Calculated Risk

advertisement

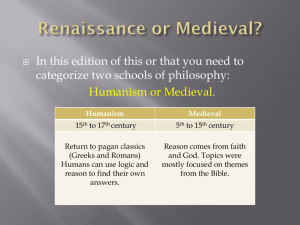

FUR XII 2006 at LUISS in Roma 12th International Conference on the Foundations and Applications of Utility, Risk and Decision Theory Insurance and Financing in Long-term Agricultural Decision Making in Transition Economies- The Case Of Croatia Njavro, Ma, Van Asseldonk, Mb. and Meuwissen, M.b a Faculty of Agriculture University of Zagreb b Institute of Risk Management in Agriculture, Wageningen University Content 1. Introduction 2. Rural Finance in Croatia Agricultural Lending Crop Insurance 3. Objectives 4. Methodology Stochastic simulation SERF Growth model 5. Risk Management Model 6. Stochastic Inputs 7. Hail insurance 8. On-farm strategy- Hail Nets 9. Leverage 10. Conclusions and Recommendations 11. References 12. Contact details 2 Introduction [1] •Market failures of agricultural risk sharing instruments, such as crop insurance and agricultural finance, in transition economies of Central and Eastern Europe hamper efficient risk management. •Apart from hail insurance, other forms of agricultural insurance products and hedging instruments are only limited available. •In combination with a constraint external fund inflow investments are often postponed thereby deteriorating farms’ competitiveness. 3 Introduction [2] •In order to improve farms’ competitiveness in the process of EU accession, policy makers’ have initiated incentive programs for investments in agriculture (so called “Operational Plans”). •Plans aim to stimulate investments in order to create a viable production sector. •Impacts are questionable in the current state of risk management markets! 4 Rural Finance in Croatia Financial sector •The financial sector in Croatia constantly grows and develops in quality and quantity terms. •Highly competitive and innovative market that has already reached EU standards. Commercial banks (mainly in foreign ownership) are the major players in the financial sector. •Their credit policies are mainly oriented to households and the share of household loans in total bank financing is 49.6%. Networks of the banks’ branches bring financial products to almost every corner of Croatia. 5 Rural Finance in Croatia- Agricultural Lending [1]- Supply side 1. Agricultural policy reform- Model of capital investment • Step ahead from classical subsidized and directed credit program. • It is aimed at encouraging the development of business relations between commercial banks and farmers. • The model can be described as the assigning of irretrievable capital (25% out of total loan) from the budget of the Republic of Croatia. 2. EU Pre- accession program- SAPARD 6 Rural Finance in Croatia- Agricultural Lending [2]- Supply side “Operational Plans” To date, two programs have been launched, one for establishing perennial crops and another for cattle production. OPERA TIONAL PLAN Purposes Repayment period Grace period Interest rates Max amount of a loan Entitled to borrow PERENNIA L CROPS Investments in establishing new plantations, buying agricultural land, mac hinery and equipment, Olive groves: 15 years including grace period (5 years) Investments in existing orchards:10 years including grace period (2 year) Other investments: 12 years including grace period (3 years) 4% 1,5 million kunas (natural persons*) 3,5 million kunas (legal persons**) Family farms, trade companies, craftsmen, cooperatives Croatian National Bank- Exchange rate on 21.06.2006. Euro: Kunas = 1: 7,254437 CA TTLE Investments in buildings, livestock, equipment and agricultural land 12 years period) (including grace 2 years 4% 3,5 million kunas Family farms, companies, craftsmen trade 7 Rural Finance in Croatia- Agricultural Lending [3]- Demand side The main constraints are: • The lack of collateral and non- functioning land market, • Unfavorable farms’ structure, • Lack of business history, • Lack of clear presentations of business ideas through business plans. 