5.01 -- Apply procedures to prepare journal entries for notes payable

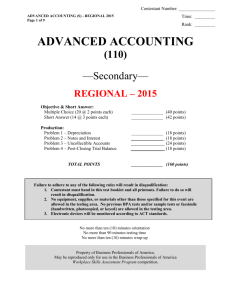

advertisement

5.01 -- Apply procedures to prepare journal entries for notes payable and notes receivable transactions. Textbook Chapters: 20 I. A promissory note is a written and signed promise to pay a sum of money on a specific date. a. Promissory notes are used when a business borrows money from a bank or other lending agency for a period of time. These are called Notes Payable. b. Businesses may request a note from a customer who wants credit beyond the usual time given for sales on account. These are called Notes Receivable. c. Notes can be useful in a court of law as written evidence of a debt. d. The time of a note issued for less than one year is usually stated in days. The time used in calculating interest is usually stated as a fraction of 360 days. e. The time between the date a note is signed and the date a note is due (maturity date) is typically expressed in days. The maturity date is calculated by counting the exact number of days. The date on which the note is written is not counted, but the maturity date is counted. II. Calculating Interest, Maturity Date, and Maturity Value on a Note a. Interest = Principal X Interest Rate X Time in Years b. Maturity Date --Example: 90-day Note, signed May 18, Maturity Date is August 16 i. Calculate the number of days remaining in May (13) by subtracting the date of the note (18) from the number of days in May (31): 31 – 18 = 13. ii. Calculate the number of days remaining in the term of the note (77) by subtracting the number of days in the previous month (13) from the term of the note (90). Because 77 is greater than the number of days in June (30), add all of the days in June (30). iii. Calculate the number of days remaining in the term of the note (47) by subtracting the number of days in the previous months, 43 (13+30), from the term of the note, 90. Because 43 is greater than the number of days in July (31), add all of the days in July (31). iv. Calculate the number of days remaining in the term of the note (16) by subtracting the number of days in the previous months, 74 (13+30+31), from the term of the note, 90: 90 – 74 = 16. Because 16 is less than the number of days in August (31), add only 16 days in August. The Maturity Date is August 16. c. Maturity Value = Principal + Interest III. Procedures for Journalizing Notes Payable Transactions a. Issuance of a note payable i. Write the date in the Date column of the Cash Receipts Journal. ii. Write the receipt number in the Doc. No. column. iii. Debit Cash for the principal amount of the note. iv. Credit Notes Payable for the principal amount of the note. b. Payment of principal and interest on a note payable i. Write the date in the Date column of the Cash Payments Journal. ii. Write the check number in the Doc. No. column. iii. Debit Notes Payable for the principal amount of the note. iv. Debit Interest Expense for the amount of the interest paid. v. Credit Cash for the total amount paid (maturity value of the note). c. A note payable issued for an extension of time i. Write the date in the Date column of the General Journal. ii. Debit Accounts Payable (referencing the appropriate vendor account) for the principal amount of the note. iii. Credit Notes Payable for the principal amount of the note. d. Payment on a note payable for an extension of time i. Write the date in the Date column of the Cash Payments Journal. ii. Write the check number in the Doc. No. column. iii. Debit Notes Payable for the principal amount of the note. iv. Debit Interest Expense for the interest paid. v. Credit Cash for the total amount paid. IV. Procedures for Journalizing Notes Receivable Transactions a. Acceptance of a note receivable from a customer i. Write the date in the Date column of the General Journal. ii. Write the note number in the Doc. No. column. iii. Debit Notes Receivable for the principal amount of the note. iv. Credit Accounts Receivable (referencing the appropriate customer) for the principal amount of the note. b. Collection of principal and interest on a note receivable i. Write the date in the Date column of the Cash Receipts Journal. ii. Write the receipt number in the Doc. No. column. iii. Debit Cash for the total amount received (maturity value of the note receivable). iv. Credit Interest Income for the amount of the interest received. v. Credit Notes Receivable for the principal amount of the note. c. A dishonored note receivable i. Write