ECON 1100 * Global Economics (Fall 2007)

advertisement

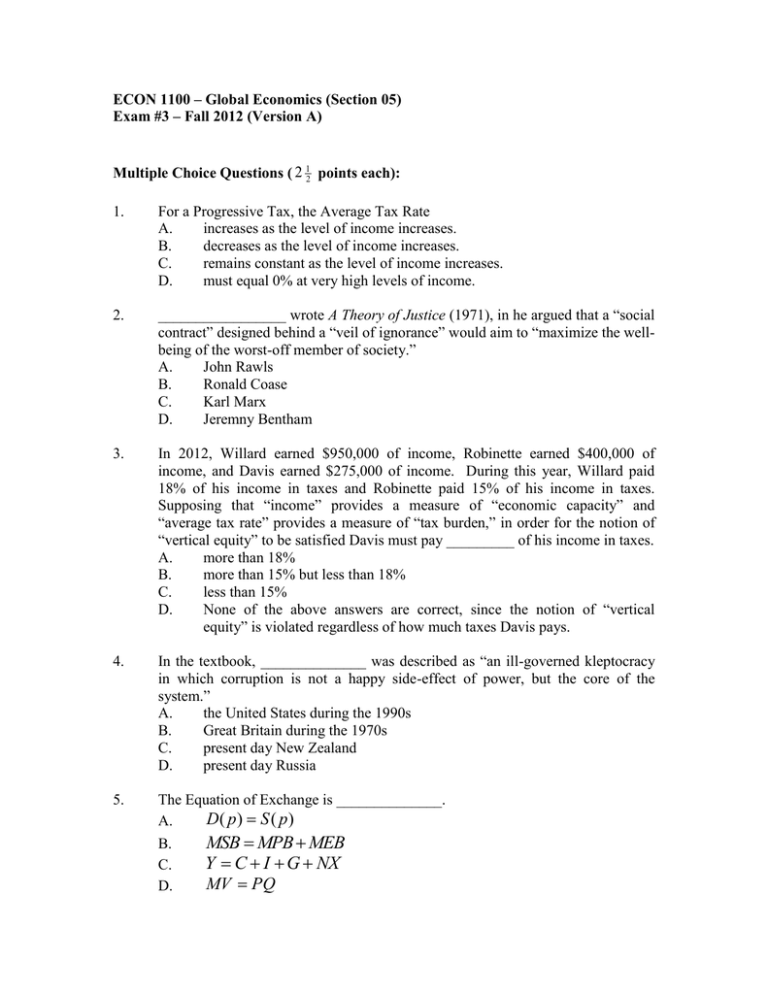

ECON 1100 – Global Economics (Section 05) Exam #3 – Fall 2012 (Version A) Multiple Choice Questions ( 2 12 points each): 1. For a Progressive Tax, the Average Tax Rate A. increases as the level of income increases. B. decreases as the level of income increases. C. remains constant as the level of income increases. D. must equal 0% at very high levels of income. 2. _________________ wrote A Theory of Justice (1971), in he argued that a “social contract” designed behind a “veil of ignorance” would aim to “maximize the wellbeing of the worst-off member of society.” A. John Rawls B. Ronald Coase C. Karl Marx D. Jeremny Bentham 3. In 2012, Willard earned $950,000 of income, Robinette earned $400,000 of income, and Davis earned $275,000 of income. During this year, Willard paid 18% of his income in taxes and Robinette paid 15% of his income in taxes. Supposing that “income” provides a measure of “economic capacity” and “average tax rate” provides a measure of “tax burden,” in order for the notion of “vertical equity” to be satisfied Davis must pay _________ of his income in taxes. A. more than 18% B. more than 15% but less than 18% C. less than 15% D. None of the above answers are correct, since the notion of “vertical equity” is violated regardless of how much taxes Davis pays. 4. In the textbook, ______________ was described as “an ill-governed kleptocracy in which corruption is not a happy side-effect of power, but the core of the system.” A. the United States during the 1990s B. Great Britain during the 1970s C. present day New Zealand D. present day Russia 5. The Equation of Exchange is ______________. D( p) S ( p) A. B. C. D. MSB MPB MEB Y C I G NX MV PQ 6. Consider the following two statements: (1) “Inflation is never caused by changes in the money supply” and (2) “Management of the business cycle should be left to the Federal Reserve; activist fiscal policy should be avoided.” Most economists A. agree with both statements. B. disagree with both statements. C. agree with Statement (1) but not Statement (2). D. agree with Statement (2) but not Statement (1). 7. One of the “7 Determinants of Productivity, Income, and Wealth” is “acquired skills,” which refers to the recognition that differences in income or wealth across individuals can result from differences in A. how hard individuals choose to work. B. the amount of money that individuals acquire as inheritances during their lifetime. C. the natural talents that people are endowed with at birth. D. the skills and experiences that people obtain through education, training, and work experience. For questions 8 through 10, consider the following scenario: The current price for a “10 pack of Slim Jims” is $2.87, at which 40 million units are consumed in the U.S. per year. Mir works as a research economist for a think tank in Washington, D.C. He is concerned that people consume too much of this unhealthy snack. In an attempt to decrease consumption he suggests imposing either: a per unit tax of 50¢ on buyers of “Slim Jims” (“Tax A”) or a per unit tax of 50¢ on sellers of “Slim Jims” (Tax B). 8. If Tax B is imposed, the price paid by buyers with the tax in place would be A. exactly equal to $3.37. B. greater than $2.87 but less than $3.37. C. exactly equal to $2.87. D. greater than $2.37 but less than $2.87. 