here

advertisement

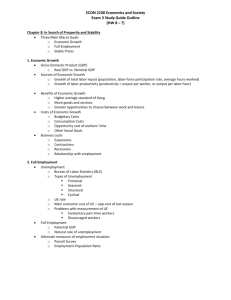

«Chapter 11» Measuring National Economic Performance 1) Distinguish between GDP and GNP/GNI as measures of economic activity. GDP (Gross Domestic Product): value of all final goods and services produced in a country within a given time period. GNP (Gross National Product): market value of all the products and services produced in a time period by the labour and capital supplied by residents of a country. GNP = GDP + net property income from abroad GNI (Gross National Income): GNP minus gross imports of goods and services and indirect business taxes. NNP (Net National Product): market value of production supplied by labour and capital supplied by the residents of a country, minus the depreciated value of capital goods. Can help give an idea of how strong the economy will be in the future 2) Explain how the circular flower of income functions as a system with leakages and injections. Leakages: money that exits Injections: money that enters 3) a) Explain the process by which nominal GDP is calculated and distinguish it from real GDP. Nominal GDP is the value, in current prices, of all final goods/services produced in a country within a given time period, whereas real GDP is the value, in constant prices, of all final goods/services produced in a country within a given time period (usually measured against prices of predetermined base year). Because nominal GDP is given in current prices, it doesn’t take inflation or deflation into account – this means that it gives a misleading idea of how the economy is doing. For example, if Japan’s nominal GDP increased from year one to year two, it may seem like the economy improved. However, if Japan’s inflation rate – increase in prices – is greater than the increase in quantity of output, then it means that the economy has not grown as much as the nominal GDP would indicate. This is because when a nation has inflation, there is a sustained rise in the prices of goods or services because the currency becomes weaker. In the case of Japan, this means that ¥100 in the second year wouldn’t have the same value as ¥100 did the first year. Therefore in the case of inflation, nominal GDP exaggerates the value of output compared to real output. Although the price of, say, a desk may have increased, the quality of the desk itself may not have changed. The opposite applies in the case of deflation – the nominal GDP would underestimate the value of real output because the currency has gotten stronger (and a smaller amount in the second year has the same value as a larger amount in the first year). There are three approaches to calculating nominal GDP: expenditure, income, and output. In the expenditure approach, consumption, investment, government spending, and net exports (exports minus imports) are added together. The income approach is similar to the expenditure approach, but income is added up instead – this makes sense because in the circular flow of income, the payments made end up being income to other people. In the output approach, economists add together the value added to goods at each level of production. To find real GDP, the nominal GDP of the year measured is divided by the GDP deflator, and then the quotient is multiplied by 100. The GDP deflator is simply a figure that shows the inflation in the country – for example, if the prices of goods and services increased by 3%, the GDP deflator would be 103. Nominal GDP: value, in current prices, of all final goods/services produced in a country within a given time period Real GDP: value, in constant prices, of all final goods/services produced in a country within a give time period (usually measured against prices of predetermined base year) Real GDP factors out price changes and show a more accurate measure of the true output from one year to the next, because inflation/deflation is hidden in nominal GDP. If inflation causes the prices of goods to increase, the GDP can become overestimated and give the impression that the economy is doing better than it actually is – exaggerates value of output compared to real output. For example: inflation could make the cost of a motorcycle more expensive – although the price has increased, the quality hasn’t. If deflation causes the prices of goods to decrease, the GDP can become underestimated and give the impression that the economy is doing worse than it actually is – underestimates the value of real output compared to actual output. b) To what extent do measures of GDP accurately estimate national well-being? Although GDP is a relatively good indicator of national well-being, because ceteris paribus, more income is better than less income. This assumes that a higher GDP means a better quality of life. However, this isn’t always the case because there are many aspects of a high-quality life of which the price can’t be quantified. GDP is also unreliable because it overestimates and underestimates well-being in addition to lacking information. GDP overestimates well-being for two reasons – first of all, it adds clearly negative social behaviors and transactions as net positives for GDP. This means that money spent on consuming unhealthy products, fighting wars, jailing criminals is included in the GDP. Although this type of money may increase GDP and make it