8 Rural Finance in Croatia - Crop Insurance •Agricultural insurance (crop insurance against unfavorable weather condition and livestock insurance) is undeveloped in Croatia. •Apart from hail insurance, other forms of agricultural insurance products and hedging instruments are of limited supply. •Statistics show a low uptake of crop insurance and a small land area covered by insurance. •Limited supply of agricultural insurance, but premium subsidies (introduced in 2003) positively influence supply. 9 Objectives Microeconomic analysis of risk sharing tools (insurance and financial leverage) and their effects in apple production Potential actions in risk transfer markets in the light of EU accession will be suggested. 10 Methodology [1]- Stochastic simulation The purpose of stochastic simulation in risk analysis is to determine probability distributions of consequences for alternative decisions to enable good and wellinformed choice (Hardaker et al., 2004, p.158). “Particularly useful for problems that involve risks, are dynamic and have discrete decision variables”… “Given our need to study finance, legal and human resources risks, simulation needs to be re-evaluated.” (Musser and Patrick, 2002) www.palisade.com11 Methodology [2a]- Stochastic dominance Stochastic Dominance – considers the full range of the simulated distributions. Quantitatively superior because every point is used and compared one-to-one with every point of another distribution. www.simetar.com 12 Methodology [2b]- Stochastic efficiency with respect to the function Compares alternatives in terms of certainty equivalents (CEs). Form of utility function: negative exponential Risk aversion coefficients : Richardson’s rule is based on Meyer’s constant relative risk aversion Risk aversion coefficient 1.0 0,1 0,01 0,001 0,0001 0,00001 Overall mean of random variable if overall mean of random values is 0 to 10 if overall mean of random values is 10 to 100 if overall mean of random values is 100 to 1,000.00 if overall mean of random values is 1,000.00 to 10,000.00 if overall mean of random values is 10,000.00 to 100,000.00 if overall mean of random values is > 100,000.00 13 Methodology [2c]- Risk premium • Risk Premium (RP) - calculate the risk premium between each of the scenarios and a Base scenario. • Risk Premiums equal the difference between the CE’s for the risky scenarios. RPG to F = CEG – CEF • Base scenario should be the current situation or the scenario picked best by CE or stochastic dominance Richardson, J.W. (2005) 14 Growth model Growth model (g) expresses the rate of growth of equity capital as a function of the rate-of return on assets, the interest rate on debt, the rates of taxation and consumption g = ( r Pa – i Pd) (1- t)(1- c) r = the average (stochastic) net rate of return on total assets over the investment’s expected life i = interest rates (4,5%) t= the average rate of income taxation (20%) c = the average rate of withdrawals for family consumption, dividends and other non-business flows (0%) Pa= the average ratio of assets to equity Pb= the average ratio of debt to equity, the leverage ratio σg= σr Pak k = (1-c) (1-t) (Barry et. al, 2000) 15 Risk Management Model in Apple production 16 Risk Management Model Investment in apple orchard (5 ha) ••••- “Naive” Hail insurance Hail nets Hail nets + hail insurance 17 Stochastic Inputs [1] Climate risks 1 0,8 0,6 0,4 0,2 0 0 1 3 2 4 probability of occurance frost hail Source: Croatian Hydro meteorological Institute