FULL COST - Binus Repository

advertisement

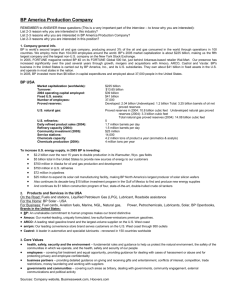

Mata kuliah : F0074 - Akuntansi Keuangan Lanjutan II Tahun : 2010 Corporate Liquidation and Reorganization Pertemuan 25-26 AICPA Accounting Standards Executive Committee Oil and Gas Accounting Background and Accounting Methods Oil & Gas Accounting Background • 1950’s and 1960’s: Diversity in practice in accounting for oil and gas activities. Two methods - Full Cost and Successful Efforts • 1970’s: FAS No. 19, “Financial Accounting and Reporting for Oil and Gas Producing Activities,” is issued. Prescribes SE method be followed • SEC issues several Accounting Series Releases that allow companies to follow either method and provide guidance on applying the different methods • FAS No. 25 issued. Makes the SE method of accounting preferable, but not mandatory. Two Types of Accounting Methods • FULL COST - Basic Concept – All costs associated with property acquisition, exploration and development activities shall be capitalized by countrywide cost center. • SUCCESSFUL EFFORTS - Basic Concept – Costs associated with property acquisition, exploration and development activities shall be capitalized if they directly result in the finding or development of proved reserves. Costs not directly resulting in proved reserves shall be expensed. AICPA Accounting Standards Executive Committee Acquisition and Retention Costs Acquisition and Retention Costs • Acquisition Costs • Retention / Holding Costs – Delay Rentals – Ad Valorem Taxes – Shut-in Royalties – Legal Costs for Title Defense – Maintenance of Land and Lease Records • Disposition of Capitalized Acquisition Costs – Impairment – Abandonment – Transfer (Reclassification) to Proved Property The Lease Agreement Mineral interest owner (fee owner or lessor) leases E&P rights to the working interest owner (lessee), the lease agreement: – – – – Defines the lessee and lessor Clearly defines the leased property States the consideration (“bonus”) paid by lessee to lessor States the amount of royalty retained by the lessor (e.g.,1/8 of production sales proceeds) – States the “primary term” (e.g., three years) – Calls for annual “rentals” or delay rentals if drilling has not yet commenced or production established – Contains a clause perpetuating the lease if oil or gas production is established Types of Mineral Interests • Fee interest • Mineral interest • Working interest (Operating Interest) • Royalty interest (Non-operating Interest) • Overriding royalty interest (Non-operating) • Net profits interest (Non-operating) • Production payment (Non-operating) • Farm-out • Free well agreement • Reversionary or carried (a.k.a. Disproportionate or promoted interests) • Unitization Accounting for Acquisition and Retention Costs – Successful Efforts Method • Lease acquisition (CAPITALIZE DIRECT ACQUISITION COSTS) – Bonus payments, advance payments, options • Retention Costs (EXPENSE AS INCURRED) – Delay rentals, property taxes, defense costs, shut-in royalties • Disposition of capitalized acquisition costs – Impairment – Abandonment – Transfer to proved properties Accounting for Acquisition and Retention Costs – Full Cost Method • Lease acquisition (CAPITALIZE DIRECT ACQUISITION COSTS) – Bonus payments, advance payments, options • Retention Costs (CAPITALIZE RETENTION COSTS) – Delay rentals, property taxes, defense costs, shut-in royalties • Disposition of capitalized acquisition costs – Impairment and Abandonment Impairment – Acquisition Costs Successful Efforts and Full Cost • Assess periodically (at least annually) • Triggering Events include dry hole(s), little time left on primary term, development not in the budget • May amortize costs in a group of properties if individually insignificant Accounting Differences: • Successful Efforts (FAS No 19) – impairment charged to exploration expense • Full Cost (SEC Reg. S-X 4-10) – impairment included in the amortization base (full cost pool) and amortized prospectively AICPA Accounting Standards Executive Committee Exploration and Development Costs Exploration Costs Defined • Costs incurred to find proved reserves, including identifying areas that may warrant examination, examining specific areas, and drilling exploratory wells and exploratory stratigraphic type test wells • Costs may be incurred prior to obtaining the lease • Include costs of: – Carrying and retaining undeveloped properties – Topographical or geophysical studies and salaries related to these studies Development Costs Defined • Obtain access to proved reserves • Provide facilities for extracting, treating, gathering, and storing oil and gas • All phases of drilling development wells (from preparing well locations to placing on production) whether tangible (having salvage value) or intangible (a tax term of not having salvage value, such as making a hole) • “Acquire, construct, and install production facilities such as lease flow lines, separators, treaters, heaters, manifolds, measuring devices, and production storage tanks, natural gas cycling and processing plants, and utility and waste disposal systems.” • “Provide improved recovery systems” Accounting for Exploration and Development Costs Exploration Costs – Successful Efforts – Expense all exploration costs as incurred, except those applicable to exploratory wells that result in discovery of proved reserves (i.e. capitalize successful exploratory wells and expense exploratory dry holes) – Full Costs – Capitalize Development Costs – Successful Efforts - Capitalize – Full Cost - Capitalize Exploration and Development Costs - Illustration Site Well D 1 Discovery, exploratory well establishes offset sites C and E as proved.* E 2 Offset, development producing well. Well 2 proves Site F.* F 3 Offset, development producing well. Assume data does not prove Site G.* B 4 Step-out,exploratory producing well on unproved drill site. Assume data proves Site A. C 5 Offset, development producing well. A 6 Offset, development dry hole. Costs remain capitalized as dev. costs. Well is plugged. G 7 Offset, exploratory dry hole. Costs are expensed (SE). Well is plugged. *Proving a site means that geological and engineering data indicate with reasonable certainty that the site has sufficient reserves to economically justify (at current prices) drilling the site. Usually a successful well and G&G data prove only sites offsetting the successful well’s site. The data may or may not prove all offset locations. Site A B C D E F G WELL 6 4 5 1 2 3 7 Gas Cap Oil Enchroaching Salt Water What if . . . Case 4-1: G&G Library • What if a company buys a library of G&G data on many geographic areas, with an estimated useful life of 3 years? Must the cost be expensed under SE? • Example: XYZ Co. pays $10,000 for seismic studies of undeveloped acreage in the Gulf of Mexico • The Rule [Oi5.109 aka FAS 19, par. 18 ] “Geological and geophysical costs, costs of carrying and retaining undeveloped properties, and dry hole and bottom hole contributions shall be charged to expense when incurred.” • Guidance/Accounting Seismic studies to enhance or evaluate development of a proved field may be capitalized as development costs. If seismic study relates to exploration activities, expense as incurred. Seismic related to both exploration and development activities should be allocated between development costs (capitalized) and exploration costs (expensed). Full Cost companies capitalize all costs. What if . . . Case 4-2: Development / Exploratory Well • What if a development well is drilled below the proved reservoir, looking for deeper reservoirs, yet unproven, and finds no new reserves? Are the added costs exploratory? • Example: XYZ Co. spends $1 million to access proved reserves at 10,000 feet and continues down to another stratigraphic region, spending another $400,000 to go to 15,000 feet, only to find no proved reserves. Rule [Oi5.401 aka FAS 19, par. 274 ] • Development A “development well is a well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be proved.” • Comment: A portion of a well (hole) can be a “development well” and the remaining portion of the hole is an exploratory well for accounting purposes. Accounting for the example above Under Successful Efforts, XYZ expenses the $400,000 (spent to explore below the proved horizon) as unsuccessful exploratory well costs and capitalizes the $1 million as development costs. 