seem as if the country is doing well (in terms of the economy and quality of life), it doesn’t contribute to welfare and therefore gives a false impression of high well-being that isn’t necessarily there. Because the government and consumers are spending money on goods that do not contribute to welfare, they don’t have as much money to spend on merit goods. Secondly, GDP under-reports the loss of natural resources. For example, if deforestation occurred to make room more more housing units, this would be added to GDP. In the short run, this spurt of increase in GDP may be beneficial to the government because it could give them political power, the citizens because there is an increased supply for housing, and the nation as a whole. However in the long run, the despoiling of the nation’s natural resources could lead to consequences that outweigh the temporary benefits – trees reduce the amount of pollution in the air, so when forests are cut down, pollution rises. It gets more complicated because not only does GDP overestimate well-being, it also underestimates it. Increasing life expectancy is a universal goal for all nations – however, this can’t be shown in GDP. A high life expectancy is one of the indicators of a high-quality life, but having a high GDP doesn’t guarantee this. For example, in 1980 Spain and Barbados had similar GDP (PPP) – in fact, Barbados’ GDP was greater. However, Spain had a greater life expectancy by around 40 years. A high life expectancy shows a high quality of life with basic needs being met and access to healthcare, and this shows that Spain had a higher quality of life than Barbados, even if her GDP was lower. Secondly some nations, the informal market has a high value; however, this is not shown in the GDP. If a nation has a thriving black market in which there is a steady flow of money and resources, the economy in reality should be doing relatively well. Thirdly, unpaid work is not included in GDP because there was no flow of money. Although volunteer efforts, housework, and childcare are civil responsibilities that don’t contribute directly to the GDP, they are socially desirable. Finally, GDP adds market transactions regardly of the quality of output. Technological advances and improvements in managerial techniques may improve choice, quality, and safety, but this is not shown in GDP. In addition to these many limitations, GDP also lacks information. A nation’s GDP is simply a figure that doesn’t show types of production and their values. It doesn’t measure the quality of life – even if a nation has a lot of community activity, strong faith in the government, trust in the law and court, and a sense of civic responsibility, it could have the same GDP as a country that meets none of those criteria. Furthermore, even if a nation’s GDP is high, it doesn’t matter if most of the wealth is distributed to a small group of people because it means that there is disparity. GDP also doesn’t account for purchasing power. With the same value of money, you can buy more in certain nations than others. For example, you wouldn’t be able to buy a student movie ticket in Japan with the value of money you need to buy one in South Korea. Overall, GDP by itself cannot help you determine the quality of life that a nation has – other indicators such as life expectancy, literacy rates, and infant mortality should also be referred to. However, it is a good indicator for getting a general idea of where the country might be compared to other countries. Therefore, GDP does not accurately estimate a nation’s well being – it can only give a vague notion of where it may be. Ceteris paribus, more income is better than less income – it is assumed that higher GDP means better quality of life. However, this isn’t always the case because wealth doesn’t necessarily lead to well-being. GDP overestimates well-being: o Adding clearly negative social behaviors and transactions as net positives for GDP Money spent on consuming unhealthy products, fighting wars, jailing criminals may increase GDP, but it doesn’t increase welfare o Under-reporting the loss of natural resources GDP doesn’t take damages to the environment/depletion of resources into consideration – only considers the monetary side of these environmentally harmful endeavors Adds to GDP wihtout increasing welfare o Harming the environment has long-term consequences GDP underestimates well-being: o Increased life expectancy Although this is a universal goal for all nations, it can’t be shown in GDP o Informal market activity is not included For some nations the informal market has a high value, although it is not included in the GDP o Unpaid output is not counted Volunteer efforts, housework, childcare – all socially desirable but not counted in GDP Subsistence economies are shown to be poorer than they really are because the farmers eat their own food o GDP adds market transactions regardless of the quality of output Technological advances, improvements in managerial techniques Although they improve choice, quality, and safety, they are not shown in GDP GDP lacks information: o Composition of output is unknown – types of productions (and their values) are not shown o Doesn’t measure quality of life – community activity, faith in government, trust in the law and the courts, sense of civil