First Week Study Guide Page Introduction to Business Business

advertisement

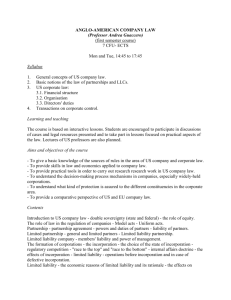

Introduction to Business Business Administration (BA) 101 School of Business Administration THE FIRST WEEK ORGANIZATIONAL FORM ___________________ PRINCIPAL TOPICS 1. Distinguish between an Organization’s Form and its Structure. An organization chooses a form for the purpose of dealing with its external environment (customers, suppliers, creditors, government agencies, etc.). An organization’s structure is the manner in which an organization internally arranges its functions. 2. A firm can be any organizational form. Corporation and company are synonymous terms. It will be assumed, unless otherwise specified, that a partnership is a general partnership (a partnership’s form is determined by how third parties perceive the relationship between its partners). A sole proprietorship should be identified by both the proprietor’s name and the proprietorship’s assumed business name, if any. 3. In addition to identifying the characteristics of the three primary organizational forms1, be able to explain an organization’s strategic rationale for selecting a particular form. A. Liability from contractual obligations and torts2. A sole proprietor is personally liable for all claims. A general partner may be jointly and severally liable for all claims made against the partnership and committed by the other partners. A corporation’s shareholders (stockholders) are not liable in contract or tort subject to the Business Judgment Rule3. A shareholder’s liability is limited (“limited liability”) to the extent of their investment (their stock’s purchase price). B. Taxation. A sole proprietorship is an individual doing business in his or her own name who will be the taxpayer. All partnerships are “pass-through” entities, i.e., 1 Special Purpose Entities (SPEs) are created by state legislatures to accomplish some purpose. The form of each will differ from state to state. Examples of SPEs include (1) Professional Corporations (PCs allow licensed professionals, e.g., physicians, architects or engineers, to enjoy benefit of contractual immunity but not avoid malpractice liability), (2) Limited Liability Corporations (LLCs are hybrids with characteristics of a partnership’s tax-treatment and a corporation’s limited liability and (3) Subchapter-S Corporations (Sub-S corporations are general-purpose corporations that elect “pass-through” tax treatment subject to restrictions that (a) limit the number of shareholders (100), (b) require all shareholders to be individuals, no partnerships, corporations or non-resident aliens can be shareholders, (c) no shareholder can have a “negative basis,” and (d) shareholders cannot provide services without triggering employment-based liabilities; in other words, a shareholder must be either an investor or an employee, but cannot be both at the same time. 2 A tort is a civil harm than injures someone in some way. Violating a statute or contract is not a tort. Torts occur from negligent actions which may have been intentional. 3 A case-law derived legal principle holding that a corporation’s directors, managers, employees and other agents will not be liable for their actions if they performed their duties (1) in good faith, (2) with the care of an ordinarily prudent person in a like position under similar circumstances and (3) in a manner reasonably believed to have been in the corporation’s best interests. First Week Study Guide Page 2 the partnership is not a tax-paying entity; rather, its profits pass-through to and are reported on the partners’ personal tax returns. A corporation pays federal, state (and sometime local) taxes on its net income. Cash dividends paid to and capital gains earned by shareholders are also taxed. These two levels of tax liability are referred to as “double-taxation.” C. Control. A sole proprietor controls every aspect of his or her business. Major partnership decisions, e.g., entry or exit of partners, distribution of losses or profits or acquisition or disposition of assets, usually require unanimous consent. Corporations are managed by a Board of Directors elected by its shareholders. Directors may manage the corporation or delegate operational authority to hired management. Bylaws will dictate which decisions can be made by a company’s managers, directors or shareholders. TEXTBOOK MATERIAL Chapter 1 Distinguish between for-profit and non-profit corporations (Section 1.3). Two essential resources: human (ideas) and capital (financial) (Sections 2.2 and 2.3). Managerial approach: decision-making that minimizes risk (predictable events); Entrepreneurial approach: decision-making under uncertainty (unpredictable events) (Section 2.4). Differentiate between stakeholders and shareholders (stockholders). Know that not all stakeholders are shareholders but all shareholders are stakeholders (Section 3). Only two types of decisions: Strategic (what do we do?) and Tactical (how do we do what we’ve decided to do?) (Section 5.3). Chapter 5 Know essential characteristics of three principal organizational forms (Sections 1, 2 and 3). Be aware of limitations of Special-Purpose Entities, e.g., Subchapter-S Corporations (Sub-S) and Limited Liability Corporations (LLC) (Sections 2.4 and 2.5). Be able to explain purpose for Articles of Incorporation (Charter) vis-à-vis a corporation’s Bylaws (Section 3.1). Note: In most western states, corporations register by filing Articles of Incorporation whereas a Charter is filed in most eastern states; these documents are virtually identical except in name. Know how corporate investors obtain a return on (and return of) their investment (Section 3.2). Franchises are not an organizational form; they are one manner of business association (Section 5.3). TERMS AND CONCEPTS Creditor/Debtor Revenue/Operating Expenses/Profit Limited Liability Liability (Joint and Several) Bylaws Board of Directors Non-profit Capital Gain Agency Problem Common Stock Double Taxation Non-profit Business Judgment Rule Perpetual Life Articles of Incorporation (Charter) Dividend (Cash and Stock) Stock/Stockholders and Stakeholders Revised December 28, 2010