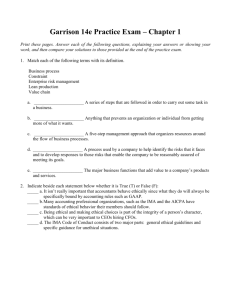

Chapter 1

advertisement

Chapter 1 Ethical Issues in Advanced Accounting Scope of Chapter Why need ethical conduct in accounting? What is fraudulent financial reporting? Ethical standards for preparers of financial statements & reports. Significant events in establishment of ethical standards. 2 Scope of Chapter 3 IMA standards of ethical conduct. FEI code of ethics. AICPA code of professional conduct. Resolutions, articles, definitions, rules, appendices. Examples, review questions and case studies. Why To Study Ethical Issues In Accounting? 4 Critics have alleged that ethical standards of accountants have deteriorated. Cute accounting to describe stretching the form of accounting standards to the limit, regardless of the substance of the underlying business transactions or events. Cooking the books to indicate fraudulent financial reporting. Fraudulent Financial Reporting 5 Misstatements in financial statements. Intentional misstatement or omission of amounts or disclosures in financial statements to deceive users. Reasons & Methods of committing fraud. Manipulation, Falsification, or Alteration of accounting records or supporting documents. Fraudulent Financial Reporting Misrepresentation in or intentional omission from, the financial statements of events, transactions or other significant information. Intentional misapplication of accounting principles relating to amounts, classification, presentation or disclosure. 6 Fraudulent Financial Reporting 7 Fraud frequently involves either a pressure or an incentive to commit fraud. Fraud may be concealed through falsified documentation, including forgery. Fraud also may be concealed through collusion among management, employees or third parties. An Example of Fraudulent Financial Reporting The sec’s accounting and auditing enforcement release no. 923 provides an example of fraudulent financial reporting. According to the SEC, the four officers overstated the company’s net income for the quarters ended Dec 31, 92 and mar 21, 93 by taking following “ cooking the books” actions: 8 An Example of Fraudulent Financial Reporting 1. 2. 3. 9 Recognizing January 1993 revenues in December 1992 and April 1993 revenues in march 1993. Deferring write-offs of uncollectible accounts past the end of the appropriate quarter. Recognizing as assets certain expenses incurred during the quarters ended December 31, 1992 and march 31, 1993. An Example of Fraudulent Financial Reporting 4. 5. 10 Making fictitious journal entries in connection with business combinations accomplished in march 1993, the effect of which was to understate doubtful accounts expense. Recognizing in the 1st quarter of 1993, a gain from the sale of an asset during the quarter ended June 30, 1993. Ethical Standards 11 American Institute of Certified Public Accountants (AICPA) adopted first code of ethics in 1917. The Institute of Management Accountants (IMA) first issued its “Standards of Ethical Conduct for Management Accountants” in 1983. The Financial Executives Institute (FEI) first issued its “Code of Ethics” in 1985. Significant Events in Establishment of Ethical Standards The Seaview Symposium of 1970 The Equity Funding Fraud of 1973 Action by IMA in 1983 Action by FEI Treadway Commission Recommendations Sarbanes-Oxley Act in 2002 12 The Equity Funding Fraud 13 In 1973, a major fraud was discovered at equity funding corporation of America (equity), a seller of mutual fund shares that were pledged by the investors to secure loans to finance life insurance premiums. During the nine-year period, at least $143 million of fictitious pretax income was generated. The Equity Funding Fraud 14 A period in which the equity reported a total net income of $ 76 million, instead of the real pretax losses totaling more than $ 67 million. The fraud was carried out by at least 10 executives of equity, including the chief executive officer (CEO), chief financial officer (CFO), controller, and treasurer. Several of the executives were CPAs with public accounting experience. Treadway Commission 15 The National Commission on Fraudulent Financial Reporting. Sponsored by the AICPA, IMA, FEI, the American Accounting Association, and the Institute of Internal Auditors. Defined “Fraudulent Financial Reporting” as “intentional or reckless conduct, whether act or omission, that results in materially misleading financial statements.” Treadway Commission The Treadway Commission made 49 recommendations for curbing such reporting. The recommendations dealt with the public company; the independent public accountant; the SEC, financial institution regulators, and state boards of accountancy; and education. 16 Treadway Commission The responsibility for reliable financial reporting resides first and foremost at the corporate level. Public companies should maintain accounting functions that are designed to meet their financial reporting obligations. 17 Sarbanes-Oxley Act 2002 18 Authorized the establishment of Public Company Accounting Oversight Board Purpose: Regulate conduct of accountants both public practice and publicly owned business enterprises Analysis of Ethical Standards For Management & Financial Execs. The ethics pronouncements of IMA, FEI and AICPA have several similarities. All three require members to be competent, act with integrity and objectivity, maintain confidentiality of sensitive information, and avoid discreditable acts. 19 Analysis of Ethical Standards For Management & Financial Execs. The IMA & AICPA codes specifically prohibit conflicts of interest, but the FEI code only indirectly addresses such conflicts in its confidentiality provision. 20 Analysis of Ethical Standards For Management & Financial Execs. Only IMA and FEI codes specifically require communication of complete information to users of their members’ reports; AICPA members are indirectly comparably obligated by rule 202. 21 Analysis of Ethical Standards For Management & Financial Execs. The IMA standards in essence require members to report violations of the standards by members of their organization to responsible officials of the organizations. The FEI and AICPA codes have no such requirements. 22 Analysis of Ethical Standards For Management & Financial Execs. The FEI code requires members to conduct their personal, as well as their business affairs with honesty and integrity. The IMA and AICPA standards do not address personal affairs. 23 Conflict of Interest Conflict of Interest results when individuals reap inappropriate personal benefits from their acts in an official capacity. 24 Conflict of Interest 25 For example, a chief accounting officer might cook the books to overstate pretax income of the employer corporation in order to obtain a larger performance bonus. The controller of a publicly owned corporation might involve in “insider trading” to maximize gains or minimize losses on purchase or sales of the employer corporation securities. Discreditable Acts None of the three codes defines “Discreditable Acts”. The term can not be adequately defines or circumscribed. A discreditable act to one observer might not be so construed by another. 26 Concluding Observations The number of SEC proceedings against reporting companies from 1981 to 1986 was less than 1% of the number of financial reports filed with the SEC during that period. 27 Concluding Observations The Chairman of the Federal Deposit Insurance Corporation contended that management fraud (presumably including cooking the books) contributed to onethird of bank failures. 10% of total bankruptcies in a study authorized by the Treadway Commission, involved fraudulent financial reporting. 28 Concluding Observations 29 Former SEC Chairman John Shad estimated that all fraudulent securities activities amount to a fraction of 1% of the $50 billion of corporate and government securities traded daily. Concluding Observations 30 Thus, cooking the books, though serious and despicable, apparently do not indicate a wholesale breakdown of ethical conduct by management accountants and financial executives of business enterprises. Concluding Observations 31 Can the codes of conduct for management accountants and financial executives established or revised by IMA, FEI and AICPA help those key players in corporate financial reporting to resist pressures, often from top management but sometimes from within themselves, to falsify financial statements and reports?