responsibility o No information about the distribution of income – doesn’t show disparity o Doesn’t account for purchasing power – in different countries, money has different spending power 4) a) Analyse the use of GNP per capita to compare living standards in different countries. Per capita GDP: average based on the national income of the country divided by the country’s population National Income of the Country Country's Population Gives a better idea of the approximately quality of life in a country (compared to total GDP) Although b) Assess the value of two other measures which might be used to compare living standards. «Chapter 12» Aggregate Demand and Aggregate Supply 1) a) Use an AD/AS diagram to analyse the likely effects of an increase in interest rates. Aggregate demand is the total demand for a nation’s goods and services from domestic households, firms, the government, and foreigners =– it measures a nation’s GDP. It’s different from plain demand, which is the quantity of a good or service that consumers are willing and able to buy at a given price during a specific time period. Aggregate supply is the total amount of goods and services that all the firms in all the industries in a country will produce at every price level in a given period of time. Again, this is different from plain supply, which is the quantity of a good or service that producers are willing to offer for sale at a given price during a specific time period. The interest rate is the opportunity cost of spending money – if firms or households borrow money to finance spending on land or capital, the interest rate is the price they must pay above and beyond the amount borrowed to the bank. If the interest rate rises, the quantity demanded of products/capital which the consumer needs to borrow decreases because borrowers find high interest rates less attractive. This is called the interest rate effect. The effect of this is that there would be less consumption at each level of household income. This would result in a decrease in GDP. Banks raise interest rates in response to rises in the price level of goods and services. Ceteris paribus, he decrease in demand for these goods and services should cause the equilibrium price to become lower again. Aggregate demand: the total demand for the goods and services of a nation at a given price level and at a given period of time – measures a nation’s GDP Inverse relationship between AD and price level o The wealth effect: the public feels wealthier at lower price levels and demands more of a nation’s goods/services o The interest rate effect: borrowers find higher interest rates less attractive o The net export effect: decrease in price level makes a nation’s goods and services more attractive to foreigners and to the nation’s public (compared to imports) Same formula as GDP o C + I + G + (X – M) Interest rate: opportunity cost of spending money – if firms/households borrow money to finance spending on capital or land, the interest rate is the price they must pay above and beyond the amount borrowed to the bank. Higher real interest rates decreased consumption of non-essential items o Inverse relationship between a nation’s interest rate and its quantity of funds demanded (for investment/consumption) o Unanticipated inflation real interest rate is reduced households induced to spend on durable goods Op. cost of holding money = inflation rate Op. cost of spending money = nominal interest rate Inflation rate increases while nominal interest rate remains the same o Unanticipated deflation real interest rates rise = less consumption at each level of household income Op. cost of holding money is less than op. cost of spending money Real interest = nominal interest rate – rate of inflation b) To what extent is the level of interest rates in an economy the primary factor businesses consider when making investment decisions? The two determinants of investments are interest rates and business confidence, and our textbook states that the level of investment by firms in an economy is determined primarily by the real interest rate. When the interest rate is high, businesses invest less. This is because as profit-maximizers, firms are less likely to invest when they can get a bigger return. Increases in interest rates mean that the number of investments in capital with an expected rate of return that at least meets the rate of interest decreases. When the interest rate is low, businesses invest more because the cost of borrowing to finance investments in new capital/technology is lower and more capital investments have an expected rate of return that at least meets the rate of interest. Therefore, there is an inverse relationship between the real interest rate and the demand for funds in the economy. The interest rate effect o Rise in price level raise interest rates quantity demanded decreases o Decrease in price level decrease interest rates quantity demanded increases 2) a) Use an AD/AS diagram to analyse the likely effects of an increase in income tax. b) Compare and contrast the levels of household consumption relative to total aggregate demand in countries with relatively high income taxes to those with relatively low income taxes. If tax rates are high and the government provides a lot of services (healthcare, eduation, transfer payments – unemployment benefits, job training, welfare), then GOVERNMENT SPENDING will make up most of the economic activity. If income taxes are low, households have more disposable income so consumption makes up a larger proportion of total spending. 