Consolidated Trust Funds Information General The Investment

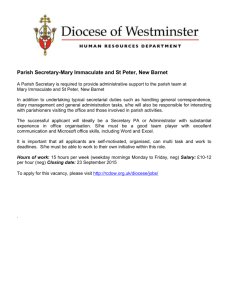

advertisement

Consolidated Trust Funds Information General The Investment Liaison Subcommittee is the Diocesan committee which oversees the Consolidated Trust Fund. There is not a specific Canon on the operation of the Consolidated Trust Fund, just the accumulated Minutes and Decisions of the Investment Liaison Subcommittee. There is an Actuarial Consultant who works with the Diocese on the Consolidated Trust Fund. He is better suited than anyone in the Synod office to give a detailed overview of the mechanics of the Fund. However, the following we can provide. Terms CTF: EFT: Consolidated Trust Fund Electronic Funds Transfer Fund Manager: Trustee: Auditor: Jarislowsky Fraser CIBC Mellon Deloitte Is a parish’s small part of the portfolio “In Trust” so it cannot be at risk of loss due to other members of the pooled funds? The parish funds are “In Trust” in the sense that any additions, withdrawals, or alterations to the parish’s Funds have to originate from the parish in properly documented correspondence. Beyond that, all members of the Fund reside in the same pool and are subject to the same ebb and flow of the marketplace. Who is responsible to administer the funds according to the terms of each fund? Responsibility lies with the Parish Council to make sure that Funds in the CTF are being administered according to terms of each specific endowment, gift, fund, etc. The intent of and use for the Funds rest solely with the parish. No action is taken on a parish’s Funds unless minutes of Parish Meetings (wherein said action is approved) accompany any correspondence to the Synod Controller’s office. When the market turns down, what will be the effect on a parish’s part of the portfolio and on its part of the quarterly distribution of “Income” interest? The possibility of loss (reduction in share value) exists if there is a downturn in the market value of the equities in the entire Fund. The possibility of gain also exists for the same reason. Does the Diocese receive audited financial statements of the portfolio and an annual statement of the portfolio income and expenses? Audited Financial Statements are available from the Trustee. Diocesan auditors cover this aspect in their annual audit. If required, copies may be obtained. The Diocese works from the Monthly Financials provided by the Trustee. How much of a parish’s investment income is reduced by management fees and can the HST portion of the management fees be recovered? Fund Manager fee calculations include: a. 0.5000% x ¼ first $5M b. 0.3500% x ¼ next $5M c. 0.2500% x ¼ of $15M d. 0.2000% x ¼ of $13.8M e. No fees payable on Jarislowsky International Fund Trustee fees average $1,800 per month. HST is recovered by the Diocese. Does the quarterly payment to a parish include unrealized gains and will the quarterly distributions be reduced to prevent erosion of capital? The current 4% per annum distribution to unit holders includes a “Top Up” from the “Realized Capital Gains Account”. If it is deemed by the Investment Liaison Subcommittee, acting on advice from the Fund Manager, that any market downturn will be prolonged and have the effect to erode the Principal of the Fund, the distribution rate would be adjusted downward. At present this committee sets the distribution rate for the following four quarters. Is there any documentation that can be shared to help explain how the distributions are made and the plan for market downturns? The “strategy for market downturns” would rest first with the Fund Manager. However, the set-up of the Fund (with the content of Fixed Income Securities) is for “long term growth” rather than quick returns. Does a parish have any input into which investments are purchased by the administrators of the CTF? Fund Managers are instructed to invest in companies of ethics when the information is available (firearms/alcohol, etc., are not permitted). The basic intent of the Fund is long term growth, so a basic 50/50 (Equities/Interest Bearing) is the A.v Revised 12/12/2013 starting point, with Fund Managers given some latitude. Letters of suggestion will be received by the Controller but the Investment Liaison Subcommittee is the body giving direction to CTF Fund Managers using criteria agreed upon by Diocesan Council. Any letters received by the Controller will be tabled with the Investment Liaison Subcommittee. When will distributions (interest) be paid from the Fund? The CTF works one quarter in arrears for both deposits and withdrawals to allow for the actual investment or withdrawal of the amount(s) involved. The portfolio runs on the calendar year. Funds deposited to a parish “account” are not attributed income until the beginning of a quarter (January 1st, April 1st, etc.). If you make a deposit in any quarter of the year: JanMar, Apr-Jun, Jul-Sep, Oct-Dec, distributions will start to be paid in the following quarter. Example: a. Deposits i. Money deposited January 2014 will generate Distribution of Income interest at June 30th, 2014. b. Withdrawals i. Money withdrawn April 2014 will be available to generate Distribution of Income interest at June 30 th, 2014 with any adjustment(s) to capital and market value posted at September 30 th, 2014. A parish’s investments might include several funds designated for specific purposes. Is it possible to have the detail included in the Trust Fund Register reporting? For each parish “account” (specifically, for each parish “bank” account which will receive EFT transactions), a page is generated in the trust fund register. This page can have any number of Funds as desired by the parish. The parish provides the name of the Fund(s) and the Diocese provides the numbering. Occasionally, the parish account number will equal the parish number; however, the chance of this happening is very slim. Currently our reporting is limited to summary information only. However, we do keep detailed electronic records so that information is available if specifically requested. Reporting is generated with Microsoft Office Access, a database program as opposed to a ‘canned’ product. Reporting is as reliable as our in-house ability to create it. What happens if a Fund accumulates? On each of the Endowment and Gravelot Trust Fund Registers are stated opening and closing balances of each Fund, with a summary of transactions processed during the quarter in question. A current market value is reported as well as the amount of quarterly “Income for Distribution” interest earned by each Fund. If the Fund is accumulating, a check box signifying as much is ticked and no payment is generated. Any interest amount accumulated is included in the summary of transactions for the specific Fund on the following register, thus increasing its balance. May a parish withdraw funds from the CTF and how long does it take? Provided all terms of a Fund are met, withdrawals are permitted. The Synod office requires the following to process a withdrawal: a) b) c) Letter of request addressed to the Diocesan Controller for the withdrawal from the parish’s CTF, signed by the Treasurer and any two of the Wardens or Rector. A copy of the Parish Council Minutes in which the motion for the withdrawal of the funds was passed. An accurate description of the Fund from which the money is to be withdrawn. A copy of the latest trust fund register from the CTF (which accompanies your quarterly payment) is the best document for providing such. Funds will be forwarded to the parish via cheque or EFT. Notification of the amount will be sent out by email or mail to the attention of whomever is indicated on the “Change of Fund Administrator Information” form included with this handbook. If the amount is not unusually large, this process typically takes 10 days. Larger withdrawals require different timing. If the Fund is being closed, there may be a final adjustment amount which will be calculated and forwarded in a ubsequent quarter. How does a parish get its interest income deposited using the EFT system? In 2009 we initiated an EFT payment system for CTF quarterly interest “Income” amounts. EFT is, on average, one week faster than a cheque. To be added to our list of parishes which receive their funds via EFT, fill in the appropriate spaces on the “Change of Fund Administrator Information” form included in this handbook and attach a voided cheque of the parish bank account to which you wish future CTF payments be deposited. Once initiated, the same setup can then be used for making any withdrawals from funds above and beyond quarterly interest income payments. A.v Revised 12/12/2013