Hwk1Solution

advertisement

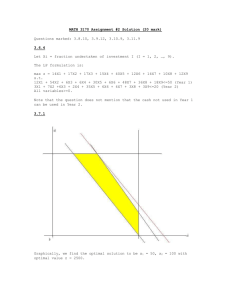

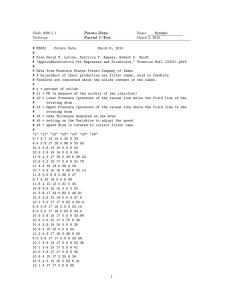

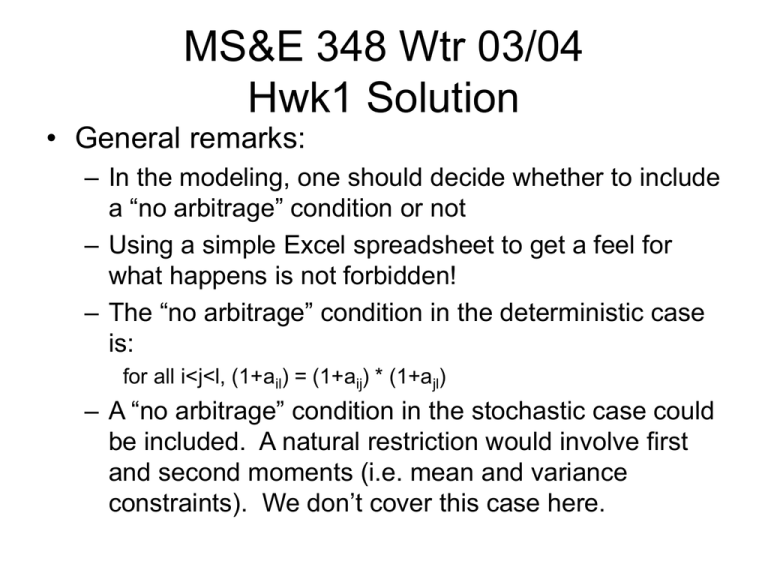

MS&E 348 Wtr 03/04 Hwk1 Solution • General remarks: – In the modeling, one should decide whether to include a “no arbitrage” condition or not – Using a simple Excel spreadsheet to get a feel for what happens is not forbidden! – The “no arbitrage” condition in the deterministic case is: for all i<j<l, (1+ail) = (1+aij) * (1+ajl) – A “no arbitrage” condition in the stochastic case could be included. A natural restriction would involve first and second moments (i.e. mean and variance constraints). We don’t cover this case here. 1. Deterministic Case Min z x s.t. x12 + x13 + x14 – s1 = b1 x23 + x24 + (s1-x12) (1+a12) – s2 = b2 x34 + (s2 – x23) (1+a23) – x13 (1+a13) – s3 = b3 x14 (1+a14) + x24 (1+a24) + x34 (1+a34) – s3 (1+a34) = z xij ≥ 0 decision variables, si ≥ 0 slack variables bi liabilities & aij interest rates are given Excel formulation: no “arb” Time 1 2 3 4 External Liability b1 100.00 b2 100.00 b3 100.00 Amount Borrowed x12 x13 x14 100.00 - x23 x24 210.00 - x34 331.00 Debt Due from Previous Borrowings Term Structure Net CF From t=1 1+a12 1+a13 1+a14 1.10 1.21 1.33 - 1+a23 1+a24 110 1.10 1.21 - From t=1 " t=2 1+a34 0 231 - From t=1 " t=2 " t=3 0 0 364.1 1.10 - z 364.10 Given the consistency of the term structure, there’s an infinity of solutions all giving the same borrowing costs (at t=4) equal to z = 364.1 for the chosen parameters values. Excel formulation: with “arb” Time 1 2 External Liability b1 100.00 b2 Amount Borrowed x12 x13 x14 100.15 - x23 x24 Debt Due from Previous Borrowings Term Structure Net CF From t=1 1+a12 1+a13 1+a14 1.10 1.21 1.33 0.15 1+a23 1+a24 3 100.00 48,806,747.45 110.1703395 1.10 1.11 48,806,537.45 4 b3 100.00 x34 - From t=1 " t=2 0 0 1+a34 - From t=1 " t=2 " t=3 0 54175489.67 0 1.10 53,687,091.20 z (4,880,310.65) Here 1 + a24 has been modified and set to 1.11 < (1+a23) (1+a34) = 1.21 Solver does not converge and model “blows up”! As expected you would borrow a huge amount x24 at t=2 and make money by rolling over the surplus from one period to the next! 2. Stochastic Case Min E[zw2w3] x s.t. x12 + x13 + x14 – s1 = b1 X23w2 + x24w2 + (s1-x12) (1+a12) – s2w2 = b2 x34w2w3 + (s2w2 – x23w2) (1+a23w2) – x13 (1+a13) – s3w2w3 = b3 x14 (1+a14) + x24w2 (1+a24w2) + x34w2w3 (1+a34w2w3) – s3w2w3 (1+a34w2w3) = zw2w3 Xijw ≥ 0 decision variables, siw ≥ 0 slack variables bi liabilities & aijw interest rates are given One of the modeling decisions here was to decide whether a13 and a14 should be uncertain or not. Here we assume these rates are deterministic like a12. 3. Utility Function There’s no one answer to this question as long as you’re consistent For instance, based upon expected values of interest rates, one could compute an approximate “expected” value of the total borrowing costs zE incurred at time t=4 to cover all previous borrowings Then one could apply a (dis)utility function that strongly penalizes incurring borrowing costs higher than this base value U(z) Piecewise linear C1 zE Base value z Make sure the shape and orientation of the utility curve you use is consistent with the fact that you want to minimize borrowing costs!