10,000 ft, Exploratory 15,000 ft, What if . . . Case 4-3: At first you don’t succeed… • What if a twin (replacement) exploratory well is needed? Are the costs of the abandoned first well expensed as unsuccessful? • Example: Drilling problems require XYZ Co. to stop short with exploratory well #1, and immediately start over with a nearby “twin” well which successfully discovers the reservoir. Is the $700,000 spent on well #1 unsuccessful exploration cost? Successful • FAS 19 does not specifically address this case. – • Arguably, it’s just another cost overrun of drilling “the well”. Accounting for the example above Follow established accounting for such cases. Likely expense the $700,000. Twin Variations of Case 4-3 • Side tracking (preferable to expense the unsuccessful costs) • Producing well re-entered and drilled deeper (an exploratory cost to be expensed if unsuccessful) • Exploratory well finds no reserves at target formation, drilling continues and discovers a deeper reservoir (capitalize all costs as successful exploratory well) • Exploratory well finds no reserves at target formation, plugged back to shallower discovery (preferable to expense the costs of drilling beyond the shallower discovery). • Exploratory well is a multi-lateral well – Wells can be described as vertical (traditional), directional, horizontal, or multi-lateral Side tracking Multi-lateral well What if . . . Case 4-4: Well in Progress at End of Reporting Period • • What if an exploratory well is in-progress at year-end whereby success cannot be determined at that time? What if it’s found to be dry soon thereafter? Are costs expensed as of period-end? Example: XYZ Co. spent/accrued $400,000 for well in progress at period-end. After period-end XYZ spent $200,000 more but found no reserves. Deemed a dry hole prior to issuance of financial • statements. Rule [Oi5.130 / FAS 19, par 39 ] paraphrased: – • Rule [Oi5.130 / FIN 36, par 2] paraphrased: – • Use information available before financial statements are issued to evaluate conditions at balance sheet date. If such information indicates well was unsuccessful, expense costs as of period-end, net of any salvage value Accounting for the example above: – Expense the $400,000 as of period-end. Expense the $200,000 in the next period (the period incurred). Well in progress at year-end ? AICPA Accounting Standards Executive Committee Amortization of Proved Property Costs What is DD&A? • Oil & gas property costs are “amortized” using a “unit of production” method whereby. . . – Amortization Base x production / beginning of year (BOY) reserves = amortization expense – $200,000 net book value x 10,000 bbls / 100,000 bbls = $20,000 amortization What is DD&A?, continued Federal income tax law and regulations call for: –“Depreciation” of capitalized well equipment cost (over a stated life or on the unit of production basis), –“Depletion” of capitalized property acquisition costs (on a unit of production basis), and –“Amortization” over 60 months of certain other costs, such as intangible drilling costs that are not immediately deducted Financial reporting (FAS No.19 and Regulation S-X Rule 4-10) requires all costs be “amortized” on the unit of production method Amortization - Simple Example • Amortization Base (NBV) – Capitalized Costs, end of period – Less prior accumulated amortization $1,200,000 (200,000) $1,000,000 • Production (quantity sold) for the period • Oil & Gas reserves at period’s beginning: – Latest reserve estimate (end of period) – Add production for the period (above) “Base” 30,000 bbls 270,000 bbls “R” 30,000 bbls “P” 300,000 bbls “R+P” • Amortization = Base x P / (R +P) = $100,000 “P” Calculating Amortization – Oil and Gas Produced • What if both oil and gas are being produced? How is amortization calculated? • Example: Production (P) is 4,000 bbls and 6,000 mcf • • Successful Efforts Rule (Oi5.129 / FAS 19, par 38) paraphrased: Convert to common unit of measure [boe or mcfe] based on relative energy content,but… OK to use either oil or gas if it dominates or if P of oil to P of gas is expected to remain relatively constant (answers about the same) Full Cost Rule (Rule 4-10[c](3)(iii) paraphrased: Same as for SE but allowed to use “gross revenue” method of P$/R$ Example solution: 4,000 bbl + 6,000 mcf x 1/6 = 5,000 boe; or 4,000 bbl x 6 + 6,000 mcf = 30,000 mcfe Successful Efforts Amortization • Costs grouped by field usually • Field’s property acquisition costs amortized over total proved reserves (developed and undeveloped) • Field’s “well equipment and development” costs (including IDC) amortized over proved developed reserves (excluding undeveloped reserves) What is a Field? • Oi5.403 / FAS 19, par. 272 – “An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature or stratigraphic condition or both.” – Reservoirs may be separated laterally or