Political Campaign Activity by Nonprofit Organizations

advertisement

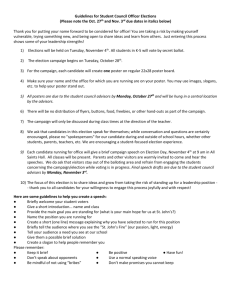

Political Campaign Activity by Nonprofit Organizations Do’s and Don'ts By: Clifford Perlman Perlman & Perlman, LLP 41 Madison Avenue, Suite 4000 New York, NY 10010 Ph: 212-889-0575 Fx: 212-748-8120 Email: cliff@perlmanandperlman.com Scope of Rules 501(c)(3) provides federal tax exemption to a charitable organization Section so long as it: – “does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office.” These rules apply to all of your organization’s political activities from a presidential election to local school board elections. 2 The Statutes Federal tax law - means those federal laws, regulations and rulings under the Internal Revenue Code ("IRC") of 1986, as amended, that pertain to a nonprofit organization's tax-exempt status. Federal election law - means those federal laws, regulations and rulings under the Federal Election Campaign Act ("FECA") of 1971, as amended, which govern nonprofits' participation in campaigns for federal office. The term "election law" includes federal, state and local law relating to the financing and conduct of elections. 3 Scope of Prohibitions The prohibition also includes: - third-party movements - efforts to "draft" someone to run - exploratory advance work Code forbids tax-exempt nonprofits from trying to prevent a public official from being re-nominated or re-elected. Code does not bar working for or against the appointment of a public official. 4 Penalties for Violating these Rules The IRS may revoke your tax-exempt status No exception for "de minimis" violations The IRS also can impose a tax on your organization and its managers personally - 10 percent tax on political expenditures of 501(c)(3) groups. - 2% percent tax on 501(c)(3) organization managers who approve such expenditures. (nonprofit managers can be protected from the personal 2% percent tax if they obtain and rely upon - a written, reasonable opinion of legal counsel supporting the organization's right to conduct a particular activity). 5 Issue Advocacy and Express Advocacy as Compared to Political Activity 501(c)(3) organizations can and should use the occasion of an election to get greater exposure for their issues of concern. 501 (c)(3)s may not attempt to intervene surreptitiously in a political campaign by using "code words" such as "conservative", "liberal", "anti-gay" or "pro-choice" in messages timed to improve or diminish the prospects for the election of candidates with whom they agree or disagree. The IRS frowns on 501(c)(3)s encouraging voters to "vote green", "vote pro-life" or "throw out the liberals", considering such forms of expression to be implied advocacy and a form of "political intervention. 6 Criticism of Incumbents If a 501(c)(3) has a record of criticizing incumbents, lobbying them and working to hold them accountable, it may continue those activities during an election year. However, be warned: close to an election, the IRS may view negative comments about someone running for re-election as illegal "intervention" in the campaign. 7 Endorsements Individuals associated with 501(c)(3) organizations are free to endorse, support or oppose candidates, so long as it is clear that they speak for themselves and not on behalf of an organization and so long as they do not in any way utilize the organization's financial resources, facilities or personnel, and clearly and unambiguously indicate that the actions taken or statements made are those of the individuals and not of the organization. 8 Candidate Appearances A 501(c)(3) may sponsor an appearance by a candidate or public official, but proceed cautiously. If he or she was invited as a candidate, you must take steps to ensure that you indicate no support of or opposition to the candidate at the event. No political fundraising should occur at the event, and the other candidates should be given an equal opportunity to participate, either at the same event or a comparable one. If you invited the person in a capacity other than candidate, you don't need to invite the opposition, but do everything you can to make sure that the event does not turn into a campaign appearance. 9 Other Issues Voter registration and get-out-the-vote (GOTV) Candidate questionnaires and voter guides Candidate debates and forums Issue briefings for candidates 10 Public opinion polls Contributions - Again 11 501(c)(3) organizations may not contribute to a candidate, political action committee (PAC) or political party, pay to attend partisan political dinners and similar events, or provide loans. Other restrictions are less obvious. The IRS considers you to be making "in-kind contributions" when you provide anything of value to a candidate, party or political organization and do not receive fair market value in return, your mailing list, facilities, equipment, staff time or any other resource. For example, the IRS takes the position that you may only rent your mailing list to a candidate or political group if you charge full price, offer the list to other contenders, and report unrelated business taxable income on the transaction. End 12