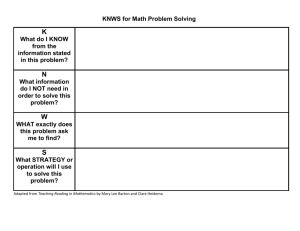

Solution to Problem #1 - Ka

advertisement

ECON 1001 AB Introduction to Economics I Dr. Ka-fu WONG Last week of tutorial sessions KKL 925, KKL 1010, K812, KKL 106 Clifford CHAN KKL 1109 givencana@yahoo.ca Covered and to be covered Covered last week Dr. Wong finished up to slides of 51 of kf013.ppt You should have at least read up to Chapter 12 Externalities and Property Rights If not, please press hard on it. For your interest, you can also read Chapter 13 Economies of Information (not examinable) The final exam covers everything up to chapter 12, except for chapter 9. Format is similar to the first and second midterm To be covered in the tutorial sessions this week Problems in chapter 12: #1, #3, #4, #5, #8 and #9 You are advised to work on the even ones as well Problem #1, Chapter 12 Determine whether the following statements are true or false, and briefly explain why A) A given total emission reduction in a polluting industry will be achieved at the lowest possible total cost when the cost of the last unit of pollution curbed is equal for each firm in the industry B) In an attempt to lower their costs of production, firms sometimes succeed merely in shifting costs to outsiders Solution to Problem #1 (1) A) True Application of Equal Marginal Principle For optimal allocation of production, marginal cost should be the same across all the firms If one firm’s marginal cost is higher than the other’s, it is cost-minimizing to divert the production from the firm with a higher marginal cost to the firm with a lower marginal cost Solution to Problem #1 (2) B) True Notion of Negative Externality It refers to situation where producers do not bear the complete production cost and the leakage is borne by a three-party outside the market Consider an example of production that generates sewage The sewage is supposed to be collected by a municipal government at a per unit charge However, the manufacturer escapes from the discharge fee by pumping the sewage into a river The river gets polluted and the society then bears an extra pollution cost Problem #3, Chapter 12 Suppose the supply curve of boom box rentals in Golden Gate Park is given by P = 5 + 0.1Q, where P is the daily rent per unit in dollars and Q is the volume of units rented in hundreds per day. The demand curve for boom boxes is 20 – 0.2Q. If each boom box imposes $3 per day in noise costs on others, by how much will the equilibrium number of boom boxes rented exceed the socially optimal number? Solution to Problem #3 (1) Equilibrium rental of boom boxes (Q*) Intersection of demand curve and supply curve 5 + 0.1Q* = 20 – 0.2Q* 0.3Q* = 15 Q* = 50 However, there is an (external) noise cost of $3 per box Supply curve = marginal cost curve (the portion above AVC) Social supply curve = original supply curve + 3 Social supply curve = 8 + 0.1Q Solution to Problem #3 (2) Socially optimal rental of boom boxes (Q**) Intersection of demand curve and social supply curve 8 + 0.1Q** = 20 – 0.2Q** 0.3Q** = 12 Q** = 40 If the negative externality (noise) is internalized into the rental, the equilibrium rental is greater than the social equilibrium rental by 10 (50 – 40) Problem #4, Chapter 12 Refer to problem 3. How would the imposition of a tax of $3 per unit on each daily boom box rental affect efficiency in this market Solution to Problem #4 The imposition of a $3 per unit tax is efficiencyenhancing Why? It actually internalizes the noise cost into the private supply curve After the imposition of tax, the supply curve becomes the social supply curve It helps bring the inefficient rental of boom boxes to the (socially) efficient rental of boom boxes Problem #5, Chapter 12 Suppose the law says that Jones may not emit smoke from his factory unless he gets permission from Smith, who lives downward. If the relevant costs and benefits of filtering the smoke from Jones' production process are as shown in the following table, and if Jones and Smith can negotiate with one another at no cost, will Jones emit smoke? Jones emits smoke Jones does not emit smoke Surplus for Jones $200 $160 Surplus for Smith $400 $420 Solution to Problem #5 (1) The efficient outcome is for Jones to emit smoke Why? The total surplus for Jones to emit smoke ($600) is greater than the total surplus for Jones not to emit smoke ($580) Jones gains more surplus by emitting smoke ($200 $160 = $40) Smith gains less surplus by authorizing Jones emit smoke ($420 - $400 = -$20) Note that Smith has the right to authorize Jones emit or not emit smoke Solution to Problem #5 (2) Since both Jones and Smith can negotiate with one another at no cost, they can actually come up with a plan that is mutually beneficial In order to induce Smith authorize Jones to emit smoke, Jones can offer Smith a side payment $30 to Smith, so that Smith’s lost in surplus (-$20) can be fully covered plus some extra gain ($10) Even if Jones has to pay Smith $30, Jones still gains $10 from the deal Problem #8, Chapter 12 (1) Barton and Statler are neighours in an apartment complex in downtown Manhattan. Barton is a concert pianist, and Statler is a poet working on an epic poem. Barton rehearses his concert pieces on the baby grand piano in his front room, which is directly above Statler’s study. The following matrix shows the monthly payoffs to Barton and Statler when Barton’s front room is and is not soundproofed. The soundproofing will be effective only if it is installed in Barton’s apartment. Problem #8, Chapter 12 (2) Soundproofed Not soundproofed Gain to Barton $100/month $150/month Gain to Statler $120month $80/month Solution to Problem #8 (1) A) If Barton has the legal right to make any amount of noise he wants and he and Statler can negotiate with one another at no cost, will Barton install and maintain soundproofing? Explain. Is his choice socially efficient? His choice is socially efficient Barton’s payoff without