3) a) Using AD/AS diagrams, analyse the likely impact on an economy of the following i) a general rise in wage costs ii) the discovery of new raw material sources iii) capital stock increases b) Examine the likely effect of one of the events above on a nation’s economy in the short run and in the long run. 4) a) Identify the components of aggregate demand and briefly explain two factors which might determine each of these components. b) Evaluate the likely impact on an economy of a substantial rise in the level of saving among the nation’s households. «Chapter 13» Macroeconomic Objective: Unemployment 1) a) Distinguish between structural unemployment, frictional unemployment and seasonal unemployment. Unemployment: the condition of someone of working age (16~64) who is willing and able to work, actively seeking employment, but unable to find a job. Structural unemployment: when workers lose their jobs due to the changing structure of the nation’s economy – likely to endure much longer than frictional unemployment. Causes: Globalization; outsourcing of secondary and tertiary sector jobs; new technology Not voluntary Possible solution: improve training, education, and mobility of labor force to encourage relocation as demnads for labor change in regional areas Frictional unemployment: when workers are unemployed because they are in between jobs or entering the labour force for the first time. Causes: young workers entering the labor force for the first time; workers who voluntarily quit to seek better job opportunities Voluntary Possible solution: improve information symmetry between employers/job seekers; reduce unemployment benefits Seasonal unemployment: when workers choose seasonal labour and so are unemployed between seasons. Causes: workers choosing jobs that allow for flexibility of time and location Voluntary Possible solution: improve information symmetry between employers/job seekers; reduce unemployment benefits b) To what extent is the existence of structural unemployment in a nation a sign of economic weakness? Structural unemployment is a type of natural unemployment, because the makeup of a nation’s GDP will change as it grows and becomes incorporated into the global economy. Therefore, structural unemployment isn’t so much a sign of economic weakness as it is of change in a nation. In the long term, the nation needs to invest in public education and training for adult workers in the skills that will be demanded by the future economy (which will be different from those that were demanded by past economies and maybe even the present economy). 2) a) Using an AD/AS model and a national labour market diagram, illustrate and explain the causes of cyclical unemployment. Cyclical unemployment is demand-deficit unemployment. It is caused by fluctuations in the nation’s business cycle, and workers are left unable to find work because a reduction in private and public spending reduces aggregate demand. b) Examine the various costs of a persistently high level of cyclical unemployment. 3) a) Explain the concept of the natural rate of unemployment. b) Justify the claim that the unemployment rate may understate the true number of people out of work in a nation. «Chapter 14» Macroeconomic Objective: Low Inflation 1) a) Use an AD/AS diagram to explain two possible causes of demand-pull inflation. Demand-pull inflation: occurs when too many consumers are chasing too few goods, so the average price of goods and services in a nation rises. AD shifts outward when a nation is at/near its full-employment level of output. Two possible causes: Reduction in indirect/direct taxation o Decrease in taxes b) Assuming a government takes no action to control demand-pull inflation, examine the likely effect it will have on a nation’s economy in the long run. 2) a) What are the costs of a high rate of inflation? If the rate of inflation is greater than 3%, the consequences are a loss of purchasing power, decrease in real interest rates for savers, increase in nominal interest rates for borrowers, and a reduction of international competition. A loss in purchasing power means that consumers have less money that they can use to buy goods and services – this could lead to a decrease in aggregate demand for the country. A decrease in real interest rates for savers decreases the incentive for them to spend because the value of their money would decrease. Instead, they could opt to spend their money now instead of later, which would add to the flow of money and potentially worsen inflation (because they’re adding more money to the already rapid flow). An increase in nominal interest rate for borrowers could decrease the incentive for them to borrow, but because this doesn’t mean that there is a change in the real interest rate, it probably wouldn’t have a drastic effect. Foreign investors would be less likely to invest in countries with high inflation, and domestic consumers would probably find imports more attractive compared to local goods (whose prices have been rising). Because of the increased demand for imports and the decreased demand (from abroad) for exports, the nation’s net exports would shift and possibly become negative if they import more than they export. Because net exports are a part of a nation’s GDP, this could lead to a decrease in GDP. It could also lead to people being laid off because not as many workers are needed in the export industry. Costs of an inflation rate greater than 3% Loss of purchasing power Lower real interest rates for savers Higher nominal interest rates for borrowers Reduction of international competition b) ‘What is wanted is not inflation or deflation but price stability.’ Discuss. Both inflation and deflation have the potential to be harmful to a nation. Rather than saying that either one is desirable, it would be better to say that price stability is what is desirable. Inflation can hurt lenders, fixed-income earners, savers, and exporters. Lenders are hurt because inflation lowers the real interest rate, meaning that borrowers will pay them back money that doesn’t have as much worth as before. Fixed-income earners are hurt because inflation reduces real income – although nominally they’ll be earning the same amount as before, each unit of money will have less value. Savers are hurt because inflation lowers the real interest rate earned on savings, so they would be collecting less interest than they could be collecting. Finally, exporters are hurt because foreign buyers would be less willing to buy their goods (because inflation causes the prices to rise). Deflation also has its costs, which are rising unemployment, falling investment, falling consumption and increased savings, and increased debt burden on households. A characteristic that deflation and inflation both have in common is that they can be self-sufficient(?). For example, inflation encourages people to spend now instead of saving – this causes more money to be added to the flow of resources, and it will speed up even more. This could lead to more inflation, which would again encourage people to purchase things now before the prices rose. This would continue in a cycle and potentially become the inflationary spiral. The same applies to deflation, which discourages people from spending because prices are going to fall in t he future. This slows the flow of money down even further, leading to increased rates of deflation (again, this could potentially lead to a deflationary spiral). 3) a) Use an AD/AS diagram to explain how cost-push inflation may occur. b) Compare and contrast the effects of inflation in an economy on different stakeholders. 4) a) Explain how the theory of the Phillips curve can be used to explain why it is often thought that a low level of unemployment makes an inflationary outburst inevitable. b) Examine the view that each country has a natural rate of unemployment that it will always return to in the long run. Can a nation’s NRU change? If so, how? «Chapter 15» Macroeconomic Objective: Economic Growth 1) a) Outline three strategies which governments may use to increase their economic growth rates. Economic growth: an increase in the total output of goods and services (GDP) in a nation over time People’s standard of living improves when they’re able to produce/consume more goods and services The government can: Increase the quantity of the physical capital available to each worker in a nation Increase the quality of capital in a nation Make improvements in a nation’s education and health – improve human capital Productivity: the amount of output attributable to each unit of input – is an important source of economic growth More productive a nation’s resources (land, labour, capital) = more output and income can be generated per capita b) Discuss whether increasing the rate of economic growth should be the major policy objective of government. The government first needs to improve efficiency, then reduce unemployment, then increase quantity of resources, then develop higher quality FOPs, and then finally use better technology. Increasing the rate of economic growth can be a long term goal that the government hopes to get to after achieving this milestones, but they should focus on the milestones first. 2) a) Why might the goal of full employment conflict with the goal of economic growth? Full employment could entail hiring workers who aren’t necessary; this would decrease efficiency and consequently decrease the economic growth possible. Economic growth is an increase in the total output of goods and services (GDP) in a nation over time, so efficiency would be important. b) Examine the possible impact economic growth may have on the distribution of income among a nation’s households 3) a) Using an AD/AS model, distinguish between short-run economic growth and long-run economic growth. b) Disucss the importance of investment for economic growth. «Chapter 16» Macroeconomic Objective: Equity in Income Distribution 1) a) Using a Lorenz curve diagram and examples, distinguish between a country with a high level of income equality and one with a low level of income equality. Lorenz curve: graphical representation of a country’s income distribution (Although no country has a perfectly equal income distribution, it is used for comparative purposes). In the diagram above, Country A has a more equal income distribution among its population compared to