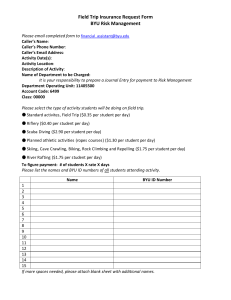

Risk Management - Internship Office

Internship Insurance and Risk Management

(February 11 & 12, 2014, BYU, Provo, Utah)

Risk Classes:

Risk Analysis:

Risk Control:

Insurance:

Claims:

1. Economic (financial loss, operational, market place)

2. Legal (liability, statute, regulatory compliance)

3. Political (governmental, legal changes)

4. Reputational (public relations, image)

5. Physical (people, property)

6. Juridical (jury or judge decisions)

1. Identification (Assessment)

2. Loss data (Assessment)

3. Financial (Assessment)

4. Quantitative analysis (loss run data, industry risk factor, loss projections, cash discounting, npv calculations, cost benefit analysis, cost of risk calculations, actuarial projections)

1. Avoidance (do not conduct or participate)

2. Transfer (insurance, indemnification, co-insure)

3. Retain (we assume all interest and potential liability)

1. Policies; provisions, exclusions, self-retention

2. BYU Policy - Corporate Education Internships

(Provo, Idaho, Hawaii, LDS Business College, Kennedy Center) ,_.

3. Commercial General Liability (bodily injury, property damage)

4. Professional Liability

5. Medical Professional Liability

6. Workers Compensation Insurance (state Law requirements)

1. NEVER accept or indicate fault, agree to anything, refer to risk management

2. Document circumstances of relevant incident

3. Fully cooperate (authorities, Risk Management, General Counsel, insurance representatives)

David Petersen

Managing Director

Risk Management Department

Office of General Counsel

250 B Fletcher Building

(801)422-1203 david petersen@byu.edu