the date in the Date column of the General Journal. ii. Debit Accounts Receivable (referencing the appropriate customer account) for the total amount of the note, including interest due. iii. Credit Notes Receivable for the principal amount of the note. iv. Credit Interest Income for the interest due on the note. KEY TERMS Promissory note Creditor Note payable Principal (face value Term (time Issue date Payee Maturity date Maker Maturity value Current liabilities Long-term liabilities Interest-bearing note Non-interest-bearing note Bank discount Proceeds Interest Expense Note receivable Interest income Dishonored note 5.01 Sample Questions 1. Carson's Shoe Store signed a 90-day, interest-bearing, 10% note for $5,000.00 with First National Bank. What is Carson's Shoe Store's journal entry for the issuance of the note payable? A. Debit Cash $5,500.00; credit Notes Payable $5,500.00 B. Debit Cash $5,000.00; credit Notes Payable $5,000.00 C. Debit Notes Payable $5,000.00; credit Cash $5,000.00 D. Debit Notes Payable $5,500.00; credit Cash $5,500.00 2. Master Marketing received a payment of a note receivable in the amount of $1,295.00. Interest on the note receivable was $95.00. What is the journal entry to record the payment of the note receivable? A. Debit Cash $1,295.00; Credit Interest Income $95.00; Credit Notes Receivable $1,200.00 B. Debit Cash $1,295.00; Credit Accounts Receivable $1,295.00 C. Debit Accounts Receivable $1,295.00; Credit Cash $1,295.00 D. Debit Cash $1,200.00; Debit Interest Expense $95.00; Credit Accounts Receivable $1,295.00 3. Blowing Rock Hardware paid First American Bank in full for a 180-day, 12%, interest-bearing note for $10,000. Using a 360day year, what is the journal entry for the payment of the note payable? A. Debit Cash $10,600.00; credit Notes Payable $10,600.00 B. Debit Cash $10,600.00; credit Notes Payable $10,000.00; credit Interest Expense $600.00 C. Debit Notes Payable $10,600.00; credit Interest Expense $600.00; credit Cash $10,000.00 D. Debit Notes Payable $10,000.00; debit Interest Expense $600.00; credit Cash $10,600.00 4. Wholesome Food Distributors granted an extension of time for the account payable of Moore Food Store for a 90-day, 8%, $10,000 note. Using a 360-day year, what is the journal entry for Moore Food Store to record the payment of the note payable? A. Debit Cash $10,000.00; credit Notes Payable $10,000.00 B. Debit Notes Payable $10,000.00; debit Interest Expense $200.00; credit Cash $10,200.00 C. Debit Cash $10,200.00; credit Notes Payable $10,000.00; credit Interest Expense $200.00 D. Debit Notes Payable $10,200.00; credit Interest Expense $200.00; credit Cash $10,000.00 5. Tucker's Cafe signed a $15,000, 180day, 10%, interest-bearing note on May 1, 2009. Using a 360-day year, what is the maturity value of the note? A. $15,750.00 B. $16,040.00 C. D. $16,500.00 $16,750.00 6. Carson's Candy Shoppe signed a 60day, 10% note to Jello Beans for an extension of time on its account payable in the amount of $2,000.00. What is the correct entry for Carson's Candy Shoppe to record the note payable for an extension of time? A. Debit Notes Payable $2,000.00; credit Accounts Payable/Jello Beans $2,000.00 B. Debit Notes Payable $2,033.33; credit Accounts Payable/Jello Beans $2,033.33 C. Debit Accounts Payable/Jello Beans $2,033.33; Credit Notes Payable $2,033.33 D. Debit Accounts Payable/Jello Beans $2,000.00; credit Notes Payable $2,000.00 Please use the following situation for this question. Scenario 5.01 C Master Marketing signed a $40,000, 90-day note at 6% on June 1, 2009. Master Marketing uses a 360-day year. 7. Using the information given in Scenario 5.01 C, what is the total amount of interest to be paid on this note? A. $400.00 B. $581.78 C. $600.00 D. $2,400.00 8. Carson Tyler has an overdue account in the amount of $415.50 with Mountain Oil Company. Mountain Oil Company agrees to accept a note receivable from Carson. What is the journal entry to record the acceptance of the note receivable? A. Debit Cash $415.50; credit Accounts Receivable/Carson Tyler $415.50 B. Debit Accounts Receivable/Carson Tyler $415.50; credit Notes Receivable $415.50 C. Debit Notes Receivable $415.50; credit Accounts Receivable/Carson Tyler $415.50 D. Debit Accounts Receivable/Carson Tyler $415.50; credit Cash $415.50 9. Carson's Candy Shoppe signed a 60day, 10% note to Jello Beans for an extension of time on its account payable in the amount of $2,000.00. What is the correct entry for Carson's Candy Shoppe to record the note payable