04.Chapter Four 2009

advertisement

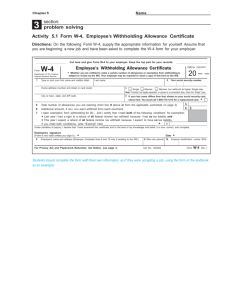

Liberty Tax Service Online Basic Income Tax Course. Lesson 4 HOMEWORK CHAPTER 3 Homework 1 - 1 2 HOMEWORK CHAPTER 3 Homework 1 - 2 3 HOMEWORK CHAPTER 3 Homework 1 - 3 4 HOMEWORK CHAPTER 3 Homework 1 - 4 5 HOMEWORK CHAPTER 3 Homework 1 - 5 6 HOMEWORK CHAPTER 3 Homework 1 - 6 7 HOMEWORK CHAPTER 3 Homework 2 - 1 Wilke (Parent would qualify her for H/H if she was not married. Parent does not make her eligible to be considered unmarried.) 8 HOMEWORK CHAPTER 3 Homework 2 - 2 Jones (Filing Status 2, Married Filing Joint is also acceptable) 9 HOMEWORK CHAPTER 3 Homework 2 - 3 Lizo 10 HOMEWORK CHAPTER 3 Homework 2 - 4 DeMarco 11 HOMEWORK CHAPTER 3 Homework 2 - 5 King 12 Chapter 4: Wages, Salaries, Tips, Etc. and Withheld Taxes Chapter Content Form W-2 Wages and Other Compensation Tip Income Other Line 7 Income Nontaxable Compensation Withheld taxes Key Ideas Objectives Know the Difference Between Taxable and Nontaxable Income Understand the Types of Employee Compensation Use Form W-2 to Report Employee Compensation Understand the Ways Tip Income is Reported Recognize How Your tax is Paid by Withholding 13 Taxable Income Taxable income. 1. All income in the form of money, goods, services, and property you receive during the tax year that is subject to income tax 2. Includes earned income and unearned income Earned income is income from personal services such as wages and other employee compensation Unearned income is non-personal service income such as interest and dividends 3. Reported on lines 7 through 21 of Form 1040. 14 Nontaxable Income Nontaxable or exempt income (not subject to income tax). Child support Federal tax refunds Interest on municipal bonds Public assistance payments Workers’ compensation Most life insurance proceeds received upon death Part or all of social security benefits Veteran’s disability benefits Gifts, bequests, and inheritances (may be subject to other taxes) Some nontaxable income, such as exempt interest, must be shown on Form 1040 but is not added to gross income. 15 Wages, Salaries and Tips Wages, salaries, and tips that are earned as an employee are probably the most familiar types of income. The most common types of income: Wages and salaries are compensation paid by your employer for work or services you provide Tips are received from customers Compensation also includes awards, bonuses, sick pay, and other taxable employee benefits Wage and tip income and other compensation can be in the form of cash or goods, services, and property All such income that is not specifically excluded by law from taxation is taxable and must be reported. 16 Form W-2 Form 1040, Page 1 17 Form W-2 Reports wage and tip income, tax withholding and other related information to you and to the IRS. 1. Employer must provide by January 31 2. Box 1 of Form W-2 reports total wages, tips, and other compensation which is entered on line 7 of Form 1040 3. Some of Form W-2 boxes provide information about the box 1 amount; this information is not entered on Form 1040 4. If box 1 information is incorrect, employer must issue Form W-2c 5. If you have more than one W-2, add the amounts in each box 1 and enter the total on line 7 6. Even if you do not receive Form W-2 from your employer, you must still report the income. 18 Statutory Employees Statutory employees include full time life insurance agents, certain home workers, and traveling salespeople. Income is reported on Form W-2 Statutory employee in box 13 of Form W-2 is checked If there are no expenses related to income, enter box 1 amount on line 7 of Form 1040 If there are expenses, complete Schedule C and enter net income on line 12 of Form 1040. 19 Wages And Other Compensation Compensation reported in box 1 that must be entered on line 7 of Form 1040 includes: regular pay; advance commissions; back pay awards; bonuses and awards; sick pay; holiday gifts; severance pay; travel and other business expense reimbursements; employer provided vehicles; supplemental unemployment benefits; disability income from an employer-paid plan received before you reach minimum retirement age, whether reported on Form W-2 or Form 1099-R (covered in Chapter 9). The amount shown in box 1 of Form W-2 is gross pay before federal and state income taxes, social security and Medicare taxes and other withholdings are taken out. 20 Wages and Income – Problem 1 Lorenzo P. Lake’s salary for 2008 was $35,000. Lorenzo’s take home pay was $28,129.50 because his employer withheld social security, Medicare and federal income taxes of $6,870.50. Which amount will be reported in box 1 of his Form W-2? a. $28,129.50 b. $35,000.00 c. None of the above 21 Wages and Income – Problem 1 Lorenzo P. Lake’s salary for 2008 was $35,000. Lorenzo’s take home pay was $28,129.50 because his employer withheld social security, Medicare and federal income taxes of $6,870.50. Which