Corporation Finance FI 3300 * Fall 2010

Instructor - Ryan Williams

My information

Ryan Williams

Email: rwilliams83@gsu.edu

Website: myrobinson.gsu.edu, Ulearn, http://www.ryanwilliams7.com

Office location: RCB #1217, 12 th floor.

Office phone: 404-413-7316

OFFICE HOURS: Mondays at 2:00-4:00 pm or by appointment. (may be late because of traffic).

Today’s Agenda

Quick summary of syllabus

Discussion of course

My expectations

Math Skills

Chapter 1 - Introduction

Chapter 2 – Income Statement and Balance Sheet

Syllabus – Important Highlights

Attendance policy – Department-wide!

On this – you are allowed to miss two weeks of class.

That means only TWO classes.

I reserve the right to pass the attendance sheet at any point in time.

Exam 1 – 9/27/2010

Exam 2 – 11/1/2010

Final Exam – 12/11/2010 at 3:45-6:15

Grading Policy

Two midterms: 25% each

One Final Exam: 40%

Quizzes: 6%

Resume: 2%

Problem Set: 2%

We will have 5 quizzes and I will drop the lowest 2. If you miss a class you will receive a 0% for the quiz.

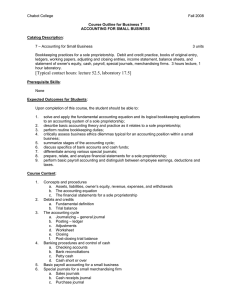

Texts

Main text: “Lectures in Corporate

Finance”, 5 th ed., by Jayant Kale and

Richard Fendler.

Optional: 12-week subscription to

The Economist, cheap student rates. Go to http://www.economistacademic.co

m and use Faculty ID code 6105.

Calculator

Texas Instruments BA II Plus

HP also makes a version

Can use NO calculator with a memory

We have used calculators available for $20. First come, first serve. Contact Prof. Genna Brown gbrown@gsu.edu

Course Outline

Split into 3 sections:

1) Blending Accounting and Finance

Financial Statements, F.S. Analysis, Fin. Mngt

2) Valuation from an Investor’s point of view

Time value of money, valuing stocks, valuing bonds

3) Valuation from a CFO’s point of view

Capital Budgeting

Classroom rules

Cellphones OFF – If your phone rings, I get to answer it. (Also true for me).

No texting. If I see you texting you will be asked to solve a problem on the board.

I prefer no laptops. However, if you take notes on the laptop, please sit near the back of the classroom so you do not distract students behind you.

Final words of wisdom

This class is hard, however:

You may have heard the class requires a lot of math formulas, but everything is based on ONE FORMULA

– not much memorization

This class rewards thinking, not arithmetic.

Math Test

Why are you here?

3.

4.

5.

Learning Objectives

1.

2.

Identify the three main subject areas in finance

Know the different forms of business organization and discuss the agency problem

Define the goal of corporate financial management

Compare/contrast finance and accounting

Understand how cash affects value

Why is finance important?

A horrible product (usually) dooms a business.

A great product is not enough - horrible financial management coupled with a great product (usually) also dooms a business.

3 subfields of finance

Financial markets and institutions (or Banking) =

Middleman

Investments = Surplus (they invest money in stock, bonds, and savings accounts)

Corporate Financial Management (or Corporate Finance)

= Deficit (they take money from investors and buy stuff)

*Identifying, managing, and valuing risky cash flows is the goal of finance*

Basic forms of Business

Organization

Sole proprietorship

Partnership

Corporation

Advantages/Disadvantages?

Ownership structures

Type Ownership Ability to Raise

Capital

Liability

Sole

Proprietorship

• 100% owned by a single individual

• Owner usually manages company

Partnership Two or more individuals

Difficult Unlimited personal liability

Less difficult than Sole

Proprietorship

Similar to Sole

Proprietorship

Corporation Typical separation of owners and managers

The least difficult of all forms

Limited to owner’s initial investment

Also taxation and liquidity differences

Agency Problem

Getting the agent (the person running the business) to act in the interest of the principal (the shareholders who own the business).

Financial manager’s goal

Maximize value of the firm.

Same as maximizing stock price.

NOT the same as “maximizing profits”. Why not?

She accomplishes this goal by two basic decisions:

How to get money (raise capital), and what to do with it (real investment).

Accounting and Finance

Accounting USUALLY deals in Book Value (i.e. cost)

Finance USUALLY deals with Market Value (what someone would pay you for it today).

Accounting is historical data (annual reports, 10-K filings, etc).

Finance attempts to project future data – BUT YOU NEED

TO UNDERSTAND ACCOUNTING TO DO THIS

Cash and Value

Value = all future expected cash flows discounted by their riskiness (we will slightly refine this definition later).

CASH is the only thing that matters here!

This may seem counterintuitive right now, but should be more clear when we look at Stock Valuation in

Chapter 9.

Class Summary – Why should you care?

After the introductory accounting chapters, this entire class is associated with VALUE.

Specifically, how to value a bond, a stock, or a new project for a company.

Next Monday:

You owe me:

Resume, upload picture to MyRobinson

Prepare for Quiz 1: Introduction, Income Statement and Balance Sheet