for an extension of time? A. Debit Notes Payable $2,000.00; credit Accounts Payable/Jello Beans $2,000.00 B. Debit Notes Payable $2,033.33; credit Accounts Payable/Jello Beans $2,033.33 C. Debit Accounts Payable/Jello Beans $2,033.33; credit Notes Payable $2,033.33 D. Debit Accounts Payable/Jello Beans $2,000.00; credit Notes Payable $2,000.00 Please use the following situation for this question. Scenario 5.01 B Grandfather Tours signed a $12,000, 180-day note at 9% on March 1, 2009. Grandfather Tours uses a 360-day year. 10. Using the information given in Scenario 5.01 B, what is the total amount of interest to be paid on this note? A. $ 108.00 B. $ 535.60 C. $ 540.00 D. $1,080.00 11. Beach Bums Surf Shop signed a 90day, 5%, interest-bearing note for $3,000.00 with First National Bank. What is the journal entry for the issuance of the note payable? A. Debit Cash $3,037.50; credit Notes Payable $3,037.50 B. Debit Cash $3,000.00; credit Notes Payable $3,000.00 C. Debit Notes Payable $3,000.00; credit Cash $3,000.00 D. Debit Notes Payable $3,150.00; credit Cash $3,150.00 12. Sneakers Snack Shop signed a $30,000, 90-day, 8%, interest-bearing note on August 1, 2009. Using a 360-day year, what is the maturity value of the note? A. $30,400.00 B. $30,592.00 C. $30,600.00 D. $32,400.00 13. Sports Warehouse received a payment in the amount of $697.50 for a note receivable. Interest on the note receivable was $47.50. What is the journal entry to record the payment of the note receivable? A. Debit Cash $697.50; Credit Accounts Receivable $697.50 B. Debit Accounts Receivable $697.50; Credit Cash $697.50 C. Debit Cash $697.50; Credit Interest Income $47.50; Credit Notes Receivable $650.00 D. Debit Cash $650.00; Debit Interest Expense $47.50; Credit Accounts Receivable $697.50 14. Marty Smith dishonored a 180-day, 5% note for $5,000.00. What is the journal entry to record the dishonored note receivable? A. Debit Notes Receivable $5,125.00; debit Interest Expense $125.00; credit Accounts Receivable/Marty Smith $5,125.00. B. Debit Accounts Receivable/Marty Smith $5,000.00; credit Notes Receivable $5,000.00 C. Debit Accounts Receivable/Marty Smith $5,125.00; credit Interest Income $125.00; credit Notes Receivable $5,000.00 D. Debit Notes Receivable $5,125.00; credit Accounts Receivable/Marty Smith $5,125.00 Please use the following situation for this question. Scenario 5.01 C Master Marketing signed a $40,000, 90-day note at 6% on June 1, 2009. Master Marketing uses a 360-day year. 15. Using the information given in Scenario 5.01 C, what is the maturity date of the note payable? A. September 1, 2009 B. August 30, 2009 C. August 29, 2009 D. August 28, 2009 5.02 -- Apply procedures to prepare journal entries for uncollectible accounts transactions. Textbook Chapters: 17 I. II. III. IV. V. VI. VII. Uncollectible Accounts a. Uncollectible accounts are accounts receivable that cannot be collected. b. The adjustment for uncollectible accounts expense is recorded as an adjusting entry in the general journal. Writing Off an Uncollectible Account Using the Direct Write-Off Method a. The direct write-off method is used primarily by small businesses and those with few charge customers. b. When the business determines that the amount owed by an individual customer is not going to be paid, that uncollectible account is removed from the accounting records. c. The direct write-off method is the only method a business can use for income tax purposes. Estimating and Recording Uncollectible Accounts Expense Using the Allowance Method a. The allowance method of recording losses from uncollectible accounts attempts to record the expense of uncollectible accounts in the same fiscal year as the related sales are recorded. b. An estimate of the uncollectible accounts is recorded to the contra asset account Allowance for Uncollectible Accounts and the expense account Uncollectible Accounts Expense (Bad Debts Expense). c. Estimate uncollectible accounts expense by calculating a percentage of total sales on account. d. The allowance method of estimating uncollectible accounts expense (percentage of total sales on account) assumes that a portion of every dollar of sales on account will become uncollectible. e. At the end of a fiscal period, an adjustment for uncollectible accounts expense is planned on a worksheet. This adjustment is recorded on the worksheet as an adjusting entry. Collecting Uncollectible Accounts Receivable a. Occasionally, after an account is written off, the customer pays the delinquent