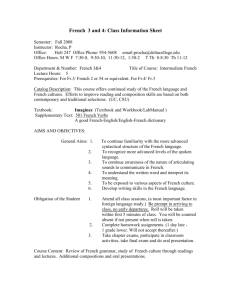

Personal Financial Literacy

advertisement

Making it Personal Financial Literacy Andrea Neff, National Sales Consultant Session Outline 1. Why teach Personal Financial Literacy? 2. Personal Financial Literacy covers what topics? 3. How to teach Personal Financial Literacy 4. Use of Instructional Materials and Resources Why Teach Personal Financial Literacy? “Financial literacy is essential…to the economic health of our nation…Ensuring that young people have the skills they need to make wise financial choices… will help us build a stronger…future…We also know that a lack of financial literacy is a major roadblock on the path of college access and success for too many students.” (Treasury Secretary Tim Geithner, September 2010.) What does this mean for your students? Teenage Spending The average teenager spends approximately $5,400 each year (National Endowment for Financial Education). Collectively, teenagers spend more than $172 billion annually – that’s billion! Today’s high school graduate will earn over $1 million in adulthood. When students go out on their own… Health Insurance Get Creditworthy Budget Online Invest Live Small Should Your Teen Have a Credit Card? 1. If you put $1,000 on a credit card and only pay the minimum (2.5 percent) each month at a 21% interest rate, how long will it take you to pay it off? a. Five months b. Three years c. 16 years 2. If you put $1,000 on a credit card and only pay the minimum (2.5 percent) each month at a 21% interest rate, how much will you have paid in interest alone? a. $432 b. $1,000 c. $1,694 Suze Orman 3. If you are late on a credit card payment, go over your credit limit or miss a payment, which of these are possible? a. You will not be able to rent an apartment. b. You will not get hired for a job. c. You will not be able to get a cell phone or a student loan. d. All of the above Topics that need to be covered with our teens… Saving and Investing -How to research, buy, and sell investments Risk Management -Decision-Making skills Spending and Credit -Buying wisely, pitfalls of credit, overspending Understanding Income -Career planning, income sources, taxes, inflation, etc. Money Management -Personal financial planning, budgeting, checking accounts, and insurance 2009 Survey… Council for Economic Education - December 3, 2009 Personal Finance Course Graduation Requirement Arkansas Georgia Idaho Illinois Louisiana Maryland New Jersey New York Oklahoma South Dakota Tennessee Utah Virginia New Mexico and Mississippi – required to offer Personal Finance Personal Financial Literacy Standards Jump$tart Coalition Standards for Personal Financial Literacy CORE COMPETENCIES: • Financial Responsibility and Decision Making • Income and Careers • Planning and Money Management • Credit and Debt • Risk Management and Insurance Saving and Investing http://www.jumpstart.org/national-standards.html What topics should Personal Finance Curriculum cover? • • • • • • • Income/Career Planning Financial Decisions and Planning Banking Credit Saving Investing Taxes Grade Levels, Students, Course Length Grade Levels • General Curriculum: 9th or 10th grade • Business Elective: depends on district Students • Basic Levels: 9th or 10th graders; are not necessarily ready to pursue business as a major • Advanced Levels: 11th or 12th grade; may have already decided to pursue a business degree Course Length • Semester-long • Year-long Managing Your Personal Finances, 6e • Our best-selling finance title • Full year comprehensive approach • 11th & 12th grades – for higher level business course • Great for future business or finance majors • In-depth exploration of finance topics from a business perspective • Covers personal finance and life-long financial planning • Most often used for business elective courses Economic Education for Consumers, 4e • Full year comprehensive approach • Suitable for 9th & 10th grades – intended for lower level business course • Provides broad coverage of personal finance topics • Covers consumer spending and wise purchasing • Provides a business and personal focus for finance topics • Can be used as part of general curriculum, but is intended for a business elective class Personal Financial Literacy, 2e • Suitable for one semester • Intended for 9th and 10th grade students • Meets the needs of Financial Literacy as a graduation requirement • Intended for general curriculum • Uses a personal focus on financial information • Offers information on personal income, money management, spending, credit, and saving Text Title Course Length Grade Levels Covers Managing Your Personal Finances Ryan, 6e Full year 11 and 12 • • • • • Economic Education for Consumers Miller and Stanford, 4e Full year 9 and 10 • Consumer spending • Broader coverage of finance topics • Wise purchasing • Money management • Lower achieving students • Popular with Family and Consumer Science teachers Personal Financial Literacy Ryan, 2e One semester 9 and 10 • Meets general ed. requirement • Broad coverage of finance topics • Personal focus • Income, money management, spending and credit, saving Personal finance Deep coverage of finance topics Life-long financial planning Intended as Business elective High achieving students Online Resources NEFE www.nefe.org National Endowment for Financial Education NAF www.naf.org National Academy Foundations (of Finance) CEE www.ncee.net Council for Economic Education (national) NBEA www.nbea.org National Business Education Association Many other online resources… http://moneycentral.msn.com/home.asp http://finance.yahoo.com/banking-budgeting www.bankrate.com www.federalreserveeducation.org www.ffltx.org www.feedthepig.org www.consumerjungle.org www.moneyskills.org www.practicalmoneyskills.com Using Free Resources • Who created the resource? What education credentials do they have? • What is the main purpose of these websites? • Is the content based on curriculum standards? Will it help you meet these for your state? Is there a scope and sequence? • Will you have to create your own materials to teach this content? Do you have time to do this? Using Free Resources • Is there any training or professional development available with this content? • How will you assess students using the free resource? • How will your students practice and apply this content? • How will your students connect this content with other academic subjects (integrated curriculum)? Managing Your Personal Finances, 6e Instructional Resources • • • • • • Annotated Instructor’s Edition Student Activity Guide Student Printed Tests Ebook ExamView® CD Instructor’s Resource CD • lesson plans/outlines • instructor’s resource manual • teaching tools • PowerPoint™ presentations • Spanish Glossary • Instructor’s Edition of Printed Tests • Instructor’s Edition of Student Activity Guide Economic Education for Consumers, 4e Instructional Resources • • • • • • Instructor’s Wraparound Edition Instructor’s Resource CD Student Workbook ExamView ® Ebook Instructor’s Resource Kit • Instructor’s Edition Workbook • Teaching Economics Book • Reteach and Enrich Activity Masters • Business Math, Communications, and Ethics Activity Masters • Alternative Assessment • Spanish Resources • Learning Styles • Using Technology Personal Financial Literacy, 2e Instructional Resources • • • • • • Annotated Instructor’s Edition Student Workbook Ebook ExamView® Instructor’s Resource CD Spanish Resources • Spanish Glossary • Student Workbook Where do we start? Personal experience - use as catalyst Standards and Competencies NBEA State Local District Jump$tart Cross-curricular applications Local parental and business partnerships Guest Speakers Web resources Articles Take a closer look at our Texts for Personal Finance Managing Your Personal Finances, 6e Author: Joan Ryan Copyright 2010 ISBN 978-0-5384-4937-3 Overview Informs students of their various financial responsibilities Chapters that not only inform but increase self-awareness and career readiness Written specifically for high school students New ways to maximize earning potential Strategies to manage resources Skills for the wise use of credit and investing money Features Alignment with National Programs Jump$tart Coalition National Academy Foundation NBEA standards for Personal Finance Students become active participants in the business world as Citizens Students Family members Consumers Reinforcement and extension in every chapter: Planning a Career in Math Minute Net Notes Unit Projects Life Span Plan Project Features Goals at the beginning of each lesson clearly state the learning objectives Key Terms within the Lesson are identified with page references Global View features show international connections relevant to personal finance Features Communication Connection offers speaking and writing activities related to the chapter content. Math Minute offers a review and practice in basic math skills linked to the chapter topics. View Points provide opportunities for students to think critically about issues that have no clear-cut answers. Features Issues in Your World enriches students’ knowledge by acquainting them with the real-world issues. Planning a Career in… provides robust career information related to the chapter topic and it incorporates the Career Clusters. Features Lesson and Chapter Assessments give students the opportunity to tie their learning together and dig deeper into the issues. Key Terms Review Check Your Understanding Apply Your Knowledge Think Critically Chapter Summary Apply What You Know Make Academic Connections Solve Problems and Explore Issues Extend Your Learning Features End-of-Unit Cases profile real people and describe how they applied the skills presented in this text to their own lives. End-of-Unit Projects give students handson practice applying and extending what they have learned in each Unit. Instructor Resources Annotated Instructor’s Edition Instructor's Resource CD Lesson plans and outlines Instructor’s resource manual Teaching tools PowerPoint presentations Spanish Glossary Instructor’s Edition of printed tests Instructor’s Edition of Student Activity Guide