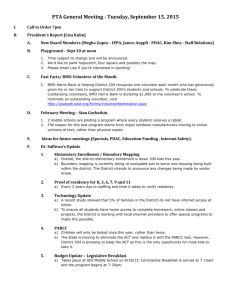

Economic and Financial Market Prospects

advertisement

0 Economic and Financial Market Prospects Earl Sweet Economic Research BMO Capital Markets CASF Conference 2015 November 18, 2015 Economics Department 1 Presentation outline Global economic performance and risks Canada’s macroeconomic prospects Motor Vehicles, Construction, and Oil & Gas Fabricated Metals & Steel Services Surface Finishing 2 Sub-par global growth since 2011; modest improvement anticipated for 2016, though risks skewed to downside Global Economic Growth (%) 8 6 Emerging Markets Global Economy 4 2 0 -2 Advanced Economies -4 2009 Source: IMF; BMO Economics 2010 2011 2012 2013 2014 2015 2016 3 Global risks – good time to play defence China hard-landing & financial crisis Emerging-market crisis as U.S. raises rates Disinflation morphs to outright deflation Re-ignition of European stresses Geopolitical stresses intensify (no shortage): Middle East & North Africa Russia/Ukraine China vs. neighbours and U.S. in the South China Sea 4 Weak global growth has caused BMO’s Oil & Gas and Base Metals indexes to retreat sharply from 2011 peaks BMO Commodity Price Indexes Index, 2003=100 400 350 Oil & Gas Base Metals 300 250 200 150 100 50 0 05:1 Source: BMO Economics 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 5 Demand and supply responses will re-balance the global oil market, though progress will be slow Crude Oil Prices $/Barrel 120 100 80 60 40 20 0 09:1 10:1 11:1 12:1 WTI in US$ Source: Bloomberg; Wall Street Journal; BMO Economics 13:1 14:1 15:1 WCS in US$ 16:1 6 U.S. production of crude oil has topped out and begun to decline, while consumption is edging upward U.S. Oil Market Million Barrels per Day 10 22 9 20 8 18 7 16 6 14 5 12 4 10 3 91:1 93:1 95:1 97:1 99:1 01:1 03:1 05:1 07:1 09:1 11:1 13:1 15:1 8 Crude Oil Production (LHS) Source: U.S. Department of Energy Oil Product Consumption (RHS) 7 While U.S. total crude oil imports are falling sharply, there is rising refinery demand for Canadian heavy oil U.S. Imports of Crude Oil Million Barrels per Day 9 8 7 6 5 4 3 2 1 0 85 87 89 91 93 95 97 From Canada Source: U.S. Department of Energy 99 01 03 05 07 09 11 From Rest of World 13 15 8 Not so for natural gas – U.S. is becoming self sufficient; long-term health of Canadian industry depends on LNG Natural Gas Production & Net Exports: Canada Billions of Cubic Feet Per Day 18 16 14 12 10 8 6 4 2 0 05 06 07 08 09 10 Production (LHS) Source: National Energy Board; U.S. Department of Energy 11 12 13 Net Exports 14 15 9 While natural resource output is steady at about 10% of GDP, its contribution to exports and investment is much higher Natural Resource Share of the Economy (%) 40 Investment 35 30 Exports 25 20 15 Output 10 5 0 06 Source: Statistics Canada 07 08 09 10 11 12 13 14 15 10 Business Investment: important driver of demand for metals Oil & gas industry – down sharply, delayed recovery Pipe Equipment Commercial construction – momentum waning Rising office vacancies Reality check for U.S. retail entrants 11 Oil & gas industry investment has plunged 40% in 2015; continued weak prices in 2016 to limit any recovery Investment: Oil & Gas Extraction $ Billions 80 70 60 50 40 30 20 10 0 06 Source: Statistics Canada 07 08 09 10 11 12 13 14 15 est. 12 Considerable new office space coming onto market and weak resource industry are boosting vacancy rates Vacancy Rates (%): Office Properties (All Classes) 18 16 14 12 10 8 6 4 2 0 01:1 02:1 03:1 04:1 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 Montreal Source: CBRE Toronto Calgary Vancouver 13 Diverging trends for industry profits: weak oil & gas; steady manufacturing returns Canadian Industry Performance: ROE 21 18 15 12 9 6 3 0 -3 -6 05:1 06:1 07:1 08:1 09:1 10:1 Manufacturing Source: Statistics Canada 11:1 12:1 13:1 14:1 Oil & Gas 15:1 14 Business has slashed capex in response to