account. Several accounts must be changed to recognize payment of a written-off account receivable. b. Two entries are recorded for the collection of a written-off account receivable. Procedure for Journalizing Uncollectible Accounts Receivable Using the Direct Write-Off Method a. Debit Uncollectible Accounts Expense. b. Credit Accounts Receivable/Customer’s account. Procedure for Estimating Uncollectible Accounts Expense and Journalizing the Adjusting Entry Using the Allowance Method a. Total sales X Percentage of sales expected to be uncollectible = Uncollectible Accounts Expense b. Adjustment for uncollectible accounts expense i. Debit Uncollectible Accounts Expense. ii. Credit Allowance for Uncollectible Accounts. Procedure for Journalizing the Collection of Uncollectible Accounts Receivable a. Re-open an account receivable previously written off i. Debit Accounts Receivable/Customer’s account. ii. Credit Allowance for Uncollectible Accounts. b. Record cash received for an account previously written off i. Debit Cash. ii. Credit Accounts Receivable/Customer’s account. KEY TERMS Uncollectible account Writing off an account Allowance for Uncollectible Accounts Uncollectible Accounts Expense Direct write-off method Allowance method Book value of accounts receivable Percentage of net sales Aging of accounts 5.02 Sample Questions 1. Hair Design Supply Company estimates uncollectible accounts expense by calculating a percentage of total sales on account. Total sales on account for the year are $1,200,000.00. In the past, actual uncollectible accounts expense has been about 2.0% of total sales on account. What is the estimated uncollectible accounts expense for the year? A. $24.00 B. $240.00 C. $2,400.00 D. $24,000.00 2. On Your Mark Writing Supplies estimates uncollectible accounts expense by calculating a percentage of total sales on account. Total sales on account for the year are $175,000.00. In the past, actual uncollectible accounts expense has been about 1.0% of total sales on account. What is the estimated uncollectible accounts expense for the year? A. $17.50 B. $175.00 C. $1,750.00 D. $17,500.00 3. Pet Food Wholesale estimates uncollectible accounts expense by calculating a percentage of total sales on account. Total sales on account for the year are $750,000.00. In the past, actual uncollectible accounts expense has been about 1.0% of total sales on account. What is the estimated uncollectible accounts expense for the year? A. $75.00 B. C. D. $750.00 $7,500.00 $75,000.00 4. Western Textile Company estimates uncollectible accounts expense by calculating a percentage of total sales on account. Total sales on account for the year are $5,275,000.00. In the past, actual uncollectible accounts expense has been about 1.0% of total sales on account. What is the estimated uncollectible accounts expense for the year? A. $52.75 B. $527.50 C. $5,275.00 D. $52,750.00 5. On Your Mark Writing Supplies received a check for $225.00 from Pen & Paper, whose account was previously written off. On Your Mark Writing Supplies uses the Allowance Method for uncollectible accounts. What is the correct entry to re-open the account for Pen & Paper? A. Debit Accounts Receivable/ Pen & Paper, $225.00; Credit Allowance for Uncollectible Accounts, $225.00 B. Debit Accounts Receivable/ Pen & Paper, $225.00; Credit Uncollectible Accounts Expense, $225.00 C. Debit Uncollectible Accounts Expense, $225.00; Credit Accounts Receivable/ Pen & Paper, $225.00 D. Debit Uncollectible Accounts Expense, $225.00; Credit Allowance for Uncollectible Accounts, $225.00 6. Steve's Auto Shop uses the direct writeoff method when handling uncollectible accounts receivable. John Taylor owes $375.00 on account. Steve's Auto Shop determined this account to be uncollectible. Which is the correct entry for writing off this account? A. Debit Accounts Receivable/John Taylor, $375.00; Credit Uncollectible Accounts Expense, $375.00 B. Debit Accounts Receivable/John Taylor, $375.00; Credit Allowance for Uncollectible Accounts, $375.00 C. Debit Uncollectible Accounts Expense, $375.00; Credit Accounts Receivable/John Taylor, $375.00 D. Debit Uncollectible Accounts Expense, $375.00; Credit Allowance for Uncollectible Accounts, $375.00 7. Legal Eagles Law Firm uses the direct write-off method when handling uncollectible accounts receivable. Joe Coffey owes $250.00 on account. Legal Eagles Law Firm determined this account to be uncollectible. Which is the correct entry for writing off this account? A. Debit Accounts