Country B – in Country A, the poorest 60% earn 50% of the income, but in Country B, the poorest 60% earn only 10%. The more constant the slope of the Lorenz curve is (in other words, the less dramatic the difference between the least steep and steepest part of the curve), the more equal the income distribution of a nation. b) Justify the claim that poverty’s consequences make its elimination the most important objective of economic policy. There are two types of poverty: relative and absolute. Relative poverty is the condition experienced by people in a country whose incomes are considerably lower than the higher income groups in the same country (the amount is different in each country). Absolute poverty is the condition experienced by individuals who cannot afford to acquire the basic necessities for a healthy and safe existence, such as sanitation, shelter, clean water and food, and healthcare. The two types of poverty both have consequences that are harmful to the nation. People living in poverty are likely to feel social unrest, which can turn into political and economic instability for the nation. If the poor can find no other way to get their needs met, they may turn to violence. Because these issues are harmful to governments in the long run, it is in their best interests to prioritize the elimination of poverty in their economic policies. Some governments may feel inclined to ignore poverty and move forward with other objectives of economic policy (such as improving efficiency, reducing unemployment, increasing the quantity of resources, developing high quality factors of production and using better technology) because it seems easier – however, in the long run the consequences of their actions will outweigh any short-term benefits they may have experienced. Although some of the other objectives – especially reducing unemployment – may help combat poverty, it is important to priotize the elimination of poverty itself (rather than having it be simply a positive consequence of other objectives). If the people in poverty rise up against the government, the effects are felt by many stakeholders, including the citizens, firms, and foreign investors. The citizens would lose in the short term (until the government resolved the issue) because of the instability caused by the social unrest. Firms would also lose for the same reason – the economic instability would lower consumer confidence, and demand could decrease. Furthermore, because the government would be preocuppied in resolving the unrest (presumably by spending money), in the short run, firms who depended on government subsidies or intervention may be more vulnerable to harm. Depending whether or not workers are hired using contracts, the firm may choose to either lay off workers or decrease their wages if the economic instability gets severe (and demand decreases). This increases unemployment, which adds to the government’s problems. Finally, the foreign investors who had previously invested in the country would see the instability and most likely invest in other more stable countries. However, this may lead to them losing some of their returns, which is a short run negative consequence. In the long run, investing in a more economically stable country will be beneficial to them, so it will most likely offset any losses. Disparity has consequences that exacerbate other problems in the nation, which is why the government should make the elimination of poverty the most important objective in economic policy. 2) a) In what ways might a more equal distribution of income contribute to greater economic growth? b) To what extent does greater growth lead to greater income equality? Equality: smaller disparities among a nation’s households in their maintainable living standards and in the distribution of income and wealth. Equity: fairness in economics – requires a level playing field on which individuals in society can all have a fiar shot at achieving economic success. Efficiency: getting the most out of a given input 3) a) Distinguish between progressive, regressive and proportional taxation, providing examples of each. Direct taxes: taxes paid directly to the government by those on whom they are imposed Indirect taxes: taxes paid by households through an intermediary such as a retail store – the intermediary then pays the government Regressive tax: percentage decreases as taxpayer’s income rises People who earn lower incomes pay a larger percentage of their income in tax than people who earn higher incomes Proportional tax: the proportion of income paid in tax is constant at all income levels People who earn a low income pay the same % of their income in tax as people who earn higher incomes Progressive tax: the percentage paid in tax increases as income rises Most equitable – allows for those with the greatest ability to pay the greatest proportion of a nation’s tax b) Evaluate the effectiveness of a progressive income tax at bringing about a more equal distribution of a nation’s income. OTHER VOCAB: Transfer payment: payment from the government to an individual for which no good or service is exchanged Examples: unemployment benefits, social security benefits, nutritional subsidies, higher education grants and tuition subsidies, welfare benefits «Chapter 17» Fiscal Policy 1) a) How might