B-Line Trucking - Edwards School of Business

advertisement

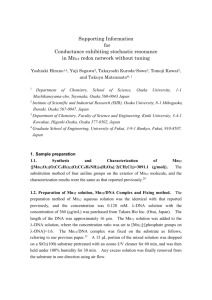

Business Plan Michael Hubbard 12/5/2014 The Quickest Way to Point A from Point B. TABLE OF CONTENTS EXECUTIVE SUMMARY ........................................................................................................................................... 2 INTRODUCTION ..................................................................................................................................................... 3 OPERATIONS PLAN ................................................................................................................................................ 3 HUMAN RESOURCES .............................................................................................................................................. 5 CAPITAL BUDGET ................................................................................................................................................... 5 MARKETING PLAN.................................................................................................................................................. 6 FINANCIAL PLAN .................................................................................................................................................... 8 SUMMARY ........................................................................................................................................................... 10 APPENDIX A – FINANCIAL MODEL ........................................................................................................................ 11 APPENDIX B – ORGANIZATION STRUCTURE ......................................................................................................... 11 APPENDIX C – SITE PLAN ...................................................................................................................................... 11 APPENDIX D – CAPITAL BUDGET .......................................................................................................................... 12 APPENDIX E – OPERATING EXPENSES ................................................................................................................... 12 Executive Summary B-Line Trucking (B-Line) is a mid-size trucking company hauling wood products for mills in the Meadow Lake area. Three mills in the Meadow Lake area include: Meadow Lake Mechanical Pulp Mill, NorSask Forest Products and Meadow Lake OSB. Previously there was a short-line railway that ran between Meadow Lake and North Battleford however about 5 years ago this line was shut down. These days the only way the three mills can get their product to mill is by truck. Operational Overview B-Line will earn revenue through completing hauling contracts for the mill. Truck drivers will be scheduled to arrive for pick-up at designated times through the day. After being loaded at the respective mill they will drive to North Battleford where the product will be loaded onto trains and shipped to market. We will expect our drivers to make three runs a day. B-Line will operate via contracting arrangements between itself and truck owner-operators. The decision to outsource all trucking aspects of the company is to limit risk. Given the nature of the business being dependent on landing hauling contracts (no contract, no business) we needed to identify strategies to mitigate this risk. By outsourcing our trucking operations, we can greatly cut down on our fixed expenses. Marketing Overview B-Line’s target customer will be Meadow Lake Mechanical Pulp Mill (MLMP). We feel MLMP to be a good target customer of the three mills as MLMP tends to have the most consistent output (therefore consistent hauling needs), generates the most consistent profits and has a strong track record of local sourcing. The strategy to obtain the hauling contract will consist of direct marketing. The aim will be to set-up multiple meetings with logistic managers at the mill, using this time to get to know their needs and prove to them what B-Line can offer. Once we feel we have a good idea of what the mill needs and believe we can deliver on this, a proposal to haul for the mill will be submitted. B-Line faces stiff competition from Edge Transportation (Edge), the company currently hauling wood products for Meadow Lake Mechanical Pulp Mill. Edge operates out of Saskatoon and has the benefit of being owned by Siemens Transport; due to its size Edge will likely have cost benefits over B-Line. Financial Snapshot As noted earlier, B-Line comes with inherently high risk simply due the make-or-break nature of landing the hauling contract. With this high risk however comes the opportunity for high reward. If we can land the contract for hauling the mills output which we intend (25% ouput years 1-2, 50% output year 3-4, 100% output by year 5), we’re looking at an IRR over the 5 years of approximately 42.9% and an NPV of $57,215. Introduction B-Line