Receivable/Joe Coffey, $250.00; Credit Allowance for Uncollectible Accounts, $250.00 B. Debit Accounts Receivable/Joe Coffey, $250.00; Credit Uncollectible Accounts Expense, $250.00 C. Debit Uncollectible Accounts Expense, $250.00; Credit Accounts Receivable/Joe Coffey, $250.00 D. Debit Uncollectible Accounts Expense, $250.00; Credit Allowance for Uncollectible Accounts, $250.00 8. Kitchen Supply Warehouse uses the direct write-off method when handling uncollectible accounts receivable. Coffey's Diner owes $450.00 on account. Kitchen Supply Warehouse determined this account to be uncollectible. Which is the correct entry for writing off this account? A. Debit Accounts Receivable/Coffey's Diner, $450.00; credit Allowance for Uncollectible Accounts, $450.00 B. Debit Accounts Receivable/Coffey's Diner, $450.00; credit Uncollectible Accounts Expense, $450.00 C. Debit Uncollectible Accounts Expense, $450.00; credit Accounts Receivable/Coffey's Diner, $450.00 D. Debit Uncollectible Accounts Expense, $450.00; credit Allowance for Uncollectible Accounts, $450.00 9. Workman Tools estimates its uncollectible accounts expense for the year to be $950.00. What is the correct entry to record the estimated uncollectible accounts expense? A. Debit Uncollectible Accounts Expense, $950.00; credit Accounts Receivable, $950.00 B. Debit Uncollectible Accounts Expense, $950.00; credit Allowance for Uncollectible Accounts, $950.00 C. Debit Accounts Receivable, $950.00; credit Uncollectible Accounts Expense, $950.00 D. Debit Allowance for Uncollectible Accounts, $950.00; credit Uncollectible Accounts Expense, $950.00 10. Hair Design Supply estimates its uncollectible accounts expense for the year to be $4,250.00. What is the correct entry to record the estimated uncollectible accounts expense? A. Debit Uncollectible Accounts Expense, $4,250.00; credit Accounts Receivable, $4,250.00 B. Debit Uncollectible Accounts Expense, $4,250.00; credit Allowance for Uncollectible Accounts, $4,250.00 C. Debit Accounts Receivable, $4,250.00; credit Uncollectible Accounts Expense, $4,250.00 D. Debit Allowance for Uncollectible Accounts, $4,250.00; credit Uncollectible Accounts Expense, $4,250.00 11. Mary Ann's Sewing Notions received a check for $75.00 from Cathy Martin, whose account was previously written off. Mary Ann's Sewing Notions uses the Allowance Method for uncollectible accounts. What is the correct entry to re-open the account for Cathy Martin? A. Debit Accounts Receivable/Cathy Martin, $75.00; credit Allowance for Uncollectible Accounts, $75.00 B. Debit Accounts Receivable/Cathy Martin, $75.00; credit Uncollectible Accounts Expense, $75.00 C. Debit Uncollectible Accounts Expense, $75.00; credit Accounts Receivable/Cathy Martin, $75.00 D. Debit Uncollectible Accounts Expense, $75.00; credit Allowance for Uncollectible Accounts, $75.00 12. Mother Goose Children's Clothing received a check for $125.00 from Little Angels, whose account was previously written off. Mother Goose Children's Clothing uses the Allowance Method for uncollectible accounts. What is the correct entry to re-open the account for Little Angels? A. Debit Accounts Receivable/Little Angels, $125.00; credit Allowance for Uncollectible Accounts, $125.00 B. Debit Accounts Receivable/Little Angels, $125.00; credit Uncollectible Accounts Expense, $125.00 C. Debit Uncollectible Accounts Expense, $125.00; Credit Accounts Receivable/Little Angels, $125.00 D. Debit Uncollectible Accounts Expense, $125.00; credit Allowance for Uncollectible Accounts, $125.00 13. Mitchell Building Supplies uses the direct write-off method when handling uncollectible accounts receivable. Lark Construction owes $1,200.00 on account. Mitchell Building Supplies determined this account to be uncollectible. Which is the correct entry for writing off this account? A. Debit Accounts Receivable/Lark Construction, $1,200.00; credit Allowance for Uncollectible Accounts, $1,200.00 B. Debit Accounts Receivable/Lark Construction, $1,200.00; credit Uncollectible Accounts Expense, $1,200.00 C. Debit Uncollectible Accounts Expense, $1,200.00; credit Accounts Receivable/Lark Construction, $1,200.00 D. Debit Uncollectible Accounts Expense, $1,2000.00; credit Allowance for Uncollectible Accounts, $1,200.00 14. Kitchen Supply Warehouse uses the direct write-off method when handling uncollectible accounts receivable. Coffey's Diner owes $450.00 on account. Kitchen Supply Warehouse determined this account to be uncollectible. Which is the correct entry for writing off this