Chapter 4

advertisement

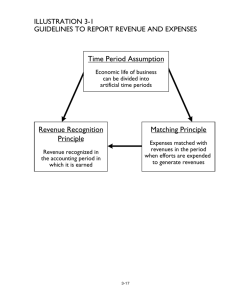

Chapter 4 Adjusting the Accounts 4-1 Guidelines to Report Revenue and Expenses Time Period Assumption Economic life of business can be divided into artificial time periods Revenue Recognition Principle Revenue recognized in the accounting period in which it is earned Matching Principle Expenses matched with revenues in the period when efforts are expended to generate revenues 4-2 Depreciation PREPAYMENT Cost of Truck $15,000 ASSET 2008 1/1/08 Entry: Truck Cash 15,000 15,000 ASSET EXPENSE 2009 12/31/08 Depreciation Expense Accumulated Depreciation EXPENSE CONTRA ASSET 2010 12/31/09 12/31/10 5,000 5,000 Depreciation Expense Accumulated Depreciation 5,000 5,000 Depreciation Expense Statement Presentation: Accumulated Depreciation Balance Sheet Asset Truck Contra Asset Less: Accum. Depr. Book Value 5,000 5,000 $15,000 $15,000 $15,000 5,000 10,000 15,000 $10,000 $ 5,000 $ -0- 4-3 Prepayment Relationships PREPAYMENTS Benefits More Than One Accounting Period RECORD AS ASSET Prepaid Insurance RECORD AS LIABILITY 1,200 Cash Cash 1,200 (Acquired one year policy) Insurance Expense Prepaid Insurance (One month expired) Initial Entry 100 100 Adjusting Entry 6,000 Unearned Rent 6,000 (Received one year’s rent) Unearned Rent Benefits Consumed or Earned in Current Period 500 Rent Revenue (One month earned) 500 4-3 Prepayment Relationships (continued) Account Effects: Balance Sheet Prepaid Insurance 1,200 100 Unearned Rent 500 Bal. 1,100 6,000 Bal. 5,500 Income Statement Insurance Expense 100 Rent Revenue 500 4-4 Accrual Relationships ACCRUALS Expense or Revenue Not Yet Recorded RECORD EXPENSE Salaries Expense RECORD REVENUE 500 Salaries Payable Accounts Receivable 500 (Accrued salary owed) Salaries Payable Cash (Paid salaries) Adjusting Entry Service Revenue 500 Subsequent Entry 1,000 (Accrued revenue for services provided) Cash 500 1,000 1,000 Accounts Receivable (Collected account receivable) 1,000 4-5 Types of Adjusting Entries Type of Adjustment Reason for Adjustment Account Balances Before Adjustment Adjusting Entry 1. Prepaid Expenses (a) Prepaid expenses originally recorded in asset accounts have been used Assets Overstated Expenses Understated Dr. Expenses Cr. Assets 2. Unearned Revenues (b) Unearned revenues initially recorded in liability accounts have been earned Liabilities Overstated Revenues Understated Dr. Liabilities Cr. Revenues 3. Accrued Revenues (c) Revenues earned but not yet received in cash or recorded Assets Understated Revenues Understated Dr. Assets Cr. Revenues 4. Accrued Expenses (d) Expenses incurred but not yet paid in cash or recorded Expenses Understated Liabilities Understated Dr. Expenses Cr. Liabilities Each adjusting entry affects a balance sheet account and an income statement account. 4-6 Examples of Adjusting Entries Instructions: For each entry indicate the name of the account debited and the account credited. Account Debited Adjusting Entry 1. To record expired rent which had been prepaid 2. To record supplies used during the period 3. To record depreciation on furniture 4. To record unearned revenue that has been earned 5. To record salary owed but not paid 6. To record rent earned but not recorded. Account Credited 4-6 Examples of Adjusting Entries (continued) Answer: Account Debited Account Credited 1. Rent Expense Prepaid Rent 2. Supplies Expense Supplies 3. Depreciation Expense Accumulated Depreciation 4. Unearned Revenue Revenue 5. Salary Expense Salary Payable 6. Rent Receivable Rent Revenue 4-7 Posting of Adjusting Entries The following unadjusted accounts and related balances are provided at September 30: Accounts Receivable………………………………. $ 2,400 Supplies…………………………………………….. 1,200 Salary Payable…………………………………….. -0- Unearned Revenue……………………………….. 500 Revenue…………………………………………….. 15,000 Salary Expense…………………………………….. 2,100 Depreciation Expense…………………………….. -0- Accumulated Depreciation……………………….. 3,000 Instructions: Open T-accounts and post the adjusting entries indicated from the a) b) c) d) e) following data: Supplies on hand, $200. Revenue earned but not accrued, $900. Unearned revenue earned by not recorded, $400. Salary owed to employees, $700. Depreciation of $200 is recognized. 4-7 Posting of Adjusting Entries (continued) Accounts Receivable Supplies 2,400 (b) 1,000 (a) 1,000 -0- 900 (d) 700 3,300 200 Unearned Revenue (c) Salary Payable 400 Supplies Expense 500 100 1,000 1,000 Depreciation Expense 15,000 (b) 900 (c) 400 16,300 Salary Expense -0(a) Revenue 700 2,100 (d) 700 2,800 Accumulated Depreciation -0(e) 200 200 3,000 (e) 200 3,200 4-8 Review Chapter Concepts Topic Applied Results Justification 1. Time Period Assumption Economic life of business is divided into time periods. To provide information to prepare financial statements and tax return 2. Revenue Recognition Revenue is recorded in period earned. Requires adjusting entries. To record assets or decreases in liabilities and proper reporting of revenue earned. 3. Matching Principle Record expenses in the period they occur. Requires adjusting entries. To record liabilities or use of assets and expenses incurred in earning revenues. 4. Accrual Basis Accounting Applies revenue recognition principle, matching principle, and time period assumption. To record revenue when earned and expenses when incurred. 4-9 Prepayment—Alternative Treatment PREPAYMENTS Benefits More Than One Accounting Period RECORD AS EXPENSE Insurance Expense RECORD AS REVENUE 1,200 Cash Cash 1,200 (Acquired one year policy) Prepaid Insurance Initial Entry 1,100 Insurance Expense (Eleven months unexpired) Rent Revenue Adjusting Entry 6,000 (Received one year’s rent) Rent Revenue 1,100 6,000 5,500 Unearned Rent (Eleven months unearned) 5,500 4-9 Prepayment—Alternative Treatment (continued) Account Effects: Balance Sheet Prepaid Insurance Unearned Rent 1,100 5,500 Income Statement Insurance Expense 1,200 Bal. 100 1,100 Rent Revenue 5,500 6,000 Bal. 500