9. Tax A would generate _________________ of tax revenue for the government. A. less than $20,000,000 B. exactly $20,000,000 C. more than $20,000,000 but less than $114,800,000 D. exactly $114,800,000 10. Comparing the outcome that would result from Tax A to the outcome that would result from Tax B, which of the following statements is correct? A. “Both Tax A and Tax B would decrease consumption; further, the decrease in consumption would be of the same magnitude under either tax.” B. “Tax A would result in a greater decrease in Total Consumers’ Surplus than would Tax B.” C. “Tax B would result in a greater decrease in Total Producers’ Surplus than would Tax A.” D. More than one (perhaps all) of the above answers is correct. 11. The ______________ refers to the periodic but irregular fluctuation in overall macroeconomic activity which occurs over time. A. Stabilization Function of Government B. Business Cycle C. Velocity of Money D. None of the above answers are correct. 12. In the United States, the “highest Marginal Tax Rate” currently imposed under the federal income tax is A. 91%, the highest that the “highest Marginal Tax Rate” has ever been. B. 35%, a “highest Marginal Tax Rate” which is lower than the “highest Marginal Tax Rate” of 39.6% which was in place in 2000 but higher than the “highest Marginal Tax Rate” of 31% which was in place in 1992. C. 17%, since every dollar earned by every worker in the U.S. is taxed by the federal government at a Marginal Rate of 17%. D. 0%, since the Federal Income Tax was abolished by President Obama during his first year in office. 13. The “Incidence of a Tax” refers to A. who bears the burden of the tax in terms of decreased welfare. B. how the value of Average Tax Rate behaves as the income of the taxpayer increases. C. which individual is legally responsible for writing a check to pay the tax. D. None of the above answers are correct. 14. Examining how Real (i.e., inflation adjusted) Household Incomes have changed over time in the U.S., between 1980 and 2007 the household at the 20th Percentile of the income distribution saw its Real Income A. decrease from about $42,217 down to $39,986. B. increase from about $17,590 up to $96,145. C. increase from about $24,916 up to $27,864. D. remain relatively constant at roughly $60,000. 15. The Social Security Payroll tax that is paid by incomes earners in the U.S. is a A. progressive tax. B. proportional tax. C. regressive tax. D. discriminatory tax. 16. The Labor Theory of Value, which states that the value of a commodity depends upon only the amount of labor required to produce the commodity, is most closely associated with the ideas of A. Jeremy Bentham and John Stuart Mill. B. Ludwig von Mises and Friedrich von Hayek. C. Karl Marx. D. Ronald Coase. 17. Monetarists believe that increasing the money supply can potentially increase real output A. in both the long run and the short run. B. in neither the long run nor the short run. C. in the long run but not the short run. D. in the short run but not the long run. 18. ___________________ refers to decreases in private spending that occur following increases in government spending. A. Fiscal Policy B. Utilitarian Justice C. Crowding Out D. A Negative Externality For questions 19 and 20, refer to the graph below, which illustrates the Lorenz Curves in “Country X” and “Country Y” in 2012. Note that the Lorenz Curve for “Country Y” starts out below but eventually intersects and passes above the Lorenz Curve for “County X.” CFI 1 C B “County X” Lorenz Curve A “County Y” Lorenz Curve CFP 0 0 1 19. These curves provide a graphical illustration of A. the degree to which taxation in each country is progressive. B. the length of a typical business cycle within each country. C. the damage caused in each country by pollution and other negative externalities. D. the distribution of income within each country. 