account? A. Debit Accounts Receivable/Coffey's Diner, $450.00; credit Allowance for Uncollectible Accounts, $450.00 B. Debit Accounts Receivable/Coffey's Diner, $450.00; credit Uncollectible Accounts Expense, $450.00 C. Debit Uncollectible Accounts Expense, $450.00; credit Accounts Receivable/Coffey's Diner, $450.00 D. Debit Uncollectible Accounts Expense, $450.00; credit Allowance for Uncollectible Accounts, $450.00 15. Maple Tree Candy Factory estimates uncollectible accounts expense by calculating a percentage of total sales on account. Total sales on account for the year are $185,000.00. In the past, actual uncollectible accounts expense has been about 0.5% of total sales on account. What is the estimated uncollectible accounts expense for the year? A. $9.25 B. $92.50 C. $925.00 D. $9,250.00 16. Pet Food Wholesale estimates its uncollectible accounts expense for the year to be $1,500.00. What is the correct entry to record the estimated uncollectible accounts expense? A. Debit Uncollectible Accounts Expense, $1,500.00; credit Accounts Receivable, $1,500.00 B. Debit Uncollectible Accounts Expense, $1,500.00; credit Allowance for Uncollectible Accounts, $1,500.00 C. Debit Accounts Receivable, $1,500.00; credit Uncollectible Accounts Expense, $1,500.00 D. Debit Allowance for Uncollectible Accounts, $1,500.00; credit Uncollectible Accounts Expense, $1,500.00 17. Maple Tree Candy Factory estimates its uncollectible accounts expense for the year to be $800.00. What is the correct entry to record the estimated uncollectible accounts expense? A. Debit Uncollectible Accounts Expense, $800.00; credit Accounts Receivable, $800.00 B. Debit Uncollectible Accounts Expense, $800.00; credit Allowance for Uncollectible Accounts, $800.00 C. Debit Accounts Receivable, $800.00; credit Uncollectible Accounts Expense, $800.00 D. Debit Allowance for Uncollectible Accounts, $800.00; credit Uncollectible Accounts Expense, $800.00 18. Mary Ann's Sewing Notions received a check for $75.00 from Cathy Martin, whose account was previously written off. Mary Ann's Sewing Notions uses the Allowance Method for uncollectible accounts. What is the correct entry to re-open the account for Cathy Martin? A. Debit Accounts Receivable/Cathy Martin, $75.00; credit Allowance for Uncollectible Accounts, $75.00 B. Debit Accounts Receivable/Cathy Martin, $75.00; credit Uncollectible Accounts Expense, $75.00 C. Debit Uncollectible Accounts Expense, $75.00; credit Accounts Receivable/Cathy Martin, $75.00 D. Debit Uncollectible Accounts Expense, $75.00; credit Allowance for Uncollectible Accounts, $75.00 5.03 -- Apply procedures to prepare journal entries for straight-line depreciation of plant assets transactions. Textbook Chapters: 18 I. II. III. IV. Plant Assets a. Assets that will be used for a number of years in the operation of a business are known as plant assets. b. A business may have several types of plant assets including equipment, buildings, and land. c. Most plant assets are useful for only a limited period of time. The cost of a plant asset should be depreciated over its useful life. d. Plant assets may continue to be used after their estimated useful lives have ended; however, no additional depreciation is recorded. Straight-Line Depreciation a. Generally Accepted Accounting Principles require that the cost of a plant asset be expensed over the plant asset’s useful life. b. The annual expense is recorded in Depreciation Expense and the contra-asset account Accumulated Depreciation. c. Straight-line depreciation is the easiest and most widely used method of depreciation. d. To calculate straight-line depreciation, a business must know the cost of the plant asset, the estimated salvage (disposal) value, and the estimated useful life. e. The straight-line method of depreciation charges an equal amount of depreciation expense in each full year in which the asset is used. Depreciation Expense a. A month is the smallest unit of time used to calculate depreciation. b. A plant asset may be placed in service at a date other than the first day of a fiscal period. c. A partial year’s depreciation may also be recorded in the year the plant asset is sold or disposed of. Accumulated Depreciation and Book Value a. Depreciation is not recorded as a reduction of the plant asset account. i. The amount of the depreciation of a plant asset’s useful life is known as accumulated depreciation. b. Plant Asset Records i. A separate record is kept for each plant asset. An accounting form on which a business records information