soundproofing is $50 greater than his payoff with soundproofing Barton has the legal right to make noise He will of course not install the soundproof unless he receives an additional income of at least $50 Solution to Problem #8 (2) Statler’s payoff without soundproofing is $40 less than his payoff with soundproofing Statler’s additional payoff from having a soundproof is not sufficient to feed Barton’s additional payoff from not having a soundproof Both Barton and Statler will have no intention to negotiate with one another Since the total payoff from not having a soundproof ($230) is greater than the total payoff from having it ($220), it is socially efficient Solution to Problem #8 (3) We can notice that an inequitable allocation of payoff can be socially efficient! B) If Statler has the legal right to peace and quiet and can negotiate with Barton at no cost, will Barton install and maintain soundproofing? Explain. Is his choice socially efficient? As Statler’s payoff with soundproofing is $40 greater than his payoff without soundproofing, he will exercise his right to require Barton to install and maintain a soundproof Solution to Problem #8 (4) The total payoff will then be $220, which is less than the total payoff without soundproofing ($230) Statler’s choice is thus not socially efficient However, the negotiation cost is zero Barton will have an intention to negotiate with Statler on not installing the soundproof by providing Statler a compensation of $40 (Statler’s additional payoff from having a soundproof) Barton is willing to make this compensation, as he can gain an additional payoff from not having a soundproof If such transaction occurs, the result will then be socially efficient Solution to Problem #8 (5) C) Does the attainment of an efficient outcome depend on whether Barton has the legal right to make noise, or Statler the legal right to peace and quiet? No, it is actually independent of who has the legal right on either issues. Parts a and b arrive with the same result However, it is only true because the negotiation cost is zero in this case If the negotiation cost is high enough to make transfer or compensation infeasible, the attainment of an efficient outcome will then become dependent on who has the legal right on either issues Problem #9, Chapter 12 Refer to problem #8. Barton decides to buy a full-sized grand piano. The new payoff matrix is shown in the matrix below Soundproofed Not soundproofed Gain to Barton $100/month $150/month Gain to Statler $120month $60/month Solution to Problem #9 (1) A) If Statler has the legal right to peace and quiet, and Barton and Statler can negotiate at no cost, will Barton install and maintain soundproofing? Explain. Is this outcome socially efficient? Statler’s payoff with soundproofing is $60 greater than his payoff without soundproofing He has the legal to peace and quiet Thus, Statler will exercise his right to require Barton to install and maintain a soundproof Solution to Problem #9 (2) Barton will not have an intention to negotiate with Statler, as Barton’s additional payoff from not having a soundproof ($50) is not enough to provide a compensation for Statler’s additional payoff from having a soundproof ($60) Therefore, they will end up having a soundproof installed and maintained It is an efficient outcome The total payoff from having a soundproof is $10 greater than the total payoff from not having a soundproof Solution to Problem #9 (3) B) Suppose that Barton has the legal right to make as much noise as he likes and that negotiating an agreement with Barton costs $15 per month. Will Barton install and maintain soundproofing? Explain. Is this outcome socially efficient? Barton’s payoff without soundproofing is $50 greater than his payoff with soundproofing Barton has the legal right to make noise He will of course not install the soundproof unless he receives an additional income of at least $50 Solution to Problem #9 (4) On the other side, Statler’s payoff with soundproofing is $60 greater than his payoff without soundproofing However, Statler will have no intention to negotiate with Barton, as there is a negotiation cost of $15 In order to reach an agreement with Barton to install a soundproof, Statler will need to pay a total of $65 ($50 + $15)- it is beyond his additional payoff with soundproofing As the total payoff without soundproofing is $10 less than the total payoff with soundproofing, the outcome is not socially efficient Solution to Problem #9 (5) C) Suppose Statler has the legal right to peace and quiet, and it costs $15 per month for Statler and Barton to negotiate any agreement. (Compensation for noise damage can be paid without incurring negotiation cost.) Will Barton install and maintain soundproof? Is this outcome socially efficient? As Statler’s payoff with soundproofing is $60 greater than his payoff without soundproofing, he will exercise his right to require Barton to install and maintain a soundproof Solution to Problem #9 (6) The total payoff will then be $220, which is greater than the total payoff without soundproofing ($210) Statler’s choice is thus socially efficient Barton will have no intention to negotiate with Statler on not installing the soundproof by providing Statler a compensation of $60 (Statler’s additional payoff from having a soundproof) Solution to Problem #9 (7) D) Why does the attainment of a socially efficient outcome now depend on whether Barton has the legal right to make noise? It is attributed to the presence of negotiation cost The $15 negotiation cost blocks the efficient outcome, as total amount Statler has to pay to compensate for Barton’s additional payoff with soundproofing ($65) outweigh Statler’s payoff with soundproofing ($60) However, if Statler has the legal right to peace and quiet instead, no agreement is necessary to arrive at the efficient outcome The end Thanks and Goodbye! Good luck on the final exam @^.^@