amount will be reported in Box 1 of his Form W-2? b. $35,000.00 22 Wages and Income – Problem 2 Corey was employed by the Ace Insurance Company, her salary in 2008 was $29,000. She was given a Christmas bonus of $500. Corey won a sales contest in November 2008 and the prize was a 4 day vacation to Florida. The value of the vacation prize (cost of the airline tickets and hotel) was $1,200. She did not actually take the vacation until February 2009. What is the total compensation that her employer should report in box 1 of Form W-2? a. b. c. d. $29,500 $29,000 $30,700 $30,200 23 Wages and Income – Problem 2 Corey was employed by the Ace Insurance Company, her salary in 2008 was $29,000. She was given a Christmas bonus of $500. Corey won a sales contest in November 2008 and the prize was a 4 day vacation to Florida. The value of the vacation prize (cost of the airline tickets and hotel) was $1,200. She did not actually take the vacation until February 2009. What is the total compensation that her employer should report in box 1 of Form W-2? c. $30,700 $29,000 salary + $500 bonus + $1,200 prize awarded in 2007 = $30,700. The amounts of the bonus and prize included in box 1 may be broken out and shown in box 14 of Form W-2. 24 Tip Income All cash and non-cash tips received from customers are taxable income and must be reported on line 7 of Form 1040. You must keep a daily tip record so you can: Report tips to your employer Report tips accurately on your tax return Prove tip income if your return is questioned 25 Tip Income Include the value of all noncash tips such as tickets or passes. 26 Reporting Tips To Your Employer Report to your employer cash, check, or credit card tips of $20 or more for any one month for any one job. 1. These tips are included in the amount shown in box 1 of Form W-2 2. Your employer withholds social security and Medicare taxes for these tips from your wages 3. Any social security and Medicare taxes not collected by your employer must be reported as additional tax on your return 4. Do not report the value of noncash tips to your employer 5. If you do not report tips of $20 or more as required, you may be subject to a penalty. 27 Reporting Tips To Your Employer – Problem 3 Zachary works at Uncle Sam’s Restaurant as a waiter. He keeps a daily tip record. He received only cash tips in 2008. His tips in June were $17. Every other month his tips were $20 or more. Is Zachary required to report his June tips to his employer? Yes or No? 28 Reporting Tips To Your Employer – Problem 3 Zachary works at Uncle Sam’s Restaurant as a waiter. He keeps a daily tip record. He received only cash tips in 2008. His tips in June were $17. Every other month his tips were $20 or more. Is James required to report his June tips to his employer? No. 29 Tips Not Reported To Your Employer Do not report tips under $20 a month or to your employer. These tips are subject to income tax but not social security or Medicare tax Add these tips and the value of noncash tips to your box 1 wages and enter the total on line 7 of Form 1040 If you did not report tips of $20 or more per month to your employer as required, also add these tips to the amount entered on line 7 Use Form 4137 to figure and report social security and Medicare tax on these tips. 30 Tips Not Reported – Problem 4 Bob works for Tanya’s beauty shop. His salary is $18,000. Bob keeps a daily tip diary. One month he made $32 in tips and another month he made $26. He reported these tips to his employer as required and his employer included them in box 1 of Bob’s 2008 Form W-2 that showed total compensation of $18,058. The other 10 months Bob did not make more than $19 in cash tips in any month, so he was not required to report these tips to his employer. He received total cash tips for the year of $175 that he did not report to his employer. One of his customers also tipped Bob with passes to the County Fair. The value of the passes was $12. What is the total income that Bob must report in box 1 of his Form W-2 and on line 7 of Form 1040? a. $18,058 b. $18,245 c. $18,233 31 Tips Not Reported – Problem 4 Bob works for Tanya’s beauty shop. His salary is $18,000. Bob keeps a daily tip diary. One month he made $32 in tips and another month he made $26. He reported these tips to his employer as required and his employer included them in box 1 of Bob’s 2008 Form W-2 that showed total compensation of $18,058. The other 10 months Bob did not make more than $19 in cash tips in any month, so he was not required to report these tips to his employer. He received total cash tips for the year of $175 that he did not report to his employer. One of his customers also tipped Bob with passes to the County Fair. The value of the passes was $12. What is the total income that Bob must report in box 1 of his Form W-2 and on line 7 of Form 1040? b. $18,245 32 Tips Not Reported To Your Employer BOB’S BOB’S WAGES, WAGES, PLUS PLUS THE THE TIPS HE TIPS REPORTED HE REPORTED TO HIS TO EMPLOYER HIS EMPLOYER + Unreported cash tips ($175) + Value of non-cash tip ($12) = $18,245 Form 1040 33 Allocated Tips Allocated tips are tips that are assigned to you by your employer in addition to the tips you report to the employer. 