ACG 2021 T33 - St. Petersburg College

advertisement

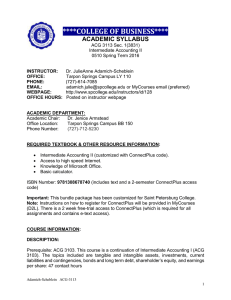

****COLLEGE OF BUSINESS**** ACADEMIC SYLLABUS ACG 3113 Intermediate Accounting II Spring Term 2015 INSTRUCTOR: OFFICE: PHONE: EMAIL: WEBPAGE: OFFICE HOURS: Roni Murphy TE 107-B (St. Pete Gibbs campus) (727) 341-4628 murphy.roni@spcollege.edu or MyCourses email (preferred) http://www.spcollege.edu/instructors/id/1436 Follow above link to SPC Instructor webpage for office hours. ACADEMIC DEPARTMENT: Program Director: Mike Ewell Office Location: Epi- Room 2-305E Phone Number: (727) 791-2610 REQUIRED TEXTBOOK & OTHER RESOURCE INFORMATION: Intermediate Accounting II (customized with ConnectPlus code). Access to high speed Internet. Knowledge of Microsoft Office. Basic calculator. ISBN Number: 9781308356839 (Book & ConnectPlus code) Important: This bundle package has been customized for the Saint Petersburg College only. Library: http://www.spcollege.edu/central/libonline/. COURSE INFORMATION: DESCRIPTION: Prerequisite: ACG 3103. This course is a continuation of Intermediate Accounting I (ACG 3103). The topics included are tangible and intangible assets, investments, current liabilities and contingencies, bonds and long term debt, shareholder’s equity, and earnings per share: 47 contact hours Fernandez ACG-3113 1 MAJOR LEARNING OUTCOMES: 1. The student will identify the various costs included in the initial cost of property, plant, and equipment, natural resources, and intangible assets. 2. The student will determine depreciation (depletion in case of natural resources) using both time-based and activity-based methods. 3. The student will describe the amortization and valuation of intangible assets. 4. The student will identify the situations that involve significant impairment of the value of operational assets and describe the required accounting procedures. 5. The student will demonstrate how to identify an account for investments and its different classifications. 6. The student will define liabilities and distinguish between current, long-term liabilities, and other instruments of debt such as bonds. 7. The student will describe the components of shareholder’s equity and explain how they are reported in the statement of shareholder’s equity. 8. The student will calculate Earnings per Share (EPS). ASSIGNMENTS AND SCHEDULE: MODULE Module 1 TOPIC CH 10 Property, Plant, and Equipment and Intangible Assets: Acquisition and Disposition. Fernandez HOMEWORK Learn Smart CH 10 Homework CH10: ConnectPlus Quiz CH10: ConnectPlus Discussion Question Initial cost of property, plant, and equipment Intangible assets Exchange for equity securities Fixed-asset turnover ratio Dispositions and exchanges Capitalized interest Accounting treatment of costs incurred ACG-3113 2 MODULE Module 2 TOPIC CH11 Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment. Module 3 Module 4 Fernandez Held-to-maturity Trading securities Available-for-sale securities Significant influence Equity method Fair value of the net asset CH 13 Current Liabilities and Contingencies Learn Smart CH 11 Homework CH11: ConnectPlus Quiz CH11: ConnectPlus Discussion Question Concept of cost allocation Periodic depreciation Periodic depletion Periodic amortization of intangible assets Different accounting treatments Accounting treatment for errors Identify significant impairment Repairs, maintenance, additions, improvements CH 12 Investments. HOMEWORK Learn Smart CH 12 Homework CH12: ConnectPlus Quiz CH12: ConnectPlus Discussion Question Learn Smart CH 13 Homework CH13: ConnectPlus Quiz CH13: ConnectPlus Discussion Question Current and long-term liabilities Notes Accrued liabilities and other liabilities Noncurrent obligations Contingencies ACG-3113 3 MODULE Module 5 TOPIC CH 14 Bonds and Long-Term Notes. Module 6 CH15 Leases Fernandez Characteristics of debt instruments Bonds: Face value, discount, or at premium Notes, installment notes Forms of long-term debt Financial ratios Extinguishment of debt Report liabilities at their fair values Operational, financial, and tax implications Rental agreements Leases classification Transactions associated with operating leases Capital lease Sales-type lease Bargain purchase option Residual value of a leased asset Executory cost, discount rate, initial direct cost, and contingent rentals Sale-leaseback agreements HOMEWORK Learn Smart CH 14 Homework CH14: ConnectPlus Quiz CH14: ConnectPlus Discussion Question Learn Smart CH 15 Homework CH15: ConnectPlus Quiz CH15: ConnectPlus