www.meteo.hr 18 Stochastic Inputs [2] • Yields- CDF 1 0,9 0,8 Prob 0,7 0,6 0,5 0,4 0,3 0,2 0,1 0 0 10000 20000 30000 40000 50000 60000 kg/ha Yield 1st class Source: RM Model (@Risk simulation, 5000 iteration) triangular distribution based on expert advice and case study data 19 Stochastic Inputs [3] Share of the first class apples (%) under different risks 1,00 0,90 0,80 0,70 Average 0,60 5th Percentile 0,50 25th Percentile 0,40 75th Percentile 0,30 95th Percentile 0,20 0,10 0,00 hail frost hail and frost without climate risks Source: RM Model (@Risk simulation, 5000 iteration) triangular distribution based on expert advice and case study data Simetar© graphical tools 20 Stochastic Inputs [4] Prices Average Distribution @Risk funkcija Price I class-fall 4,40 Normal =RiskNormal(4.40, 0.50) Price I class-spring 5,54 Normal =RiskNormal(5.54, 0.49) Price- second class 1 Normal =RiskNormal(1, 0.25) Source: based on Market information system in Agriculture dana (weekly data) www.mps.hr/tisup 21 Hail insurance Insured sum: between 50,000.00 and 100,000.00 kunas per hectare (@RiskSimtable function) Damages- normal(50%, 20%) Deductibles 0 5 10 15 Premium rate* (quantity + quality insurance 0,19 0,15 0,11 0,09 * 5th premium class (on scale from 1 to 15) Source: Croatia osiguranje d.d., Insurance Company Premium subsidy: 25% (state level) No of combination= 24 22 Hail Nets Investment (kunas) 1 954,077.25 AREA UNDER NET (HA) 2 3 4 1,034,077.25 1,114,077.25 1,194,077.25 5 1,274,077.25 No of combination= 5 23 Selected Risk Management Strategies Descriptive statistics • Net present Value Name HailInsurance I * HailInsurance II ** HailNets 4 ha HailNets 5ha Naive Insurance (1 ha)+nets(4ha) Mean*** 246.543,94 237.053,27 480.565,84 519.974,58 250.751,41 449.988,35 Std Dev 480.184,55 478.697,33 473.588,57 472.179,26 527.479,85 470.717,64 CV 194,77 201,94 98,55 90,81 210,36 104,61 * Insured sum: 50.000,00 kunas, deductibles 15% ** Insured sum: 50.000,00 kunas, deductibles 15% *** Discount rate= 4% 24 Selected Risk Management Strategies • SERF analysis and Risk Premium Stochastic Efficiency with Respect to A Function (SERF) Under a Neg. Exponential Utility Function 800.000,00 600.000,00 400.000,00 200.000,00 0,00 -200.000,00 0 2E-06 4E-06 6E-06 8E-06 1E-05 1E-05 1E-05 2E-05 Neg. Exponential Utility Weighted Risk Premiums Relative to Naive -400.000,00 -600.000,00 600.000,00 -800.000,00 -1.000.000,00 500.000,00 -1.200.000,00 400.000,00 -1.400.000,00 ra 300.000,00 HailInsurance I HailInsurance II HailNets4 HailNets5 Naive Insurance200.000,00 (1 ha)+nets(4ha) 100.000,00 - 0 2E-06 4E-06 6E-06 8E-06 1E-05 1E-05 1E-05 2E-05 -100.000,00 ra 25 HailInsurance I HailInsurance II HailNets4 HailNets5 Naive Insurance (1 ha)+nets(4ha) Financial Leverage Scenario I II III Sources of funds External funds to 90% of total investment 30% of own capital Own capital Risk Management strategies taken in consideration: 1. hail insurance I, 2. hail net 4 ha, and 3. Insurance (1ha) + hail net (4 ha) 26 Growth model Scenario I growth rate st.dev. Scenario II growth rate st.dev. Scenario III growth rate st.dev. Naive -4,74% 0,30% -5,19% 0,39% -0,08% 0,11% Hail insurance 0,48% 1,47% 0,01% 0,21% 0,00% 0,32% Hail insurance (1ha)+ nets (4ha) 4,21% 0,18% 4,01% 0,13% 2,14% 0,05% Hailnets4 2,98% 0,15% 2,52% 0,09% 1,01% 0,03% Source: Simulation model (5000 iteration) 27 Growth Model- “Naive” PDF -50,00% -40,00% -30,00% -20,00% Scenario I -10,00% growth Scenario II 0,00% 10,00% 20,00% Scenario III Source: Simulation model (5000 iteration), Simetar© graphical tools 28 Growth Model- hail insurance PDF -4,00% -3,00% -2,00% -1,00% 0,00% 1,00% PDF 2,00% 3,00% 4,00% 5,00% -0,02000% Scenario I -0,01000% 0,00000% 0,01000% 0,02000% 