Texas Real Estate Law - PowerPoint - Ch 02

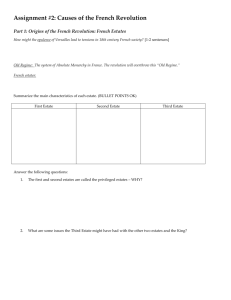

advertisement

TEXAS REAL ESTATE LAW 11E Charles J. Jacobus Chapter 2 Estates in Land — Freehold Estates 2 What’s an “estate in land”? An estate in land has been defined as the degree, quantity, nature, and extent of interest that a person has in real property. 3 What are “freehold estates”? Freehold estates are estates that manifest some title to real property. Freehold Estates Fee simple Life estates Fee on conditional limitation Fee on condition subsequent Fee on condition precedent Mineral rights Air rights 4 Rule Against Perpetuities Primogeniture – the right of the first male child to become legal title holder to the property upon the death of the father Entailments – only heirs of the individual’s body could get fee title to the property Neither are allowed under Texas law! 5 Title Theory Versus Lien Theory Title theory – lender holds legal title until loan is repaid. Texas is lien theory! Lien theory – borrower holds legal title and lender has a lien. 6 Legal Title Versus Equitable Title Legal title – actual ownership Equitable title – title in fairness What borrower holds during the term of the loan under lien theory. What lender holds during the term of the loan under lien theory 7 Freehold Estates Freehold Estates Fee simple Life estates Fee on conditional limitation Fee on condition subsequent Fee on condition precedent Mineral rights Air rights Freehold estates are estates that (1) manifest some title to real property, (2) are of indefinite duration, and (3) inheritable by the heirs of the owner. 8 Fee Simple A fee simple estate is one entitling the owner to: 1. The entire property 2. Unconditional powers of disposition during his life. 3. Title that descends to heirs upon his death. 4. Includes both legal and equitable title. What people consider clear, unencumbered title. Vast majority of real estate conveyed with fee simple title. Fee simple is presumed unless otherwise specified. Fee simple title can be encumbered as with an easement or lien. 9 Life Estates An estate for the life of some person, along with a second estate that is termed a remainder interest. Texas recognizes three types of life estates: (1) a regular life estate; (2) a life estate pur autre vie; and (3) a homestead life estate (discussed in Chapter 3). 10 Regular life estate • Generally conveyed to a grantee for the term of the grantee’s life. • Remainderman receives possession at a future date. • It vests fee simple in the remainderman upon the grantee’s death. Grantor (grants life estate to life tenant) Grantee (has possession for life) Remainderman (receives fee simple estate upon death of grantee) Grantor – Grantee – Remainderman 11 Pur autre vie You can also convey the life estate to someone for the life of someone else. Life estates for the life of another person are called life estates pur autre vie. Example: You convey property to your sister as long as your mother lives and upon the death of your mother the property passes to your daughter. Grantor – you Grantee – your sister Measuring life – your mother Remainderman – your daughter 12 Final points on life estates • The life estate may be conveyed separate and apart from the remainder interest. • Life estate holder has a limited legal and equitable interest, subject to the rights of the holder of the remainder interest. • Neither party may encumber the property if it results in waste, deterioration, or alienation of the other’s rights. • Life estate owner can maximize the economic benefits (oil and gas leases, leasing it to tenants, or developing it), but must also bear the expense of maintenance (taxes, expenses, and insurance). 13 Fee on Conditional Limitation • AKA: determinable fee, or fee simple defeasible • Estate is limited to the happening of a certain event • When such event happens, the estate automatically goes back to grantor or to some third party named by grantor • Generally uses the words “so long as,” “until,” or “during” • Example: “I convey property to the city so long as it is used as a park.” 14 Fee on Condition Subsequent • Would convey the property to the grantee “on the condition that” or “provided however,” or “if” • Gives the grantor the right to terminate the estate rather than the automatic reversion provided for by the fee on conditional limitation. • This right of reversion is called the right of reentry. • Grantor can only get title back if grantor takes the initiative to reenter the property by court action. • Example: The property is conveyed to the city on the condition that it never be used for multi-family residences. 15 Fee on Condition Precedent • Title will not take effect in the named grantee until a condition is met. • Grantee gets a conditional title at first. • Title will only be fully vested upon the completion of the condition. • No other consideration in the deed, no other value has changed hands. • Example: Title will not vest until the grantee has built a house on the property within two years from the date of the conveyance. • Texas does not favor the fee on condition precedent. 16 Subsurface Estates – Mineral interests • Subsurface rights are a freehold estate and the owner may separate his surface estate from the minerals underneath and reserve the surface. • “Oil, gas, and other minerals” includes virtually everything a person anticipates as a valuable mineral. • Does not include building stone, limestone, caliche, and surface shale. 17 Subsurface Estates – Lateral Severance • Estates in land are considered to go to the center of the earth. • A separation of the mineral estate results in a lateral severance. • Lateral severance generally provides the grantee rights to drill for oil and gas or to mine certain minerals. • Estates are of equal dignity, so neither is greater than the other so far as title is concerned. 18 Subsurface Estates – Lateral Severance • If the owner of the surface reacquires the subsurface, the estates retain their separate identity and do not merge into one title again. • A grant or reservation of minerals should not include a substance that must be removed by methods that will consume or deplete the surface. • A substance is not a mineral if it lies so near the surface that removal will entail stripping away and substantial destruction of the surface. 19 Subsurface Estates – Lateral Severance • The “surface” is defined, as a matter of Texas law, to be on the surface of the real estate, or within 200 feet of the surface. • These substances belong to the surface estate and compensation paid must include compensation for surface destruction. • This is important in strip-mining coal, iron ore, and other substances. • Owner may have duty to restore the surface after mining. 