1. Tip allocation is only required if you work for certain food and drink establishments and your reported tips are less than your share of a required percentage of food and drink sales 2. Allocated tips are shown in box 8 of Form W-2 and must be included in your gross income unless you have proof of actual tips 3. If you have to include allocated tips in your income, add the amount in box 8 to the box 1 amount, enter on line 7 of Form 1040 and complete Form 4137 to figure the social security and Medicare tax you owe 4. You must use Form 1040 if reporting allocated tip income. 34 Allocated Tips – Problem 5 In 2008, Hope reported $400 in total tips to her employer. Her employer reported wages of $16,580, which included those tips. Box 8 of her Form W-2 showed allocated tips of $484. How much income would Hope report Form 1040, line 7? a. $16,980 b. $16,580 c. $17,064 35 Allocated Tips – Problem 5 In 2008, Hope reported $400 in total tips to her employer. Her employer reported wages of $16,580, which included those tips. Box 8 of her Form W-2 showed allocated tips of $484. How much income would Hope report Form 1040, line 7? c. $17,064 36 Allocated Tips – Problem 5 + Form 1040, Page 1 = $17,064 37 OTHER FORM 1040 LINE 7 INCOME The following are some of the types of income that are either not reported on a Form W-2 or not included in box 1 that must be reported on line 7 of Form 1040: 1. The taxable portion of scholarships and fellowships not reported on Form W-2. Write “SCH” and the amount not reported on Form W-2 in the space to the left of line 7. If you are a degree candidate, only those amounts not used for tuition and other course related expenses are taxable. 2. Wages received as a household employee that were not reported on a Form W-2 because an employer paid less than $1,500. Write “HSH” and the amount not reported on a Form W-2 in the space to the left of line 7. 38 OTHER FORM 1040 LINE 7 INCOME 3. The amount of dependent care benefits shown in box 10 of Form W-2 that you cannot exclude from your income. Dependent care benefits are amounts an employer paid to an employee or paid out on behalf of an employee for child and dependent care services. 4. Any amount of employer provided adoption benefits or moving expense reimbursements that are not excludable. If these benefits were received, the amounts are shown on Form W-2 in box 12. 39 Form 1099-MISC Income If income is reported by the payer in box 7 of Form 1099-MISC, you are being reported as self-employed. Report your income on Schedule C and line 12 of Form 1040 You may also owe self-employment tax on income reported on Form 1099-MISC Use the SS-8 questionnaire to help you determine if you are an employee or an independent contractor 40 Nontaxable Employee Compensation Many fringe benefits you receive from your employer are tax free or tax deferred because you pay fair market value for them or they are specifically excluded by law from taxable income. A tax-free fringe benefit is never included in your gross income and you will never pay tax on it. Examples of tax-free benefits are: Health care benefits Group term life insurance up to $50,000 of coverage 41 Nontaxable Employee Compensation A tax-deferred benefit is not included in gross income in the year you receive it and so is not taxed in the year received. Your employer’s contributions to a qualified retirement plan Your contributions for retirement under a qualified deferred compensation plan set up by your employer, such as a 401 (k) plan Contribution limited to $15,500 in 2008 ($20,500 if age 50 or over) Any amount over that is subject to income tax in the year you receive it Contributions to a deferred compensation is shown in box 12 of Form W-2 with the code letter D 42 Nontaxable Employee Compensation Social security and Medicare taxes are collected on this deferred compensation in the year you receive it Social security and Medicare wages shown in boxes 3 and 5 of Form W-2 will include this deferred compensation and be different from the amount shown in box 1. Retirement plan distributions are taxed in the year you withdraw them from your retirement plan. 43 Nontaxable Employee Compensation Jack D. Sprat’s salary is $28,640. He participates in his employer’s 401(k) plan. In 2008, Jack contributed $1,400 of his salary to the plan. Jack’s Form W-2 is shown below. 