about each plant asset is called a plant asset record. ii. Plant asset records may vary in arrangement for different businesses, but most records contain similar information. iii. Plant asset records include annual depreciation expense amounts, accumulated depreciation, and ending book value. Plant asset records may also include information regarding the disposal of the asset. c. Book Value i. The original cost of a plant asset minus accumulated depreciation is known as the book value of a plant asset. ii. The ending book value for one year becomes the beginning book value for the next year. d. Journalizing and Posting Depreciation Expense i. The adjustment for Depreciation Expense is recorded in the Adjustments column of the worksheet. V. VI. VII. VIII. ii. The adjustment is also entered as an adjusting entry in the General Journal. iii. The adjusting entry is then posted to the general ledger. Procedure for Calculating Straight-Line Depreciation a. Subtract the asset’s estimated salvage (disposal) value from the asset’s original cost. The difference is the estimated total depreciation expense for the asset’s entire useful life. b. Est. Total Deprec. Expense = Original Cost – Est. Salvage Value c. Divide the estimated total depreciation expense by the years of estimated useful life. The result is the estimated annual depreciation expense. d. Est. Annual Deprec. Expense = Est. Total Deprec. Exp. ÷ Years of Useful Life Procedure for Calculating Depreciation Expense for Part of a Year a. Divide the annual depreciation expense by 12, the number of months in a year. The result is the monthly depreciation expense. b. Monthly Depreciation Expense = Annual Depreciation Expense ÷ 12 c. Multiply the monthly depreciation expense by the number of months the plant asset is used in a year. The result is the partial year’s depreciation expense. d. Partial Deprec. Exp. = Monthly Deprec. Exp. X Months Asset Used Procedure for Calculating Accumulated Depreciation and Book Value a. The accumulated depreciation of a plant asset is calculated by adding the depreciation expense for the current year to the prior year’s accumulated depreciation. b. Accum. Deprec. = Prior Year Accum. Deprec. + Current Year Deprec. Exp. c. The book value is calculated by subtracting the accumulated depreciation from the original cost of the plant asset. d. Book Value = Original Cost of Plant Asset – Accumulated Depreciation e. The book value can also be calculated by subtracting the year’s depreciation from that year’s beginning book value. f. Book Value = Year's Beginning Book Value – Year's Depreciation Procedure for Journalizing and Posting Annual Depreciation Expense a. Recording on the worksheet i. Debit Depreciation Expense for the total annual depreciation expense amount. ii. Credit Accumulated Depreciation for the total annual depreciation expense amount. b. Journalizing in the General Journal i. Write the date in the Date column of the General Journal. ii. Debit Depreciation Expense for the total annual depreciation expense amount. iii. Credit Accumulated Depreciation for the total annual depreciation expense amount. c. Posting to the General Ledger i. Post the debit to Depreciation Expense. ii. Post the credit to Accumulated Depreciation. KEY TERMS Plant asset Depreciation expense Straight-line method of depreciation Estimated salvage value (estimated disposal value) Estimated useful life Plant asset record Declining balance method of depreciation 5.03 Sample Questions 1. Mountain Business Services purchased a computer on January 1, 2009 for $3,600.00. The estimated salvage (disposal) value is $200.00 and the estimated useful life is 5 years. What is the annual depreciation expense? A. $200.00 B. $360.00 C. $680.00 D. $720.00 2. Burger Boy Diner purchased a commercial oven on January 1, 2009 for $5,800.00. The estimated salvage (disposal) value is $200.00 and the estimated useful life is 7 years. What is the annual straight-line depreciation expense? A. $200.00 B. $400.00 C. $800.00 D. $828.50 3. Joe's Taxi Service purchased a new taxi on January 1, 2010 for $22,000.00. The estimated salvage (disposal) value is $1,000.00 and the estimated useful life is 3 years. What is the annual depreciation expense? A. $7,333.33 B. $7,000.00 C. $3,500.00 D. $1,000.00 4. Creative Art Supplies purchased a new display easel on January 1, 2010 for $850.00. The estimated salvage (disposal) value is $50.00 and the estimated useful life is 5 years. What is the annual depreciation expense? A. $850.00 B. $170.00 