an accurate value for the spending multiplier aid a government in setting fiscal policy? Fiscal policy: the government’s use of taxes and spending to influence the overall level of aggregate demand in the economy to promote the macroeconomic goals of full employment, stable prices and economic growth. Automatic fiscal policy: the notion that, in most nations, tax and government spending systems have an element of built-in stability through which an increase in GDP is automatically accompanied by a decrease in government spending and an increase in taxes. A fall in total output and income, on the other hand, automatically results in an increase in government spending an a decrease in taxes. Discretionary fiscal policy: a change in taxes and spending undertaken by government with the explicit aim of either stimulating or contracting the overall level of demand in the economy to promote economic stability and full employment. Expansionary fiscal policy: decrease in tax and/or an increase in government spending aimed at increasing the level of aggregate demand to close a recessionary gap and move an economy towards its full-employment level of output. Contractionary fiscal policy: increase in tax and/or a decrease in government spending aimed at decreasing the level of aggregate demand to close the inflationary gap and move the economy towards its full-employement level of output and price stability. Multiplier effect: any change in government spending will have a larger ultimate effect on the nation’s GDP as the resulting change in household income leads to further changes in consumption and investment in the economy Size depends on the government spending multiplier (k), which is a function of the nation’s marginal propensity to consume o k = 1/(1-MPC) MPC = ∆C/∆Y Marginal propensity to tax (MPT) Marginal propensity to save (MPS) Marginal propensity to import (MPM) MRL = MPS + MPT + MPM MRL + MPC = MRL Setting an accurate value for the spending multiplier would help the government because it would be able to know how much needs to be injected to produce the desired effect. Not knowing the spending multiplier would b) Evaluate the view that a tax cut is more effective at stimulating aggregate demand than an increase in government spending. Although tax cuts could be the politically more desirable policy to undertake, in terms of economics government spending is likely to be more effective. The reason for this is that government spending is a direct injection into the economy, whereas a tax cut is an indirect injection that allows for households to decide how much of their increase income they are going to put back into the economy. Instead of using their increased salary to consume additional products, households could choose to save and spend on imports (which don’t contribute to the nation’s real GDP). For example, if the households in a nation had a marginal propensity to spend of 0.5, 50% of the increased income would not have been saved. This means that only half of the money the government indirectly injected through tax cuts would actually help the economy. The other 50% would be leakages. On the other hand, if the government directly injected it into the economy through government spending, the full amount that they injected would have an effect on the economy. Although the same amount of money might be spent on both government spending and in tax cuts, more could be done with the former. Because the governments need to borrow money in order to be able to carry out both policies, it would be economically better for them to choose to make government subsidies (instead of making tax cuts). However, using the expansionary policy also has its negative consequences on the rest of the economy due to the crowding-out effect. The crowding-out effect refers to the effect on private consumption and investment of a deficit-financed increase in government spending that leads to an increase in interest rates. Although the fiscal stimulus may shift the aggregate demand to the right, the increases in interest rates could results in decreases in investment and consumption that shift the AD back to the left. 2) a) What macroeconomic policies would a government adopt if it wished to reduce aggregate demand in an economy? Demand-side policies: macroeconomic policies of government aimed at stimulating/reducing the overall level of AD to promote the short-run achievement of the three macroeconomic objectives of full employment, price stability, and economic growth. b) Should a government attempt to manage the level of aggregate demand to influence unemployment and inflation rates? 3) a) Explain why an increase in government spending not accompanied by an inrease in taxes may lead to a fall in private sector investment. b) Evaluate the likelihood that this will happen during a demand-deficient recession. 