Trucking (B-Line) is a mid-sized trucking company based in Meadow Lake, SK. B-Line will generate revenue through the completion of hauling contracts for three mills in the Meadow Lake area. B-Line will not own any trucks nor have any truck drivers on its payroll, rather the company will operate via contracting arrangements between B-Line, the mills and independent truck owner-operators. B-Line’s focus will be on the marketing side of the arrangement, landing contracts with the mills and bidding out the hauling itself to independent truck owners. Target market for the enterprise includes three major mills: Meadow Lake Mechanical Pulp Mill producing 360,000 tonnes of pulp per year, NorSask Forest Products (saw mill) producing 160 million cubic feet of lumber per year and Meadow Lake OSB producing 700 million square feet of OSB per year (City of Meadow Lake, 2008). Previously, wood products created by these mills were shipped to market via train on a short line track to North Battleford and then to Saskatoon. In 2008 however, the American rail company OmniTRAX that owns the line between Meadow Lake and North Battleford announced they would discontinue its operation (Canada.com, 2008). Multiple attempts have been made by groups in the area to purchase the rail line from OmniTRAX, who still owns the line, but there has been no success in completing the purchase, much less getting it back to working order. Since the line was shut down, the three mills can only get their product to market by truck. This has resulted in an increased demand for trucking in the area. Further increasing this demand is the fact that the Meadow Lake Pulp Mill has plans to increase output from 360,000 to 500,000 tonnes of pulp per year (City of Meadow Lake, 2008). Based on these facts we see a high demand for trucking in the area for many years to come. The decision to outsource almost all the operational aspects of the company is to limit risk. Because the success of the business is dependent on landing long-term hauling contracts with the mills, B-Line’s success comes with an inherently high degree of risk. Outsourcing the hauling operation will substantially reduce our risk because it eliminates an enormous amount of fixed costs. Operations Plan Ownership Structure B-Line will be set-up as a corporation. The main reason for incorporating will be to limit the liability of shareholders. It’s also the belief of the company that it will be more attractive to future investors if the company is incorporated as opposed to a partnership or sole proprietorship. B-Line will be governed by a board of directors comprised of three people: Michael Hubbard, Dallas Bear, and Dr. Robert Hubbard. We will also offer a spot on our board to representatives from any mill we land hauling contracts from. Michael Hubbard will be responsible for the business end of the organization; key responsibilities will include fostering and maintaing relationships with potential customers and overseeing all financial matters. The other two board members, Mr. Bear and Dr. Hubbard will act as semi-silent partners, not participating in the day to day operations but still encouraged to attend monthly board meetings to offer advice and share any insights or thoughts on the organizations strategic direction. See Appendix B for Detailed Org. Chart Location and Site Plan B-Line Trucking will be located just off Highway 4 in Meadow Lake, SK. The leased space will be approximately 1,000 sq. ft. This will act as general office space for management and administrative employees to carry-out dispatch and quality control duties. (See Appendix C). In order to increase the credibility of the organization, we plan to renovate our office space to give it a mondern and professional look. The hope here is that it will improve how the mill views us as a potential business partner, improving our ability to land that all-important hauling contract. Process Plan B-Line will generate revenue through hauling MLMP’s wood pulp by truck to North Battleford. On a daily basis, trucks will arrive at the mill at their specified loading time. MLMP will be responsible for loading the trucks. Once loaded and secure, the pulp will go by truck to North Battleford. Once in North Battleford, the pulp will be loaded on to train cars for shipment to markets around the world. On a regular day, the goal will be for our drivers to make 3 hauls per day, which works out to be an 11-12 hour day, depending on a number of factors from line-ups at loading and offloading locations to road conditions. Payment collection will be anticipated at once per month, offering MLMP 30 days to pay. Based on the size of MLMP, we don’t consider payment collection to be an issue. 