Benefits and Services

advertisement

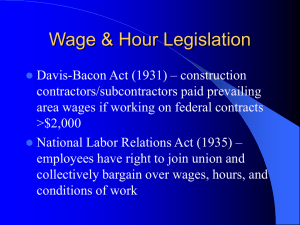

Chapter 13 Benefits and Services 1. Name and define each of the main pay for time not worked benefits. 2. Describe each of the main insurance benefits. 3. Discuss the main retirement benefits. 4. Outline the main employees’ services benefits. 5. Explain the main flexible benefit programs. 1 The Benefits Picture Today Benefits Indirect financial and nonfinancial payments employees receive for continuing their employment with the company 2 The Benefits Picture Today Benefits Required by Federal or Most State Law Social Security Unemployment Insurance Workers’ Compensation Leaves under the Family Medical Leave Act Benefits Discretionary on Part of Employer* Disability, Health, and Life Insurance Pensions Paid Time Off for Vacations, Holidays, Sick Leave, Personal Leave, Jury Duty, etc. Employee Assistance and Counseling Programs “Family Friendly” benefits for Child Care, Elder Care, Flexible Work Schedules, etc. Executive Perquisites Which benefits to offer Who will be covered Whether to include retirees Coverage during probation Policy Issues How to finance benefits Degree of employee choice Cost containment procedures Communicating benefits options 3 Pay for Time Not Worked Supplemental Pay Benefits Benefits for time not worked such as unemployment insurance, vacation and holiday pay, and sick pay Unemployment Insurance Vacations Holidays Provides for benefits if a person is unable to work through no fault of his or her own and Paid vacation days and holidays given by employer Sick Leave Provides pay to an employee when he or she is out of work because of illness Parental FMLA Such as pregnancy and maternity leave Leave and Severance Pay A one-time payment when terminating an employee Supplemental Unemployment The employer makes contributions to a reserve fund from which SUB payments 4 are made to employees for the time the employee is out of work due to layoffs, Insurance Benefits Workers’ Compensation Provides income and medical benefits to work-related accident victims or their dependents, regardless of fault How benefits are determined – The ADA – Controlling workers’ compensation cost – Case management Hospitalization, Health, and Disability Insurance Provide for loss of income protection and group-rate coverage of basic and major medical expenses for off-the-job accidents and illnesses Health Maintenance Organization (HMO) A medical organization consisting of specialists operating out of a community-based health care center. Which provides routine medical services to employees who pay a nominal fee. Preferred Provider Organizations (PPOs) Groups of health care providers that contract to provide services at reduced fees Mental Health Benefits Used to deal with mental illnesses 5 Insurance Benefits Trends in Health Care Cost Control Communication, involvement, and empowerment Premiums and co-pays Prevention programs Health savings accounts Claim audits Other cost control options 6 Insurance Benefits Long Term Care Nursing assistance for former employees Life Insurance Group life insurance or accidental death and dismemberment Group Life Insurance Benefits for Part Time and Contingent Workers Provides lower rates for the employer or employee and includes all employees Up to what extent its important? 7 Retirement Benefits Social Security A federal program provides benefits as retirement benefits at the age of 62. Also, survivor’s or death benefits paid to the employee’s dependents. In addition to disability payments to disabled employees and their dependents Pension Plans Plans that provides a fixed sum when employees reach a predetermined retirement age or when they can no longer work due to disability Defined Benefits Pension Plans A plan that contains a formula for determining retirement benefits Defined Contribution Pension Plans A plan in which the employer’s contribution to employees’ retirement saving funds is specified Portability Instituting policies that’s enable employees to easily take their accumulated pension funds when they leave employer 401 (k) Plans Defined contribution plans based on section 401(k) of the Internal Revenue Code. 8 Retirement Benefits Pension Plans Plans that provides a fixed sum when employees reach a predetermined retirement age or when they can no longer work due to disability Defined Contribution Pension Plans A plan in which the employer’s contribution to employees’ retirement saving funds is specified Saving and Thrift Plan Employees contribute a portion of their earnings to a fund; the employer usually matches this contribution in whole or in part Deferred Sharing Plan Profit Employers contribute a portion of profits to the pension fund, regardless of the level of employee contribution Employees Ownership (ESOP) Stock Plan Cash Balance Plans Qualified, tax-deductible stock bonus plans in which employers contribute company stock to a trust for eventual use by employees Defined benefit plans under which the employer contributes a percentage of employees’ current pay employees’ pension plans every year, and employees earn interest on this amount 9 Retirement Benefits Pension Planning and the Law Law impact on pension planning Employee retirement income security act (ERISA) Pension benefits guarantee corporation (PBGC) Membership requirements Vesting vested funds (Money placed in pension fund that cannot be forfeited for any reason) Benefit formula Plan funding 10 Retirement Benefits Early Retirement Early Window Employees retired before retiring date Retirement Phased Retirement and the Aging Workforce A type of offering by which employees are encouraged to retire early, the incentives being liberal pension benefits plus perhaps a cash payment What is phased retirement programs? Improving Productivity Through HRIS: Benefits Management Systems 11 Personal Services and Family Friendly Benefits Personal Services Benefits provided to employees voluntarily Credit Unions - Employee Assistance Programs Family – Benefits Friendly Benefits such as child care and fitness facilities that make it easier for employees to balance their work and family responsibilities Subsidized child care – Sick child benefits – Elder care – Time off … etc. What is the effect on performance? Other Job Benefits Executives Perquisites Related Educational subsidies Examples and Use 12 Flexible Benefits Programs The Cafeteria Approach / Flexible Benefits Plans Flexible Accounts Flexible Arrangements Each employee is given a benefits fund budget to spend on the benefits he or she prefers Spending Work Enable employees to pay for medical and other expenses with pretax dollars by depositing funds in their accounts from payroll deductions Types Flextime A work schedule in which employees’ workdays are built around a core of mid-day hours when all workers are required to be present Compressed Workweek A work schedule in which employee works fewer but longer days each week What is the effectiveness of flextime and compressed workweek programs? Other Flextime Work Arrangements Job sharing – Work sharing - Telecommuting 13