44 Withheld Taxes Federal income tax is a pay-as-you-earn tax. You owe tax on income as you earn or receive it Must pay the tax you owe as you receive the income. Paid in one of two ways: Withheld from your wages , or Make estimated tax payments. If you do not pay enough tax during the year, you may owe a penalty in addition to the tax that is still due. 45 Withheld Taxes WITHHELD TAXES are tax payments withheld from your income and made to the IRS in your name during the year by the payer of the income. If you are an employee, your employer will withhold income tax payments from your pay based on the amount you earn and the information you give your employer on Form W-4. 46 Withheld Taxes Other types of income from which taxes must be or may be withheld: Unemployment compensation Gambling winnings Pensions Social security benefits Interest and dividend payments The taxes withheld during the year from your income determine whether you owe money or whether you will receive a refund. 47 Mandatory Withholding Taxes must generally be withheld from wages, from some gambling winnings and in certain cases from interest and dividend payments. For some types of required withholding the withholding rate is also set by law. 48 Salaries and Wages Your employer withholds the tax you owe on your wages or other employee compensation. Federal income tax your employer is required to withhold from your pay is based on the amount you earn and the information you provide on Form W-4. You must complete a Form W-4 when starting a new job. 49 Salaries and Wages The W-4 includes three types of information your employer will use to figure your withholding: Whether to withhold at the single or the lower married rate (the higher the rate, the more tax is withheld) How many withholding allowance you claim (each allowance reduces the amount withheld) Whether you want an additional amount withheld (so that you are paying more of your tax liability during the year) 50 Form 1040, Page 2 Enter the withholding on line 62 of Form 1040. If you worked for more than one employer during the year, add the amounts in box 2 from all your W-2 forms and enter the total on line 62. If you are married filing jointly, add the box 2 amounts from all the W-2 forms for each spouse and enter the total on line 62 of Form 1040. Form 1040, Page 2 51 Wages, Salaries, Tips, Etc. and Withheld Taxes Key Ideas The total of all taxable compensation earned as an employee is entered on line 7 of Form 1040. Taxable employee compensation includes payment given in the form of bonuses, awards, strike benefits, and severance pay in addition to salary or wages. In general, the amount entered on line 7 is the amount from box 1 of Form W-2 that your employer provides to you. If more than one Form W-2 is received, add the amounts from box 1 of each Form W-2 and enter the total on line 7. Tip income that was not reported to your employer or allocated tips from Form W-2, box 8, must be added to the amounts reported in box 1 and report the total on line 7. 52 Wages, Salaries, Tips, Etc. and Withheld Taxes Key Ideas Other income that must be reported on line 7 includes scholarships and fellowships, household employee income not reported on a Form W-2, and the nonexcludable portion of certain fringe benefits such as dependent care benefits. Deferred compensation is the part of pay received by an employee that is contributed to a qualified retirement arrangement set up by an employer. While this income is not subject to tax when contributions are made, it is subject to tax when plan contributions are withdrawn. 53 Wages, Salaries, Tips, Etc. and Withheld Taxes Key Ideas You are expected to pay at least 90% of your income tax liability as you receive income during the year. Withholding is one way income tax is paid as it comes due. The payer withholds tax payments from your income and sends these to the IRS. The most common type of withholding is from your pay by your employer. 54 Wages, Salaries, Tips, Etc. and Withheld Taxes KEY IDEAS The amount of your pay and the information provided on Form W-4 determine the amount of tax your employer withholds. Withholding from your pay is mandatory. You generally do not have the option of having no tax withheld from your pay. You can choose to have income tax withheld from other types of income such as unemployment compensation or social security benefits. If you do not have enough tax withheld to pay your tax liability, you have to pay the difference with your tax return. If the tax withheld is more than your tax liability, you are due a refund of the overpayment. 55 Wages, Salaries, Tips, Etc. and Withheld Taxes Classwork 1. True or False. 1) Employee bonuses are not included in gross income. 2) Most taxable compensation you receive as an employee is shown in box 1 of Form W-2. 3) Tips are not taxable income. 4) The amounts shown in each box on Form W-2 are entered on your tax return. 5) Taxable employee compensation is reported on line 7 of Form 1040. 6) If the amount shown in box 1 of Form W-2 is incorrect, you should cross it out and write in the correct amount. 56 Wages, Salaries, Tips, Etc. Classwork 1. True or False. 