title insurance - Demotech, Inc.

advertisement

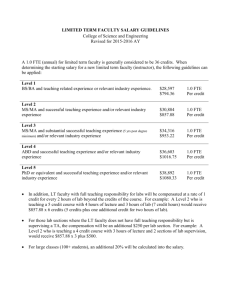

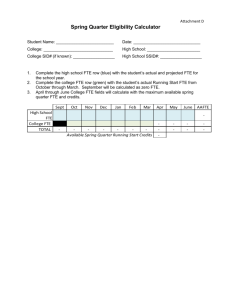

Joseph L. Petrelli, Demotech, Inc. 614 -761- 8602 Incorporated in 1985, Demotech, Inc. is a financial analysis firm serving the P&C and Title insurance industries. In 1989, we became the first company to review and rate regional and specialty insurance companies. In 1992, we became the first company to review and rate Title underwriters. 2 1. Title insurance coverage is retrospective, from the policy effective date. 2. P&C insurance coverage is prospective, from the policy effective date. 3. These timeframes of coverage in conjunction with cost containment activities have not been properly reflected in Title insurance financial reporting requirements. Although Demotech, Inc. first discussed this in 2006, regulatory authorities have not yet adopted procedures and practices to address the situation. A grass roots effort by title agents would be helpful. Let’s take a fresh look at Title insurance and the coverage provided in a Title insurance policy. 4 The term “title insurance” means a contract of insurance against loss or damage on account of encumbrances upon or defects in the title to real estate. 5 The term “title search” means a search and examination of the public records sufficient to determine: 1. Ownership of; 2. Encumbrances on; 3. Liens on; and 4. Defects in the title to; the real estate that is the subject of the search. 6 Summary of some covered risks under the American Land Title Association (ALTA) Loan Policy – 2006 edition. 1. Title being vested other than as stated in Schedule A 2. Any defect in or lien or encumbrance on the Title. The Covered risk includes but is not limited to insurance against loss from … 7 A defect in Title caused by: 1. Forgery 2. Fraud 3. Undue influence 4. Duress 5. Incompetency 6. Incapacity 7. Impersonation 8 8. Failure to authorize a transfer or conveyance 9. Improperly created, executed, witnessed, sealed, acknowledged, notarized or delivered document(s) 10. Documents executed under falsified, expired or otherwise invalid power(s) of attorney 11. Documents not properly filed, recorded or indexed in the Public Records 12. Defective judicial or administrative proceeding 9 13. Lien of real estate taxes or assessments imposed on the Title by a government authority due or payable, but unpaid. 14. Encroachment, encumbrance, violation, variance or adverse circumstance affecting the Title that would be disclosed by an accurate and complete land survey 15. Unmarketable Title 16. No right of access to and from the land 10 Subject to the exclusions from coverage, the exceptions from coverage contained in Schedule B and the conditions and stipulations, the Title insurance company, as of the Date of Policy shown in Schedule A, against loss or damage… Coverage is Retrospective. In Consideration of the Provisions and Stipulations herein, the Property and Casualty Insurance Company, for the term of this date at 12:01 a.m. to one year later at 12:01 a.m. at the location of the property involved, does insure… Coverage is Prospective. P & C is Prospective Date of Policy Incident must have occurred prior to policy date to be considered covered Date of Policy Title is Retrospective Incident must occur within policy period to be considered covered 13 National Association of Insurance Companies (NAIC) Casualty Actuarial Task Force Recommendation to the NAIC’s Accounting Practices and Procedures (Ex4) Task Force. To eliminate confusion arising from the association of the term “allocated” with the ability to assign expenses to a specific claim, NAIC approved a Blanks proposal in 1999. Loss adjustment expenses were no longer “allocated” or “unallocated” rather “Defense and Cost Containment” or “Adjusting and Other.” 14 1. Surveillance expense 2. Litigation management expense 3. Fees or salaries for appraisers 4. Fees or salaries for private investigators 5. Fees or Salaries for fraud investigators 6. Attorney fees incurred owing to a duty to defend, even when other coverage does not exist 7. Cost on engaging experts 15 1. Fees of adjustors and settling agents 2. Attorneys fees incurred in the determination of coverage, including litigation between the insurer and policy-holder 3. Fees or salaries for appraisers, private investigators, hearing representatives, fraud investigators in the capacity of an adjustor 16 An expense directly allocated to a particular claim or incident. Addressing specific defects Everything in Schedule B? The profitability of title underwriters or Title agents will not change if curative and mitigation expenses are more accurately allocated from “agent retention” to “loss adjustment expense.” An initial study prepared by Demotech, Inc. suggests that the Title industry loss and LAE ratio, on this proposed basis, would increase by 70%, to about 78%, and the Title industry expense ratio would decline by 70%, to about 25%. The net effect? Title operating results are comparable to P&C results! 18 Regrettably, the financial reporting necessary to accomplish this has not been promulgated. Absent the financial information needed to silence critics of Title insurance, regulators remain focused on perceived excess profits in the Title insurance industry. Recent events indicate to me that agents are in the crosshairs. 