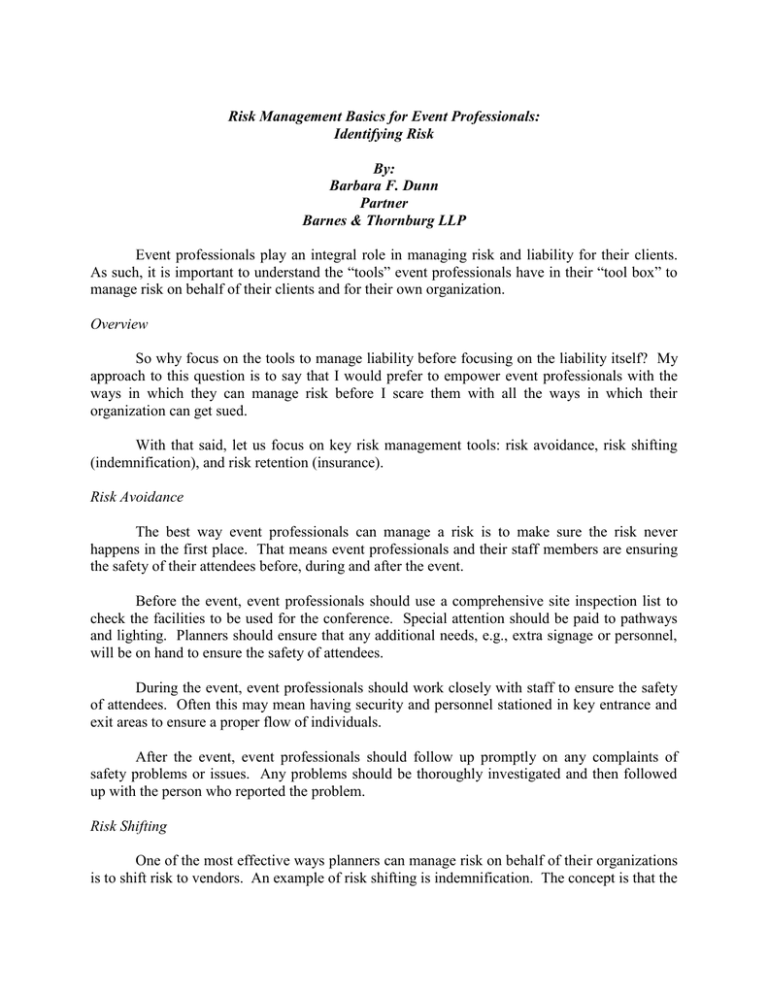

Risk Management Basics for Event Professionals:

Identifying Risk

By:

Barbara F. Dunn

Partner

Barnes & Thornburg LLP

Event professionals play an integral role in managing risk and liability for their clients.

As such, it is important to understand the “tools” event professionals have in their “tool box” to

manage risk on behalf of their clients and for their own organization.

Overview

So why focus on the tools to manage liability before focusing on the liability itself? My

approach to this question is to say that I would prefer to empower event professionals with the

ways in which they can manage risk before I scare them with all the ways in which their

organization can get sued.

With that said, let us focus on key risk management tools: risk avoidance, risk shifting

(indemnification), and risk retention (insurance).

Risk Avoidance

The best way event professionals can manage a risk is to make sure the risk never

happens in the first place. That means event professionals and their staff members are ensuring

the safety of their attendees before, during and after the event.

Before the event, event professionals should use a comprehensive site inspection list to

check the facilities to be used for the conference. Special attention should be paid to pathways

and lighting. Planners should ensure that any additional needs, e.g., extra signage or personnel,

will be on hand to ensure the safety of attendees.

During the event, event professionals should work closely with staff to ensure the safety

of attendees. Often this may mean having security and personnel stationed in key entrance and

exit areas to ensure a proper flow of individuals.

After the event, event professionals should follow up promptly on any complaints of

safety problems or issues. Any problems should be thoroughly investigated and then followed

up with the person who reported the problem.

