Financial Standards Code

advertisement

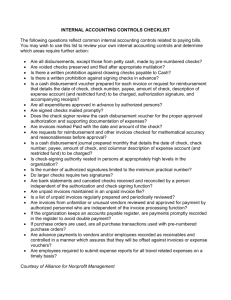

Taking Care of Business AFSCME’s Financial Standards Code Workshop Objectives Recognize the purpose and importance of the Financial Standards Code Be aware of key components of the Code Be able to locate the resources to carry out the requirements of the Code Fiduciary Responsibility Fiduciary = Holding in trust for another; involving a confidence or trust It’s NOT Your Money AFSCME Financial Standards Code ARTICLE I - PURPOSE AND SCOPE • Establishes minimum financial standards for the handling of funds and records maintenance • Adopted by the International Executive Board and is part of the AFSCME Constitution • Compliance with the code is required for all AFSCME affiliates Workshop Objectives Recognize the purpose and importance of the Financial Standards Code Be aware of key components of the Code Be able to locate the resources to carry out the requirements of the Code Custody of Funds Bank Accounts Should Be… • In federally insured institutions • In the name of the union • Contain only union funds Paid Bill and Voided Checks Records • Paid Bills or Invoices When signing checks, write the Date Paid, Amount Paid, and Check Number on your copy of the bill or invoice • Check Stubs and Voided Checks Before storing a voided check, write “VOID” across the check in ink and tear off the signature portion • Retain All Voided Checks Reimbursement Records • All Officer and Employee Expense Reimbursements need approved expense reports • Union business purpose MUST be explained as part of the supporting documentation Financial Records Keep Copies of: • Financial Reports prepared for the membership or the Executive Board • Federal Reports filed with the Internal Revenue Service (IRS), including payroll, or U.S. Department of Labor • Copies of Financial Reports filed with the International Union: - Surety Bond Report - Local Union Annual Financial Report (LUAFR) • Minutes of any Executive Board, Membership or Committee Meetings Financial Records • All Financial Records (including the minutes of Executive Board and Membership Meetings) must be kept for a minimum of six years • Retention Period is determined by the previous six years plus the current year Income • Retain Copies of transmittal, remittance advice or membership documents • Make Deposits Promptly and keep a copy of the check with the deposit slip • Record deposits in Cash Receipts Journal Authorization of Expenditures • Union money can only be spent with proper authorization. • Authorization should only be given for expenditures that serve a legitimate Union Purpose. Unauthorized Expenses Authorization of Expenditures Four Types of Authorizations: • Required by Law - Payroll Taxes or IRS Fines • Required by Constitution - Council and International Per Capita Taxes • Required by Contract - Lease for office rental • Vote - Must be approved by the Executive Board or Membership1 Annual Budget • Estimate income and expenses • Required for all large affiliates • Strongly Recommended for all affiliates Knowledge Check 1. Which of the following statements about union bank accounts is NOT true? o They must be in federally insured institutions. o They can be in the name of the union or its officers. o They can only contain union funds. 2. Which financial records must be retained by every local union? o Reports to government agencies, such as the IRS and Department of Labor o AFSCME Surety Bond and Local Union Annual Financial Report (LUAFR) Reports o Minutes of monthly meetings regarding financial matters o All of the above 3. True or False: All of the local’s financial records must be kept for a minimum of 5 years. o True o False Answers 1. Correct answer – it is not true that union bank accounts can be in the name of the union or its officers. 2. Correct answer is all of the above – Financial records prepared for the membership and the executive board must be retained in the union records. Keep copies of any federal reports filed with the Internal Revenue Service, such as payroll Form W-2’s, Form 941’s, 940’s or IRS Form 990’s.You should also have copies of the reports filed annually with the International 3. Correct answer is false – All Financial records must be retained for a minimum of six years plus the current year Authorization of Expenditures Before You Write a Check,You Need: • Authorization • Documentation • Explanation Writing Checks • Checks should never be written payable to CASH • Checks should be written payable to vendors or individuals. • All checks must be signed by two (2) officers of the Union.. • Never pre-sign checks or use a rubber stamp for check signing purposes. • Never use an ATM card.0 Documentation of Expenditures • Receipts and Invoices must be maintained to support all disbursements • Union Purpose must be clearly explained • Expense Reports are required to document all reimbursements to Officers and Members Minutes of Meetings • Serve as a permanent record of actions and decisions • Document financial authorizations • Financial Reports are attached to the minutes Financial Reports Must…. • Be prepared monthly • Be reviewed by the Executive Board and Membership • Be attached as a permanent part of the local’s minutes • Include the following components: income and expenses for the period excess or deficit for the period beginning and ending cash balances listing of unpaid bills Government Reporting You may be required to file one or more of the following: Form IRS Form 990, 990-EZ or 990-N IRS Form 1120-POL DOL Form LM-2/3/4 Due Date May 15 March 15 March 31 These dates are for calendar-year filers. Knowledge Check 1. Which of he following statements about writing checks is correct? o Checks can be made out to cash. o Funds can be withdrawn by using an ATM card. o All checks must be signed by two officers of the union. 2. Which of the following are required before writing a check? o o o o Authorization, such as approval by the board or membership Documentation (such as a bill, invoice, or expense report) for the payment An explanation of the purpose of the payment All of the above 3. Financial reports must be: o o o o Prepared monthly Reported to the executive board and the membership Attached as part of the local union’s minutes All of the above Answers 1. Correct answer is the last choice – All checks must be signed by two officers of the union. 2. Correct answer – All of the above Before you write any check, you need to be clear about the following things: • The authorization for the expenditure-was it approved in the budget, by the board or membership? Is this approval documented in the minutes? • Documentation-you should never sign a check for an expenditure that does not have complete supporting documentation. This documentation may consist of a bill or invoice for a payment to a vendor or an expense report for a payment to an officer or member. The supporting documentation for each and every expenditure must include an explanation of the union business purpose. • An Explanation-what is the purpose of this payment? Expenditures should be made solely for the benefit of the union members, and not just for a few officers. 3. Correct answer – All of the above • Prepared monthly • Reported to the executive board and the membership • Attached s part of the local union’s minutes AFSCME Reporting Every Affiliate Must File: • Surety Bond Report is due by March 1st each year • Local Union Annual Financial Report (LUAFR) is due May 15 (or 4½ months after Fiscal Year ends) AFSCME Reporting Large Affiliates (2000+) must file: • Monthly report showing actual income and expenses vs. budgeted income and expenses for the month and year-to-date • Quarterly financial statements and annual budgets on a timely basis • An annual audit performed by a CPA Audits • Required at least once each year • Consult your local constitution • Audits are performed by Trustees or Independent Auditors not otherwise connected with the Union • All Councils and any Local Unions over 2,000 Members must have an annual CPA audit Audits Written report: • Details material deviations from the Financial Standards Code • Includes action taken to correct audit discrepancies • Must be reported to Executive Board and Membership • Is attached to Minutes of the Meeting at which it Was Presented Workshop Objectives Recognize the purpose and importance of the Financial Standards Code Be aware of key components of the Code Be able to locate the resources to carry out the requirements of the Code AFSCME SecretaryTreasurer’s Training • Secretary-Treasurer’s Training is highly recommended for all union officers • Contact your Council or Local to have them schedule a training in your area For More Information AFSCME Financial Standards Code web page: http://www.afscme.org/publications/1717.cfm AFSCME Auditing Department 202-429-5032