20. Suppose (Area A)=(.08), (Area B)=(.19), and (Area C)=(.05). It follows that the value of the Gini-Coefficient is _____ in “Country X” and _____ in “Country Y.” A. (.74); (.77). B. (.48); (.54). C. (.26); (.23). D. (.24); (.27). 21. The reintroduction of the gray wolf into the wilderness of the Western United States during the last several decades A. led to incomes in this region becoming less equal, evidenced by the fact that the value of the Gini-Coefficient in Montana increased from .72 to 1.35 in the decade following the start of these efforts. B. was done by a corrupt government agency and was therefore inefficient. C. illustrates how an approach similar to the “Coasian Solution” to the problem of externalities can help to internalize an externality. D. More than one (perhaps all) of the above answers is correct. 22. Focusing on the “Average Tax Rate” of the “Top 26%-50% of Income Earners,” this figure ____________________ between 1980 and 2000 and then ____________________ between 2000 and 2009. A. increased from 1.85% up to 6.10%; increased further from 6.10% up to 9.28% B. decreased from 11.91% down to 9.28%; decreased further from 9.28% down to 5.56% C. decreased from 24.04% down to 17.93%; increased from 17.93% up to 27.36% D. increased from 12.44% up to 15.19%; decreased from 15.19% down to 7.18% 23. The U.S. economy entered into a recession in December 2007. This recession A. lasted for 5 months, shorter than any other post-World War II recession. B. lasted for 18 months, longer than any other post-World War II recession. C. is still ongoing and will therefore be at least 58 months long (and consequently is certain to be longer than any recession in the entire history of our country). D. None of the above answers are correct (since the U.S. has not actually entered into a recession since October 1988). 24. Suppose that President Obama is concerned that the U.S. economy is not experiencing a sufficiently strong economic recovery. In light of this view, he argues that we should drastically increase government spending in 2013, in an attempt to further stimulate overall macroeconomic activity. This proposal could be described as A. Crowding Out. B. the setting of the discount rate. C. Expansionary Fiscal Policy. D. Expansionary Monetary Policy. 25. The _________________ is the Central Bank of the United States. A. Bank of New York B. Bank of America C. Federal Reserve D. U.S. Congress 26. ________________ refers to the number of times that a typical dollar is used in a transaction in a given year. A. Interest B. The Economic Calculation Problem C. The Velocity of Money D. The Money Supply For Questions 27 through 29, consider a good with Marginal Private Benefits, Marginal Private Costs, Marginal Social Benefits, and Marginal Social Costs as illustrated below. $ 24.00 (Marginal Social Costs) = (Marginal Private Costs) 17.25 c a 12.10 Marginal Social Benefits b d Marginal Private Benefits quantity 0 0 1,950 2,875 3,400 27. Based upon this graph, it appears as if A. the government is imposing a per unit tax on buyers of this good. B. the government is imposing a per unit tax on sellers of this good. C. production/consumption of this good generates a positive externality. D. production/consumption of this good generates a negative externality. 28. If this good were traded in a free market (without any government intervention), _________, although the Social Welfare Maximizing level of trade is _________. A. 0 units would be traded; 1,950 units. B. 1,950 units would be traded; 2,875 units. C. 1,950 units would be traded; 3,400 units. D. 2,875 units would be traded; 1,950 units. 