7) Box 8 of Jackie’s Form W-2 shows allocated tips of $340. If Jackie cannot prove she received a smaller amount of tips, she must include $340 in the amount she enters on line 7 of Form 1040 and she must complete Form 4137. 8) Joe contributes part of his salary to the 401(k) retirement plan set up by his employer. Joe will never have to pay tax on these contributions. 9) Generally, withholding of federal taxes is required on all employee compensation. 10) In 2001, Carol (born 2/2/1949) retired on disability from her job at Starr Industries. The minimum retirement age at Starr is 62 years of age. For the 2008 tax year, Carol reports the disability pension payments she received from Starr on line 7 of her Form 1040. 57 Wages, Salaries, Tips, Etc. and Withheld Taxes Classwork 1. True or False. 1) Employee bonuses are not included in gross income. F 2) Most taxable compensation you receive as an employee is shown in box 1 of Form W-2. T 3) Tips are not taxable income. F 4) The amounts shown in each box on Form W-2 are entered on your tax return. F 5) Taxable employee compensation is reported on line 7 of Form 1040. T 6) If the amount shown in box 1 of Form W-2 is incorrect, you should cross it out and write in the correct amount. F 58 Wages, Salaries, Tips, Etc. and Withheld Taxes Classwork 1. True or False. 7) Box 8 of Jackie’s Form W-2 shows allocated tips of $340. If Jackie cannot prove she received a smaller amount of tips, she must include $340 in the amount she enters on line 7 of Form 1040 and she must complete Form 4137. T 8) Joe contributes part of his salary to the 401(k) retirement plan set up by his employer. Joe will never have to pay tax on these contributions. F 9) Generally, withholding of federal taxes is required on all employee compensation. T 10) In 2001, Carol (born 2/2/1949) retired on disability from her job at Starr Industries. The minimum retirement age at Starr is 62 years of age. For the 2008 tax year, Carol reports the disability pension payments she received from Starr on line 7 of her Form 1040. T 59 Wages, Salaries, Tips, Etc. and Withheld Taxes CLASSWORK 2: Should the following types of compensation be included in box 1 of Form W-2? Yes or No. 1) A vacation trip you were awarded as a prize for meeting sales goals. 2) Your employer’s contribution to a qualified retirement plan. 3) The ham your employer gave you for Christmas. 4) Employer provided vehicles used for personal driving, including commuting to and from work. 5) Payments received from your employer while you were out with a broken leg. 60 Wages, Salaries, Tips, Etc. and Withheld Taxes CLASSWORK 2: Should the following types of compensation be included in box 1 of Form W-2? Yes or No. 1) A vacation trip you were awarded as a prize for meeting sales goals. Y 2) Your employer’s contribution to a qualified retirement plan. N 3) The ham your employer gave you for Christmas. N 4) Employer provided vehicles used for personal driving, including commuting to and from work. Y 5) Payments received from your employer while you were out with a broken leg. Y 61 Wages, Salaries, Tips, Etc. and Withheld Taxes CLASSWORK 3: Multiple choice. 1) Shea is a waitress. The amount in box 1 of her Form W-2 is $17,540. She reported tips as required to her employer. Her reported tips totaled $2,489. Her unreported tips totaled $37. What is the amount of her tips included in the box 1 of her Form W-2? a. $2,489 b. $2,526 c. $0 1) How much does Shea have to include on Form 1040, line 7? a. b. c. d. $17,540 $17,577 $20,029 $20,066. 62 Wages, Salaries, Tips, Etc. and Withheld Taxes CLASSWORK 3: Multiple choice. 3) James is a waiter. The amount in box 1 of James’s Form W-2 is $14,722. He reported tips of $1,554 to his employer. Box 8 of his Form W-2 shows the amount of $412 and James does not have records to dispute this amount. What amount will James enter on line 7 of Form 1040? a. $16,688 b. $15,134 c. $14,722 d. $16,276 4) Which of the following is an example of unearned income? a. Wages b. A bonus from your employer c. Sick pay d. Unemployment compensation 63 Wages, Salaries, Tips, Etc. and Withheld Taxes CLASSWORK 3: Multiple choice. 1) Shea is a waitress. The amount in box 1 of her Form W-2 is $17,540. She reported tips as required to her employer. Her reported tips totaled $2,489. Her unreported tips totaled $37. What is the amount of her tips included in the box 1 of her Form W-2? a. $2,489 2) 3) How much does Shea have to include on Form 1040, line 7? b. $17,577 ($17,540 from box 1 plus $37) 4) James is a waiter. The amount in box 1 of James’s Form W-2 is $14,722. He reported tips of $1,554 to his employer. Box 8 of his FormW-2 shows the amount of $412 and James does not have records to dispute this amount. What amount will James enter on line 7 of Form 1040? b. $15,134 ($14,722 from box 1 plus $412) 5) 6) Which of the following is an example of unearned income? d., unemployment compensation 64 Questions and Answers 65