C. $160.00 D. $50.00 5. Burger Boy Diner purchased a commercial oven on August 1, 2010 for $6,800.00. The estimated salvage (disposal) value is $500.00 and the estimated useful life is 7 years. What is the depreciation expense for 2010? A. $375.00 B. $485.00 C. $525.00 D. $900.00 6. Joe's Taxi Service purchased a new taxi on March 1, 2010 for $24,000.00. The estimated salvage (disposal) value is $3,000.00 and the estimated useful life is 3 years. What is the depreciation expense for 2010? A. $7,000.00 B. $5,833.33 C. $2,857.14 D. $1,166.67 7. NC Office Supply purchased a heating system on September 1, 2010 for $18,500.00. The estimated salvage (disposal) value is $500.00 and the estimated useful life is 10 years. What is the depreciation expense for 2010? A. $1,800.00 B. $1,200.00 C. $616.67 D. $600.00 8. Steve's Auto Parts purchased a display case on January 1, 2009 for $3,400.00. The estimated salvage (disposal) value is $200.00 and the estimated useful life is 10 years. What is the accumulated straight-line depreciation at the end of 2011? A. $320.00 B. $640.00 C. $680.00 D. $960.00 9. Joe's Taxi Service purchased a new taxi on March 1, 2009 for $24,000.00. The estimated salvage (disposal) value is $3,000.00 and the estimated useful life is 3 years. What is the accumulated depreciation at the end of 2011? A. $7,000.00 B. $19,833.33 C. $21,000.00 D. $24,000.00 10. NC Office Supply purchased a heating system on September 1, 2009 for $18,500.00. The estimated salvage (disposal) value is $500.00 and the estimated useful life is 10 years. What is the accumulated depreciation at the end of 2011? A. $1,800.00 B. $2,400.00 C. $4,200.00 D. $5,400.00 11. Creative Art Supplies purchased a delivery van on March 1, 2009 for $12,500.00. The estimated salvage (disposal) value is $500.00 and the estimated useful life is 10 years. What is the accumulated depreciation at the end of 2011? A. $1,200.00 B. $2,400.00 C. $3,400.00 D. $3,600.00 12. Steve's Auto Repair has depreciation expense of $3,500.00 at the end of the fiscal year. What is the entry to journalize the depreciation expense? A. Debit Accumulated Depreciation $3,500.00; Credit Depreciation Expense $3,500.00 B. Debit Depreciation Expense $3,500.00; Credit Accumulated Depreciation $3,500.00 C. Debit Depreciation Expense $3,500.00; Credit Equipment $3,500.00 D. Debit Equipment $3,500.00; Credit Accumulated Depreciation $3,500.00 13. Joe's Taxi Service has depreciation expense of $12,200.00 at the end of the fiscal year. What is the entry to journalize the depreciation expense? A. Debit Equipment $12,200.00; credit Accumulated Depreciation $12,200.00 B. Debit Depreciation Expense $12,200.00; credit Equipment $12,200.00 C. Debit Depreciation Expense $12,200.00; credit Accumulated Depreciation $12,200.00 D. Debit Accumulated Depreciation $12,200.00; credit Depreciation Expense $12,200.00 14. Michael's Soda Shoppe has depreciation expense of $1,250.00 at the end of the fiscal year. What is the entry to journalize the depreciation expense? A. Debit Equipment $1,250.00; credit Accumulated Depreciation $1,250.00 B. Debit Depreciation Expense $1,250.00; credit Equipment $1,250.00 C. Debit Depreciation Expense $1,250.00; credit Accumulated Depreciation $1,250.00 D. Debit Accumulated Depreciation $1,250.00; credit Depreciation Expense $1,250.00 15. NC Office Supply has depreciation expense of $7,525.00 at the end of the fiscal year. What is the entry to journalize the depreciation expense? A. Debit Equipment $7,525.00; credit Accumulated Depreciation $7,525.00 B. Debit Depreciation Expense $7,525.00; credit Equipment $7,525.00 C. Debit Depreciation Expense $7,525.00; credit Accumulated Depreciation $7,525.00 D. Debit Accumulated Depreciation $7,525.00; credit Depreciation Expense $7,525.00 16. Creative Art Supplies has depreciation expense of $950.00 at the end of the fiscal year. What is the entry to journalize the depreciation expense? A. Debit Accumulated Depreciation $950.00; credit Depreciation Expense $950.00 B. Debit Depreciation Expense $950.00; credit Accumulated Depreciation $950.00 C. Debit Depreciation Expense $950.00; credit Equipment $950.00 D. Debit Equipment $950.00; credit Accumulated Depreciation $950.00 5.01 1. B 2. A 3. D 4. B 5. A 6. D 7. C 8. C 9. D 10. C 11. B 12. C 13. C 14. C 15. B 5.00 Sample Questions Answer Key 5.02 5.03 1. D 2. C 3. C 4. D 5. A 6. C 7. C 8. C 9. B 10. B 11. A 12. A 13. C 14. C 15. C 16. B 17. B 18. A 1. C 2. C 3. B 4. C 5. A 6. B 7. D 8. D 9. B 10. C 11. C 12. B 13. C 14. C 15. C 16. B