29. At the free market outcome (without any government intervention) there would be a Deadweight-Loss equal to A. “area (a).” B. “area (b).” C. “areas (c).” D. “areas (a)+(b)+(d).” 30. Consider a bank that is currently holding deposits of $200,000,000. If the central bank decreases the reserve requirement from 5% to 4%, then the amount of money that this bank is allowed to loan out will A. increase from $190,000,000 to $192,000,000. B. decrease from $10,000,000 to $8,000,000. C. decrease from $210,000,000 to $208,000,000. D. remain constant at $18,000,000. 31. The “Economic Calculation Problem” posits that A. a system of planning will never be able to achieve efficient outcomes, precisely because under such a system the planners do not have access to the information generated by market transactions. B. in order for economic outcomes to be fair, it is necessary to redistribute wealth through a highly progressive tax structure. C. it is impossible to calculate any measure of income inequality. D. calculating the true economic value of a worker can only be done under a system of planning. 32. _______________ is a welfare program which provides medical care for people in the U.S. with low incomes. A. Temporary Assistance for Needy Families B. Supplemental Security Income C. Medicaid D. Healthcare Stamps 33. Consider a good for which production/consumption generates a “negative externality.” At the free market outcome A. more than the efficient amount of the good is traded. B. less than the efficient amount of the good is traded. C. trade takes place at a price of $0. D. zero units of the good are traded. 34. The __________________ Function of Government refers to attempts by the government to minimize fluctuations in overall macroeconomic activity. A. Allocation B. Distribution C. Stabilization D. Taxation 35. Which of the following is one of the primary policy tools used by a central bank? A. Imposing progressive taxes in order to alter the distribution of income. B. Loaning money to low income home buyers at below market interest rates (in order to make housing “affordable for all”). C. Conducting open-market operations. D. More than one (perhaps all) of the above answers is correct. 36. ____________________ refers to the time that it takes for an enacted policy to have an impact on macroeconomic outcomes. A. A Monetary Lag B. An Implementation Lag C. An Information and Recognition Lag D. A Decision Lag 37. “The General Theory of Employment, Interest and Money” was written by A. Jeremy Bentham and John Stuart Mill B. Milton Friedman and Anna Schwartz C. Ronald Coase D. John Maynard Keynes 38. The notion of ______________equity says that in order for a tax to be “fair,” individuals of greater economic capacity should not have a smaller tax burden. A. diagonal B. fiscal C. horizontal D. vertical 39. Which of the following policies could likely reduce “Deadweight-Loss” in the presence of a negative externality, such as pollution? A. Offer subsidies to consumers, inducing them to purchase more of the good which is generating the negative externality. B. Do nothing (i.e., just let the market allocate the good as is currently the case, with no deliberate government action whatsoever). C. Establish minimum compliance standards for manufacturers in the industry (allowing them to generate only a certain amount of the negative externality). D. More than one (perhaps all) of the above answers is correct 40. _________________ is the process by which a legislator votes to approve one bill in exchange for favorable votes from other members on other bills. A. Regulatory Capture B. Rational Ignorance C. Corruption D. Logrolling (Blank Page)