falling resource cash flows, rising commercial vacancies, and global risks Business Investment in Canada % Change From Year Ago 20 15 10 5 0 -5 -10 -15 -20 -25 06 07 08 09 10 Machinery & Equipment Source: Statistics Canada; BMO Economics 11 12 13 14 15 16 Non-residential Construction 15 Household demand: also an important driver of demand for metals Motor Vehicle OEM & Parts Production Strong North American sales Slipping Canadian share of North American market Household Durables Near peak demand, some slippage as housing market cools from its current unsustainable pace 16 Canadian household debt ratio is edging upward, but is not egregiously high Household + Unincorporated Business Liabililties % of Personal Disposable Income 325 300 275 250 225 200 175 150 125 100 75 99:1 01:1 Canada 03:1 U.S. 05:1 07:1 Australia Source: Bank of Canada; Statistics Canada; Federal Reserve; Dept. of Commerce; Haver 09:1 11:1 Norway 13:1 15:1 Denmark 17 Sharp U.S. household deleveraging 2/3 by default; Canadian ratio still above pre-GFC level low rates Household Debt as a Per Cent of Net Worth 35 30 25 20 15 10 97:1 99:1 01:1 03:1 Canada 05:1 07:1 09:1 11:1 United States Source: Bank of Canada; Statistics Canada; Federal Reserve; Dept. of Commerce 13:1 15:1 18 Canada’s jobless rate essentially flat near 7% since early 2013; weak resource prices restraining growth … Unemployment Rate (%) 10 9 8 7 6 5 4 3 03:1 05:1 Canada 07:1 09:1 11:1 Canada on US Basis Source: Statistics Canada; U.S. Dept. of Labor; BMO Economics 13:1 15:1 United States 19 … and a lower rate of labour force drop-outs contribute to the higher Canadian jobless rate Labour Force Participation Rate % of Adult Population in the Labour Force 68 67 66 65 64 63 62 03:1 05:1 07:1 Canada Source: Statistics Canada; U.S. Dept. of Labor 09:1 11:1 13:1 United States 15:1 20 A higher percentage of Canada’s adult labour force is employed Employment Rate % of Adult Population Employed 65 64 63 62 61 60 59 58 57 56 55 03:1 05:1 07:1 Canada Source: Statistics Canada; U.S. Dept. of Labor 09:1 11:1 13:1 United States 15:1 21 House prices are running around 12% above trend; mostly in Vancouver and GTA single-family detached Average Price for Resale Homes: Canada $ Thousands, SA 500 450 12% Gap 400 350 300 250 200 150 100 50 0 80:1 85:1 Source: CREA MLS; BMO Economics 90:1 95:1 00:1 05:1 10:1 15:1 22 Potential problem? Building boom three years ago has brought a lot of condos to the GTA market in 2015 Total New & Unabsorbed Housing Units: Toronto Per Million Persons 600 500 400 L.T. Avg. 300 200 100 0 97:1 99:1 01:1 03:1 Source: CMHC; Statistics Canada; BMO Economics 05:1 07:1 09:1 11:1 13:1 15:1 23 GTA housing pipeline had been correcting toward trend, but has upshifted since mid-year: Risk: rising supply meets slowing demand during 2016-2018 Housing Units Under Construction: Toronto Per Million Persons 16000 14000 12000 10000 Trend 8000 6000 4000 2000 0 04:1 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 Condos Source: CMHC; Statistics Canada; BMO Economics Other Total 24 Housing starts in Canada expected to run near demographic requirement; U.S. recovery at measured pace Housing Starts Millions of Units 0.25 2.5 0.20 2.0 0.15 Demographic Requirement 1.5 0.10 1.0 0.05 0.5 0.00 0.0 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 16:1 Canada -- LHS Source: CMHC; U.S. Census Bureau; BMO Economics United States -- RHS 25 Mortgage quality still rock solid in Canada despite dire warnings from headline writers Mortgages 90+ days in Arrears % of Total Mortgages 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 95:1 97:1 99:1 01:1 Canada 03:1 05:1 Alberta 07:1 09:1 11:1 13:1 United States Source: Canadian Bankers Association; U.S. Mortgage Bankers Association 15:1 26 Equity in Canadian households’ real estate has held remarkably steady near 70% for 25 years Household Residential Equity % of Value of Residential