Document

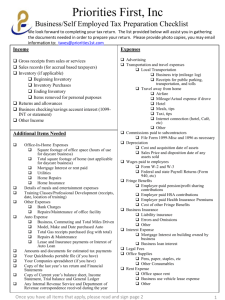

advertisement

Chapter F3 Power Notes The Matching Concept and the Adjusting Process Learning Objectives 1. The Matching Concept 2. Nature of the Adjusting Process 3. Recording Adjusting Entries 4. Summary of Adjustment Process 5. Financial Analysis and Interpretation C3 C3 - 1 Chapter F3 Power Notes The Matching Concept and the Adjusting Process Slide # Power Note Topics 3 6 9 20 36 41 • • • • • • Reporting Revenue and Expense The Matching Concept Trial Balance, Chart of Accounts Deferrals and Accruals Summary of Adjustments Vertical Analysis Note: To select a topic, type the slide # and press Enter. C3 - 2 Reporting Revenue and Expense TWO METHODS Cash Basis of Accounting Accrual Basis of Accounting C3 - 3 Cash Basis of Accounting Revenue reported when cash is received Expense reported when cash is paid Does not properly match revenues and expenses C3 - 4 Accrual Basis of Accounting Revenue reported when earned Expense reported when incurred Properly matches revenues and expenses in determining net income Requires adjusting entries at end of period It just sounds mean – it really isn’t C3 - 5 The Matching Concept Debits = Credits Liabilities Assets Owner’s Equity Expenses Revenues C3 - 6 The Matching Concept Debits = Credits Liabilities Assets Owner’s Equity Net Income Expenses Revenues C3 - 7 The Matching Concept Debits = Credits Liabilities Assets Owner’s Equity Net Income Expenses Revenues matching Net income is determined by properly matching expenses and revenues. C3 - 8 NetSolutions Unadjusted Trial Balance December 31, 2002 Assets 11 12 14 15 17 18 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment 2,065 2,220 2,000 2,400 20,000 1,800 C3 - 9 NetSolutions Unadjusted Trial Balance December 31, 2002 Liabilities 11 12 14 15 17 18 21 23 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent 2,065 2,220 2,000 2,400 20,000 1,800 900 360 C3 - 10 NetSolutions Unadjusted Trial Balance December 31, 2002 Stockholders’ Equity 11 12 14 15 17 18 21 23 31 33 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Capital Stock Dividends 2,065 2,220 2,000 2,400 20,000 1,800 900 360 25,000 4,000 C3 - 11 NetSolutions Unadjusted Trial Balance December 31, 2002 Revenue 11 12 14 15 17 18 21 23 31 33 41 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Capital Stock Dividends Fees Earned 2,065 2,220 2,000 2,400 20,000 1,800 900 360 25,000 4,000 16,340 C3 - 12 NetSolutions Unadjusted Trial Balance December 31, 2002 Expenses 11 12 14 15 17 18 21 23 31 32 41 51 52 54 55 59 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Pat King, Capital Pat King, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense 2,065 2,220 2,000 2,400 20,000 1,800 900 360 25,000 4,000 16,340 4,275 1,600 985 800 455 42,600 42,600 C3 - 13 NetSolutions Unadjusted Trial Balance December 31, 2002 11 12 14 15 17 18 21 23 31 33 41 51 52 54 55 59 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Capital Stock Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense 2,065 2,220 2,000 2,400 20,000 1,800 900 360 25,000 4,000 16,340 4,275 1,600 985 800 455 42,600 42,600 C3 - 14 NetSolutions Expanded Chart of Accounts Balance Sheet 1. 11 12 14 15 17 18 19 Assets Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation 2. 21 22 23 Liabilities Accounts Payable Wages Payable Unearned Rent 3. 31 32 33 Stockholders’ Equity Capital Stock Retained Earnings Dividends Income Statement 4. Revenue 41 Fees Earned 42 Rent Revenue 5. 51 52 53 54 55 56 59 Expenses Wages Expense Rent Expense Depreciation Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense C3 - 15 NetSolutions Expanded Chart of Accounts Balance Sheet 1. 11 12 14 15 17 18 19 Assets Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation 2. 21 22 23 Liabilities Accounts Payable Wages Payable Unearned Rent 3. 31 32 33 Stockholders’ Equity Capital Stock Retained Earnings Dividends Income Statement 4. Revenue 41 Fees Earned 42 Rent Revenue 5. 