CHAPTER 7

Cost-Volume-Profit

Analysis

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

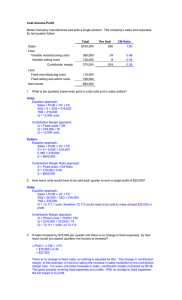

The Break-Even Point

The break-even point is the point in the volume of activity where the

organization’s revenues and expenses are equal.

Sales

$ 250,000

Less: variable expenses 150,000

Contribution margin

100,000

Less: fixed expenses

100,000

Net income

$

-

7-2

Equation Approach

Sales revenue – Variable expenses – Fixed expenses = Profit

Unit

Sales

sales × volume

price in units

Unit

Sales

variable × volume

expense in units

($500 × X) –

($300 × X)

– $80,000 = $0

($200X) – $80,000 = $0

X = 400 surf boards

7-3

Contribution-Margin Approach

Consider the following information

developed by the accountant at Curl, Inc.:

For each additional surf board sold, Curl

generates $200 in contribution margin.

Sales (500 surf boards)

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

Total

$250,000

150,000

$100,000

80,000

$ 20,000

Per Unit

$

500

300

$

200

Percent

100%

60%

40%

7-4

Contribution-Margin Approach

Fixed expenses

Break-even point

=

Unit contribution margin

(in units)

Sales (500 surf boards)

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

$80,000

$200

Total

$250,000

150,000

$100,000

80,000

$ 20,000

Per Unit

$

500

300

$

200

Percent

100%

60%

40%

= 400 surf boards

7-5

Contribution-Margin Approach

Here is the proof!

Sales (400 surf boards)

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

400 × $500 = $200,000

Total

$200,000

120,000

$ 80,000

80,000

$

-

Per Unit

$

500

300

$

200

Percent

100%

60%

40%

400 × $300 = $120,000

7-6

Contribution Margin Ratio

Calculate the break-even point in sales dollars rather than units

by using the contribution margin ratio.

Contribution margin

Sales

= CM Ratio

Fixed expense

Break-even point

=

CM Ratio

(in sales dollars)

7-7

Contribution Margin Ratio

Sales (400 surf boards)

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

$80,000

40%

=

Total

$200,000

120,000

$ 80,000

80,000

$

-

Per Unit

$

500

300

$

200

Percent

100%

60%

40%

$200,000 sales

7-8

Graphing Cost-Volume-Profit Relationships

Viewing CVP relationships in a graph gives managers a

perspective that can be obtained in no other way.

Consider the following information for Curl, Inc.:

300 units

Sales

$ 150,000

Less: variable expenses

90,000

Contribution margin

$ 60,000

Less: fixed expenses

80,000

Net income (loss)

$ (20,000)

400 units

$ 200,000

120,000

$ 80,000

80,000

$

-

500 units

$ 250,000

150,000

$ 100,000

80,000

$ 20,000

7-9

Cost-Volume-Profit Graph

450,000

400,000

350,000

Dollars

300,000

250,000

200,000

150,000

Fixed expenses

100,000

50,000

100

200

300

400

Units

500

600

700

800

7-10

Cost-Volume-Profit Graph

450,000

400,000

350,000

Dollars

300,000

250,000

200,000

150,000

Fixed expenses

100,000

50,000

100

200

300

400

Units

500

600

700

800

7-11

Cost-Volume-Profit Graph

450,000

400,000

350,000

Dollars

300,000

250,000

200,000

150,000

Fixed expenses

100,000

50,000

100

200

300

400

Units

500

600

700

800

7-12

Cost-Volume-Profit Graph

450,000

400,000

350,000

Dollars

300,000

250,000

200,000

150,000

Fixed expenses

100,000

50,000

100

200

300

400

Units

500

600

700

800

7-13

Cost-Volume-Profit Graph

450,000

400,000

350,000

Dollars

300,000

Break-even

point

250,000

200,000

150,000

Fixed expenses

100,000

50,000

100

200

300

400

Units

500

600

700

800

7-14

Profit-Volume Graph

Some managers like the profit-volume

graph because it focuses on profits and volume.

100,000

80,000

60,000

Break-even

point

Profit

40,000

20,000

0

(20,000)

`

100

200

300

400

Units

500

600

700

(40,000)

(60,000)

7-15

Target Net Profit

We can determine the number of surfboards that Curl must

sell to earn a profit of $100,000 using the contribution

margin approach.

Fixed expenses + Target profit

Unit contribution margin

$80,000 + $100,000

$200

=

Units sold to earn

the target profit

= 900 surf boards

7-16

Equation Approach

Sales revenue – Variable expenses – Fixed expenses = Profit

($500 × X) –

($300 × X) – $80,000 = $100,000

($200X) = $180,000

X = 900 surf boards

7-17

Effect of Income Taxes

Income taxes affect a company’s

CVP relationships. To earn a

particular after-tax net income, a

greater before-tax income will be

required.

Before-tax

Target after-tax net income

=

net income

1 - t

7-18

Applying CVP Analysis

Safety Margin

The difference between budgeted sales revenue and break-even

sales revenue.

The amount by which sales can drop before losses occur.

7-19

Safety Margin

Curl, Inc. has a break-even point of $200,000

in sales. If actual sales are $250,000, the safety margin is

$50,000, or 100 surf boards.

Sales

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

Break-even

sales

400 units

$ 200,000

120,000

80,000

80,000

$

-

Actual sales

500 units

$ 250,000

150,000

100,000

80,000

$

20,000

7-20

Changes in Fixed Costs

Curl is currently selling 500 surfboards per year.