Risk Shifting

One of the most effective ways planners can manage risk on behalf of their organizations

is to shift risk to vendors. An example of risk shifting is indemnification. The concept is that the

organization shifts risk to the party which can best control the risk. For example, if the

organization is hiring a bus company to transport attendees at their conference, the risk is that the

bus will get into an accident and attendees will get hurt. In this case, the organization shifts that

risk to the bus company by asking the bus company to indemnify the organization in their

contract. The indemnification language states that the bus company will indemnify and hold the

organization harmless (from a financial standpoint) from any claims due to the bus company’s

negligence. Here’s a sample indemnification clause:

"Supplier shall indemnify, defend, and hold harmless [Organization Name], its officers,

directors, employees and agents and each of them (collectively "the indemnitees"), from and

against any and all claims, demands, actions, judgments, costs, and expenses, including costs of

defense thereof, incurred by any of the indemnitees caused by or arising from the negligence,

gross negligence, or intentional misconduct of Supplier, its officers, directors, employees, agents

or contractors."

With this clause in place, should the bus get into an accident, an attendee gets hurt, and

that attendee sues the organization, the organization can invoke its rights under the

indemnification clause and have the bus company hire lawyers to defend the lawsuit on the

company’s behalf right from the beginning and to pay any damages awarded against the

organization.

Indemnification clauses should be part of every contract as there is always the possibility

that the good or service which is being purchased will cause harm to someone and the

organization will be sued. By having indemnification in the contract, the organization knows

that it will be protected in such circumstances.

One last note re: indemnification: It is important to have the organization’s lawyer draft

or review each indemnification provision as this is the type of clause in which one word can

make a difference in the scope of the protection.

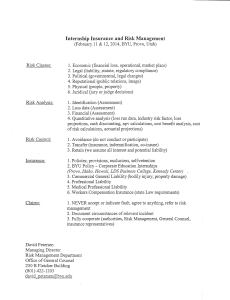

Risk Retention (Insurance)

Another way organization can cover their risk is through risk retention. When an

organization purchases insurance, it is agreeing to “retain” the risk (up to the dollar amount of

the deductible). Everything in excess of that deductible is covered by the insurance company.

Let us explore some types of insurance:

General commercial liability insurance is often referred to as GCL or CGL or errors and

omissions insurance. This insurance is the backbone of any organization’s insurance coverage as

it protects against personal injury or death among other things. For example, if an organization

is sued by an attendee who slipped and fell at their event, this liability insurance would cover the

cost of defending the lawsuit along with paying any damages which are awarded against the

organization.

Note that liability insurance coverage should start at 2 million dollars. While many

organizations may have 1 million dollars of coverage, such amount is not sufficient in today’s

dollar terms given the cost to defend a personal injury lawsuit.

As with the indemnification provision, it is important to have the organization’s lawyer

and insurance representative involved in the review of liability insurance to ensure the

organization is getting comprehensive coverage. Of particular concern is the list exclusions, i.e.,

those items which are not covered under the policy. Note that liquor liability claims are typically

excluded from general commercial liability insurance. Given the risk that the organization may

be held liable for liquor liability claims under social host liability (topic to be addressed in the

next column), event professionals should ensure that their organization has obtained an

endorsement or rider to have such claims covered under the policy.

Directors and officers liability insurance is another type of insurance in which the

directors, officers and other key personnel are protected by insurance in the event they are

individually named in a lawsuit.

Property and casualty insurance covers equipment and other property owned by the

organization and insures it against fire, theft or other damage.

Event cancellation insurance is another type of insurance which protects the revenue and

costs associated with the organization’s conference. If the organization would have to cancel its

event entirely or shut it down earlier than scheduled due to weather problems or transportation

strikes, event cancellation insurance would cover the greater of the revenue which would have

been incurred in connection of the event or the expenses incurred in connection with the event.

While this type of insurance no longer provides coverage for acts or terrorism (although

organizations can purchase riders to obtain such coverage), it covers many other occurrences

which could impact a event. Note that many groups which had to cancel spring events in Mexico

due to the government orders surrounding the H1N1 outbreak benefitted greatly from having

event cancellation insurance in place.

Conclusion

So now that you have an understanding of risk avoidance, insurance and indemnification,

you can begin using these “tools” in your work as event professionals to minimize the risk to

your client and your own organization.

Barbara Dunn is a Partner with the Associations and Foundations Practice Group at Barnes &

Thornburg where she concentrates her practice in association law and meetings, travel and

hospitality law. Barbara can be reached at (312) 214-4837 or barbara.dunn@btlaw.com.

©Copyright 2013. Barbara F. Dunn, Barnes & Thornburg LLP. Chicago, Illinois, USA. All

rights reserved under both international and Pan American copyright conventions. No

republication permitted without the express written consent of the copyright holder.