4) a) What are the main macroeconomic objectives of government? b) Assume the government chooses to pursue one of these objectives. Evaluate the possible consequences for the other objectives. «Chapter 18» Monetary Policy 1) a) List and explain the three methods or tools used by central banks to control the money supply. Money: any object/record that is widely accepted as payment for goods and services. Central bank: monetary authority of a country Issues currency Manages money supply o Combined value of the currency and demand deposits of a country Controls interest rates Three methods: Changing the discount rate o Discount rate: rate that the central banks charge when giving loans to big commercial banks o Lower discount rate = banks can increase money supply and lower interest rates Buying or selling bonds o Expansionary monetary policy: central bank buys bonds, so the supply of money increases. Because the commercial banks have more money in their excess reserves, they are able to lower the interest rates. This increases the consumption and investments made in the economy. o Contractionary monetary policy: central bank sells bonds, so the supply of money decreases. Because the commercial banks have less money in their excess reserves, they raise the interest rates. This decreases the consumption and investments made in the economy. Changing the reserve requirement. o Reserve requirement: percentage of deposits that banks are required to have at all times o If the reserve requirement is raised, then banks have less funds available to loan out. This leads to an increase in interest rates and a consequent decrease in consumption and investment. o If the reserve requirement is lowered, then banks have more funds available to loan out. This leads to a decrease in interest rates and a consequent increase in consumption and investment. b) Assess the effectiveness of monetary policy in fighting a recession. Monetary policy has both its strengths and weaknesses in fighting a recession. Strengths include speed, control, lack of politics, and no crowding-out effect. Because the central bank doesn’t need agreement by legislators, policy decisions can be carried out relatively quickly. This is important because the policy needs to be put into effect while the recession is still existent. The central bank also has more control; unlike in the fiscal policy, the interest rate can be adjusted more exactly to what the economy needs. Because the central banks don’t need to be voted in, they can focus on economic efficiency instead of having to appease the public. This allows their policies to be more effective. Finally, because the interest rate is lowered in order to stimulate the aggregate demand (instead of government injections like in the fiscal policy), there is no risk of the crowding-out effect. However, there are also weaknesses, including investors reluctant to borrow, time lags, and change in elasticity of demand for investment. If firms and individuals have little confidence in the recession (which is very likely to happen), then they are not likely to make loans, regardless of a low interest rate. Furthermore, the effect of the monetary may take some time to show results (even if the implementation itself is immediate). Lastly, the elasticity in the demand for investment could also affect the potence of the decrease in interest rates. If the demand was more elastic, then it would lead to a relatively large increase in investment; however, if the demand was more inelastic, then it would lead to a relatively insignificant change in investment. 2) a) Using appropriate diagrams, show how the central bank may fight inflation. b) Evaluate the effectiveness of monetary policy in managing inflation. 3) a) Analyse the methods by which the central bank might decrease the money supply. b) Discuss the likely impact on the economy of a substantial decrease in the level of interest rates. «Chapter 19» Supply-side Policies 1) Using an appropriate diagram(s), explain how supply-side policies are expected to affect national income. Supply-side policies: combination of government-led and free market policies designed to increase the productive capacity of the country. 2) Distinguish between market-based supply policies and interventionist policies. Market-based supply-side policies: are intended to reduce government intervention thereby allowing the free market to increase efficiency and improve incentives. Types Policies to encourage competition Labour market reforms Incentive-related policies Interventionist supply-side policies: government-led attempts to increase the productive capacity of the country. Types Invesmentment in human capital Investment in new technology Investment in infrastructure Industrial policies By using supply-side policies to shift the long-run aggregate supply (LRAS) to the right, the government is able to increase the economy’s overall productive capacity. This incr 3) a) Explain two possible supply-side factors that may cause an increase in the level of unemployment. Reducing government intervention in order to let the market become more efficient would most likely lead to an increase in the level of unemployment because it would force the firms that were previously dependent on government support to survive on their own. In order to be efficient, they would need to minimize costs while maximizing revenue, and laying off unnecessary workers would be one of the first steps. b) Evaluate the view that demand-side policies are more effective than supply-side policies in reducing the level of unemployment. 4) a) Explain the difference between demand-side and supply-side economic policies. b) ‘Higher economic growth can only be achieved through the implementation of supply-side policies.’ Discuss.