Date of exam: June 17, 2011

advertisement

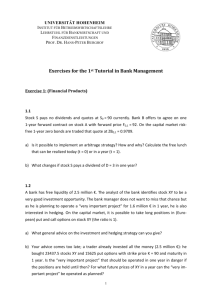

FIXED INCOME SECURITIES Sitting: 1 Date of exam: June 17, 2011 Time: 2.00 PM Duration: 4 hours READ THESE INSTRUCTIONS FIRST 1. The exam takes place in a computer room where computers have internet connection. You can prepare your answers to the questions asked on these computers or on your own laptop if you prefer to do so. 2. As explained before, time pressure is real during the exam. The exam schedule is as follows: 1.45pm: Students enter the exam room, student ID’s are checked. 1.55pm: Students ready for exam, computers logged on. 2.00pm: Students receive multiple choice questions. 2.30pm: Deadline for handing in multiple choice questions and receiving open questions. 3.00pm: Deadline for handing in open questions and receiving a problem set. 5.55pm: Students finalise their work on the problem set in a single Excel-sheet. 6.00pm: End of exam. 3. You are allowed to use all means at your disposition during the exam, the only condition being that you do not communicate with any other person inside or outside the exam room, i.e. your exam must be an individual effort. If you break this rule your exam will be voided. 4. Mobile phones should be switched off and must not be kept on the desk at any time. 5. Take into account that no two students have identical question sets. Minor and major, subtle and less subtle, obvious and not so obvious differences between exam sets will make any attempt to exchange answers or answer sets traceable. Although question sets are non-identical they are equivalent. 6. You will receive - in the order explained above - the following question sets: Four multiple questions with five alternatives: i. Each correct answer is worth one point (out of twenty). There is no correction for guessing. ii. Clearly indicate the alternative of your choice with an arrow pointing at the alternative. iii. Only one of the alternatives is correct. Two open questions: iv. Each correct answer is worth two points (out of twenty). v. The answer to an open question is a structured and original text. It is not merely a reference to or a copy of one or a number of slides. A problem set consisting of three problems: vi. The total weight of the problem set is seven points (out of twenty). The value of each correctly solved problem is indicated in the problem set. vii. Write your answers to the problems in the reserved area on the problem set pages. viii. A numerically correct answer to the exercises is a priori considered 100% correct. In order to prevent fraud you must show in detail how you obtained these answers. Do this by mailing your self made solution file named “your full name.xls” or “your full name.xlsx” to bart.vinck@hubrussel.be before 6.00pm today (and before leaving the exam room). ix. Avoid disaster and save your intermediate results regularly. x. Do not round off intermediate results. 7. All paper used during the exam must be handed in before leaving the exam room. GOOD LUCK! 11 NAME & STUDENT NUMBER: (IN FULL, USE PRINT WRITING) MULTIPLE CHOICE QUESTIONS (4 points) The four questions underneath are multiple choice questions. Indicate your choice by an arrow () in front of the option of your choice. No points will be subtracted for a wrong answer. Only one of the alternatives is 100% correct. MPC 11 (1 point) In a CMO-structure with a floating rate tranche (FR) and an inverse floating rate tranche (IFR), the interest rate conditions for both tranches are set in such a way that a. the total interest paid to the FR tranche is equal to the total interest paid to the IFR tranche. b. the interest “saved” on other tranches is equally spread over the FR and IFR tranches. c. an investor would a priori be indifferent to investing in the FR tranche compared to the IFR tranche. d. the interest paid to the FR in excess of the reference rate is covered by the prepayments to the IFR tranche. e. it is possible to obtain a fixed coupon payment by combining adequate proportions of the FR tranche and the IFR tranche. MPC 14 (1 point) If the surplus (modified) duration of a financial institution is positive, a. it benefits from rising interest rates only when the leverage is sufficiently low. b. it can benefit from falling interest rates only when the duration gap is substantially different from zero. c. it benefits from falling interest rates only when the leverage is sufficiently high. d. it can benefit from rising as well as from falling interest rates, depending on leverage. e. it runs into trouble if the duration gap is too high. MPC 06 (1 point) In a fixed for floating interest rate swap, the fixed rate payer a. benefits more from volatility in interest rates than the floating rate payer. b. takes a prudent position because paying fixed rates is less risky than paying floating rates. c. in normal circumstances has a comparative advantage on floating rate borrowing compared to his counterparty. d. runs less reinvestment risk than the floating rate payer. e. cannot make a profit unless the floating rate payer makes a loss. MPC 20 (1 point) An essential difference between the mean reverting model and the arbitrage free model lies in the fact that: a. the mean reverting model is not arbitrage free, the arbitrage free model is. b. the jump probabilities in the mean reverting model are constant throughout the tree, in the arbitrage free model they aren’t. c. the mean reverting model uses the principle of backward induction, the arbitrage free model doesn't. d. the mean reverting model is stochastic, the arbitrage free model is deterministic. e. spot curves produced by the mean reverting model are unrealistic, those produced by the arbitrage free model are realistic. 