Why Have Rules

advertisement

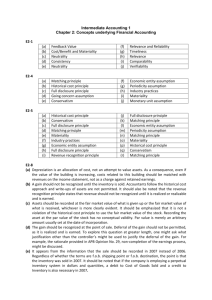

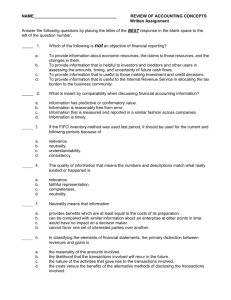

Unit 1 The Rules Rules of The Accounting "Game” The process of Accounting and bookkeeping are guided by rules of process. Why Have Rules ? All games such as football, baseball, basketball, etc. have rules. Why ? So that everyone plays the game the same way. Playing the Accounting "Game" is no different. . What if owners and managers could prepare their business's financial statements the way they felt like ? If a business was wanting a loan or credit, they would have a tendency to overstate the value of their assets and the value of their business. If it came to taxes (we don't like to have to pay them), let's expense and write off everything. As for measuring performance (profitability) and comparing businesses in the same industry, you'd have no idea as to who was actually doing well and who wasn't. You couldn't even compare your own business from year to year. So, to put all businesses on the same playing field, the accounting profession has established some rules and guidelines The current accounting rules and standards are continually reviewed, studied, changed, and added to in order to make financial presentations more consistent, comparable, meaningful, and informative. The Rules Generally accepted accounting principles are a set of rules and practices that are recognized as a general guide for financial reporting purposes. Generally accepted means that these principles must have substantial authoritative support. The Canadian Institute of Chartered Accountants (CICA) is responsible for developing accounting principles in Canada. CICA’S CONCEPTUAL FRAMEWORK The conceptual framework consists of: objective of financial reporting, qualitative characteristics of accounting information, elements of financial statements, and recognition and measurement criteria (assumptions, principles, and constraints). OBJECTIVE OF FINANCIAL REPORTING The objective of financial reporting is to provide information that is useful for decision-making QUALITATIVE CHARACTERISTICS OF ACCOUNTING INFORMATION The accounting alternative selected should be one that generates the most useful financial information for decision making. To be useful, information should possess the following qualitative characteristics: 1. understandability 2. relevance 3. reliability 4. comparability and consistency UNDERSTANDABILITY Information must be understandable by its users. Users are assumed to have a reasonable comprehension of, and ability to study, the accounting, business, and economic concepts needed to understand the information. RELEVANCE Accounting information is relevant if it makes a difference in a decision. Relevant information helps users forecast future events (predictive value), or it confirms or corrects prior expectations (feedback value). Information must be available to decision makers before it loses its capacity to influence their decisions (timeliness). RELIABILITY Reliability of information means that the information is free of error and bias – it can be depended on. To be reliable, accounting information must be verifiable – there must be proof that it is free of error and bias. The information must be a faithful representation of what it purports to be – it must be factual. COMPARABILITY AND CONSISTENCY Comparability means that the information should be comparable with accounting information about other enterprises. Consistency means that the same accounting principles and methods should be used from year to year within a company. 2000 2001 2003 RECOGNITION AND MEASUREMENT CRITERIA Recognition and measurement criteria used by accountants to solve practical problems include assumptions, principles, and constraints. Assumptions provide a foundation for the accounting process. Principles indicate how economic events should be reported in the accounting process. Constraints permit a company to modify generally accepted accounting principles without reducing the usefulness of the reported information. Assumptions Going concern Monetary unit Economic entity Time period Principles Revenue recognition Matching Full disclosure Cost Constraint s Cost - benefit Materiality GOING CONCERN ASSUMPTION The going concern assumption assumes that the enterprise will continue to operate in the foreseeable future. Implications: capital assets are recorded at cost instead of liquidation value, amortization is used, items are labeled as current or non-current. MONETARY UNIT ASSUMPTION The monetary unit assumption states that only transaction data capable of being expressed in terms of money should be included in the accounting records of the economic entity. Also assumes unit of measure ($) remains sufficiently stable over time. Ignores inflationary and deflationary effects. Should not be included in accounting records Should be included in accounting records Customer satisfaction Percentage of international employees Salaries paid ECONOMIC ENTITY ASSUMPTION The economic entity assumption states that economic events can be identified with a particular unit of accountability. Example: Harvey’s activities can be distinguished from those of other food services such as Swiss Chalet. TIME PERIOD ASSUMPTION The time period assumption states that the economic life of a business can be divided into artificial time periods. Example: months, quarters, and years 2000 QTR 1 QTR 2 QTR 3 QTR 4 2001 JAN MAY SEPT DEC 2003 FEB MAR APR JUN JUL AUG OCT NOV REVENUE RECOGNITION PRINCIPLE The revenue recognition principle says that revenue should be recognized in the accounting period in which it is earned. Revenue can be recognized: 1. 2. 3. 4. At point of sale During production At completion of production Upon collection of cash MATCHING PRINCIPLE Expense recognition is traditionally tied to revenue recognition. This practice – referred to as the matching principle – dictates that expenses be matched with revenues in the period in which efforts are expended to generate revenues. FULL DISCLOSURE PRINCIPLE The full disclosure principle requires that circumstances and events that make a difference to financial statement users be disclosed. A summary of significant accounting policies is usually the first note to the financial statements. COST PRINCIPLE The cost principle dictates that assets are recorded at their historic cost. Cost is used because it is both relevant and reliable. 1. Cost is relevant because it represents the price paid, the assets sacrificed, or the commitment made at the date of acquisition. 2. Cost is reliable because it is objectively measurable, factual, and verifiable. CONSTRAINTS IN ACCOUNTING Constraints permit a company to modify generally accepted accounting principles without reducing the usefulness of the reported information. The constraints are cost-benefit and materiality. 1. Cost-benefit means that the value of information should be greater than the cost of providing it. 2. Materiality relates to an item’s impact on a firm’s overall financial condition and operations.