Chapter 7

advertisement

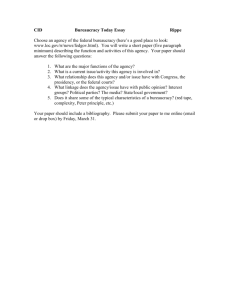

Chp.7 The Executive Branch The executive branch relies on a large federal bureaucracy to carry out its work and raise revenue. Sec. 1: The Federal Bureaucracy The federal bureaucracy includes all the organizations and agencies of the executive branch. The civil service system is used to place qualified civilians into positions of the federal bureaucracy. Do Now What are some of the agencies that work for the Executive branch and what do they do? Learning Goals Objectives ▪ Learn what the federal bureaucracy is. ▪ Learn what the civil service is and how its changed over the years. Essential Question ▪ What are the functions of executive departments and independent agencies? I. What is the Federal Bureaucracy? A.Bureaucracy i. Any organization having the following features: a) Clear formal structure b) Division of labor c) Set of rules & procedures by which it operates. B. Bureaucrats i. Administrators & skilled, expert workers who carry out tasks of the fed. Bureaucracy. II. The Civil Service A. Civil Service i. Civilians who carry out the work of the fed. Gov’t. B. The Spoils System i. Gov’t. jobs given out as political rewards for supporting the Prez. ii. “To the victors go the spoils.” iii. Inexperienced & inefficient C. The Civil Service Today i. Pendleton Civil Service Act ii. 90% of jobs are based on merit through standardized examinations. Exit Slip 1. Critics of the _______________________ believed it hindered the government from doing its job and led to corruption. 2. The departments, agencies, and organizations of the executive branch are collectively known as the federal _______________________. 3. Any nonmilitary worker is a member of the _______________________. 4. How are civil service employees chosen today? 5. Who carries the responsibility of implementing legislation and executive orders? Sec. 2: Executive Dept. & Independent Agencies Executive departments and independent agencies provide key services and regulate important industries for the American people. Do Now What are some government agencies that you have heard of? What do those agencies do? Learning Goals Objectives ▪ Purpose of executive departments. ▪ Primary functions of executive departments today ▪ List independent agencies. ▪ Issues regarding power & accountability in the federal bureaucracy. Essential Question ▪ What explains the growth in the number of executive departments that occurred in the 1900s? I. Executive Departments A. Early Departments i. As needs arise new departments are made ii. Ex. Dept. of Interior, Dept. Labor B. Departments since 1950 i. Increase of Fed Gov’t. power = New Departments ii. Housing & Urban Development, Energy C. Departments Today i. Health & Human Services a. Protect Americans’ health, 65,000 employees ii. Department of Defense a. Protects the nation, Over 3 million employees iii. Homeland Security a. Newest, (Police, borders, emergency agencies, transportation, etc.) II. Independent Agencies A. 140 gov’t. agencies that operate separately from the executive departments. B. Independent Executive Agencies i. Oversee & manage a specific aspect of fed. Gov’t. (NASA, Peace Corps) C. Independent Regulatory Commissions i. ii. Regulate some aspect of the economy Bipartisan: Includes members from both major political parties a. SEC: Securities & Exchange Commission watches stocks D. Government Corporations i. Organized & run like businesses but are owned in whole or in part by the fed. gov’t. E. Iron Triangle: Bureaucratic agencies, congressional committees, and interest groups work together for benefits Creating an Executive Department ▪ Small groups of 3 or 4. ▪ Think of ideas for a new executive department (Not something already being done) ▪ Draft a formal statement stating the purpose & function of the department –Persuade, compromise, negotiate conflicts or differences w/in your group ▪ Present your proposal to the class (Can make flyers or pictures) Sec. 3: Financing Government By collecting taxes and borrowing money, the fed. gov’t. is able to generate the funds it needs to run the nation. The gov’t. then assigns these funds to create a federal budget for the upcoming year. Do Now How would you allocate the nation’s money if you were in charge of the budget? You can use percentages. Learning Goals Objectives ▪ Ways the federal government pays for its operations. ▪ Describe the two types of government spending. ▪ Explain how the federal budget process works. ▪ Understand how fiscal & monetary policy affect the nation’s economy. Essential Question ▪ What are the main goals of the federal government’s fiscal policy and monetary policy? I. Paying for Government A. Income Taxes: Tax on a person’s or business’ income. i. Progressive Tax: Rate increases as amount taxable increases. B. Payroll Taxes: Money withheld from a person’s paycheck i. Regressive Tax: Tax applied only up to a certain amount . ii. Proportional Tax: Tax applied at same rate to all incomes. C. Other Sources of Revenue i. Tariffs, estate tax, gift tax, Loan interest D. Borrowing Money i. Bond: Borrower pays back money at a certain time + interest ii. Federal Debt: Money gov’t. borrowed and not yet repaid. II. Government Spending A. Mandatory Spending i. Required by laws & not subject to the annual budget process. ii. Ex. Social Security B. Discretionary Spending i. Subject to the annual budget process ii. Ex. Defense, Education, Aid C. The Budget Process i. President’s Budget i. President proposes budget reflecting their priorities. ii. Budget shows how spending & revenue will be effected in the future ii. Budget in Congress i. President gives budget to Congress and Congressional Budget Office ii. Agree on amount and then argue how best to spend it. III. Fiscal & Monetary Policy A. Fiscal Policy: Creating the fed. Budget & tax laws. i. Provide funds for gov’t w/out hurting economy ii. 3 Options: Spend more money or Cut Taxes or Spend & Cut B. Monetary Policy: Alters money in circulation & interest rates for borrowed money. i. ii. iii. iv. Selling bonds reduces money in circulation Buying back bonds puts money into system Raising interest rates reduces money in circulation Requires bank to have more money in reserve reduces money in circulation Exit Slip 1. A tax on a person’s or corporation’s income 2. A tax whose rates increase as the amount that is subject to taxation increases 3. Money that is withheld from a person’s paycheck by his or her employer 4. Tax that has greater impact on lower income earners than on upper-income earners 5. A financial instrument by which a borrower agrees to repay borrowed money, plus interest, at a future date 6. Actions and decisions made by Congress and the president to create the federal budget and tax laws 7. Actions and decisions made by the government that change the amount of money in circulation and the interest rates at which money is borrowed