vertically. – Geological structure is not intended to include an entire “basin”, “trend”, “play”, “area of interest”, etc. – A reservoir is a “porous and permeable underground formation containing a natural accumulation of producible oil or gas . . . separate from other reservoirs.” Developed vs. Undeveloped Proved Reserves • Proved oil and gas reserves are - estimated quantities which “geological and engineering data demonstrate with reasonable certainty to be recoverable in the future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made.” (excerpt from SEC S-X Rule 4-10) • Developed reserves are those expected to be recovered through existing wells, using existing equipment and operating methods • Undeveloped reserves (PUDs) are those expected to be recovered from: - New wells on undrilled acreage, or - Existing wells requiring major expenditure Full Cost Amortization Broader parameters for capitalized oil & gas costs – Governed by SEC S-X Rule 4-10(c) – Amortized costs are grouped by country, not field – Amortization base includes all acquisition, exploration, and development costs, including future development and abandonment costs • Includes company internal costs directly identified with acquisition, exploration and development activities (not G&A or production) • Some costs may be temporarily excluded from amortization – Amortized over total proved developed and proved undeveloped reserves AICPA Accounting Standards Executive Committee Disposition of Oil & Gas Assets Dispositions - Successful Efforts • Accounting - Successful Efforts • General Rules: – No gain if • Pooling of assets in a joint venture – No gain, but a loss may be recognized if • Recovery of costs is in doubt or future performance is required – Gain or loss if not described above Dispositions – Full Cost • Accounting - Full Cost • General Rule: – No gain or loss calculated – Exception - Significantly alters the relationship between costs and reserves Sale of Entire Unproved Property • Full Cost – Credit proceeds to cost pool . . . • Successful Efforts – If impaired individually, recognize gain or loss – If in an impairment group, no gain or loss recognition • except to the extent sales price exceeds original cost Sale of Part of an Unproved Property • Full Cost – Credit proceeds to cost pool . . . • Successful Efforts – Recovery of remaining cost is uncertain, so treat sales proceeds as a recovery of cost… – Except to the extent sales price exceeds • original cost (if in an impairment group) • carrying value net of impairment (if individually assessed for impairment) Sale of Entire Proved Property • Successful Efforts – Recognize Gain or Loss • Full Cost – Credit sales proceeds to full cost pool • unless DD&A rate significantly distorted (greater than 10%) Sale of Part of a Proved Property (or Amortization Group) • Successful Efforts – Recognize Gain or Loss • Option: Do not recognize gain or loss (asset retirement) if amortization rate not significantly changed • No gain recognized if significant continuing involvement, however loss may be recognized • Apportion book value based on fair values • Full Cost – Credit sales proceeds to full cost pool • unless DD&A rate significantly distorted (greater than 10%) Example – Sale of Part of a Proved Property – No continuing involvement XYZ Company sells half of a 2% ORRI in a proved property with a NBV of $10,000 for $1 million. – Rule: Oi5.138(j) [FAS 19 par. 47j]: Recognize gain or loss. Allocate cost between portion sold and portion retained on the basis of fair values. – Accounting: [selling 50%, FV of sold = FV of retained] Cash $1,000,000 Proved property costs [$10,000 x 50%] $5,000 Gain on sale $995,000 Example – Sale of Part of a Proved Property – Continuing involvement XYZ Company sells a 10% ORRI carved from a working interest on proved property with a NBV of $100,000 and a remaining FV of $120,000 for $40,000. – Rule: Oi5.136(b), .138(j), .138(k), & .138(a): May recognize loss, but no gain. .138(j): Calculate using relative fair values – Accounting: • • Gain or loss? $100m x [40m / (40m + 120m)] = $25m cost $40m proceeds - $25m cost = $15m gain. Do not recognize. Cash $40,000 Property cost $40,000 AICPA Accounting Standards Executive Committee Impairment of Oil & Gas Assets General Rules – Comparison Between Successful Efforts and Full Cost Element Successful Efforts Full Cost • Authoritative Guidance • FAS No. 144 • Regulation