19 General Information 1Calendar year reporting 2State reporting for 3Agent/Agency/Firm Name a) d/b/a (if applicable) Federal tax ID/SSN (for Underwriter Direct Operations: use NAIC 4 Company Code) Parent Company EIN (if applicable) (for Underwriter Direct Operations: use NAIC Group Code) 5License number (for this state) 6Address (line 1) Address (line 2) City State Zip 7Contact person 8Contact phone 9Contact e-mail 20 Agency Information 10Independent 11Affiliated (owned by underwriter) 12Underwriter direct Is reporting agent an Affiliated Business Arrangement (affiliated with real estate brokerage, mortgage company, etc.)? 13 (Y)es/(N)o. If Yes, List affiliated business names on Appendix A 14Agency/Branch Type: Title & closing (full service) Title only Closing only Attorney title 21 Agency Information 15State of domicile/residence of Reporting Entity/Person Number of states in which Reporting Entity operates (list all states on 16 Appendix) A 17Date originally licensed (for this state) 18Percentage of business for this state (by premium) a) Percentage of law firm revenue Number of underwriter appointments, contracts, or agreements. (List 19 underwriters and percentage of business for each on Appendix A) 22 Agency Information 20 No. of employees (total FTE - as of last date of reporting period) a) No. of FTE on March 31 (end of Q1) b) No. of FTE on June 30 (end of Q2) c) No. of FTE on September 30 (end of Q3) d) No. of FTE on December 31 (end of Q4) 21 Licensed employees a) No. of licensed FTE on March 31 (end of Q1) b) No. of licensed FTE on June 30 (end of Q2) c) No. of licensed FTE on September 30 (end of Q3) d) No. of licensed FTE on December 31 (end of Q4) List licensed employees (both allocated and unallocated employees) accounted for in Lines 21(a), (b), (c), and (d) on Appendix A 22 Unlicensed employees a) No. of unlicensed FTE on March 31 (end of Q1) b) No. of unlicensed FTE on June 30 (end of Q2) c) No. of unlicensed FTE on September 30 (end of Q3) d) No. of unlicensed FTE on December 31 (end of Q4) 23 Risk Assumption 23 Open Title Orders 24 Closed Title Orders in Which Policy Was Issued 25 Total number of policies issued in reporting period a) Residential Policies b) Non-residential Policies 26 a) Number of searches billed to 3rd parties b) Number of searches purchased from 3rd parties 27 Number of non-insurance title products produced 28 a) Total settlement/escrow/closing transactions conducted b) Number of line 28 that were sale/purchase settlement/escrow/closing transactions Number of settlement/escrow/closing transactions conducted in which a title policy was 29 not issued 24 Income 30Premium written 31Premium remitted to underwriters 32Settlement/closing/escrow income 33Title examination income 34Abstract/search income 35Income from cancelled orders 36Investment income 37All other income 38Total income (automatically totals) 25 Expenses 39 Employee compensation 40 a) Contract labor (1099) b) Temporary labor (non-1099) 41 Payroll taxes 42 Employee Benefits 43 Rent, utilities, and repair 44 Title plant maintenance/subscription expenses 45 Abstract/search expenditures 46 Computer/software a) Depreciation (if applicable) 47 Business insurance 48 Business legal 49 Accounting 50 Licenses, taxes, and fees 51 Marketing/sales 52 Travel and lodging 53 Employee education 54 Bank charges 55 Charge offs 56 Miscellaneous expense 57 Total business expenses (automatically totals) 26 Loss, Loss Mitigation, and Underwriting Expenses 58 Title losses paid and not reimbursed by underwriter or included in underwriter loss reserves a)Title Loss Files Opened b) Title Loss Files Paid c) Reimbursements paid to underwriter for title losses 59 Closing/Escrow losses a) Number of Closing/Escrow Losses resulting from escrow shortages b) Total amount of funded shortages 60 Abstract/search losses (from abstracts/searches sold) 61 Title loss-related and Closing/Escrow loss-related legal expenses 62 Deductibles paid 63 E&O insurance premiums 64 Fidelity/Surety bond premiums 65 Total loss expenses (automatically totals) 66 Total expenses (automatically totals) 67 Net income before taxes (automatically totals) 68 Federal income tax incurred 69 Net income (automatically totals) 27 Risk Identification including Mitigation Schedule B – Part 1 Items Identified Schedule B – Part 2 Items Identified Items Identified Not on Schedule B – Part 1 or Part 2 Total Items Identified (33)+(34)+(35) 28 This proposal is not a statistical plan. It is a financial reporting plan. It measures financial outcomes only, it does not collect the data necessary to understand the activity that occurs at the policy level. Example: Pitchers versus all other baseball players. 29 State Policies in Sample Incidents in Schedule B Colorado 83 888 Florida 43 248 Louisiana 114 585 North Carolina 270 3,323 All Samples 510 5,044 Given the retrospective coverage in a Title insurance policy, loss adjustment expense is expended PRIOR to policy issuance. These efforts resolve matters that would manifest themselves subsequent to policy issuance. Financial reporting requirements are based upon P&C policies, which are prospective. This reporting overstates the Title expense ratio and understates the Title loss adjustment expense ratio. Unless and until the value proposition of Title insurance – curative efforts, mitigation, analysis, etc. is captured and reported to regulators, the failure to communicate will continue.