Instructor Companion Website ExamView Printed Tests IMPACT CD-ROM Animated graphs and figures illustrate key concepts Definition of terms are reinforced Hot Links to relevant websites Forms to complete and send via email to instructor Instructor’s Companion Website Personal Financial Literacy, 2e Author: Joan Ryan Copyright 2010 Pub Date: January 2011 ISBN: 9780538449373 Personal Financial Literacy, 2e Three to Know • One-semester course • Fulfills financial literacy graduation requirement • Perfect for all 9th and 10th grade students Ch. 1: Ch. 2: Ch. 3: Ch. 4: Ch. 5: Ch. 6: How Your Choices Affect Income Income, Benefits, & Taxes Your Purchasing Power Financial Decisions & Planning The Banking System Personal Risk Management Ch 7: Buying Decisions Ch 8: Preserving Your Credit Ch 9: Credit Problems and Laws Ch 10: Basics of Saving & Investing Ch 11: Saving & Investing Options Ch 12: Buying & Selling Investments NEW Concepts covered in this edition Job search skills/online job applications Interviewing techniques Preparing resumes and cover letters Benefits/challenges of entrepreneurship Consumer rights and responsibilities in marketplace Charitable giving/philanthropy Health care providers, services, fraud Simple/compound interest New to This Edition • All features now include a question or activity for application • Sharpen Your 21st Century Entrepreneurial Skills feature incorporates the framework for 21st Century Learning • Exploring Careers has a new focus to link content more closely to the 16 career clusters • Net Bookmark — a short feature that provides chapterrelated activities for online research • Take Action — an course-long project provides opportunity to synthesize concepts Features Building Communication Skills feature focuses on crucial soft skills that are necessary in today’s competitive environment. (listening, reading, speaking, writing) Features Focus On…feature highlights specific topics related to chapter content and supports students’ participation in student organizations. Features Success Skills … feature provides information to help students be successful in school, work and personal activities. Net Bookmark Feature provides opportunities for students to use the most current, relevant information through online research Features Exploring Careers in….feature presents specific information about careers in the areas identified by the US Dept. of Education as the 16 Career Clusters Feature Take Action feature provides students with an opportunity to synthesize the concepts by participating in an ongoing project throughout the chapter. End of Lesson Assessment Key terms review helps students understand and apply key lesson terminology Check your understanding ensures student comprehension End of Chapter Assessment Summary provides and concise wrap-up of chapter topics. Making Academic Connection relates chapter concepts to the “four core” curriculum areas Personal Financial Literacy, 2e Instructional Resources • • • • • • Annotated Instructor’s Edition Student Workbook Ebook ExamView® Test Generator Instructor’s Resource CD Spanish Resources • Spanish Glossary • Guided Practice CD (workbook activities in Spanish and teachers can just print them off the CD) Free Companion Website Personal Financial Literacy, 2e Author: Joan Ryan Copyright 2010 Pub Date: January 2011 Economic Education for Consumers, 4e Author: Miller and Stafford Copyright 2010 ISBN 978-0-5384-4888-8 Bring Economics to life! Focus on consumer spending and making wise purchasing decisions Bright, new design Updated information on important changes in technology, banking, and taxes Content aligned with Jump$tart coalition National Standards for Personal Financial Literacy Valuable and Relevant Content Extensive coverage is given to planning for college, retirement, saving, loans, online shopping, and banking. Real-world Applications Life-Span Plan Project Links all aspects of personal finance to the students’ lives! Maintain Student Interest Consumer Action Consumer Alert Vote Your Wallet Math Money NetBookmark In Class Activity Student Resources Workbook Key Terms Review Concepts Review Critical Thinking Consumer Applications Make Decisions Companion Website Instructor Resources Companion Website Instructor’s Wraparound Edition ExamView Instructor Resource Box Workbook solutions Printed Test bank Reteach and Enrichment Activities Alternative Assessments Test Preparation and Study Skills Instructor Resource CD PowerPoint Presentation What your students learn in this book will have a direct impact on their life today and throughout their future!! Other products available… Session Outline Why teach Personal Financial Literacy? Personal Financial Literacy covers what topics? How to teach Personal Financial Literacy Use of Instructional Materials and Resources For live or recorded webinars and training sessions, visit our TeamUP Training & Services website! www.cengage.com/school/teamup/ http://www.cengagesites.com/academic/?site=5266 Questions? Andrea Neff National Sales Consultant Andrea.neff@cengage.com