The owner believes that an increase of $10,000 in the annual

advertising budget, would increase sales to 540 units.

Should the company increase the advertising budget?

7-21

Changes in Fixed Costs

Current

Sales

(500 Boards)

Sales

$

250,000

Less: variable expenses

150,000

Contribution margin

$

100,000

Less: fixed expenses

80,000

Net income

$

20,000

Proposed

Sales

(540 Boards)

$

270,000

162,000

$

108,000

90,000

$

18,000

540 units × $500 per unit = $270,000

$80,000 + $10,000 advertising = $90,000

7-22

Changes in Fixed Costs

Current

Sales will increase by

Sales

$20,000, but net income

(500 Boards)

decreased by $2,000.

Sales

$

250,000

Less: variable expenses

150,000

Contribution margin

$

100,000

Less: fixed expenses

80,000

Net income

$

20,000

Proposed

Sales

(540 Boards)

$

270,000

162,000

$

108,000

90,000

$

18,000

7-23

Changes in Unit

Contribution Margin

Because of increases in cost of raw materials, Curl’s

variable cost per unit has increased from $300 to $310

per surfboard. With no change in selling price per

unit, what will be the new break-even point?

($500 × X) –

($310 × X) – $80,000 = $0

X = 422 units (rounded)

7-24

Changes in Unit

Contribution Margin

Suppose Curl, Inc. increases the price of each surfboard to

$550. With no change in variable cost per unit, what will

be the new break-even point?

($550 × X) –

($300 × X) – $80,000 = $0

X = 320 units

7-25

Predicting Profit Given Expected Volume

Given:

Given:

Fixed expenses

Unit contribution margin

Target net profit

Fixed expenses

Unit contribution margin

Expected sales volume

Find: {req’d sales volume}

Find: {expected profit}

7-26

Predicting Profit Given

Expected Volume

In the coming year, Curl’s owner expects to sell 525

surfboards. The unit contribution margin is expected to

be $190, and fixed costs are expected to increase to

$90,000.

Total contribution

-

Fixed cost = Profit

($190 × 525) – $90,000 = X

X = $99,750 – $90,000

X = $9,750 profit

7-27

CVP Analysis with Multiple Products

For a company with more than one product, sales mix is the

relative combination in which a company’s products are

sold.

Different products have different selling prices, cost

structures, and contribution margins.

Let’s assume Curl sells surfboards and sail boards and see how we deal

with break-even analysis.

7-28

CVP Analysis with Multiple Products

Curl provides us with the following: information:

Description

Surfboards

Sailboards

Total sold

Unit

Unit

Number

Selling Variable Contribution

of

Price

Cost

Margin

Boards

$

500 $ 300 $

200

500

1,000

450

550

300

800

Number

Description of Boards

Surfboards

500

Sailboards

300

Total sold

800

% of

Total

62.5% (500 ÷ 800)

37.5% (300 ÷ 800)

100.0%

7-29

CVP Analysis with Multiple Products

Weighted-average unit contribution margin

Contribution

Weighted

Description

Margin

% of Total Contribution

Surfboards $

200

62.5% $

125.00

Sailboards

550

37.5%

206.25

Weighted-average contribution margin $

331.25

$200 × 62.5%

$550 × 37.5%

7-30

CVP Analysis with Multiple Products

Break-even point

Break-even

Fixed expenses

=

point

Weighted-average unit contribution margin

Break-even

=

point

$170,000

$331.25

Break-even

= 514 combined unit sales

point

7-31

CVP Analysis with Multiple Products

Break-even point

Break-even

point

Description

Surfboards

Sailboards

Total units

=

514 combined unit sales

Breakeven

Sales

514

514

% of

Individual

Total

Sales

62.5%

321

37.5%

193

514

7-32

CVP Relationships and the Income

Statement

A. Traditional Format

ACCUTIME COMPANY

Income Statement

For the Year Ended December 31, 20x1

Sales

Less:

Gross margin

Less: Operating expenses:

Selling expenses

Administrative expenses

Net income

$500,000

380,000

$120,000

$35,000

35,000

70,000

$50,000

7-33

CVP Relationships and the Income

Statement

B. Contribution Format

ACCUTIME COMPANY

Income Statement

For the Year Ended December 31, 20x1

Sales

Less: Variable expenses:

Variable manufacturing

Variable selling

Variable administrative

Contribution margin

Less: Fixed expenses:

Fixed manufacturing

Fixed selling

Fixed administrative

Net income

$500,000

$280,000

15,000

5,000

$100,000

20,000

30,000

300,000

$200,000

150,000

$50,000

7-34

Cost Structure and Operating Leverage

The cost structure of an organization is the relative proportion

of its fixed and variable costs.

Operating leverage is:

the extent to which an organization uses fixed costs in its cost

structure.

greatest in companies that have a high proportion of fixed costs in

relation to variable costs.

7-35

Measuring Operating Leverage

Operating leverage

factor

=

Contribution margin

Net income

Sales

Less: variable expenses

Contribution margin

Less: fixed expenses

Net income

$100,000

$20,000

Actual sales

500 Board

$ 250,000

150,000

100,000

80,000

$

20,000

= 5

7-36

Measuring Operating Leverage

A measure of how a percentage change in sales will affect profits. If

Curl increases its sales by 10%, what will be the percentage

increase in net income?

Percent increase in sales

Operating leverage factor ×

Percent increase in profits

10%

5

50%

7-37

Measuring Operating Leverage

A firm with proportionately high fixed costs has

relatively high operating leverage. On the other

hand, a firm with high operating leverage has a

relatively high break-even point.

7-38

End of Chapter 7

We made

it!

7-39