problem with IRR and PI As you can see, individual IRRs and PIs are not good for comparing between two mutually exclusive projects. However, we know IRR and PI are good for evaluating whether one project is acceptable. Therefore, consider “one project” that involves switching from the smaller project to the larger project. If IRR or PI indicate that this is worthwhile, then we will know which of the two projects is better. Incremental cash flow analysis looks at how the cash flows change by taking a particular project instead of another project. Using IRR and PI correctly when projects are mutually exclusive and are of differing scales Year Cash flows of Project A Cash flows of Project B Incremental Cash flows of A instead of B (i.e., A-B) 0 -$100,000 -$50 -$99,950 1 +$150,000 +$100 +$149,900 Using IRR and PI correctly when projects are mutually exclusive and are of differing scales IRR and PI analysis of incremental cash flows tells us which of two projects are better. Beware, before accepting the better project, you should always check to see that the better project is good on its own (i.e., is it better than “do nothing”). Incremental Analysis – Self Study For self-study, consider the Cash Cash flows following two Year flows of of Project A investments and Project B do the incremental IRR and PI analysis. 0 -$100,000 -$50,000 The opportunity cost of capital is 10%. Should either project be 1 +$101,000 +$50,001 accepted? No, prove it to yourself! Incremental Cash flows of A instead of B (i.e., A-B) Mutually Exclusive Projects of Different Length or with Different Risks IRR gives us one rate of return for all the cash flows relevant to a project. If necessary, NPV and PI allow for different discount rates to be used on different cash flows. This is useful when cash flows are of differing risk levels or when different discount rates apply due to the different timing of cash flows (recall the term structure of interest rates allows for different interest rates for different cash flows through time). If different rates should be used for different cash flows over a project’s life, then IRR cannot be used. If we choose between two mutually exclusive projects of different length, based on IRR, then, by comparing IRR’s, we must be assuming that the project’s cash flows can be reinvested at their IRR rates. NPV and PI make a more conservative assumption that all reinvested cash flows earn the opportunity cost of capital. Mutually Exclusive Projects of Different Lengths – Example Check the IRR’s. If B’s cash flows can be reinvested at B’s IRR, then B may indeed be the better investment. Otherwise, it depends on what are the appropriate discount rates for cash flows 1 year in the future, versus cash flows 10 years in the future. Cash flows Year of Project A Cash flows of Project B 0 -$10,000 -$10,000 1 0 $11,500 10 $31,058.48 0 Capital Rationing Recall: If the firm has capital rationing, then its funds are limited and not all independent projects may be accepted. In this case, we seek to choose those projects that best use the firm’s available funds. PI is especially useful here. Note: capital rationing is a different problem than mutually exclusive investments because if the capital constraint is removed, then all projects can be accepted together. Analyze the projects on the next page with NPV, IRR, and PI assuming the opportunity cost of capital is 10% and the firm is constrained to only invest $50,000 now (and no constraint is expected in future years). Capital Rationing – Example (All $ numbers are in thousands) Year Proj. A Proj. B Proj. C Proj. D Proj. E 0 -$50 -$20 -$20 -$20 -$10 1 $60 $24.2 -$10 $25 $12.6 2 $0 $0 $37.862 $0 $0 NPV $4.545 $2.0 $2.2 $2.727 $1.4545 IRR 20% 21% 14.84% 25% 26% PI 1.0909 1.1 1.11 1.136 1.145 Capital Rationing Example: Comparison of Rankings NPV rankings (best to worst) A, D, C, B, E A uses up the available capital Overall NPV = $4,545.45 IRR rankings (best to worst) E, D, B, A, C E, D, B use up the available capital Overall NPV = NPVE+D+B=$6,181.82 PI rankings (best to worst) E, D, C, B, A E, D, C use up the available capital Overall NPV = NPVE+D+C=$6,381.82 The PI rankings produce the best set of investments to accept given the capital rationing constraint. Capital Rationing Conclusions PI is best for initial ranking of independent projects under capital rationing. Comparing NPV’s of feasible combinations of projects would also work. IRR may be useful if the capital rationing constraint extends over multiple periods (see project C). Other methods to analyze investment projects – self study Payback – the simplest capital budgeting method of analysis Know this method thoroughly. Discounted Payback Know thoroughly. Average Accounting Return (AAR) You will not be asked to calculate it, but you should know what it is and why it is the most flawed of the methods we have examined. Summary and Conclusions DCF techniques are the best of the methods we have presented. In some cases, the DCF techniques need to be modified in order to obtain a correct decision. It is important to completely understand these cases and have an appreciation of which technique is best given the situation. Other techniques you should know include payback (which is nice because of its simplicity), discounted payback, and AAR.