Payment Mortgages

advertisement

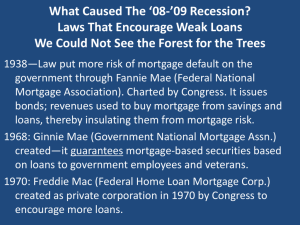

Mortgages and Fannie Mae Mortgages Fixed rate Variable rate Fixed Rate Mortgage $200,000 mortgage This Year’s Balance Graduated payment Previous = Year’s Balance + This Year’s Payment Based on the Previous Year’s Unpaid Balance 10 percent interest rate Claim: $23,492 annual payment Payment Interest Paid on Balance This year (Year 0) Next year (Year 1) Year 2 23,492 23,492 Balance 200,000 200,000 + 20,000 23,492 = 196,508 196,508 + 19,651 23,492 = 192,667 Year 10 23,492 144,348 14,435 Year 19 Year 20 23,492 23,492 21,356 21,356 + 2,136 23,492 2,136 21,356 +2,136 23,492 = 0 Interest 20,000 19,651 19,267 Variable (Adjustable) Rate Mortgages When inflation is present purchasing power is key. What we expect to pay back to the bank and what the bank expects to receive depends on the inflation rate that we expect in the future. What we will actually pay back to the bank depends upon the actual inflation rate in the future. Real Nominal Interest = Interest Rate Rate When the actual inflation rate turns out to be greater than that expected Real interest rate is less than expected In terms of purchasing power, borrowers repay the bank less than expected Borrowers gain Lenders lose Inflation Rate When the actual inflation rate turns out to be less than that expected Real interest rate is greater than expected In terms of purchasing power, borrowers repay the bank greater than expected Borrowers lose Lenders gain The experience of the 1970s prompted banks to offer variable rate mortgages. The nominal interest rates are these mortgages are adjusted periodically to account for inflation. Graduated (Escalating) Payment Mortgages Graduated (Escalating) Payment $20,000 $28,156 Payment for the first 7 years: Payment for the next 13 years: Payment This year (Year 0) Next year (Year 1) Year 2 20,000 20,000 Balance 200,000 200,000 + 20,000 20,000 = 200,000 200,000 + 20,000 20,000 = 200,000 Year 7 Year 8 20,000 28,156 200,000 200,000 + 20,000 28,156 = 191,844 Year 19 Year 20 28,156 28,156 25,596 25,596 + 2,560 28,156 = 0 25,596 +2,560 28,156 A $8,156, 40%, increase Interest 20,000 20,000 20,000 20,000 2,560 Fannie Mae (Federal National Mortgage Association) Fannie Mae is a government-sponsored enterprise plays a large role in the market for home mortgages. It is more or less invisible to households holding mortgages because if does not does not provide mortgages directly to households. Instead it: Purchases whole mortgages that that banks have previously issued on what is called the secondary market. Keeps some of the whole mortgages and earns income from them as they are repaid. Cobbles whole mortgages together into mortgage backed securities (MBSs) Keeps some of the MBSs for itself and sells the remainder to private financial institutions (Citibank, Bank of America, etc.). Owners of the MBSs receive income as the mortgages are repaid. We will now focus more closely on MBSs. Mortgage Backed Securities (MBS) Bank A “Whole” Mortgages Mortgage Hunter Mortgage Christin A financial institution such as Fannie Mae, Bear Stearns, etc. buys a bunch of whole mortgages from “primary” lenders (banks). Mortgage Haley Bank B “Whole” Mortgages Mortgage Jayde Mortgage Mateo Fannie Mae, Bear Stearns, etc. Cobbles a large number of these mortgages into a single Mortgaged Back Securities (MBS) Splits the MBS into a large number of shares Fannie Mae, Bear Stearns, etc. keeps some shares of the MBS for itself and sells others to private parties. Mortgage Kate Each share of the MBS represents a fraction of each mortgage that have been cobbled together into the MBS. Private parties including banks and other financial institutions The owners of the MBSs earn income as the mortgages included in the MBS are repaid. Policy Change, Home Prices, and Mortgage Backed Securities (MBS) Bank A “Whole” Mortgages Mortgage Hunter Mortgage Christin Mortgage Haley Assets Reserves Liabilities 50 Vault Cash 30 Dep at Fed 20 Suppose that Bank: Sold Hunter’s and Haley’s mortgages to Fannie Mae. Used the proceeds to purchase mortgagebacked securities (MBSs). 100 60 Securities Stock&Bonds 60 MBSs 40 440 480 Loans Hunter 20 Christin 20 Haley 20 Net Worth = 590 510 = 80 Deposits Borrowing 500 10 Question: Why might a bank wish to sell some of its whole mortgages to purchase mortgage-backed securities? Answer: Diversification. Fannie Mae Eases Credit To Aid Mortgage Lending By STEVEN A. HOLMES New York Times: September 30, 1999 WASHINGTON, Sept. 29— … the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders. The action … will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring. Fannie Mae … has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people ... In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the governmentsubsidized corporation may run into trouble in an economic downturn … Fannie Mae … does not lend money directly to consumers. Instead, it purchases loans that banks make on what is called the secondary market. By expanding the type of loans that it will buy, Fannie Mae is hoping to spur banks to make more loans to people with less-than-stellar credit ratings. Effect of the Policy Change Banks took advantage of the new policy providing mortgages to households who would not have received them previously. Let us call these households “not so credit worthy” buyers. Question: What type of mortgage would you expect these “not so credit worthy” home buyers choose, fixed rate mortgages or graduated payment mortgages? $200,000 Mortgage at a 10 Percent Interest Rate Fixed Rate Graduated Payment Payment for the first 7 years: $23,492 $20,000 Payment for the next 13 years: $23,492 $28,156 Answer: The “not so credit worthy” home buyers chose graduated payment mortgages. Question: What would you expect the banks providing the loans to “not so credit worthy” households to do with these “whole” mortgages? Answer: Sell the “whole” mortgages to Fannie Mae, Bear Stearns, etc. who would create MBSs from them. 2000-2007 Question: How did this affect the market for new homes? Market for New Homes Answer: The P price increased. S Real Price of Single Family Homes ($1,000): 2000-2008 300 275 250 225 200 D 175 2000 D 2002 2004 2006 2008 2010 Q Question: What happens when the payment rises for the “not so credit worthy” home buyers who Payment for the first 7 years: Payment for the next 13 years: have a graduated mortgage? Graduated Payment $20,000 $28,158 40%, increase Answer: Some of these home buyers discovered a few years after purchasing their homes that they could not afford the higher payments required by their graduated payment mortgages. Question: Was this a problem for the “not so credit worthy” home buyer between 2000 and 2007? Answer: No. Since home prices were rising a buyer could sell his/her home and have more than enough to pay off the mortgage.