Discussion Question ACG-3113 4 Module 7 CH18 Shareholder’s Equity Components Comprehensive income Forms of organizations Issuance of shares Retired shares and treasury shares Paid-in capital Dividends Stock dividends and splits Learn Smart CH 18 Homework CH18: ConnectPlus Quiz CH18: ConnectPlus Discussion Question CH19 Share-Based Compensation and Earnings Per Share Module 8 Fernandez Stock award plans Stock options Share purchase plans Complex capital structure Common shares Effect on EPS of the sale of new shares Preferred dividends and EPS Options, rights, and warrants Convertible securities Treasury stock method EPS in the income statement CUMULATIVE FINAL EXAM!! Learn Smart CH 19 Homework CH19: ConnectPlus Quiz CH21: ConnectPlus STUDY FOR FINAL EXAM!! ACG-3113 5 IMPORTANT DATES: Course dates: 03/16/2015 – 05/07/2015 Last day to drop and receive a refund: 03/20/2015 Last day to withdraw and receive a grade of “W”: 04/16/2015 Financial Aid: http://www.spcollege.edu/central/SSFA/HomePage/calendar.htm DISCIPLINE SPECIFIC INFORMATION: Accounting in general is a hard subject that requires a lot of patience, perseverance, practice and study to learn. This is an intensive eight-week course. It is recommended the student dedicate a minimum of 10 hours per week to its study. Online and Blended classes give the student a lot of flexibility in regards to study time but it is imperative to get organized and set a consistent time per week to go over the study material and the other requirements of this course. The learning process can be very demanding, but at the same time it will be very rewarding. The world of accounting is fascinating and will help the student develop a new set of skills that will open the doors to a whole new world of opportunities. ATTENDANCE: The college-wide attendance policy is included in the Syllabus Addendum at: http://www.spcollege.edu/webcentral/policies.htm Students classified as “No Show” for both of the first two weeks will be administratively withdrawn from the class. For online classes “No Show” means not completing the Syllabus Agreement Quiz and registering for ConnectPlus in Week 1 and not completing all assignments in Week 2. Students who have not completed more than 40% of their assignments due (homework & chapter exams) at the 60% point will be considered as “not actively participating” in the class and may be administratively withdrawn with a grade of “WF”. Fernandez ACG-3113 6 GRADING: Grades will be earned in five parts, as follows: Discussion Questions----------------------------Learn Smart----------------------------------------Homework ------------------------------------------Quizzes ---------------------------------------------Cumulative Final Exam -------------------------Total possible points --------------------------A B C F 10% 10% 25% 40% 15% 100.00% 90 - 100% 80 - 89% 70 - 79% Less than 70% ASSIGNMENTS: It will be the students’ responsibility to complete their assignments on time and in an acceptable manner. Thus, late assignments will not be accepted regardless of circumstances. Assignments that are not completed by the due date will receive a zero (0). In consideration of personal contingencies, the instructor will drop the student’s lowest score on homework, LearnSmart and chapter quizzes. With this rule, the student will not be penalized for a low score on a homework, LearnSmart and chapter quiz. Please pay attention to the instructions for every assignment such as due date, time allowed (if that is the case), maximum attempts, etc. The instructions will be displayed in ConnectPlus. STUDENTS’ AND INSTRUCTOR’S EXPECTATIONS: Online /Student Conduct http://www.spcollege.edu/ecampus/help/conduct.htm Online Student, Faculty and Staff Expectations and Performance Targets http://www.spcollege.edu/ecampus/help/expectations.htm Academic Honesty Policy http://www.spcollege.edu/AcademicHonesty/ Fernandez ACG-3113 7 STUDENT SURVEY OF INSTRUCTION: The student survey of instruction is administered in courses each semester. It is designed to improve the quality of instruction at St. Petersburg College. All student responses are confidential and anonymous and will be used solely for the purpose of performance improvement. SYLLABUS CHANGES: Will be posted on the ANGEL and announced to all the students in case they happen. SYLLABUS ADDENDUM: State and College policies are found on the addendum. Please make sure you read the information by following the link below. http://www.spcollege.edu/webcentral/policies.htm Fernandez ACG-3113 8