20 Subsurface Estates – Dominant Estates • The concept of lateral severance creates a conflict of estates— between the surface owner’s rights and the mineral owner’s rights. • In Texas the mineral owner has what is termed the dominant estate. • This means that he has the right to use the surface, reasonably, to exercise his rights to extract the minerals from the subsurface. • Case law indicates that this concept of the dominant estate has been eroded somewhat and must be exercised reasonably. 21 Subsurface Estates – Dominant Estates • Any subsequent purchaser of the surface rights would title subject to the rights of the mineral owner. • This may seem at first to be a disadvantage to the surface owner. • But the surface owner often leases the subsurface and will receive royalties and even a cash bonus in addition to the lease payments. • These payments or “royalty interests” are not real estate, and the owner relinquishes his right to explore for minerals himself. • The surface value is often diminished during extraction, and the surface owner calculates this into the compensation he receives. 22 Subsurface Estates – Waiver of Surface Rights • The surface owner may reserve the sole rights to the surface estate. • Which may force the mineral estate owner to extract the minerals through an adjacent parcel. • This has created problems for developers who have purchased property that never had surface control reserved. • In counties of population greater than 400,000 (or counties of greater than 140,000 that border counties greater than 400,000) subdivisions can apply to the Oil and Gas Commission to designate drill sites and eliminate some of these conflicts 23 Resource – Railroad Commission of Texas www.rrc.state.tx.us 24 Subsurface Estates – Mineral interests • How important are these rights under Texas law today? • The high cost of oil and gas has made it economically feasible to use much more sophisticated techniques in extracting the oil and gas. • In DFW and south Texas new sources of oil and gas have been found. • Many home owners (on a 50 by 100-foot lot!) have become oil barons. • How does one negotiate oil rights in the sale of their home? • How involved should the real estate agent be in such negotiations? • TREC has promulgated a new addendum to help homeowners and real estate agents deal with this new issue. 25 TREC Form 44-0 26 Realty vs. Personalty • All the oil, gas, and other minerals are considered to be real property. • Once they reach the wellhead they are considered personal property. • Complications have arisen from underground storage in salt domes. • The Texas Supreme Court ruled that minerals that are put back into the subsurface remain personalty rather than reverting back to real estate. 27 Air Rights • Air rights tend to be nebulous and difficult to describe. • One can sell his air rights, mortgage them, and treat them as any other right in real estate. • The surface owner has control over his air rights subject to limitations. • The initial question of air rights came from owners of property that was adjacent to airports. 28 Air Rights • Between the two private property owners there is a conflict over the noise, pollution, and litter. • This found its origin in the law of nuisance, where one property owner would sue the other property owner because of these issues. • With municipal ownership of airports there is a more severe problem between the concepts of private ownership and the public welfare. • Ordinances are passed prohibiting building adjacent to an airport due to the danger to air traffic and the discomfort of the people nearby. • The municipality exercises eminent domain to acquire adjacent property or to restrict uses that would be detrimental to the airport. 29 Overhead Structures • Involves the construction of overhead walkways, office buildings, and similar structures across streets. • Such structures may create pollution hazards, carbon monoxide buildup, and other unhealthy conditions if not built properly. • In these cases we have the conflict of the private ownership of the building versus the public welfare of people in the area. 30 Solar Rights • Another concept of air rights is the right of adjacent property owners to the sun. • Although this is a very old concept, one that generally was predicated on creating “tunnels” in downtown areas. • A new type of legal problem could arise because of the use of solar energy. 31 Wind Farms • Texas has become the nation’s leading source of wind power. • Wind energy leases usually pay a royalty fee which is based on the gross revenue generated from the sale of the electricity. • Wind alone does not seem to be susceptible to ownership • Its value must be based on the value after the investment has been made by harnessing that power. 32 Wind Farms • Texas has always subscribed to the ownership theory which says that we own the fee simply interest up through the earth and the sky. • Can these be separated similar to mineral rights and water rights? Texas has not had a case that has resolved the issue. • One issue which has been litigated is the unsightliness of the turbines. One case has held that it is not a cause of action under Texas law. 33 Wind Farms • This is a brand new area of the law, and it is evolving very quickly. Can one own the wind? • There are areas of Texas that are very conducive to sustained high wind. Most of these areas are remote, sparsely populated areas. • Getting the wind power to populated areas is a challenging concept. • If a party creates a wind farm could an adjacent owner build anything that would hinder the free flow of wind? • Many questions are on the horizon for this new source of energy. • There will be a lot of new law in this area over the next few years. 34 CASE STUDIES FOR DISCUSSION Mr. and Mrs. Richard Carl Crawford were owners of royalty interests in oil and gas produced from their property. The natural reservoir of gas contained under their property had been substantially depleted by the oil company. The oil company then proceeded to inject gas reserves into the existing reservoir for storage purposes. The oil company maintained that all gas extracted from this reservoir in the future was their personalty. The landowners maintained that at least part of the gas still in the ground was a real property right on which they deserved payment for their royalty interest. What legal ramifications do you see? 35 Resource – The Real Estate Center www.recenter.tamu.edu 36 Resource – The Real Estate Center 37 Resource – The Real Estate Center 38 Resource – The Real Estate Center 39 Questions for Discussion 1. What is the difference between title theory and lien theory and which is considered the guiding principle in Texas? 2. List the four elements a property owner is entitled to in a fee simple estate. 3. Explain the concept of lateral severance and its importance in Texas law. 4. In the situation just discussed the land has been divided into a surface estate and a subsurface estate. Which estate is considered dominant and what does that mean? 5. Wind rights are a new and ever-developing area of Texas law. Which of the following statements can be considered true with regards to those rights? 40