5-Year Development Plan Assuming we’re able to successfully land a hauling contract with MLMP, the plan will be to haul 25% of the mill’s output in year one and two, increasing to 50% in year three and four, and then finally hauling 100% of the mill’s output by year five. Based on this plan, we will have to grow our work force and office space. Year Year 1 Year 2 Plan Secure hauling contract at 12 Hauls per Day (HpD). Assess successes and challenges from past year, improving where necessary. Secure long-term hauling contract for additional hauls per day. Year 3 Year 4 Year 5 Begin hauling 19 HpD. Increase workforce to accommodate one additional part-time worker. Assess effectiveness at 19 HpD, ask “do we have capacity to increase to 38 HpD?” If yes to above question, will need to obtain bigger office space and add three more full-time employees Human Resources B-Line will employ 3 full-time employees. This includes one manager (me) and two additional employees responsible for dispatch, reception and quality control duties. B-Line’s full-time employees will mainly be responsible for monitoring pick-ups and deliveries, ensuring all the loads we’re responsible for get where they need to go. For example, if one of our drivers has mechanical difficulty, these employees will be responsible for determining the quickest way to get that driver’s load moving. This could mean calling a service truck to go meet the trucker to make the repairs or it could mean calling the next driver on our list, requesting them make the run and offering them a premium to do so. If we run into difficulties on our end, we need to be able to fix these problems if we want to keep the mills business. See Organization Chart in Appendix. Can We Get Enough Drivers? Obviously a big question regarding this venture is whether we can get enough drivers. Currently, MLMP’s hauling is carried out by Edge Transportation a large Saskatoon based trucking company which has access to a large pool of drivers. We believe we’ll be able to get the required contract drivers for variety of reasons, the most important being the incentive to local truck drivers from the Meadow Lake area. Meadow Lake has an abundance of people with their 1A license, B-Line Trucking can offer these individuals the opportunity to drive truck and be home every night, an opportunity that doesn’t come often in the trucking industry. Furthermore we believe our pay rates are very competitive, offering drivers 80% of our hauling revenue. Capital Budget B-Line Trucking benefits from having a relatively low capital budget, only requiring around $60,000 to finance its capital requirements. Over the 5-year projection period, B-Line plans to expand in year five in order to grow at our intended rate. This expansion in year 5 will be financed by internally generated cash flows and therefore requires no external financing (Refer to appendix D). Working Capital The company’s working capital outlook appears favorable (appendix D); net working capital is projected at about $75,421. Although receivables take slightly longer to collect compared to payables, remaining portions of start-up cash will be able to finance any gaps between receiving payment from customers and making distributions to drivers and suppliers. B-Line doesn’t anticipate cash flow difficulties as its cash conversion cycle is estimated around 7 days. (See appendix D) Marketing Plan Market Overview The three mills in the Meadow Lake area create a strong market for hauling wood products. MLMP alone requires 13,640 hauls per year to get its product to market while NorSask Forest Products and Meadow Lake OSB require approximately 24,000 and 15,000 truckloads per year, respectively. This, aside from hauling logs to the mills and all other trucking in the area, highlights the sheer size of the trucking industry in Meadow Lake, SK. Primary Target B-line’s primary target customer will be MLMP, for a couple reasons. One reason we chose MLMP is that it has the most consistent output of the mills as well as consistent profits. Further justification for targeting MLMP is its track record of locally sourcing as much of its inputs as possible. Despite the fact MLMP has less hauling requirements we view them as a more stable company with consistent output and therefore consistent hauling needs. Customer Needs From a trucking standpoint, customers want a few key things: low cost hauling, efficient pick-ups, and trust that the trucks will be where they need to be. Our job here is to communicate to MLMP that we can deliver on all three. Strategy B-Line’s marketing strategy will be direct marketing. Leverage Local Networks Being born and raised in Meadow Lake, I’m optimistic I’ll be able to leverage family and friends to get a meeting with the right people from the mill. This will come with two benefits, one being that it will offer me a better chance at getting the meeting in the first place and number two, potentially these personnel from the mill will know myself or my family, adding credibility and trust to my name. Trust will be the key in signing a long-term hauling contract. Face-to-Face Meetings After getting in touch with the necessary personnel from MLMP, the next step will be to land a meeting. This meeting will be what our success hinges on. Here the objective will be to