Appraisal Value and Embedded Value

advertisement

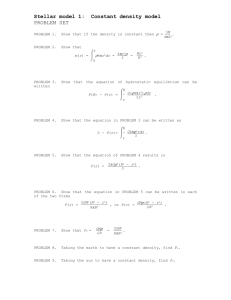

An Introduction to Embedded Value Peter Erlandsen, CFO, Manulife Rio Winardi, Chief Actuary, Astra CMG Simon, Chief Accountant, Panin life Date: 8 December, 2005 AGENDA I. II. III. IV. V. VI. VII. 2 Why Calculate Embedded Value? What is Embedded Value? Net Worth Value of In-Force Value of new business Other Issues Question & Answer I. Why Calculate Embedded Value An Introduction • Embedded Value Estimates Value. • Quiz 1 - What Does Profit Measure? • • Quiz 2 – Why is Profit not a measure of Value? • • • Profit is a measure of this year’s results Value is a measure of long-term worth Quiz 3 – Why doesn’t value = profit * P/E ratio? • 3 Income less Outgo New Business Strain “Typical” Profit Signature 6 4 Shareholder Profit 2 0 -2 -4 -6 -8 -10 -12 -14 1 2 3 4 5 6 Year 4 7 8 9 10 “Typical” Projection Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8 Yr 9 Yr 10 Premium Invest E 500 47 450 53 405 105 364 156 328 166 295 254 265 302 239 349 215 397 194 442 Initial Exp Ren Exp Death Surrender Inc Res 258 75 250 47 47 68 235 92 98 61 221 135 78 55 208 176 62 49 195 216 9 44 183 255 37 40 172 293 28 36 162 330 20 32 152 367 16 29 143 403 11 -130 10 15 20 25 30 35 40 45 50 Profit 5 1. The loss in the first year is often called New business Strain. 2. Over the life of the policy we expect PV profit to be positive. What’s wrong with Statutory Profit? Profit drivers for Statutory Reporting incorrect! • Shows a loss when writing lots of profitable new business when in value is actually added • Shows a gain when policies cancels when value is actually lost A growing company writing profitable business can have a negative statutory profit for many years, but is generating a lot of value for it’s shareholders. 6 I. Why Calculate Embedded Value Reasons to Calculate Value • • A measure of performance To calculate Return On Equity (ROE) • • • • 7 Increase in value / starting value Carrying value in accounts of owner Sale or Purchase Management bonus II. What is Embedded Value? Embedded Value comes from three segments: 1. Net Worth (Assets – Liabilities) 2. PV of profit from in-force business 3. PV of profit from future sales Sometimes: • 1 + 2 is referred to as Embedded Value • 1 + 2 + 3 is referred to as Appraisal Value 8 III. Net Worth Net Worth = Assets – Liabilities Assets • Market Value of Assets • Costs of sale of investments / assets (tax, fees) • Value of some assets depends on purpose of calculation. • • Difficult to value some assets • • • 9 In a sale situation computer software may have no value. Intangible assets (e.g. Goodwill) often set to zero Property, direct holdings, … have no ready market value Do deferred tax assets have value? III. Net Worth Net Worth = Assets – Liabilities Liabilities • Local Indonesian policy reserves • Should include RBC requirements • • 10 Cannot be distributed Market Value of other liabilities IV. Value of In force (VIF) Definition VIF = Present Value of future Distributable Profits from in force policies Distributable Profits = Statutory Profits less increase in required RBC Statutory Profits = Premium + II – claims – expenses – change Resv tax 11 IV. Value of In force (VIF) Assumptions VIF = Present Value of future Distributable Profits from inforce policies Assumptions • Best estimate assumptions needed • • • • • • • 12 Mortality/Morbidity Interest earnings Inflation Lapses Expenses Tax etc. IV. Value of In force (VIF) Risk Discount rate Profits are discounted at the Risk Discount Rate (RDR) RDR represents • The company’s minimum desired rate of return on capital • Sometimes referred to as the “hurdle rate” RDR should reflect: • the Expected Shareholder’s return • the risk that future profits will not match expectations (risk profile of the business) • the current local market conditions 13 IV. Value of In force (VIF) Risk Discount Rate Profits are discounted at the Risk Discount Rate (RDR) • The RDR is key to the final Embedded Value figure • Often a range of figures is used to show sensitivity • CAPM says • • Currently perhaps • 14 RDR =Risk free + Beta * (Market Rate – Risk Free) RDR = 14.0 + 1.2 * (20.0 – 14.0) = 21.2% V. Value of New business (VNB) VNB = Present Value of future Distributable Profits from future sales. Assumptions • Same issues as VIF • How many years New business? • • Additional Assumptions • 15 Judgment but often around 5 years. Future sales growth, agency size, productivity, product mix, … VI. Other Issues • Expense Over-run • • Minimum or target RBC ratio • • How should we treat later year losses (25 years from now!) Investment Return • • • 16 120% or 150% of estimated RBC Later year losses • • Expense budget versus Expense allowables Should be consistent with asset valuation. Should a change in asset mix affect value? Can we forecast changes to current rates? VI. Other Issues • It is extremely important that future bonus rates on with-profit policies should be consistent with: • • • • Future Sales (Value of New Business) • • • 17 Future assumptions. Likely future management action Policy holders reasonable expectations Can we assume a re-price of loss making products Are future margins going to be the same as today? Should we use a higher RDR because of greater uncertainty? VI. Other Issues • Product Guarantees • • Valuation Software • • • • Many available (e.g. Prophet, VIP, AXIS, MOSES, etc) Possible but cumbersome to do in spreadsheets Model points Vs seriatim data. Changing Assumptions • • • 18 Investment /mortality – no value in deterministic approach How often depends on purpose Assumptions are long term to try to not have big swings Future improvements in mortality VII. Question & Answer 19