0,03000% Scenario II PDF -0,002000% -0,001500% -0,001000% -0,000500% 0,000000% 0,000500% 0,001000% Scenario III Source: Simulation model (5000 iteration), Simetar© graphical tools 29 Growth Model- hail insurance (1 ha) and hail nets (4 ha) PDF -10,00% -5,00% 0,00% 5,00% 10,00% 15,00% 20,00% growth Scenario I Scenario II Scenario III Source: Simulation model (5000 iteration), Simetar© graphical tools 30 Growth Model- hail nets (4 ha) PDF -10,00% -5,00% 0,00% 5,00% 10,00% 15,00% growth Scenario I Scenario II Scenario III Source: Simulation model (5000 iteration), Simetar© graphical tools 31 Conclusions •“Naïve” strategy, the most common, represents all its weakness. •Insurance protects from shortfalls, stabilize financial indicators and liquidity. Premium subsidy made a great influence on the results. Higher subsides (>25%) enables greater coverage in terms of insured sum and lower on no deductibles. •Hail nets positively influences yields, ratio of extra quality fruits and possibility for storing which has been only indirectly considered. •In combination with insurance, hail net is dominant strategy. •The main problem with insurance is number of perils covered. Perils, like frost usually remain uncovered. Active protection against frost is possible however with additional investment and possible higher exposure to financial risk. 32 Conclusions • Sources of external financing and interest rates seem not to be a problem at the moment. Nevertheless, access to agricultural credits is still constrained. • Hail insurance stabilizes income enabling positive risk/return for borrowers and for lenders. • In order to accelerate growth, higher leverage is necessary. Results showed that efficient risk management strategies (hail insurance and hail nets) enables higher financial leverage without significant influence on farm risk position. • Outreach of agricultural credits is influenced by the collateral that borrowers can offer. A deficiency in or an absence of collateral influences use of own financial sources slowing down business development, specialization, modernization and rural development in all. • Policy makers need to have it in mind in creation in conduction EU pre-accession programs! 33 References 1. 2. 3. 4. 5. 6. 7. 8. Barry P.J., Ellinger P.N., Hopkin J.A., Baker C.B.(2000): Financial Management in Agriculture, Interstate Publishers, Inc., Danville, Illinois, USA Hardaker, J.B., Huirne, R.B., Anderson, J.R., Lien, G. (2004): Coping with risk in agriculture. CABI Publishing, London, UK. Just, R.E. i Pope, R.D. (edit.) (2002): A Comprehensive Assessment of the Role of Risk in U.S. Agriculture, Kluwer Academic Publishers, USA Palisade Corporation (2004): Guide to Using @RISK, Risk Analysis and Simulation Add-In for Microsoft® Excel, Version 4.5, USA Rejda, G.E. (2005): Principles of Risk Management and Insurance, Addison Wesley, London, UK Republic of Croatia, Ministry of Agriculture, Forestry and Water Management of the Republic of Croatia (2004). Operativni plan podizanja trajnih nasada., Zagreb, Croatia. http://www.mps.hr/pdf/publikacije/op_prog_trajni_nasadi.pdf Richardson, J.W., Schumann, K., Feldman, P. (2004): Simetar©, simulation & econometrics to analyze-Users manual. Simetar Inc. USA, p 46. van Asseldonk, M.A.P.M., Meuwissen, M.P.M., Huirne, R.B.M.(2001.): Stochastic Simulation of Catastrophic Hail and Windstorm Indemnities in the Dutch Greenhouse Sector, Risk Analysis, Vol 21. no.4, p. 761-769 34 Correspondence address Mario Njavro, PhD Faculty of Agriculture University of Zageb Svetosimunska c. 25 10000 Zagreb, Croatia tel: +385 1 23 93 762 fax: +385 1 23 93 745 mnjavro@agr.hr http://agririsk.agr.hr or http://www.agr.hr/cro/curriculum/njavro_mario.htm 35