find out exactly what the customer needs, to the finest detail, then be able to prove to them that B-Line can deliver on these needs. I’m confident we can be as efficient as the mill needs us to be and I’m confident we can get enough drivers that the mill can trust us to be there every time they need us. That said, the only thing we won’t have control over is whether we can offer a price low enough for the mill to accept. During these meetings the strategy will simply be to reiterate the fact that B-Line can offer efficiency and reliability. Our trucks will be in and out as quick as you can load them and you can bet that we will always have a truck where and when you need it. The hope will be that increased interaction and giving the managers a chance to get to know the “jockey” behind the company will help establish the trust required to sign a long-term hauling contract. Competition B-Line faces direct competition from Edge Transportation (Edge), the company currently hauling for MLMP. Edge Transportation has a competitive advantage over B-Line just based on its sheer size. Owned by Siemens Transportation, Edge will have improved economies of scale compared to B-Line so it may have the ability to undercut our price, but that is yet to be known. Pricing Strategy B-Line’s pricing strategy will be competitive. To be blunt, in the trucking industry, if you can’t offer a price equal to or lower than the competition, you won’t be hauling much. Our initial price offer to MLMP will be $0.57/km, per haul that equates to $199.50 (350km). Although we currently don’t have access to Edge Transportations prices being charged, we’re optimistic they won’t differ by a whole lot from what we offer. It should also be noted that we have wiggle room in the above price. For example, currently our break-even Hauls-per-Day (HpD) is 12 at a price of $0.57/km. If we drop this to $0.50 per KM, we simply need 2 additional HpD, or 14 HpD to break-even in year one, which we consider to be feasible. The above pricing strategy will also incorporate a 5% discount with each increase in hauling by B-Line. Currently the intention is to propose hauling 25% of MLMP’s output, increasing to 50% in year three and 100% by year 5. Contingency Plan Inherent in in B-Line’s business model is a high degree of risk based on the type of contracts that are being sought; the business is dependent on its ability to land long-term hauling contracts. B-Line will mitigate this risk through contingency plans in the event that the MLMP contract isn’t obtained. Plan B– Other two mills If initial efforts to obtain a long-term hauling contract with MLMP are unsuccessful, B-Line still has two other mills to approach. The aim will be to approach NorSask Forest Products (saw mill) in the same manner we approached MLMP, a direct approach of sitting down with the necessary personnel from the mill to find out what they want and how B-Line can give it to them. Ideally, we will have learned from any mistakes or oversight made in our attempts with MLMP. If efforts fail again, we will go for Meadow Lake OSB with the same strategy, learning from our previous experiences. Plan C– Alternate Hauling Lastly, if all of the above fails and we have an adequate number of truck owner-operators that want to drive for B-Line, we will explore other opportunities in the trucking industry. Meadow Lake is a growing city, considered to be the “gateway to the north”. Trucking opportunities in the area are numerous and varied; what industry we settle on will just depend where there happens to be excess demand for hauling at the time. These opportunities include transporting supplies and goods to Northern communities, hauling mining equipment, or even grain hauling. The point here is that if we get the commitments from a number of drivers, we have opportunity beyond the three mills to establish a successful hauling enterprise. Financial Plan Capital structure B-Line is targeting a financing budget of $140,000: $100,000 of equity and $40,000 debt. After investing in capital assets, the remaining money will enable B-Line to maintain adequate cash flows in case the business runs into unforeseen circumstances such as not hitting sales targets or increased costs. The extra cushion will enable B-Line to persevere through any potential rainy days. See financial model for specific allocations. Hauling Forecast In coming up with revenue projections, we assumed that MLMP would offer us a sort of ‘trial period’, approximately 1-2 years where B-Line will haul approximately 25% of output, then increasing to 50% of output by year 3 and 100% of MLMP output by year 5. Note that each increase in output is accompanied by a 5% discount in hauling price (discounts in year 3 and 5), coupled with anticipated inflation of 2% per year. Hauls per Day (HpD) Est. Hauling Days per Year Revenue per KM Revenue per Haul (350 KM) Estimated Annual Revenue Allocation to Truck Drivers (80%) Gross Profit Operating Expenses (Appendix D) Net Income (Loss) 2015 12 360 