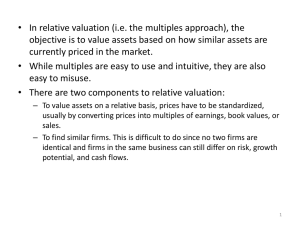

relative valuation part II

advertisement

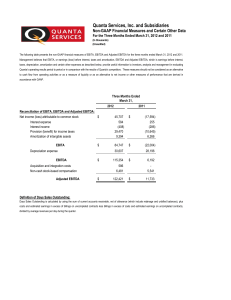

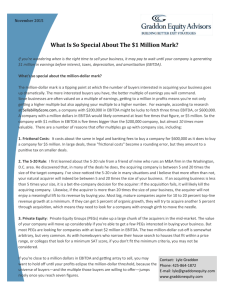

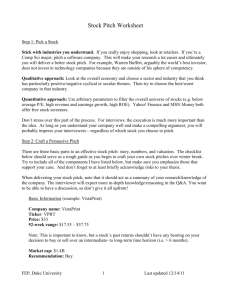

Major classifications of multiples • Price multiples – ratios of a stock’s market price to some measure of fundamental value per share • Enterprise value multiples – relate the total market value of all sources of a company’s capital to a measure of fundamental value for the entire company 1 Price to Earnings (P/E) • Alternative definitions – Trailing P/E • a stock’s current market price divided by the most recent 4 quarters’ EPS – Forward P/E • also called the leading P/E • A stock’s current price divided by next year’s expected earnings • Rationales for using the P/E – Earnings power is a chief driver of investment value – It is widely recognized and used by investors 2 • Drawbacks – EPS can be zero, negative, or insignificantly small relative to price, and P/E does not make economic sense under these circumstances – Tends to be highly variable because it reflects leverage – The ongoing or recurring components of earnings that are most important in determining intrinsic value can be practically difficult to distinguish from transient components – Differences in accounting standards adopted by firms may affect the comparability of P/Es among companies • Fundamental factors that could explain differences in P/Es – Growth in EPS: companies with a higher growth rate are expected to have higher P/Es – Risk (measured by beta or leverage): companies with lower risk can have higher P/Es 3 Price to Book Value (P/B) • The ratio of the market price per share to book value per share • Most useful for valuing companies composed chiefly of liquid assets, such as finance, investment, insurance, and banking institutions • Rationales for using the P/B – Because book value is a cumulative balance sheet amount, book value is generally positive even when EPS is zero or negative – Book value per share is more stable than EPS. May be more meaningful than P/E when EPS is abnormally high or low or is highly variable 4 • Drawbacks – Some assets (e.g., human capital, company reputation) are not reflected on the balance sheet – P/B may be misleading when the levels of assets used by the companies under examination differ significantly. Such differences may reflect differences in business models. – Accounting effects on book value may compromise how useful book value is as a measure of the shareholders’ investment in the company • e.g. Intangible assets that are acquired are shown on the books; those that are generated internally are not (R&D, advertising, marketing are expensed not capitalized) – Book value largely reflects the historical purchase cost of assets, net of accumulated depreciation. Significant differences in the average age of assets among companies being compared may weaken the comparability of P/Bs among companies – Share repurchases or issuances may distort historical comparisons • Fundamental factors that could explain differences in P/Bs – Return on Equity – Risk 5 Price to Sales (P/S) • The ratio of the market price per share to annual net sales • Most useful for valuing certain types of privately held companies, including investment management companies and many types of companies in partnership form • Appropriate for valuing the stocks of mature, cyclical, and zero-income companies • Rationales for using the P/S – Sales are generally less subject to distortion or manipulation than are other fundamentals, such as EPS or book value – Sales are positive even when EPS is negative – P/S is generally more stable than P/E 6 • Drawbacks – A business may show high growth in sales even when it is not operating profitably as judged by earnings and cash flows from operations – Sales is a prefinancing income measure while share price reflects the effect of debt financing – P/S does not reflect differences in cost structures among different companies – Although P/S is relatively robust with respect to manipulation, revenue recognition practices have the potential to distort P/S • Fundamental factors that could explain differences in P/Es – Profit margin – Growth in EPS – Risk 7 Enterprise Value to EBITDA (EV/EBITDA) • The ratio of the enterprise value to EBITDA – EV = MV of Equity + MV of Debt + MV of Pref Shares – Cash and M/S – EBITDA = Net income + Interest expense + Taxes + Depreciation + Amortization – Alternative denominators: EBITA, EBIT • Frequently used in the valuation of capital intensive businesses such as cable companies and steel companies • Rationales for using the EV/EBITDA – EV/EBITDA is usually more appropriate than P/E alone for comparing companies with different levels of debt. EBITDA is a pre-interest earnings figure; EPS is post-interest – EBITDA controls for differences in depreciation and amortization among business, in contrast to net income. – EBITDA is frequently positive when EPS is negative 8 • Drawbacks – EBITDA will overestimate cash flow from operations if working capital is growing. – Free cash flow to the firm (FCFF), which directly reflects the amount of the company’s required capital expenditures, has a stronger link to valuation theory than does EBITDA • Fundamental factors that could explain differences in EV/EBITDA – Return on Capital – Growth in FCFF – Risk (as measured by WACC) 9 Enterprise Value to Sales (EV/Sales) • The ratio of the enterprise value to sales • Alternative sales-based ratio that is particularly useful when comparing companies with diverse capital structures 10 • Source: – Pinto, Henry, Robinson, & Stowe, “Equity Asset Valuation”, 2nd ed. 11