Chapter 14: Long-Term Liabilities

advertisement

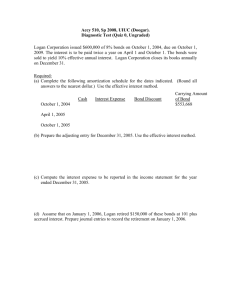

Bonds and Long-Term Notes Sid Glandon, DBA, CPA Assistant Professor of Accounting Long-Term Debt Bonds payable Long-term notes payable Mortgages payable Pension liabilities Lease liabilities Bonds Payable Bond indenture Promise to pay principle amount at maturity date Promise to pay periodic interest at stated rate on face (maturity) value Valuation of Bonds Payable Present value of Sold at a premium Principle discounted at market rate Interest (ordinary annuity) discounted at market rate Market rate of interest < Stated rate Sold at a discount Market rate of interest > Stated rate Bonds Issued at a Discount ACCOUNT Cash Discount on bonds payble Bonds payable Bonds issued at 95 DEBIT 855,000 45,000 CREDIT 900,000 Bonds Issued at a Premium ACCOUNT Cash Bonds payable Premium on bonds payable Bonds issued at 105 DEBIT 945,000 CREDIT 900,000 45,000 Amortization of Premium or Discount Amortization of premium Reduces interest expense Amortization of discount Increases interest expense Bonds Issued between Interest Dates Buyer pays seller for accrued interest up to the date of purchase Purchaser receives full interest payment on the interest payment date Example: Bonds Issued between Interest Dates ACCOUNT Cash Bonds payable Interest expense DEBIT 907,500 10% bonds issued at par on February 1 dated Janurary 1 Interest is payable on January 1 of each year CREDIT 900,000 7,500 Effective Interest Method Bond interest expense Bond interest paid Multiply carrying value of bonds times effective interest rate Multiply face amount of bonds times stated interest rate Amortization of premium or discount Subtract interest paid from interest expense Bond Issue Price Issue price of bonds payable $900,000, 5-year, 10% (payable annually) bonds issued to yield 12% Present value of principal: Face amount PV of $1, n=5, i=12% PV of principal Present value of annuity: Face amount Stated interest rate Annuity PVOA, n=5, i=12% PV of annuity Issue price of bonds $900,000 0.56743 $510,687 900,000 10% 90,000 3.60478 324,430 $835,117 Journal Entry to Record Issue ACCOUNT DEBIT 835,117 64,883 CREDIT Cash Discount on bonds payable Bonds payable 900,000 To record the issuance of $900,000, 5-year, 10% bonds to yield 12% Amortization Schedule Schedule of Amortization of Discount Effective Interest Method 5-Year, 10% Bonds Sold to Yield 12% Date 1/1/01 1/1/02 1/1/03 1/1/04 1/1/05 1/1/06 Payment 90,000 90,000 90,000 90,000 90,000 450,000 Interest Expense 100,214 101,440 102,813 104,350 106,066 514,883 Amortization of Discount 10,214 11,440 12,813 14,350 16,066 64,883 Carrying Value 835,117 845,331 856,771 869,584 883,934 900,000 To Record Interest Expense in 2001 and Interest Payment in 2002 DATE ACCOUNT DEBIT 12/31/01 Interest expense 100,214 Amortization of discount Interest payable To record interest expense for the year ended December 31, 2001 DATE ACCOUNT 1/1/02 Interest payable Cash To record the payment of interest on January 1, 2002 DEBIT 90,000 CREDIT 10,214 90,000 CREDIT 90,000 Bond Issue Costs Record as deferred charge (asset) “Unamortized Bond issue costs” Amortize over the life of the bonds Use of straight-line method is ok Extinguishment of Debt Before maturity date of bonds Amortization must be brought current Discount Premium Unamortized bond issue costs Gain or loss is classified as separate line item, part of ordinary income Long-Term Notes Payable Valued as the present value of Future principle payments, and Future interest payments Premium or discount is amortized over life of loan Types of Long-Term Notes Interest-Bearing Notes Issued at par Issued at less than market rate Zero-Interest-Bearing Notes Calculate discount Amortize discount as interest expense for each period over the life of the loan Zero-Interest-Bearing Note Zero-Interest-Bearing, 5-Year, 10% $100, 000 Note Maturity Value Principle PV of $1, n=5, i=10% Carrying value Discount on Note Payable 100,000 100,000 0.62092 62,092 37,908 Journal Entry ACCOUNT Cash Discount on note payable Note Payable DEBIT 62,092 37,908 Zero-Interest-Bearing, 5-Year, 10%, $100,000 Note CREDIT 100,000 Amortization Schedule Amortization Schedule on Discounted Note Zero-Interest Bearing, 5-Year, 10% Note of $100,000 Date 01/01/2001 01/01/2002 01/01/2003 01/01/2004 01/01/2005 01/01/2006 Cash Paid Interest Expense 0 0 0 0 0 6,209 6,830 7,513 8,264 9,091 Discount Amortization 6,209 6,830 7,513 8,264 9,091 Carrying Amount 62,092 68,301 75,131 82,644 90,909 100,000