0.5700 $199.50 $861,840 ($689,472) $172,368 ($174,229) ($1,861) Source: See Financial Model for further detail 2016 12 360 0.5814 $203.49 $879,077 ($703,261) $175,815 ($175,048) $768 2017 19 360 0.5648 $197.68 $1,352,104 ($1,081,683) $270,421 ($192,920) $67,568 2018 19 360 0.5761 $201.63 $1,379,146 ($1,103,317) $275,829 ($196,136) $69,333 2019 39 360 0.5596 $195.87 $2,749,996 ($2,199,997) $549,999 ($339,941) $182,751 Although B-Line is expected to show a net loss in year one, this isn’t concerning to us for a couple reasons. For one, the loss is relatively small and considered immaterial, secondly B-Line will still have a healthy cash balance at the start of year two based on this scenario. Critical Risk Factor and Break-even When considering risks to B-Line Trucking, the critical risk factor of the company is Hauls per Day. Plainly put, if the company can’t get enough Hauls per Day, this plan isn’t feasible. Based on our current scenario, break-even Hauls per Day will be 12 in years one and two, increasing to 14 in year three and 28 by year 5. These increases in break-even are due to planned expansion the organization will undertake if it can obtain planned increases in hauling. Net Income Breakeven Number of Hauls per Day 45 40 35 39 Red Line – Break-Even Blue Line – Intended Scenerio 30 25 19 20 15 10 12 24 12 12 12 1 2 5 19 14 14 3 Year 4 0 5 The critical risk factor for B-Line will be for it to hit 19 Hauls per Day by year three. If we hit this target, the business can earn a healthy and sustainable profit, anything beyond will be just a bonus. On the other side, anything less than 19 hauls per day in year three and this is no longer feasible. While we can make a profit on anything beyond 12 hauls per day, we don’t consider the profits to be adequate based on the risk profile of this business unless we can hit 19 HpD by year three. In fact, if we see HpD to 19 by year three and hold it constant, we get an NPV of $43.96, proving that 19 HpD by year three is where we draw the line. Key Metrics IRR Dividends paid Over 5 Year Projection Net Pay Back NPV (25% Required Return) 42.9% $86,248 $267,900 $57,215 Summary B-Line Trucking aims to provide locally sourced hauling services for Meaow Lake Mechancial Pulp Mill. Based on the above scenario, the company plans to operate via contracting arrangements between with independent truck owner-operators. B-Line will work to secure long-term contracts with MLMP via direct marketing to their logistics managers. The hope is that given the opportunity to sit down with these key individuals, B-Line will be able to convince MLMP that it has the capacity and ability to complete hauling contracts for the mill in a timely and efficient manner. If a contract can be established, we will aim to haul 25% of the mills output in year one and two, 50% of output in year three and four, and finally 100% of its output by year five. If this plan can be accomplished, B-Line stands to benefit from strong cash flows and consistent demand for its services. On the other hand, B-Line’s ability to continue as a going concern is highly questionable if it cannot land a long-term contract with MLMP. That said, B-Line can mitigate this risk by having a plan in place to approach the other two mills with the same offer as with MLMP and also having a plan to try hauling different goods if still unsuccessful. Based on the above factors we can see that despite having alternate opportunities beyond hauling for MLMP B-Line has a high degree of risk. If successful, B-Line stands to make healthy profits for many years to come, if unsuccessful B-Line will be lucky to be around as long as it took to make this business plan. Appendix A – Financial Model See Financial Model Appendix B – Organization Structure Board of Directors Manager Dispatch / Quality Control Appendix C – Site Plan Dispatch / Quality Control Appendix D – Capital Budget Item Leasehold Improvements - Upgrading entire office space for a modern look Furniture and Fixtures Computer Equipment Total Year 1 $30,000 Year 5 $20,000 Source Various experienced friends/family $20,000 $10,000 $60,000 $15,000 $6,500 $41,500 Staples, Costco Best Buy Net Working Capital Avg Days In Receivables Avg Days in Payables Accounts Receivable Accounts Payable Cash Net Working Capital 30 days 23 days $71,820 ($43,355) $46,956 $75,421 Appendix E – Operating Expenses Operating Expenses Accounting and Legal Advertizing (Marketing) General Supplies Insurance Telephone Utilities Lease Expense Repair and Maintenance Wages Employee Benefits Capital Cost Allowance Debt Interest Total Operating Expenses 2015 900 10,000 1,000 400 1,200 3,000 15,000 500 118,400 16,529 4,100 3,200 174,229 2016 918 5,000 1,020 408 1,224 3,060 15,300 510 120,768 16,859 7,326 2,655 175,048 2017 936 5,100 1,040 416 1,248 3,121 15,606 520 137,831 19,241 5,794 2,065 192,920 2018 955 5,202 1,061 424 1,273 3,184 15,918 531 141,735 19,786 4,637 1,429 196,136 2019 974 5,306 1,082 433 1,299 3,247 16,236 541 266,274 37,172 6,633 742 339,941