Property 75 70 65 60 55 50 45 40 35 30 90:1 92:1 94:1 96:1 98:1 00:1 02:1 04:1 06:1 08:1 10:1 12:1 14:1 Canada Source: CMHC; U.S. Census Bureau; BMO Economics United States 27 North American motor vehicle sales spurred by rising employment and very low borrowing costs Motor Vehicle Sales Million Units 2.0 20 1.8 18 1.6 16 1.4 14 1.2 12 1.0 10 0.8 8 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 16:1 Canada -- LHS Source: Statistics Canada; Autodata; BMO Economics United States -- RHS 28 Imports of vehicles and parts have surpassed pre-recession peak by 22%; exports rising, but constrained by capacity Motor Vehicle and Parts Trade $ Billions, Monthly 30 25 20 15 10 5 0 91:1 93:1 95:1 97:1 99:1 01:1 03:1 05:1 07:1 09:1 11:1 13:1 15:1 Exports Source: Statistics Canada Imports 29 Challenging markets for the Oil & Gas, Construction, and Transportation Equipment industries are restraining demand for and output of fabricated metals and steel services Metal Surface Finishing Markets Real GDP: Billions of 2007 Dollars 18 1.8 16 1.6 14 1.4 12 1.2 10 1.0 8 0.8 6 0.6 4 0.4 97:1 99:1 01:1 03:1 05:1 Fabricated Metals Source: Statistics Canada 07:1 09:1 11:1 13:1 Steel Service Centres 15:1 30 Metal coating, heating, & engraving have fallen as a per cent of fabricated metals shipments since 2003 … Metal Surface Finishing Shipments % of Fabricated Metal Shipments 14 12 10 Long-run Average = 8.4% 8 6 4 2 0 95:1 97:1 99:1 01:1 03:1 05:1 07:1 09:1 11:1 13:1 15:1 Source: Statistics Canada 31 … in part, reflecting a more challenging pricing environment for surface finishers Industry Selling Prices Indexes, 2003=100 135 130 125 120 115 110 105 100 95 90 03:1 04:1 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 Metal Surfacing Source: Statistics Canada Fabricated Metals 32 On the plus side, the lower loonie should act as a tail-wind for the trade-intensive Canadian economy … Canadian Dollar US Cents 105 100 95 90 85 80 75 70 65 60 00:1 02:1 04:1 Source: Bank of Canada; BMO Economics 06:1 08:1 10:1 12:1 14:1 16:1 33 … and non-energy exports have already begun to respond Non-Energy Exports $ Billions 120 100 80 60 40 20 0 93:1 Source: Statistics Canada 95:1 97:1 99:1 01:1 03:1 05:1 07:1 09:1 11:1 13:1 15:1 34 Another positive: even small steps taken to close the large infrastructure gap would boost economic growth Government Real Capital Stock Thousands of 2007 Dollars Per Capita 24 22 Infrastructure Deficit = $180b 1971-1994 Trend Extrapolated Trend Growth = 1.8% 20 18 16 14 12 10 8 6 61 65 69 73 Source: Statistics Canada; BMO Economics 77 81 85 89 93 97 01 05 09 13 35 Canadian growth to strengthen to 2.1% in 2016, supported by robust U.S. demand and the low loonie Real GDP Growth (%) 4 3 2 1 0 -1 -2 -3 05 06 07 08 09 Canada 10 11 12 13 United States Source: Statistics Canada; Bureau of Economic Analysis; BMO Economics 14 15 16 36 Resource-rich provinces will face challenging conditions; momentum improving in manf-oriented Central Canada Economic Growth by Province (%) 5 4 3 2 1 0 -1 B.C Alb Sask 2014 Source: Statistics Canada; BMO Economics Man 2015 Ont Que 2016 Atl 37 Fed expected to go in December; global risks expected to keep BoC on hold until early-2017 Monetary Policy Rates (%) 6 5 4 3 2 1 0 04:1 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 16:1 BoC Overnight Source: Bank of Canada; Federal Reserve Board; BMO Economics Fed Funds Target 38 Modest policy tightening, overseas QE, and slowing potential growth to restrain the increase in LT yields 10-Year GoC/Treasury Rates (%) 6 5 4 3 2 1 0 04:1 05:1 06:1 07:1 08:1 09:1 10:1 11:1 12:1 13:1 14:1 15:1 16:1 GoC 10-Year Source: Bank of Canada; Federal Reserve Board; BMO Economics 10-Year Treasury 39 Upside surprises for the industry? A positive LNG Final Investment Decision Would boost natural gas E&P and pipeline development Accelerated infrastructure investment Faster-than-expected recovery in oil prices