11 NAME & STUDENT NUMBER: (IN FULL, USE PRINT WRITING) HOME WORKS (5 points) Please leave this section blank: I : ………………… II : …………………… OPEN QUESTIONS (4 points) Please do NOT use numerical examples to make your point. OQ 18 (2 points) Can binomial models ever be arbitrage free? And mean reverting models? http://www.macs.hw.ac.uk/~andrewc/papers/ajgc33.pdf It depends a bit on how you interprete arbitrage-free and what the framework is you are working in. In principle, both models are arbitrage free; they are even no-arbitrage models. They behave that way ‘by definition’: when setting up the model, you calibrate it to market data. This initial calibration to observed prices makes that there is no arbitrage opportunity at the outset. However, if you use e.g. the one-factor binomial tree model, you only have 3 variables to play with. When you want to match 4 bonds (4 ‘observations in the market’), you cannot perfectly match those, giving rise to arbitrage opportunities. The same holds for the mean reverting tree model, although you have one extra variable there (so you can ‘perfectly’ match 4 observations, but not 5). More complex models with more variables allow you to match more observations. But then, this is only at the start. The next day, when rates change, you would need to recalibrate the model. Since there are many factors influencing the price of bonds in the market (...), reality will overtake the model (eventually), creating (theoretic?) arbitrage opportunities – or the need to recalibrate your model frequently. OQ 11 (2 points) What is wrong with using the simple yield to maturity concept in order to determine the relative value of different bonds? (How) is the problem solved? The bond yield is an endogeneous instrument: Price and yield are related to the same instrument (from the same issuer): n P c (1 y ) t (1 y ) n t 1 This is of course not ideal if you want to compare different bonds (different maturities). Therefore we would need a more exogeneous expression that takes into account the ‘price’/’yield’ of other (though similar) bonds in the market. This is done by following formula: n n t 1 t 1 P c (1 rt ) t (1 rn ) n c d t d n In this case, the price takes into account the spot rates / spot rate curve based on the different instruments in the market (via bootstrapping, estimations, ...). It shows that a change eg in the spot rate of a bond with a lower or higher maturity (can) also effect the price of another bond. Looking at the formula, it is clear this is most important for coupon bonds – or zero bonds which are not held to maturity. If you buy a zero bond and hold it until maturity, the 11 NAME & STUDENT NUMBER: (IN FULL, USE PRINT WRITING) PROBLEM SET (7 points) BP 11 (3 points) Today is June 17, 2011. Consider the portfolio of option free straight bullet bonds underneath. number nominal 1 € 50,000 2 € 35,000 3 € 40,000 4 € 70,000 5 € 65,000 maturity next coupon 21/02/201 21/02/2012 3 25/11/201 25/11/2011 5 25/07/201 25/07/2011 8 07/05/202 07/05/2012 0 14/09/202 14/09/2011 2 coupon price rate 5.375% 104.46 7.500% 114.77 5.125% 108.86 5.750% 113.91 5.000% 102.46 All bonds are denominated in euro, pay annual coupons and are redeemed at par. a. (1 point) Compute market value, yield to maturity, modified duration and convexity of this portfolio. market value yield to maturity modified duration convexity Consider the following government bonds number maturity A B next coupon 28/09/201 28/09/2011 2 28/03/202 28/03/2012 6 coupon price rate 5.000% 108.86 4.500% 100.25 b. (2 points) Use these two bonds to construct a duration and convexity hedge for the bond portfolio. nominal position in A nominal position in B MI 11 (2 points) Consider the portfolio of liabilities underneath. number size 1 € 60,000 2 3 due two years from now € 25,000 three years from now € 80,000 four years from now promised yield 1.75% 2.50% 2.75% Consider the following zero bonds available in the market. number A B C maturity 18 months 42 months 60 months YTM 1.500% 2.600% 3.200% Immunise the portfolio of liabilities using the zero bonds. Do this in such a way that the initial profit of the financial institution is maximal but without creating net short positions. nominal position in A nominal position in B nominal position in C net profit for the financial institution TS 10 (2 points) Use a mean reverting interest rate tree (0r1 = 3.50%, = 3.5%, = 0.75%, k = 2) to compute the price of a risk free instrument with the following pay off structure: o 10 at time 1 if the spot rate is between 2% and 5%, and 0 otherwise, o 10 at time 2 if the spot rate is between 2% and 5%, and 0 otherwise, o 11 at time 3 if the spot rate is between 2% and 5%, and 0 otherwise, o 112 at time 4 if the spot rate is between 2% and 5%, and 100 otherwise. price of the instrument