S-X 4-10 • Performance Criteria • Trigger event • Quarterly • Price and Cost Assumptions • Management’s internal pricing • Constant (based on year end prices) • Grouping • Usually field-level • Country by country • Property Types • Proved properties only • Proved properties only • Income Tax Considerations • Typically excluded • Included • Component of Income from • continuing operations presented either separately or disclosed in notes • Presentation and Disclosure Component of Income from continuing operations presented either separately or disclosed in notes General Impairment Rules Property Type Successful Efforts Full - Cost • Proved • SFAS 144 • S-X 4-10(C)(4) “Ceiling Test” - If country-wide costs less deferred taxes exceed discounted after-tax cash flows at current pricing (plus costs not being amortized), writeoff excess • Unproved • FAS No. 19 and S-X 4-10; judgmental, systematic amortization, based on lease terms, dry holes, and drilling intent • S-X 4-10(C)(3)(II)(1) and (C)(4) “Asset Impairment” as for successful efforts and reclassify impairment to amortization base (reducing ceiling) Assessing Impairment – Step 1 • Assess impairment when events or circumstances indicate the asset carrying amount may not be recoverable. • Usually quarterly because mere passage of time is an indicator. • Types of “Trigger Events”: • • • • • • Passage of time Decrease in prices Higher than anticipated development costs Decrease in reserve estimates (“downward revisions”) Environmental issues Adverse political; legislative; or regulatory changes Assessing Impairment - Step 2 • Compare carrying amount to undiscounted, expected future cash flows (UEFCF) • If carrying amount exceeds UEFCF, go to Step 3. Assessing Impairment - Step 3 • Write off carrying amount in excess of fair value • No requirement to get an appraisal • No specific guidance in determining FV • Usually fair value reflects discounted, expected future cash flows • Discount rate is usually greater than 10% when applied to truly expected future cash flows Example FAS No. 144 Impairment Analysis for Proved Properties Step 1 - Assumed occurrence of trigger event Determination of NBV Step 2 Comparison against undiscounted cash flow Capitalized cost of proved properties Accumulated DD&A Liability for plugging & abandonment $ 5 nil Net book value Recognition test Future UEFCF before taxes Impairment loss Step 3 Measurement of impairment Field A $4 Measurement of impairment Fair value (Discounted Expected Future Cash Flows) Impairment Field B Field C $ 20 (2) (2) $10 (8) (1) $ 3 $ 10 $ 6 $ 8 no $8 yes no (5) $ 5 (3) Full Cost Ceiling Test CEILING COMPONENTS: • Present value of of future cash flows from proved reserves – – – – Current sales prices and cost rates as of the balance sheet date Proved reserves (no probable or possible reserves) Future revenues less (operating, development, and P&A) costs Future net revenues are discounted at 10% per annum • Current capitalized costs of properties not amortized – Cost of unproved properties not being amortized – Cost of unusually significant development projects not being amortized Full Cost Ceiling Test CEILING COMPONENTS (continued) • Lower of cost or fair value of unproved properties amortized – Usually zero if unproved properties are excluded from amortization since impaired costs moving into amortization base have a fair value of zero • Income tax effects of the first three components – Exemptions for purchased property and favorable events prior to auditor’s report Full Cost Ceiling Test - Other Topics • Ceiling Test Exemption for Proved Purchased Property: – SAB Topic 12D, Question 3: Explains how ASR 258 ceiling exemption can be obtained – Request temporary waiver from SEC – Registrant requesting waiver should be prepared to demonstrate the additional value exists beyond a reasonable doubt • Subsequent Events: – SAB Topic 12D, Question 3 – Ceiling test write-down avoided if: • Additional proved reserves added before audit report • Price increases become known before audit report AICPA Accounting Standards Executive Committee FAS No. 143 - Asset Retirement Obligations FAS No. 143 - Overview • Obligations of an entity that are unavoidable as a result of the acquisition, construction or the normal operation of a tangible long-lived asset • Designed to end diversity in practice • Retirement obligation (liability) recognized when incurred • Fair value