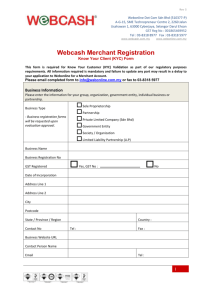

A new processor option Merchant info

advertisement

Excluded merchants: Bankruptcy attorneys Pawn shops Credit repair agencies Coin dealers Included merchants: Jewelry stores Travel/vacations/timeshares Home-based businesses Clothing Car audio Full amount of used cars (processor does take a position on the note) No merchants are turned down due to credit/bank statements (leasing company may still decline, however). Merchant does not need to furnish bank statements or IRS forms. Merchant must furnish: Business license Voided check Driver’s license Merchant must lease/purchase terminal and check reader No setup fee $7.00 application fee for single check conversion option 1.5% +$0.20 fee for single check conversion Financing terms: 45 days, 60 days, 90 days, 135 days, 180 days Limits/warranty fees: $0 - $1500 – 8% $1501 - $2500 – 15% Customer must present ID, paycheck stub or bank statement (if self-employed) If customer has 1 or fewer NSFs in past 6 months, merchant receives full amount of funds If customer has 2 - 5 NSFs in past 6 months, merchant receives the downpayment and the balance is “paid when paid” If customer has 6 or more NSFs in previous 6 months, s/he does not qualify Customer may request to have funds withdrawn weekly, biweekly or once a month Transaction process Merchant: 1. 2. 3. 4. 5. logs into website fills in application online, receives transaction number faxes in bank statement or check stub along with transaction number submits down payment check via check reader/terminal along with transaction number receives approval notification within 10 minutes Call James Kosmatka at 800/330-7221 or email at platinumonellc@gmail.com