51 52 53 54 55 56 59 Expenses Wages Expense Rent Expense Depreciation Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense C3 - 16 NetSolutions Expanded Chart of Accounts Balance Sheet 1. 11 12 14 15 17 18 19 Assets Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation 2. 21 22 23 Liabilities Accounts Payable Wages Payable Unearned Rent 3. 31 32 33 Stockholders’ Equity Capital Stock Retained Earnings Dividends Income Statement 4. Revenue 41 Fees Earned 42 Rent Revenue 5. 51 52 53 54 55 56 59 Expenses Wages Expense Rent Expense Depreciation Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense C3 - 17 NetSolutions Expanded Chart of Accounts Balance Sheet 1. 11 12 14 15 17 18 19 Assets Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation 2. 21 22 23 Liabilities Accounts Payable Wages Payable Unearned Rent 3. 31 32 33 Stockholders’ Equity Capital Stock Retained Earnings Dividends Income Statement 4. Revenue 41 Fees Earned 42 Rent Revenue 5. 51 52 53 54 55 56 59 Expenses Wages Expense Rent Expense Depreciation Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense C3 - 18 NetSolutions Expanded Chart of Accounts Balance Sheet 1. 11 12 14 15 17 18 19 Assets Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accumulated Depreciation 2. 21 22 23 Liabilities Accounts Payable Wages Payable Unearned Rent 3. 31 32 33 Stockholders’ Equity Capital Stock Retained Earnings Dividends Income Statement 4. Revenue 41 Fees Earned 42 Rent Revenue 5. 51 52 53 54 55 56 59 Expenses Wages Expense Rent Expense Depreciation Expense Utilities Expense Supplies Expense Insurance Expense Miscellaneous Expense C3 - 19 Adjustments – Deferrals and Accruals Revenues Current Period Deferrals Cash Received Future Period Revenue Recorded C3 - 20 Adjustments – Deferrals and Accruals Revenues Current Period Deferrals Cash Received Accruals Revenue Recorded Future Period Revenue Recorded Cash Received C3 - 21 Adjustments – Deferrals and Accruals Revenues Current Period Deferrals Cash Received Accruals Revenue Recorded Cash Received Current Period Future Period Expenses Deferrals Cash Paid Future Period Revenue Recorded Expense Recorded C3 - 22 Adjustments – Deferrals and Accruals Revenues Current Period Deferrals Cash Received Accruals Revenue Recorded Cash Received Current Period Future Period Expenses Deferrals Accruals Cash Paid Expense Recorded Future Period Revenue Recorded Expense Recorded Cash Paid C3 - 23 Adjustments – Deferred Expense On December 1, NetSolutions purchased insurance for 24 months at a cost of $2,400. Example P1 – Purchase initially recorded as an asset. Cash P1..... 2,400 Prepaid Insurance Adjustment A1 – Record insurance used for December, $100. Assets P1..... 2,400 Insurance Expense Expenses C3 - 24 Adjustments – Deferred Expense On December 1, NetSolutions purchased insurance for 24 months at a cost of $2,400. Example P1 – Purchase initially recorded as an asset. Adjustment A1 – Record insurance used for December, $100. Cash P1..... 2,400 Prepaid Insurance P1..... 2,400 Assets A1..... 100 A1 Insurance Expense A1.....100 A1 Expenses C3 - 25 Adjustments – Deferred Expense On December 1, NetSolutions purchased insurance for 24 months at a cost of $2,400. Example P2 – Purchase initially recorded as an expense. Cash P2..... 2,400 Prepaid Insurance Adjustment A2 – Record insurance unused as of December 31. Assets Insurance Expense P2..... 2,400 Expenses C3 - 26 Adjustments – Deferred Expense On December 1, NetSolutions purchased insurance for 24 months at a cost of $2,400. Example P2 – Purchase initially recorded as an expense. Adjustment A2 – Record insurance unused as of December 31. Cash P2..... 2,400 Prepaid Insurance Assets A2..... 2,300 A2 A2 Insurance Expense P2..... 