method of calculating liability • Retirement costs are capitalized (and depreciated) FAS No. 143 – Qualifying Obligations Qualifying Obligations: • Dismantlement of offshore platform • Plugging and abandonment of oil and gas well bores • Production facilities • Underground storage facilities • Distribution and transmission assets • Others. . . FAS No. 143 – Full Cost Implications • Impact on the Full Cost Ceiling Test • • • Asset retirement costs are recorded in the full cost pool and subject to ceiling limitation; when calculating the ceiling, ARO (abandonment obligation) is deducted from future cash flows, resulting in “double counting” SAB 106 requires companies to exclude abandonment obligation from future cash flow analysis Impact on DD&A calculation related to future asset retirement costs expected to result from future development activities • SAB 106 provides that companies must estimate the asset retirement costs associated with future development activities (for ARC not recorded in the balance sheet) AICPA Accounting Standards Executive Committee Oil & Gas Revenues and Production Costs Determinants of Revenue • Ownership • Volumes • Prices Ownership • Division Order – Contract between all of the owners of an oil and gas property and the company purchasing production from the property. – Sets forth the interest of each owner and serves as the basis on which the purchasing company pays each owner’s respective share of the proceeds of the oil and gas purchased. Ownership - Example Working interest (WI): Cost Sharing Net revenue interest (NRI): Revenue Sharing Example: WI NRI E&P, Inc. 60% 51% Mee2 oil and gas 40% 34% Geologist (ORRI) 0% 2.5% Lessor (royalty, RI) 0% 12.5% 100% 100% Volumes Oil BBL - barrels (42 gallons) Gas MCF - thousand cubic feet - MMCF - million cubic feet - BCF - billion cubic meet • Gas may also be expressed in heat quantity (Btu or MMBtu) rather than volume • Ratio of MMBtu to Mcf varies from 1:1 to 1.3:1. The wetter the gas, the higher the ratio. Volumes • Oil Volumes – Stored In “Lease Tanks" at the field until enough accumulated to sell • Gas Volumes – Produced into a pipeline or gathering system – Often sold downstream, out of a pipeline or processing plant (pipelines usually act as transporters, not purchasers) – Meters (pipeline meter and operator's check meter) measure volume movement – Lease-use gas and shrinkage Oil Prices • Evergreen contract tied to posted price bulletins • Price may also be - Fixed - New York mercantile exchange futures (NYMEX) - Other indices • Bulletin's pricing determinants: - Geographic location - Date of sale - Sulfur content (i.e., sweet or sour) - Density (API gravity) Gas Prices • Typically per MMBTU • Marketing charges - Gathering - Dehydration - Processing - Transportation - Marketing fees - Pipeline capacity reservation - Storage - Hub services (banking) • Sales points Production Costs (aka Lease Operating Expense) • Definition - Costs incurred to operate and maintain wells and related equipment and facilities, including depreciation and applicable operating costs of support equipment and facilities and other costs of operating and maintaining those wells and related equipment and facilities (SX Rule 4-10(a)(17)) Types of Production Costs • Direct Production Costs – – – – – Salaries and wages, including related employee benefits Contract pumping services Well services and workover Repairs and maintenance of surface equipment Ad Valorem (property), production and severance taxes • Indirect Production Costs – Depreciation of support facilities – Salt water disposal Accounting for Production Costs • Expensed as incurred, except – Recording oil and gas inventory at cost – Workover costs that qualify for capitalization Workover Costs • Expense – Costs to restore or maintain production – Increases production • Capitalize – Costs to explore to an unproved formation – Costs to access a proved formation – Increases reserves AICPA Accounting Standards Executive Committee Joint Interest Billing Joint Venture – Defined • An association of two or more persons or companies to drill, develop, and operate jointly owned properties. Each owner has an undivided interest in the properties. Why Joint Operations? • Companies desire to share the risk and high costs involved in exploration and development • Economic sense • Necessity • Secondary or tertiary recovery techniques Joint Operations - Overview • Joint ventures are common in the industry, therefore, joint interest billing (JIB) systems are essential • Agreements – Joint venture agreement • Who is in what venture? – Joint operating agreement (JOA) • Designates an operator (others are non-operators) • Rules for going “non-consent” – JOA’s accounting exhibit • Billing and audit protocol Joint Operations - Overview • JIB system – Operator obtains partners’ approvals for major costs (using an authorization for expenditure “AFE”) – Operator billed for venture costs and bills its partners for their share – Operator records its net share – Operator pays venture’s costs and bills partners their share – Most JOAs allow partners (non-operators) to audit the operator’s billings within two years of the related expenditures Joint Operating Agreement JOA provides: • Parties’ interests in costs (working interest “WI”) and production (Net revenue interest “NRI”) • Operator – Designation, removal – Rights and duties • Protocol for joint venture conducting drilling and development – Initial well – Deepening, sidetracking, completion, reworking, recompleting, plugging back and abandoning wells – Non-consent provisions • Taking production in kind Joint Operating Agreement • Gas balancing – Gas balancing agreement (GBA) • Operator’s remedies for failure of non-operator to pay – Pay and take over interest – Have rest of JV pay and take over interest – Net billings against revenues • Election to not be a partnership for income tax purposes • Insurance to be carried by operator • Sharing of costs for suits against the joint venture JOA Accounting • Operator bills non-operators monthly – By AFE, lease, or project – Sufficient detail for financial & tax accounting – May bill in advance, major approved projects (“cash calls”) • Non-operators allowed two years after billing date to challenge paid billings. – Conduct expenditure audit to uncover and substantiate adjustments – Adjustments argued and negotiated JOA Accounting • Operator bills for: – – – – – Direct charges Operator’s employees directly employed Materials Use of operator’s equipment and facilities Overhead recovery (determined by COPAS) • At a fixed rate (e.g. $3,000/mo/drilled well and $300/mo/producing well), adjusted for inflation annually using escalation factors; or • At a percentage of direct costs AICPA Accounting Standards Executive Committee Oil & Gas Reserves and Related Disclosures Oil & Gas Reserve Classifications • Society of Petroleum Engineers defines reserves as discovered and recoverable – Proved (“reasonably certain” - 90% probability) • Developed • Undeveloped – Unproved • Probable (“likely” - as in 51% to 90% probability) • Possible (“reasonably possible” - less than likely) Proved Reserves • Proved oil and gas reserves Estimated quantities which “geological and engineering data demonstrate with reasonable certainty to be recoverable in the future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made.” (excerpt from SEC S-X Rule 4-10) Proved Reserves – Developed vs. Undeveloped • Developed reserves: – Expected to be recovered through existing wells, using existing equipment and operating methods • Undeveloped reserves: – Expected to be recovered from - New wells on undrilled acreage; or - Existing wells requiring major expenditure Key Definitions • Economically Recoverable: – Reserves that can be extracted from reservoir and delivered to market in an economically beneficial way to the producing entity • Shut-in: – Reserves expected to be recovered from completion intervals that were open at the time of the reserve estimate but are not producing • Behind pipe: – Reserves expected to be recovered from completion interval(s) not yet open but still behind casing in existing wells. Such wells are usually producing, but from another completion interval. Additional completion work is needed before these reserves are produced. Determination of Oil & Gas Reserve Quantities • Estimates may be performed internally • Estimates may be performed internally and data reviewed or audited by external engineer based on Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserve Information by the Society of Petroleum Engineers • Estimates may be performed externally with certain data provided by the oil and gas company Reserve Estimation and Valuation Process Data Points Technical Economic • Porosity • Proved determination • Permeability • Year end pricing • Gas to liquids ratio • Historical lifting costs • Product quality /characteristics • Future development costs • Well logs • Seismic data • Interpretations • Decline curves • Feasibility assumptions Reserve Volume and SMOG Value Calculations • Future abandonment costs/ reclamation costs • Production/severance tax rates Transactional • Historical production volumes • Recovery techniques • New well/property sale/property abandonment/property purchase • PZ factor • Division orders/title opinions • Curtailments/shut-ins • Net profit interests • Payouts/reversionary interests • Take-or-pay Reserve Quantity Information SMOG Is Disclosure of Oil & Gas Reserve Information Required? Disclosure required for “significant” oil and gas producing activities if O&G activities are at least 10% of company’s total activities, based on any one of the following ratios: – Revenues from oil and gas > 10% of combined revenues of all segments – Identifiable assets of oil and gas activities > 10% of the assets, excluding assets used exclusively for general corporate purposes – Results of operations of oil and gas activities > 10% of the larger of: (a) Combined operating profit or all industry segments that did not incur an operating loss; or (b) Combined operating loss of all industry segments that did incur an operating loss Supplemental Disclosures Required by FAS No. 69 – – – – – Capitalized costs Costs incurred Results of operations for oil & gas related activities Proved reserves and changes in proved reserves Standardized Measure of Discounted Future Net Cash Flows (SMOG) and related changes therein – Special disclosures for companies using full cost – Disclosures only for PROVED oil and gas reserves SMOG Overview • FAS 69 requires disclosure of “a standardized measure of discounted future net cash flows relating to proved O&G reserve quantities • Intended to be a comparative benchmark tool • SMOG disclosures: – Required for publicly traded oil and gas companies – Must be disclosed in aggregate – Must be disclosed for each geographic area for which reserve quantities are disclosed – Changes in SMOG also must be disclosed AICPA Accounting Standards Executive Committee Other Property Conveyances Property Conveyance Types • 4 Types – – – – Loan Prepaid Commodity Sale Volume Production Payment (VPP) Outright Sale What is a Borrowing? What is a Sale? Loan Prepaid commodity sale Volumetric Prod. Pmt. Outright Sale Who assumes production risks “Seller” (cash recipient) Who assumes pricing risks “Seller” (cash recipient) Seller Buyer Buyer, mostly Buyer Buyer Buyer What is a Borrowing? What is a Sale? • Loan - borrowings are repaid usually through money received from production • Prepaid - borrowings are repaid through volumes of production. Seller must make up short fall • VPP - same as Prepaid except there is no obligation to make up short fall • Outright Sale - buyer assumes all risk Special Cases • Production Payment: Conveyor’s obligation to pay – (holder’s right to receive) specified cash or deliver specified production from specified production only – If specified cash, production payment is conveyor’s payable (loan) and holder’s receivable – If specified quantity, the Volumetric Production Payment (VPP) is a mineral interest sale but proceeds received are credited as deferred revenue. • Prepaid: Conveyor’s obligation to deliver specified quantity (no required source) Volumetric Production Payment (VPP) Accounting • Full Cost: – SX Rule 4-10c(6i) literally says credit the full cost pool (The VPP is a sale). – Off-balance sheet financing • Successful Efforts: – FAS 19, par. 47(a) says to treat as unearned revenue to be recognized as the oil and gas is delivered. – EITF 88-18 states that these financing arrangements are advances for future production and should be classified as debt unless conditions justify otherwise. Volumetric Production Payment (VPP) Accounting • Both credit deferred revenue • VPP is sale of a mineral interest. Conveyor sells reserves to holder. • Prepaid is NOT a sale of a mineral interest but prepayment for future sale of oil or gas. Conveyor sells no reserves to holder. Volumetric Production Payment (VPP) • Sale. No gain recognition; seller has substantial future obligation (disproportionate LOE burden + delivery obligation) • Buyer has oil and gas reserves. UOP amortization of property cost. • Seller records deferred revenue! Not deferred gain.