2,400 A2.....2,300 Expenses C3 - 27 Adjustments – Deferred Revenue On December 1, NetSolutions received cash of $360 for three months’ rent beginning December 1. Example S1 – Sale initially recorded as a liability. Cash Adjustment A3 – Record rent earned for December. S1..... 360 Unearned Rent Liabilities S1..... 360 Rent Revenue Revenues C3 - 28 Adjustments – Deferred Revenue On December 1, NetSolutions received cash of $360 for three months’ rent beginning December 1. Example S1 – Sale initially recorded as a liability. Cash Adjustment A3 – Record rent earned for December. S1..... 360 Unearned Rent A3..... 120 A3 Liabilities S1..... 360 A3 Rent Revenue A3.....120 Revenues C3 - 29 Adjustments – Deferred Revenue On December 1, NetSolutions received cash of $360 for three months’ rent beginning December 1. Example S2 – Sale initially recorded as revenue. Cash Adjustment A4 – Record rent unearned as of December 31. S2..... 360 Unearned Rent Liabilities Rent Revenue S2.....360 Revenues C3 - 30 Adjustments – Deferred Revenue On December 1, NetSolutions received cash of $360 for three months’ rent beginning December 1. Example S2 – Sale initially recorded as revenue. Cash Adjustment A4 – Record rent unearned as of December 31. S2..... 360 Unearned Rent Liabilities A4..... 240 A4 A4 Rent Revenue A4..... 240 S2.....360 Revenues C3 - 31 Adjustments – Accrued Expense NetSolutions received employee services for the last two days of December amounting to $250, to be paid later. Adjustment A5 – Record accrued wages of $250. Wages Payable Liabilities Wages Expense Bal.....4,275 Expenses C3 - 32 Adjustments – Accrued Expense NetSolutions received employee services for the last two days of December amounting to $250, to be paid later. Adjustment A5 – Record accrued wages of $250. Wages Payable Liabilities A5..... 250 A5 Wages Expense Bal.....4,275 A5.....250 A5 Expenses C3 - 33 Adjustments – Accrued Revenue As of December 31, NetSolutions provided 25 hours of services at $20 per hour to be billed next month. Adjustment A6 – Record accrued fees earned of $500. Accounts Receivable Assets Bal.....2,220 Fees Earned Bal....16,340 Revenues C3 - 34 Adjustments – Accrued Revenue As of December 31, NetSolutions provided 25 hours of services at $20 per hour to be billed next month. Adjustment A6 – Record accrued fees earned of $500. Accounts Receivable Assets Bal.....2,220 A6..... 500 A6 Fees Earned Bal....16,340 A6.....500 A6 Revenues C3 - 35 Summary of Adjustments Buying Side Deferred Expenses Assets A1 A2 Expenses Rearranging the Debits C3 - 36 Summary of Adjustments Buying Side Selling Side Deferred Expenses Deferred Revenues Assets Liabilities A1 A2 A3 A4 Expenses Revenues Rearranging the Debits Rearranging the Credits C3 - 37 Summary of Adjustments Buying Side Selling Side Accrued Expenses Liabilities A5 Expenses Adding a New Transaction C3 - 38 Summary of Adjustments Buying Side Selling Side Accrued Expenses Accrued Revenues Liabilities Assets A5 A6 Expenses Revenues Adding a New Transaction Adding a New Transaction C3 - 39 Summary of Adjustments Buying Side Selling Side Deferred Expenses Accrued Expenses Deferred Revenues Accrued Revenues Assets Liabilities Liabilities Assets A1 A2 Expenses A5 Expenses Rearranging Adding a New the Debits Transaction A3 A4 Revenues A6 Revenues Rearranging Adding a New the Credits Transaction C3 - 40 Financial Analysis and Interpretation Objective: Use vertical analysis to compare financial statement items with each other and with industry averages. Comparative Income Statements For the Years Ended December 31, 2003 and 2002 Fees earned Operating expenses: Wages expense Rent expense Vertical Analysis: 2003 Amount Percent $ 187,500 100.0% 2002 Amount Percent $ 150,000 100.0% $ 60,000 15,000 $ 45,000 Wages expense $ 60,000 Fees earned $ 187,500 32.0% 8.0 30.0% = 32.0% C3 - 41 Chapter F3 Power Notes The Matching Concept and the Adjusting Process This is the last slide in Chapter F3. Note: To see the topic slide, type 2 and press Enter. C3 - 42